Welcome to Our Blog

Stay up to date on the latest News on our industry.Update: Oxford/United and Mt Sinai Health Systems Split

Mount Sinai, UnitedHealthcare dispute terminating contract March 1, 2024 . What Oxford/United members need to know.

Why We Love PEO This Valentine’s Day

Why We Love PEO This Valentine’s Day. Today we’re counting down our top 5 reasons why we love PEO. National Capabilities, Liability Protections, Technologies, One Vendor and PEO saves you money on HR staff. Try Our PEO Quoting Tool today.

5 Trends Shaping The Future Of Employee Wellness

Discover the future of employee wellbeing. From mental health strategies to tech-driven solutions and flexible work arrangements, this piece explores 5 trends shaping the workplace of tomorrow.

2024 Open Enrollment Checklist

To prepare for 2024 open enrollment, health plan sponsors should be aware of the legal changes affecting the design and administration of their plans for plan years beginning on or after Jan.

Webinar: Employee Benefits Communications Into Advantage

Join Us for the Sept 26, 2023 Webinar!Don't Get Caught Out of Timre. Be Proactive Before Your Plan Renews. What Can You Do and What Are the Best Practices?LearnBE INFORMED TO BE EMPOWERED WEBINARS About this Session:Engaging your workforce and captivating them:...

Best Hospitals – Newsweek 2023

Best Hospitals – Newsweek 2023. Where did your hospital rank? Not sure which area hospital is the best? The study is only a helpful tool. For the best options contact us at info@medicalsolutionsforp.com or 855-667-4621.

HSA 2024 Dollar Limits

2024 HSA contribution limits increase to $4,150, $8,300

AI Could Detect Cancer in Chest X-Rays

Artificial intelligence can help spot early signs of cancer in chest x-rays. AI tool identified abnormal chest X-rays with a 99% sensitivity.

FSA & Commuter Contribution 2023 Limits Released

2023 FSA & Commuter Contribution Limits Released.Health FSA $3,050, Carryover $610 and Depends Care FSA $5,000.Contact info@360peo.com or (855)667-4621.

CareMount Medical Joins Empire Blue Access + Connection Networks

On September 1, 2022, Empire BlueCross BlueShield will begin partnering with CareMount Medical, the largest independent, multi-specialty group in New York State, to provide access to affordable care throughout New York City, Westchester, Putnam, Dutchess, Columbia,...

Study: Employer Sponsored Health Plans Generate 47% ROI

For every dollar employers spent on health insurance-related costs, they get back $1.47 according to a new study. This figure in fact is expected to grow to 52% by 2026 from 47%. Employee productivity reflects the reductions in absenteeism and presenteeism after receiving employer-sponsored coverage. These productivity increases contributed an estimated $275.6 billion in employer benefits in 2022, or 53.3 percent of all benefits. By 2026, this is expected to rise to $346.6 billion or 55.9 percent of total ROI.

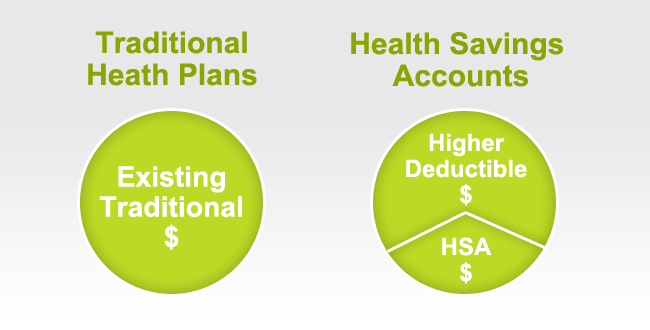

Webinar: How HDHP Can Set Employees Up for Financial Success

A common fear among employees can be that High Deductible Health Plans (HDHPs) expose them to too much risk. However, this misconception misses the near-certain long-term losses that come with not choosing a HDHP that includes an HSA. What employees are often missing is a full knowledge of the long-term financial impacts and risks associated with enrolling in an HDHP paired with HSA savings strategy, compared to a more traditional, low deductible PPO option. Employer contributions to HSAs can also set employees up for financial success and retirement readiness.

HSA 2023 Dollar Limits

The IRS has released the 2023 Health Savings Account (HSA) inflation adjustments. To be eligible to make HSA contributions, an individual must be covered under a high deductible health plan (HDHP) and meet certain other eligibility requirements. New HSA 2023 limits...

Free Telehealth Restored Under HSA Until 2023

Effective April 1, 2022, Free Telehealth Restored Under HSA Until 2023.CARES Act offered temporary relief related to telehealth offered HSA. Does your HSA charge a copay for telehealth?

Why We Love PEO This Valentine’s Day

We already love Professional Employer Organization (PEO)– our clients do too. Today we’re counting down our top 5 reasons why we love PEO: 1.National Capabilities: It ensures your compliance with local and federal laws, even if your business has locations in...

Health Insurers Cover Home COVID-19 Tests

Starting Jan 15 at-home CIOVID-19 tests will be free of charge.How Will this work with your Insurer? Types of COVID Tests? Call (855)667-4621

5 Tips to Staying Healthy During Flu Season

You can get ahead of cold and flu season by embracing a few habits that can help support a healthy immune system. Bookmark 360peo.com

OSHA Issued COVID-19 Vaccination (ETS)

Biden Administration Announces Details of 2 Major Vaccine Policies. Covered Employers 100+ details and rules for healthcare works.Call 855-667-4621

Montefiore and Oxford Reach Agreement

Good news Bronx/Westchester. Oxford and Montefiore Health System announced moments ago that they have reached an agreement effective December 1, 2021 for UnitedHealthcare and Oxford employer-sponsored plans, as well as UnitedHealthcare’s Medicare Dual Special Needs Plan.

