2024 Open Enrollment Checklist

2024 Open Enrollment Checklist

To download this entire document as a PDF, click here: Open Enrollment eBook

This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

In preparation for open enrollment, Employers should review their plan documents in light of changes for the plan year beginning Jan 1, 2024. Below is an Employer 2024 Open Enrollment Checklist including some administrative items to prepare for in 2024.

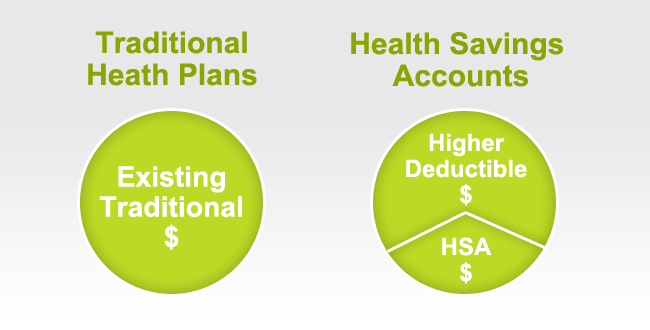

Change has been constant for employer plans in the last few years. Unfortunately, 2023 was no exception. As they prepare for 2024 open enrollment, employers must incorporate new requirements affecting the design and administration of their health plans for plan years beginning on or after Jan. 1, 2024. Those changes include items that are adjusted for cost of living changes each year, – e.g., the cost-sharing limits for high deductible health plans (HDHPs), contribution limits to health savings accounts (HSAs), as well as new requirements due to legislative and regulatory updates, such as the expiration of COVID-19 mandates, to name a few.

Employers should ensure their health plan is updated and communicate benefit changes to participants through an updated summary plan description (SPD) or a summary of material modifications (SMM) for the 2024 plan year.

As a general best practice, employers should confirm that their open enrollment materials contain certain required participant notices and consider including some periodic notices, such as the Medicare Part D creditable/non-creditable coverage notice, in their open enrollment materials.

PLAN DESIGN CHANGES

ACA Mandates

Affordability Requirements

Under the ACA’s employer shared responsibility rules (the “pay or play” rules), applicable large employers (ALEs) (those with 50 or more full-time employees or the equivalent) are required to offer affordable, minimum value health coverage to their full-time employees (and dependent children) or risk paying a penalty.

Under the ACA, an ALE’s health coverage is considered affordable if the employee’s required contribution to the plan does not exceed 9.5% of the employee’s household income for the taxable year (as adjusted each year). The adjusted percentage is 9.12% for 2023.

The affordability percentage for plan years that begin on or after Jan. 1, 2024, will be 8.39%. That is another reduction demonstrating the need for ALEs to monitor the affordability percentage each year so they can confirm that at least one of the health plans offered to full-time employees satisfies the ACA’s affordability standard (typically by the use of one of the optional safe harbors – federal poverty level, W-2 or rate of pay).

Out-of-pocket Maximum

Under the ACA, non-grandfathered health plans (which apply to almost all employer plans) are subject to limits on cost sharing for essential health benefits. Confirm that out-of-pocket maximum limits for your health plan comply with the ACA’s limits for the 2024 plan year.

Plan years beginning on or after Jan. 1, 2024:

- $9,450 for self-only coverage

- $18,900 for family coverage

Note, the out-of-pocket maximum limits for HDHPs compatible with HSAs must be lower than the ACA’s limits. For the 2024 plan year, the out-of-pocket maximum limits for HDHPs are $8,050 for self-only coverage and $16,100 for family coverage.

Preventive Care Benefits

The ACA requires non-grandfathered health plans to cover certain preventive health services without imposing cost-sharing requirements (e.g., deductibles, copayments, or coinsurance) when in-network healthcare providers supply the services. The preventive care services covered by the requirements are based on the following:

- Evidence-based items or services that have a rating of A or B in the current recommendations of the United States Preventive Services Task Force (USPSTF).

- Immunizations for routine use in children, adolescents, and adults that are currently recommended by the Centers for Disease Control and Prevention.

