by Alex | Aug 7, 2018 | CT, group health insurance, Health Care Reform, Health Exchanges, NJ, NY News, Small Business Group Health

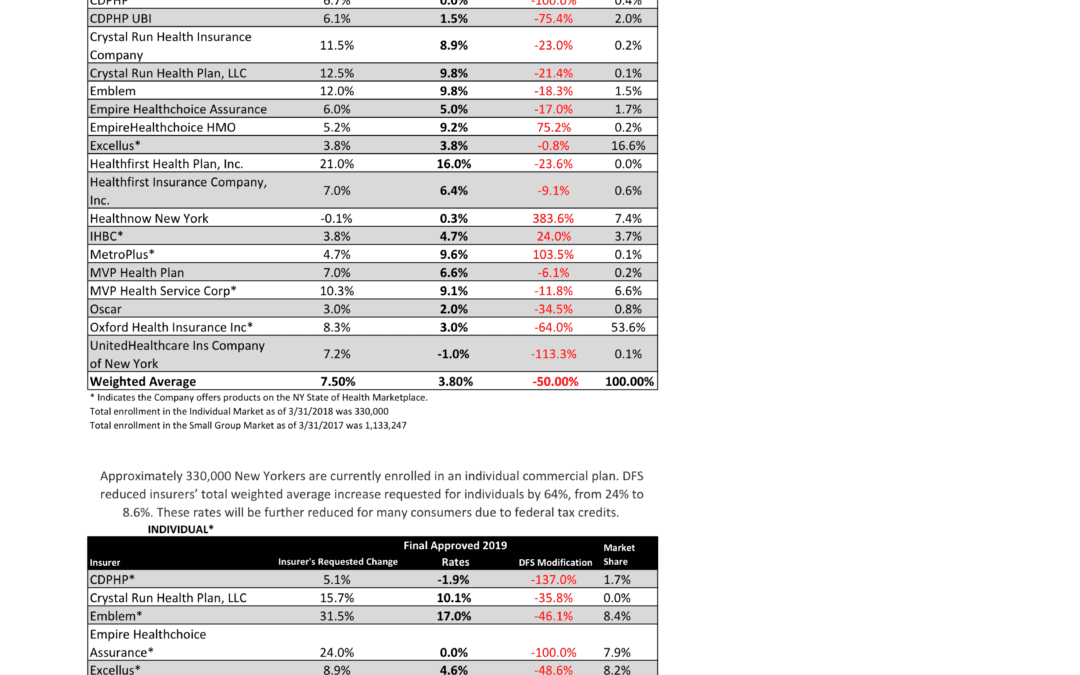

NYS 2019 Final Rates Approved

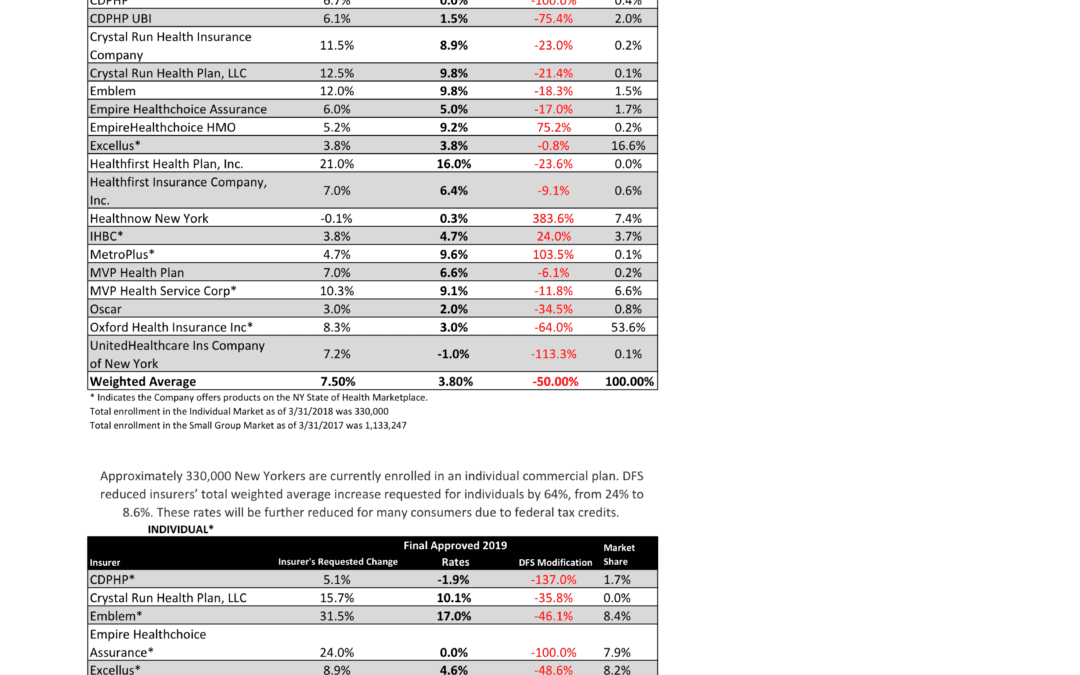

NYS has approved 2019 Final Rates last Friday. Small group rates will increase 3.8% and 8.6% for individuals.

As per NY State Law, Health Insurers are required to send out early notices of rate request filings to groups and subscribers see original –NYS 2019 Rate Requests. Despite only 3 months of mature claims data experience for 2018 health insurers’ original requests were noticeably below average 7.5% for small group and 24% for individuals. Ultimately NYS reduced this request substantially by approximately 50%.

Experts are concerned over the long term effects. Example, the Individual mandate was removed last December by Presidential order. Without the Mandate anyone can drop insurance without penalty. A comparable take away for similar auto insurance industry would be something like this -Drivers ought not be mandated to buy auto insurance as its a profit scheme by Insurers. While a popular decision this will hardly bend the curve long term and reduce competition. Furthermore, the new order of Selling Across State lines makes NYS most unwelcoming.

OTHER STATES

Insurers have been filing to sell Obamacare plans that will go into effect in 2019, and in some states they appear to be pricing in for the fact that the mandate is going away next year. Other states are seeing mild increases, but that is in part because they saw significant hikes for the previous year.