Medicare 2022 Open Enrollment

Medicare 2022 Open Enrollment. Plan F was replaced by Plan G. What can you do? Call 855-667-4621 or info@medicalsolutionscorp.com

Must Know Cyber Stats For 2021

Cybersecurity Awareness Month is intended to raise employee awareness in every way possible. It's never been more important for cybersecurity to be top of mind for all of us. We are all connected to the internet both professionally and personally, therefore, we are...

FEDERAL JAN 1st SMALL GROUP ANNUAL OPEN ENROLLMENT WAIVER

A little-known requirement but most important under the Affordable Care Act (ACA) is for Health Insurers must waive their minimum employer contribution and employee-participation rules once a year. ACA requires a one-month Special Open Enrollment Window for January 1st coverage. FEDERAL JAN 1st SMALL GROUP ANNUAL OPEN ENROLLMENT WAIVER. For more help w/Special Open Enrollment Window info@360peo.com or (855)667-4621

2022 Open Enrollment Checklist

2022 Open Enrollment Tools. A handy checklist of Employers s for the upcoming 2022 renewals. PLAN DESIGN CHANGES, ACA EMPLOYER MANDATE 855-667-4621.

Employee Retention Tax Credit

You may be eligible for the Employee Retention Tax Credit (really!) The #ERTC may seem complex if you’re using a PEO but it’s simplified and a hidden goldmine. #payroll #cashflowmanagement #bookkeeping #financeEmployee Retention Tax Credits (#ERTC) under CARES ACT have been available for #SMB yet there has been confusion. Learn and call (855)667-4621. #caresact #payroll

HSA 2022 Limits Released

HSA 2022 Limits. To be eligible to make HSA contributions, an individual must be covered under a high deductible health plan. Find out more 855-667-4621.

PEO White Papers: The PEO Industry Footprint in 2021

Key PEO Data 2021 Study.Nearly 4 Million Work Site Employees serving 173,000 PEO clients. 16% of 10-99 employees on PEO. Call (855)667-4621.

PPE Expenses May Be Reimbursable Under HSA

PPE Expenses May Be Reimbursable Under Health Spending Accounts – Video During the COVID-19 pandemic, you may have purchased masks or PPE for the purpose of preventing the spread of the COVID-19. Now, according to a recent announcement from the IRS, those purchases...

PEO Pros and Cons

When choosing the right PEO, especially when it comes to human resource management, you should ensure that they offer basic HR services like benefits, payroll, and compliance.

JAN 1 SMALL GROUP ANNUAL OPEN ENROLLMENT WAIVER

A little-known requirement but most important under the Affordable Care Act (ACA) is for Health Insurers must waive their minimum employer-contribution and employee-participation rules once a year. ACA requires a one-month Special Open Enrollment Window for January 1st coverage. FEDERAL JAN 1st SMALL GROUP ANNUAL OPEN ENROLLMENT WAIVER. For more help w/Special Open Enrollment Window info@360peo.com or (855)667-4621

2021 Open Enrollment Checklist

To download this entire document as a PDF, click here: Open Enrollment eBook This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice. In...

2021 Dollar Limits

IRS & SSA announced 2021 dollar limits IRA, HSA, 401k benefits and compensation levels for retirement plans and IRAs. There are incremental changes but nonetheless worth bookmarking.

President Issues Health Care Plan Executive Order

On Sept. 24, 2020, President Donald Trump issued an executive order outlining his health care plan, called the America First Health Care Plan. This Legal Update video explains further.For information about transparency providers and new tech tools contact us...

PPP Loans: What You Need to Know Now

Newsletter Sign Up Now Learn how our PEO Partnership can help your group please contact us at info@360peo.com or (855)667-4621.Put You & Your Employees in Good HandsGet In Touch For more information on PEOs or a customized quote please submit your contact. We...

PPP Flexibility Act Signed

24 weeks to spend funds. 60% of the loan on payroll costs. December 31 instead of June 30 covered period. Payback period extended. Call 855-667-4621.

HSA 2021 Limits

HSA 2021 Limits.To be eligible to make HSA contributions, an individual must be covered under a high deductible health plan. Find out more 855-667-4621.

6 Advantages of a PEO during COVID-19

6 Advantages of a PEO during COVID-19 As COVID-19 unfolds, the importance of a PEO for a Small Business becomes evident. How can you protect your employees while also managing costs? Here are examples of how our PEO clients have benefited. 1. Rapid Law Changes With...

(function(i,s,o,g,r,a,m){i['GoogleAnalyticsObject']=r;i[r]=i[r]||function(){

(i[r].q=i[r].q||[]).push(arguments)},i[r].l=1*new Date();a=s.createElement(o),

m=s.getElementsByTagName(o)[0];a.async=1;a.src=g;m.parentNode.insertBefore(a,m)

})(window,document,'script','https://www.google-analytics.com/analytics.js','ga'); ga('create', 'UA-24199025-1', 'auto');

ga('send', 'pageview');</script>