NYS 2017 FINAL Rates Approved

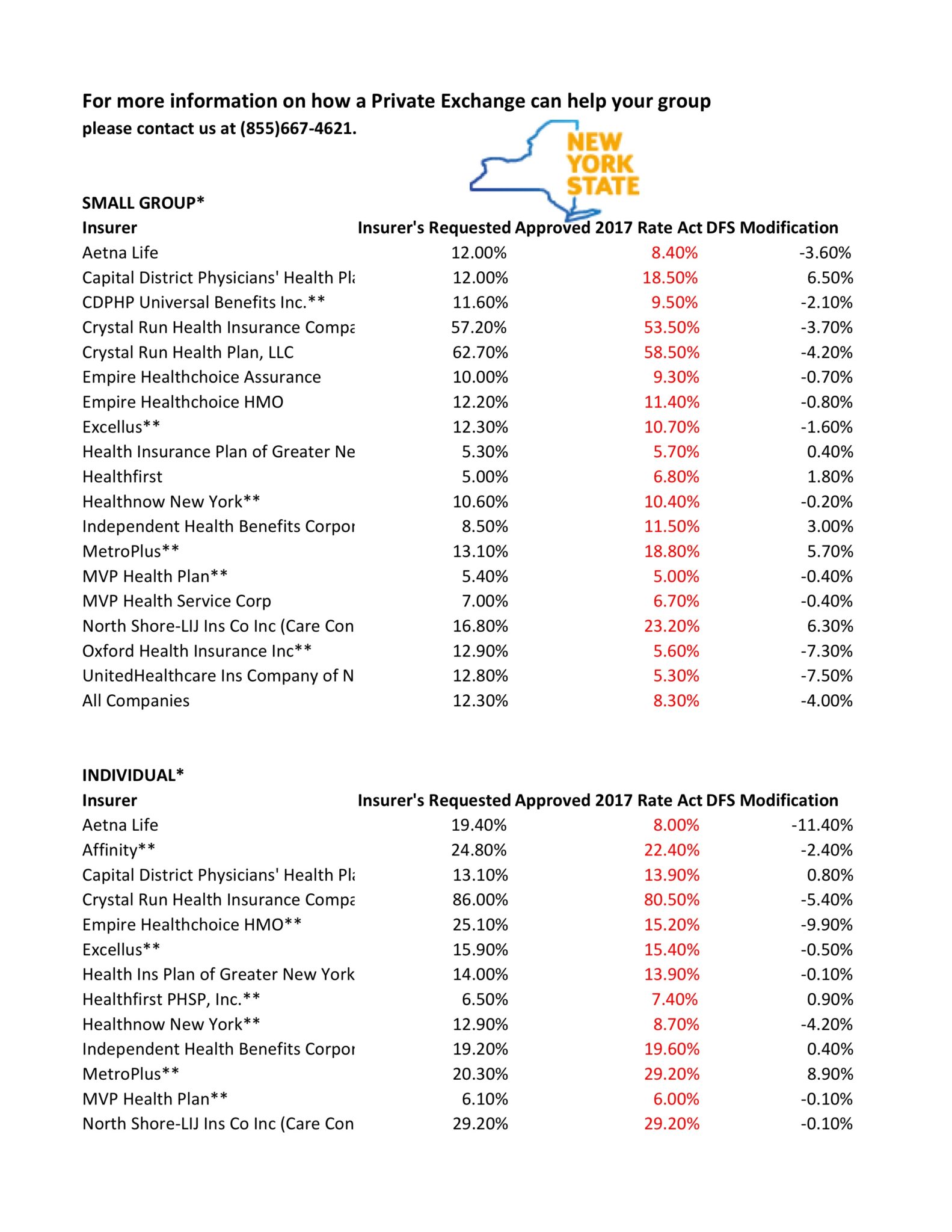

NYS has approved 2017 Final Rates. Small group rates will increase 8.3%, a reduction from the 12.3% average originally requested. In the individual market, the average increase will be 16.6%, a reduction from the originally requested 19.3%.

As per NY State Law carriers are required to send out early notices of rate request filings to groups and subscribers see original –NYS 2017 Rate Requests. With only 3 months of mature claims experience for 2016 health insurers’ requests are historically above average. Ultimately the State reduces this request substantially. This year, however, NYS acknowledged that medical costs increased, citing a 7-percent average increase on the individual market and an 8.5-percent increase on the small group market. The administration also acknowledged drug prices have impacted insurers, pointing specifically to blockbuster drugs for Hepatitis C.