Insurers have concluded that fewer people will enroll without the mandate than otherwise, so in some places they are pricing their plans higher based on the assumption that sicker people will be left behind, which will increase medical costs for those left. It is well worth pointing out that in recent years the loss federal risk reinsurance corridor funds account for 5.5 percent of the rate increase.

How are neighboring States doing?

In NJ, not that bad. Last year the average increase were 5.5% for small groups and some popular plans such as Horizon Blue Cross Blue Shield’s OMINA increasing only 4.8% increase. This year the increase is only 5.2. Other insurers offering EPO and HMO plans in the individual market for 2019 include Oscar Health and Oxford Health Plans.

With individual mandate repeal fewer people will buy health insurance raising the prices for those who do. NJ Banking and Insurance Department officials said premium prices would have increased, on average, by 12.6 percent.

For CT market, on the other hand, things are much worse at least for the individual marketplace with average 25% rate increases last year. The 2019 proposed rate increases for both the individual and small group market are, on average lower, than last year: The proposed average small group rate increase request is a 10.22 percent and ranges from -5.0 percent to 21.1 percent. This compares to the average increase request of 18.06 percent requested last year.The proposed average individual rate increase request is 12.3 percent and ranges from -10.9 percent to 31.0 percent. This compares to the average increase request of 25.51 percent requested last year.

Final plan rates in New Jersey & CT will be finalized and released in the fall, state officials said. ACA open enrollment begins Nov. 1

- Trend: Trend is a factor that accounts for rising health care costs, including the cost of prescription drugs, and the increased demand for medical services.

- Uncertainty in Washington:

- Removal of penalty for individual mandate: The elimination of the penalty means that individuals who are typically younger and healthier would have no inducement to participate in the insurance pool, which could further destabilize the market. Lack of participation shrinks the pool and increases the cost of insurance to the remaining members.

- Short-duration health plans and Association Health Plans: Still pending are final federal regulations on non-ACA compliant short-duration plans, which may have implications for the ACA risk pool. Also, Connecticut along with other state insurance regulators, are awaiting clarification from the federal government on new federal regulations allowing association health plans, which could further shrink the ACA risk pool.

A bipartisan group of congressional representatives has discussed an agreement to extend and guarantee the payments, but it’s unclear whether they could do so by the new filing deadline of Sept. 5. A lawsuit filed by Congress against the Obama administration to challenge the payments is still pending. In addition, Trump has repeatedly threatened to withhold payments to insurers that reduce cost-sharing – deductibles, copays and coinsurance – paid by low-income customers. More than half of New Jersey’s marketplace customers receive that assistance, and without it, most would be unable to afford coverage.

Finally, a tax on health insurance premiums has been reinstated in 2018 after a one-year “tax holiday” approved by Congress for 2017. That contributed 2.3 percent to the rate hikes that insurers requested for 2019 and for 2019

SMALL GROUP MARKET VS. INDIVIDUAL MARKET

Importantly, small group market is still more advantageous than individual markets unless one gets a sizable low-income tax credit. Overall, about 350,000 individual plan consumers will be affected by the price hike, while more than a million users will be hit by higher small group fees. Last year, Blue Cross Blue Shield released a study showing Obamacare user costs were 22 percent higher than people with employer-sponsored health plans, while UnitedHealth plans to exit most Exchanges see – Breaking: Oxford Exits Metro Indiv & Oxford Liberty HMO 2017.

The correct approach for a small business in keeping with simplicity is a Private Exchange and with our large buying group PEO partnerships. This is a true defined contribution empowering employees with a choice of leading insurers offering paperless technologies integrating HRIS/Benefits/Payroll. Both employee and employers still gain tax advantage benefits under the business. Also, the benefits, rates and network size are superior under a group plan as the risk are lower for small group plans than individual markets.

Learn how a PEO Partnership can help your group please contact us at info@360PEO.com or (855)667-4621.

Newsletter Sign Up Now

by Alex | Jun 8, 2017 | family health insurance, group health insurance, Health Care Reform, Health Exchanges, Individual Exchanges, NY News

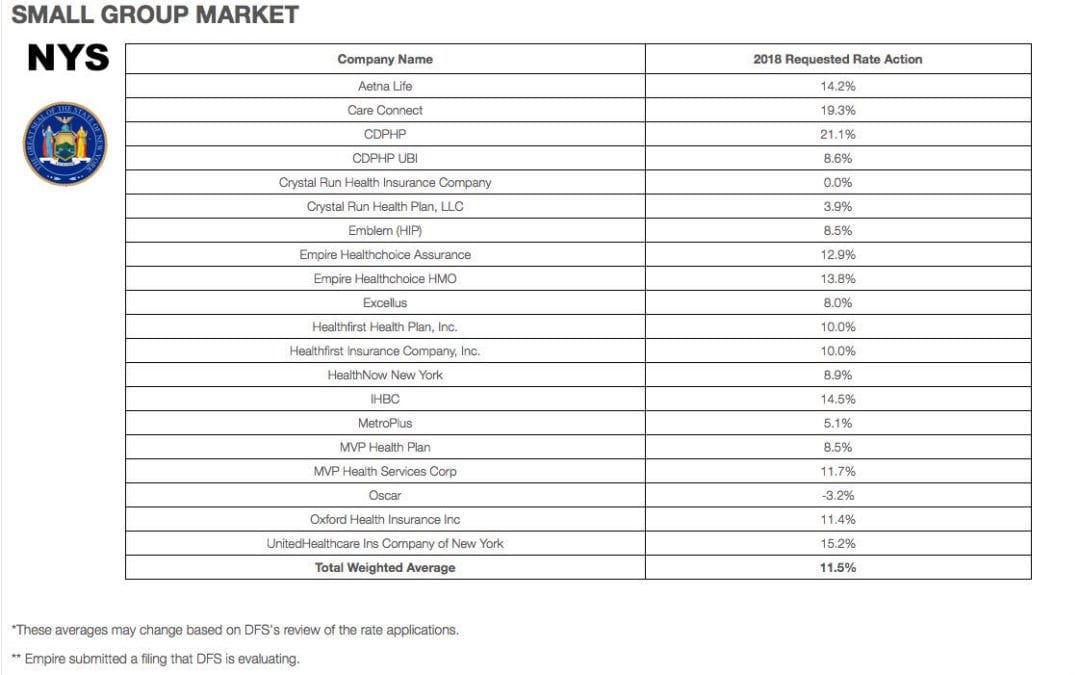

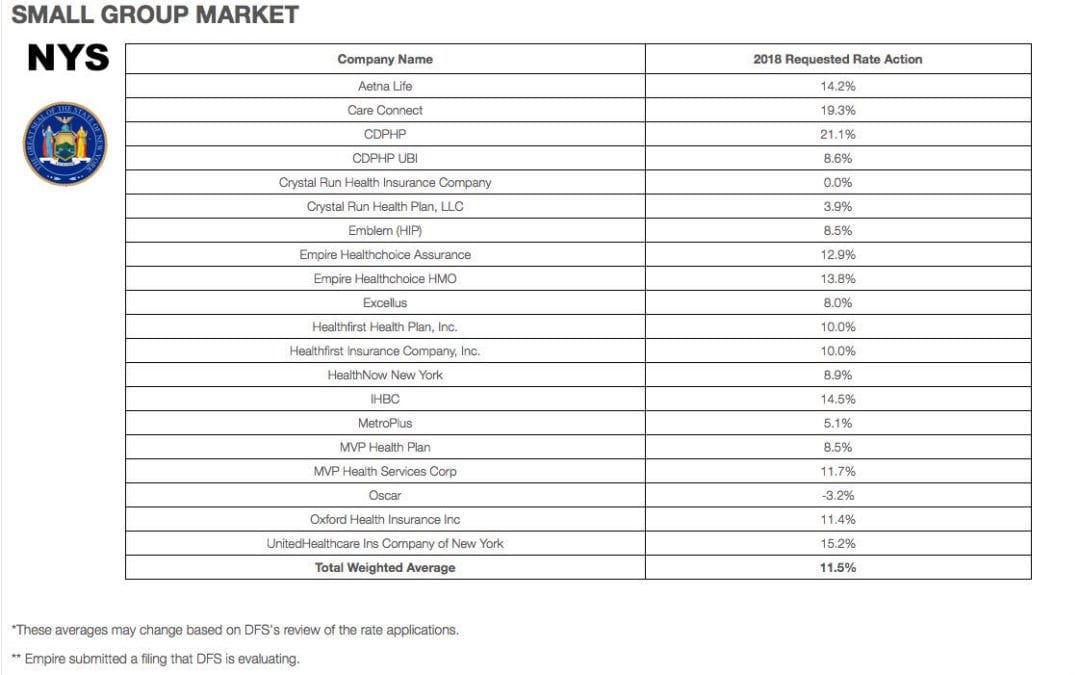

NYS 2018 Health Insurance Rate Filing

Yesterday, NYS 2018 Health Insurance Rate Filing were released. The total weighted average increases were 11.5% small groups and 16.6% individual market. This early filing request deadline request requirement is not an Obamacare requirement. As per NY State Law carriers are required to send out notices of rate increase filings to groups and subscribers.

These are simply requests and the state’s Department of Financial Services has authority to modify the final rates. But they are the first indication of what New Yorkers can expect when shopping for health insurance on the individual marketplace at the end of this year. The news comes as insurance companies across the country brace consumers for another year of large rate hikes, owing in part to the composition of the individual market, and in part to the uncertainty over the future of the law under the Trump administration.

Background:

By comparison last year NYS 2017 Rate Request early filings were higher at 12.3% small group and 19.3% for individuals. The final filing rates were lower NYS 2017 Final Rates were 8.3% small group and 16.6% for individuals. The NYS 2016 Rates final rates were 9.8% small group and 7.1% for individuals. Using these past figures one projects a 2018 Final Rates of 7% small groups and 14% individuals.

With only 3 months of mature claims in 2017 to work of off Insurance Actuaries have little experience to predict accurate projections. Simply put the less credible information presented to actuarial the higher the uncertainly and higher than expected rate increase. The national rate trend, however, has been much higher than in past years due to higher health care costs and the loss of Federal reinsurance fund known as risk reinsurance corridor.

Individuals:

Individual rates are expected to be higher than small group. The national rate trend, however, has been much higher than in past years due to higher health care costs Like other states throughout the nation, the 2018 rate of increase for individuals in New York is higher than in past years partly due to the termination of the federal reinsurance program. The lost of the program’s aka federal risk reinsurance corridor funds accounts for 5.5 percent of the rate increase.

This is one of the reasons why the individual market is significantly more costly to operate than small group as per recent Aetna and United Healthcare pull out of most State Individual Exchanges. Another local example was last year’s Oscar Health Insurance which had lost $105 million and is asking for up to 30% rate increase. The 3 year old company said the increase was necessary because medical costs have risen, government programs that helped cover costs are ending, and its members needed more care than expected. For 2018, with successful pivotal changes Oscar is asking below average 11% individual increase and a decrease of 3.2% small group next year.

Small Groups:

While small group rates are better risk and naturally lower rates. There is some rate shock with notably Careconnect. CareConnect, the financially struggling health insurance arm of Northwell Health, has asked the Cuomo administration to allow an average 30 percent premium hike on the individual market in 2018. The company, which lost $157 million in 2016, is asking for small group increases that range between 9 and 24 percent.

THE THREE R – RISK CORRIDOR, RISK ADJUSTMENT & REINSURANCE designed to mitigate the adverse selection and risk selection. The problem, according to many insurance companies, is that the formula is flawed, and CareConnect executives have consistently complained that they are at an unfair disadvantage. The Cuomo administration has taken steps to ameliorate some of those problems, giving the DFS the authority to essentially overrule the federal numbers. In its first-quarter financial report, executives made clear that the risk adjustment penalty was a threat to its business.

Instead, the correct approach for a small business in keeping with simplicity is a Private Exchange. This is a true defined contribution empowering employees with choice of leading insurers offering paperless technologies integrating HRIS/Benefits/Payroll. Both employee and employers still gain tax advantage benefits under the business. Also, the benefits, rates and network size are superior under a group plan as THE RISK OUTLINED ABOVE ARE HIGHER FOR INDIVIDUAL MARKETS THAN SMALL GROUP PLANS.