OTHER STATES

The national rate trend, however, has been much higher than in past years due to higher health care costs Like other states throughout the nation, the 2017 rate of increase for individuals in New York is higher than in past years partly due to the termination of the federal reinsurance program. The lost of the program’s aka federal risk reinsurance corridor funds accounts for 5.5 percent of the rate increase.

How are neighboring States doing? In NJ, not that bad. According to a review of filings made public last week the expected rate increase will be likley ve half. Example: Horizon Blue Cross Blue Shield requested a 4.8% increase on their OMINA Plans. For CT market, on the other hand, things are much worse at least for individual marketplace with average 25% rate increases.

SMALL GROUP MARKET VS. INDIVIDUAL MARKET

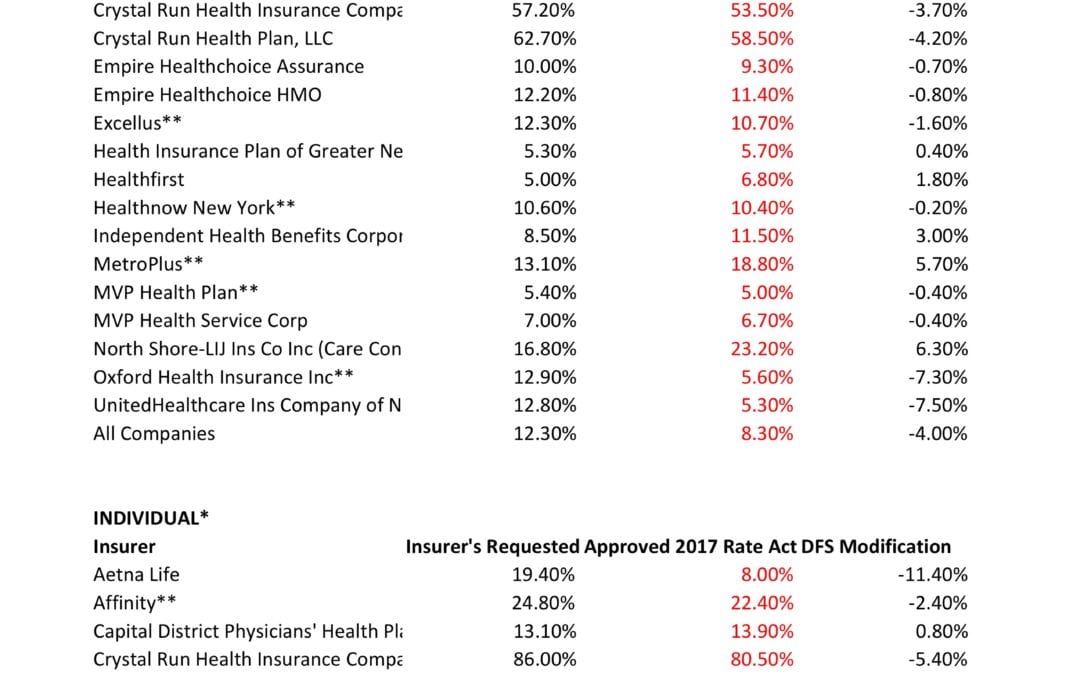

The new premium hikes ranged from as little as 5.6 percent for Oxford Small group to a whopping 58.5% percent increase for Crystal Run Health Insurance Company, an insurer that covers parts of the Hudson Valley and Catskills. Importantly, small group market are still more advantageous than individual markets unless one gets a sizable low income tax credit.

Overall, about 350,000 individual plan consumers will be affected by the price hike, while more than a million users will be hit by higher small group fees. Earlier this year, Blue Cross Blue Shield released a study showing Obamacare user costs were 22 percent higher than people with employer-sponsored health plans, while UnitedHealth plans to exit most Exchanges see – Breaking: Oxford Exits Metro Indiv & Oxford Liberty HMO 2017.

The correct approach for a small business in keeping with simplicity is a Private Exchange. This is a true defined contribution empowering employees with choice of leading insurers offering paperless technologies integrating HRIS/Benefits/Payroll. Both employee and employers still gain tax advantage benefits under the business. Also, the benefits, rates and network size are superior under a group plan as the risk are lower for small group plans than individual markets.

* All amounts are rounded to the nearest 1/10.

**Indicates that the company makes products available on the “New York State of Health” marketplace.

***After rate applications were filed on 5/9/2016, additional information, including the final results of the federal risk adjustment program, prompted several insurers to update their initially filed rates.