You may view the NYS 2018 Rate Requests DFS press release, which includes a recap of the increases requested and approved by clicking here.

For a custom analysis comparing PEO with YOUR upcoming 2017-2018 renewal please contact our team at 36PEO (855)667-4621. We work in coordination with Navigators to assist with Medicaid, CHIP Child Health Plus, Family Health Plus and Medicare Dual Eligibles. We have Spanish, Russian, and Hebrew speakers available. Quotes can also be viewed on our site.

Summary of 2018 Requested Rate Actions

INDIVIDUAL MARKET

| Company Name | 2018 Requested Rate Action |

|---|

| Affinity | 23.5% |

| Care Connect | 29.7% |

| CDPHP | 15.2% |

| Crystal Run Health Plan, LLC | 8.7% |

| Emblem (HIP) | 24.9% |

| Empire ** | N/A |

| Excellus | 4.4% |

| Fidelis | 8.5% |

| Healthfirst Insurance Company, Inc. | 13.0% |

| Healthfirst PHSP, Inc. | 22.1% |

| HealthNow New York | 47.3% |

| IHBC | 25.9% |

| MetroPlus | 7.9% |

| MVP Health Plan | 13.5% |

| Oscar | 11.1% |

| UnitedHealthcare of New York Inc | 38.5% |

| Total Weighted Average | 16.6% |

SMALL GROUP MARKET

| Company Name | 2018 Requested Rate Action |

|---|

| Aetna Life | 14.2% |

| Care Connect | 19.3% |

| CDPHP | 21.1% |

| CDPHP UBI | 8.6% |

| Crystal Run Health Insurance Company | 0.0% |

| Crystal Run Health Plan, LLC | 3.9% |

| Emblem (HIP) | 8.5% |

| Empire Healthchoice Assurance | 12.9% |

| Empire Healthchoice HMO | 13.8% |

| Excellus | 8.0% |

| Healthfirst Health Plan, Inc. | 10.0% |

| Healthfirst Insurance Company, Inc. | 10.0% |

| HealthNow New York | 8.9% |

| IHBC | 14.5% |

| MetroPlus | 5.1% |

| MVP Health Plan | 8.5% |

| MVP Health Services Corp | 11.7% |

| Oscar | -3.2% |

| Oxford Health Insurance Inc | 11.4% |

| UnitedHealthcare Ins Company of New York | 15.2% |

| Total Weighted Average | 11.5% |

*These averages may change based on DFS’s review of the rate applications.

** Empire submitted a filing that DFS is evaluating.

by Alex | Oct 31, 2016 | family health insurance, Health Care Reform, Health Exchanges, Individual Exchanges, individual health insurance, State Exchanges

2017 Individual Open Enrollment

Everything you need to know ahead of tomorrow’s 2017 Individual Open Enrollment. This Open Enrollment marks the 4th anniversary of Obamacare a.ka. The Affordable Care Act. As a helpful resource, the new NY and NJ rates with important deadlines are listed below. 33 States such as NJ use the healthcare.gov website or at https://medicalsolutionscorp.demo.hcinternal.net/individual/individual/homePage. States such as NY and CT use their own Marketplace – NYS of Health and AccessHealth CT. Importantly, individuals not expecting a subsidy may also apply Off-Exchange which in many case has more options and Insurers.

2017 NY Individual Health Plans

These rates are for New York City unless otherwise indicated, and for a single person. For a family premium, multiply by 2.85, Husband/Wife

These rates are for New York City unless otherwise indicated, and for a single person. For a family premium, multiply by 2.85, Husband/Wife

multiply by 2.0 and Parent/Children multiply by 1.70. The non single deductibles are out of pocket maximums are doubled. These are for standard plans, which two-thirds of customers enrolled in during 2016.

While deductibles for platinum, gold and silver plans have stayed the same, many bronze plan deductibles have increased 33 percent. That means consumers who purchase a bronze plan — presumably for its lower monthly premium — are paying more out of pocket for their medical costs before their insurance company kicks in a dime. A family of four that purchased a bronze plan will have an $8,000 deductible in 2017, up from $6,000 in 2015. For someone young and relatively healthy, that might be OK, but that person is vulnerable to a very large bill if he or she needs expensive medical care. It’s the platinum plans where New York State really shows itself to be a national outlier. Roughly 18 percent of New Yorkers chose a platinum plan in 2016, compared to 2 percent across the nation, according to the Kaiser Family Foundation.

Here are the 2017 rates:

2017-nys-marketplace-rates-1

2017 NJ Individual Health Plans

NJ Dept of Banking and Insurance posted the 2017 NJ individual health plans Monday. Only two carriers will offer plans on the state’s Obamacare marketplace next year: Horizon Blue Cross Blue Shield of New Jersey and AmeriHealth.

Additional insurers are participating off-exchange or outside the Marketplace. Examples: Aetna, CIGNA and Oxford. There are additional 20 plan options available off exchange. A notable new entrant, Health Republic of NJ, will no longer be available for 2017. See – Health Republic NJ Shutting Down.

Here are the 2017 rates:

2017-new-jersey-individual-health-benefits-plans-and-rates

2017 Individual Open Enrollment Deadlines

- November 1, 2016: Open Enrollment starts — first day you can enroll in a 2017 insurance plan through the Health Insurance Marketplace. Coverage can start as soon as January 1, 2016.

- December 15, 2016: Last day to enroll in or change plans for new coverage to start January 1, 2017.

- January 1, 2017: 2017 coverage starts for those who enroll or change plans by December 15.

- January 15, 2017: Last day to enroll in or change plans for new coverage to start February 1, 2017

- January 31, 2017: 2016 Open Enrollment ends. Enrollments or changes between January 16 and January 31 take effect March 1, 2017.

If you don’t enroll in a 2016 health insurance plan by January 31, 2017, you can’t enroll in a health insurance plan for 2016 unless you qualify for a Marketplace Special Enrollment Period.

Penalty: The uninsured penalty rises to $695 or 2.5% of your income, whichever is higher.

Coverage start dates

If you enroll before the 15th of any month, your coverage starts the first day of the next month. If you enroll after the 15th of the month, you’ll have to wait until the month after that for your coverage to start. So, for example, if you enroll on January 16, your coverage would start on March 1.

Enroll using our online comparison shopping tool for both on and off-Exchange Marketplace to be released next week. Email us or Contact us at (855)667-4621.

by Alex | Sep 13, 2016 | Health Care Reform, Health Exchanges, Obamacare, regional health insurance co-ops, State Exchanges

Health Republic NJ Shutting Down

Health Republic NJ Shutting Down

In yesterday’s surprise announcement, NJ regulators will be shutting down Health republic NJ for 2017 “because of its hazardous financial condition”. This marks the demise of the second Metro area healthcare co-op with the same name-sake Health Republic but different managed healthcare co-op, see Health Republic NY Shutting Down Nov 30.

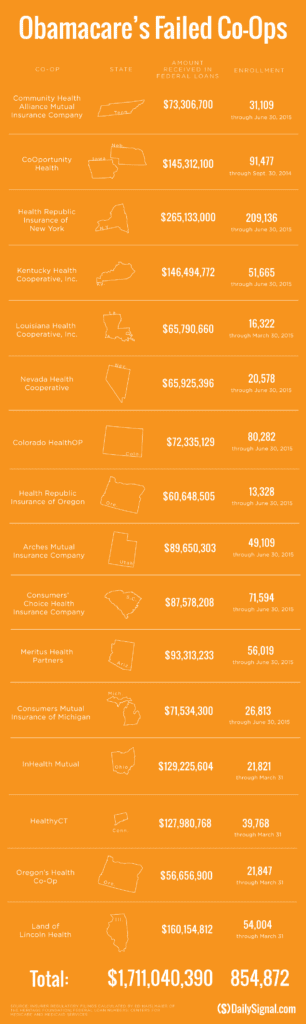

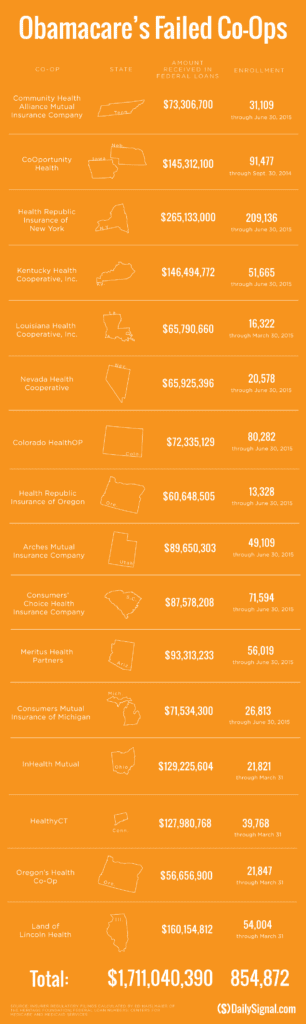

Since Obamacare’s rollout in the fall of 2013, 16 co-ops that launched with money from the federal government have collapsed. Now, just six co-ops—Wisconsin’s Common Ground Healthcare Cooperative; Maryland’s Evergreen Health Cooperative; Maine Community Health Options; Massachusetts’ Minuteman Health; Montana Health Cooperative; and New Mexico Health Connections—remain.

In a bizarre twist of fate or unintended Affordable Care Act design flaw small affordable startups not only have to gain new client footholds but also support large

established companies “with sicker patients”. Start-ups, by contrast, with much lower rate of diagnosed sick patients essentially pay into this tax. This tax is part of the risk adjustment program intended to stabilize Insurers who took on sicker patients and spread this risk. While some correctly blame too low pricing and some miscalculated business decision-making the inherent extra tax doomed the majority of the original 16 co-ops.

Health Republic in fact grew steadily and made money the first 9 months of 2015. However, HRNJ lost 17.6 million end of 2015 and is choking off at this $46.3 million payment to the government through the risk adjustment program. This is considered one of the 3 R’s of the reinsurance program – risk corridor, reinsurance and risk adjustment that were intended to level the playing field. The first “R”—“reinsurance”—subsidizes insurers that attract individual customers who rack up particularly high medical bills. The second—“risk adjustment”—requires insurers with low-cost patients to make payments to plans that share the benefits with those who insured higher-cost ones. And the third, called “risk corridors,” is a program to subsidize health plans whose total medical expenses for all their Obamacare customers overshoot a target amount.

The co-ops received less money than they initially anticipated last year under Obamacare’s risk corridor program, which resulted in the collapse of at least five co-ops and a $5 billion class action lawsuit

filed by 6 state’s co-ops – ” Oregon-based insurer Moda Health Plan Inc., Blue Cross Blue Shield of North Carolina, Pittsburgh-based Highmark Inc., and the failed CoOportunity Health, which was based in West Des Moines, Iowa, and Health Republic Insurance Co. of Oregon, which was based in Lake Oswego.”

From Politico’s “Obamacare’s sinking safety net”:

“The risk corridor program, however, has been an unmitigated debacle. In December 2014, the Republican Congress voted to prohibit the Obama administration from spending any money on the program, decrying it as a bailout for the insurance companies. Sen. Marco Rubio, then thought to be a leading GOP presidential contender for 2016, was particularly vocal in pillorying the program.

Unlike all those symbolic “repeal Obamacare” votes, Congress actually succeeded in blocking those risk corridor payments, and it hit Obamacare hard. Insurers filed claims seeking $2.9 billion, but under the limits imposed by the GOP there was less than $400 million available to make good on those payments. The end result: insurers initially received only 12.6 cents for each dollar they had counted on. Many of the new Obamacare co-op plans that went out of business blamed their collapse in part on the fact that they’d been counting on the full payments to keep them solvent.”

Regrettably, in a Presidential year no one wants to touch this burning hot potato. Perhaps NJ’s handling of this pressure cooker and taking 2017 off may be the best course of action after all.

9/16/16 Addendum:

As of Monday, September 19, 2016, the portal for Health Republic Insurance will be shut down, as they are no longer accepting new business for the year.

The New Jersey State Department of Banking and Insurance has also provided a list of FAQs related to the shutdown and how it affects individuals, small employers, brokers and providers. For more information, click here.

As always, our team is here to assist you and to help you grow your business.

by Alex | Aug 8, 2016 | group health insurance, Health Exchanges, Individual Exchanges, individual health insurance, NY News, United Healthcare

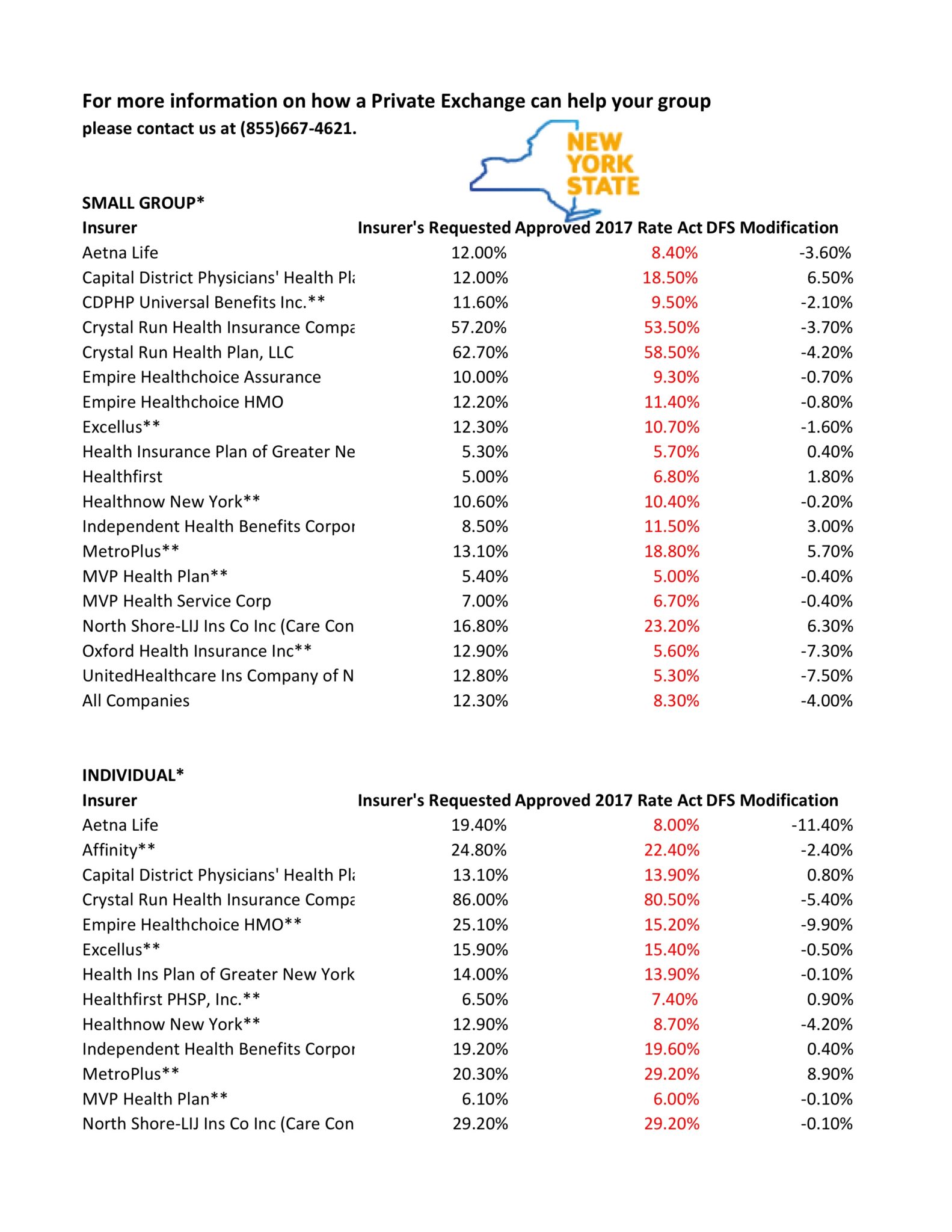

NYS 2017 FINAL Rates Approved

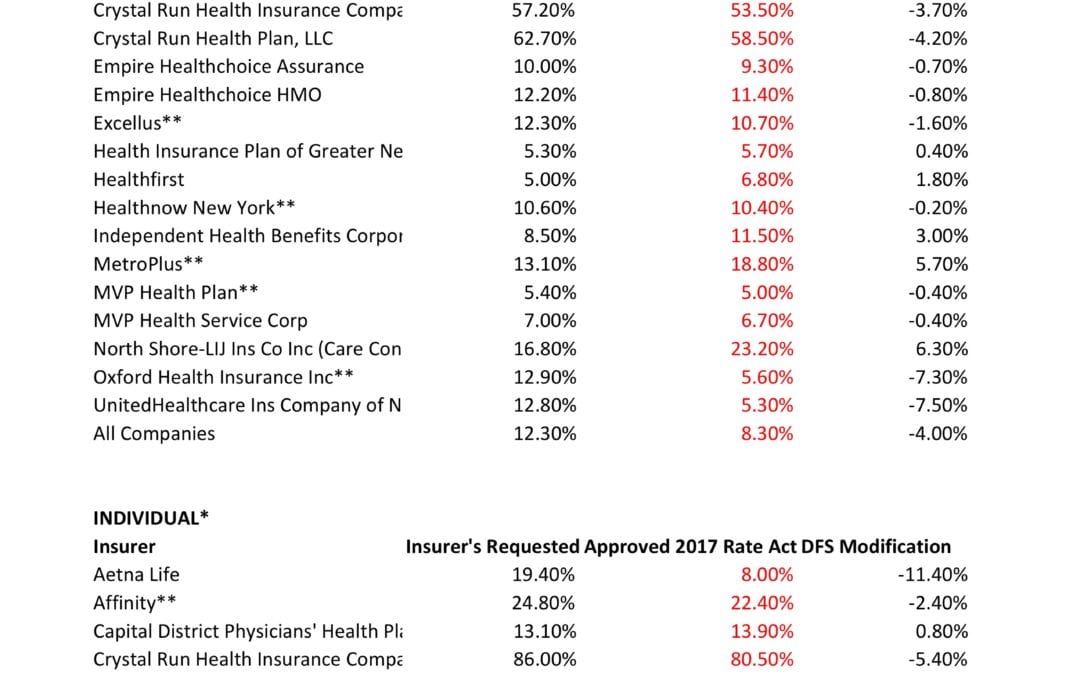

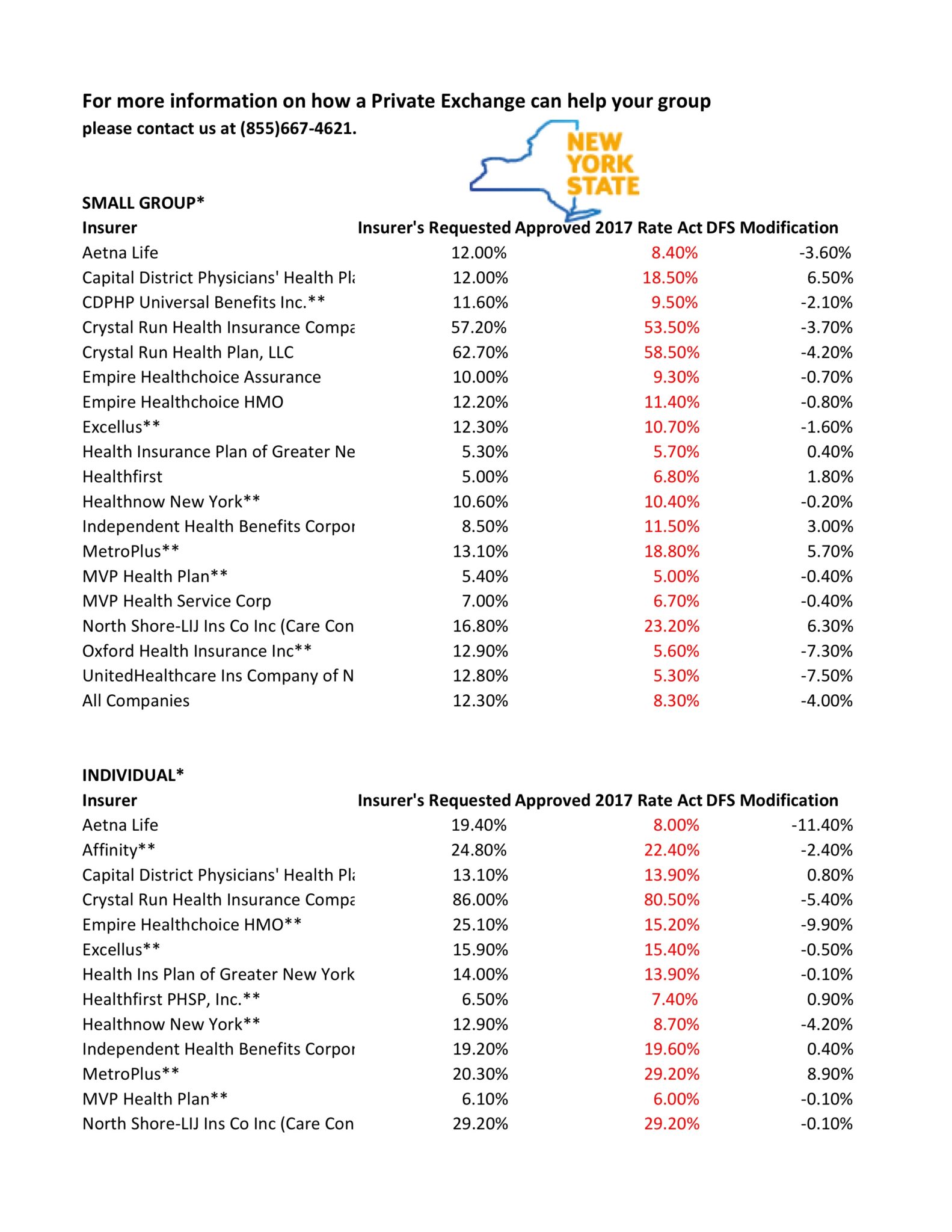

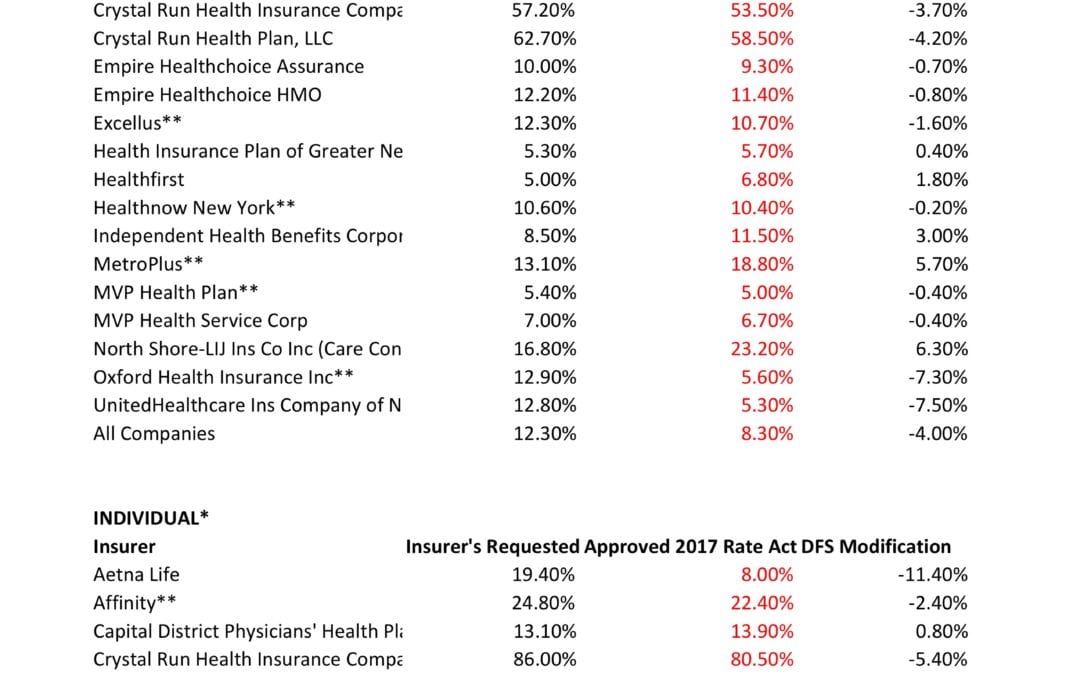

NYS has approved 2017 Final Rates. Small group rates will increase 8.3%, a reduction from the 12.3% average originally requested. In the individual market, the average increase will be 16.6%, a reduction from the originally requested 19.3%.

As per NY State Law carriers are required to send out early notices of rate request filings to groups and subscribers see original –NYS 2017 Rate Requests. With only 3 months of mature claims experience for 2016 health insurers’ requests are historically above average. Ultimately the State reduces this request substantially. This year, however, NYS acknowledged that medical costs increased, citing a 7-percent average increase on the individual market and an 8.5-percent increase on the small group market. The administration also acknowledged drug prices have impacted insurers, pointing specifically to blockbuster drugs for Hepatitis C.

OTHER STATES

The national rate trend, however, has been much higher than in past years due to higher health care costs Like other states throughout the nation, the 2017 rate of increase for individuals in New York is higher than in past years partly due to the termination of the federal reinsurance program. The lost of the program’s aka federal risk reinsurance corridor funds accounts for 5.5 percent of the rate increase.

How are neighboring States doing? In NJ, not that bad. According to a review of filings made public last week the expected rate increase will be likley ve half. Example: Horizon Blue Cross Blue Shield requested a 4.8% increase on their OMINA Plans. For CT market, on the other hand, things are much worse at least for individual marketplace with average 25% rate increases.

SMALL GROUP MARKET VS. INDIVIDUAL MARKET

The new premium hikes ranged from as little as 5.6 percent for Oxford Small group to a whopping 58.5% percent increase for Crystal Run Health Insurance Company, an insurer that covers parts of the Hudson Valley and Catskills. Importantly, small group market are still more advantageous than individual markets unless one gets a sizable low income tax credit.

Overall, about 350,000 individual plan consumers will be affected by the price hike, while more than a million users will be hit by higher small group fees. Earlier this year, Blue Cross Blue Shield released a study showing Obamacare user costs were 22 percent higher than people with employer-sponsored health plans, while UnitedHealth plans to exit most Exchanges see – Breaking: Oxford Exits Metro Indiv & Oxford Liberty HMO 2017.

The correct approach for a small business in keeping with simplicity is a Private Exchange. This is a true defined contribution empowering employees with choice of leading insurers offering paperless technologies integrating HRIS/Benefits/Payroll. Both employee and employers still gain tax advantage benefits under the business. Also, the benefits, rates and network size are superior under a group plan as the risk are lower for small group plans than individual markets.

* All amounts are rounded to the nearest 1/10.

**Indicates that the company makes products available on the “New York State of Health” marketplace.

***After rate applications were filed on 5/9/2016, additional information, including the final results of the federal risk adjustment program, prompted several insurers to update their initially filed rates.

For more information on how a Private Exchange can help your group please contact us at (855)667-4621.

by Alex | Jun 8, 2016 | group health insurance, Health Care Reform, Health Exchanges, Individual Exchanges, SHOP Exchanges

Final 2017 Marketplace Guidance

Health and Human Services had released earlier this year the final version of its 2017 Notice of Benefit and Payment Parameters. Under the Affordable Care Act (ACA) this is issued annually. While the guidance is mostly relate dot the individual marketplace itt does, however, include several items relevant to employers and group health plans, specifically:

- Annual limits for cost sharing (out-of-pocket limits)

- Marketplace eligibility notifications to employers

- Marketplace annual open enrollment period

- Small Business Health Options (SHOP) Exchange

ANNUAL LIMITS FOR COST SHARING:

The annual out of pocket limits for plan years beginning on or after January 1, 2017 are $7,150 for individual coverage and $14,300 for family coverage. These cost sharing limits apply to in-network essential health benefits offered under non-grandfathered health plans, both fully and self-insured. Annual deductibles, in-network co-insurance and other types of in-network cost sharing accumulate toward the out-of-pocket limit, including prescription drug copayments. Not included are premium payments, out-of-network cost sharing and spending on non-essential health benefits.

MARKETPLACE ELIGIBILITY NOTIFICATIONS TO EMPLOYERS:

Beginning in 2017, the Marketplace will notify an employer as soon as possible when one of its employee’s first enrolls in subsidized Marketplace coverage. Since some employers may be liable for a penalty under the ACA’s employer mandate when an employee qualifies for a subsidized Marketplace coverage, this change to a more proactive notification process will hopefully provide employers with the opportunity to work with CMS in cases where an improper subsidy has been provided.

MARKETPLACE ANNUAL OPEN ENROLLMENT PERIOD:

Open Enrollment in the Health Insurance Marketplace, Healthcare.gov, for 2017 and 2018 will take place from November 1, 2016 through January 31, 2017 and November 1, 2017 through January 31, 2018, respectively.

SMALL BUSINESS HEALTH OPTIONS (SHOP) EXCHANGE:

Beginning in 2017, small employers electing coverage in the SHOP Exchange will have the option of “vertical choice,” offering plans across all metal levels (platinum, gold, silver and bronze) from one insurer. States who opt out of the vertical choice option will continue to offer employers the choice of selecting health plans that are available at one single metal level of coverage.

Stay proactive and contact us today for a custmozied consult on how your organization can prepare ahead for ACA, Benefits, Payroll and HR @ (855) 667-4621 or info@medicalsolutionscorp.com.

These rates are for New York City unless otherwise indicated, and for a single person. For a family premium, multiply by 2.85, Husband/Wife

These rates are for New York City unless otherwise indicated, and for a single person. For a family premium, multiply by 2.85, Husband/Wife

established companies “with sicker patients”. Start-ups, by contrast, with much lower rate of diagnosed sick patients essentially pay into this tax. This tax is part of the risk adjustment program intended to stabilize Insurers who took on sicker patients and spread this risk. While some correctly blame too low pricing and some miscalculated business decision-making the inherent extra tax doomed the majority of the original 16 co-ops.

established companies “with sicker patients”. Start-ups, by contrast, with much lower rate of diagnosed sick patients essentially pay into this tax. This tax is part of the risk adjustment program intended to stabilize Insurers who took on sicker patients and spread this risk. While some correctly blame too low pricing and some miscalculated business decision-making the inherent extra tax doomed the majority of the original 16 co-ops.