- Evidence-informed preventive care and screenings are included in the Health Resources and Services Administration (HRSA) guidelines for infants, children, and adolescents.

- Evidence-informed preventive care and screenings are included in HRSA-supported guidelines for women.

There needs to be some clarity. An ongoing court case has raised some uncertainty about using the USPSTF recommendations. However, guidance from federal agencies will permit employers to use those factors without the risk of penalties for the time being. Therefore, employers should monitor future developments regarding the ACA’s preventive care mandate, which is expected by the end of 2023.

Coverage For COVID-19 Vaccines, Testing And Treatment

Because the COVID-19 public health emergency has ended (see Alert here), health plans are no longer required to cover COVID-19 diagnostic tests and related services without cost sharing or other medical management requirements. Health plans are still required to cover recommended preventive services (under the ACA requirements), including COVID-19 immunizations, without cost sharing, but this coverage requirement can now be limited to in-network providers.

For plan years ending after Dec. 31, 2024, an HSA-compatible HDHP is no longer permitted to provide COVID-19 testing and treatment benefits without a deductible (or with a deductible below the minimum deductible for an HDHP). Therefore, employers should

- Determine whether health plans will impose cost-sharing requirements, prior authorization, or other medical management requirements on COVID-19 testing for the upcoming plan year.

- Determine whether health plans will continue covering COVID-19 immunizations without cost sharing from all healthcare providers or whether this first-dollar coverage will be limited to in-network providers.

- Confirm that HDHPs that do not have a calendar year as the plan year will not pay benefits for COVID-19 testing and treatment before the annual minimum deductible has been met for plan years ending after Dec. 31, 2024.

- Notify plan participants of any changes for the 2024 plan year regarding COVID-19 testing and vaccines through an updated SPD or SMM.

Health FSA Contributions

The IRS issued a memorandum on claims substantiation (see Article here) for health FSAs. The memorandum clarifies that health FSA expenses are not considered properly substantiated if employees self-certify expenses, if the plan uses sampling, if only amounts over a certain level are substantiated, or if charges from favored providers are not substantiated. Employers should, therefore, review the health FSA substantiation procedures to make sure they comply with IRS rules.

HDHP and HSA Limits for 2024

If you offer an HDHP to your employees that is compatible with an HSA, you should confirm that the HDHP’s minimum deductible and out-of-pocket maximum comply with the 2020 limits. The IRS limits for HSA contributions and HDHP cost-sharing increase for 2024. The HSA contribution limits will increase effective Jan. 1, 2024, while the HDHP limits will increase effective for plan years beginning on or after Jan. 1, 2024.

- Check whether your HDHP’s cost-sharing limits need to be adjusted for the 2024 limits.

- If you communicate the HSA contribution limits to employees as part of the enrollment process, these enrollment materials should be updated to reflect the increased limits that apply for 2024.

The following table contains the HDHP and HSA limits for 2024 as compared to 2023. It also includes the catch-up contribution limit that applies to HSA-eligible individuals who are age 55 or older, which is not adjusted for inflation and stays the same from year to year.

| Type of Limit | 2024 | 2023 | Change | |

| HSA Contribution Limit | Self-only | $4,150 | $3,850 | Up $300 |

| Family | $8,300 | $7,750 | Up $550 | |

| HSA Catch-up Contributions (not subject to adjustment for inflation) | Age 55 or older | $1,000 | $1,000 | No change |

| HDHP Minimum Deductible | Self-only | $1,600 | $1,500 | Up $100 |

| Family | $3,200 | $3,000 | Up $200 | |

| HDHP Maximum Out-of-pocket Expense Limit (deductibles, copayments and other amounts, but not premiums) | Self-only | $8,050 | $7,500 | Up $550 |

| Family | $16,100 | $15,000 | Up $1,100 | |

HDHP Design Option – Telehealth

At the beginning of the COVID-19 pandemic, Congress temporarily relaxed the rules for HDHPs to allow them to provide benefits for telehealth or other remote care services before plan deductibles were met without jeopardizing HSA eligibility. That relaxed rule currently applies for plan years beginning before Jan. 1, 2025.

- Determine whether HDHPs will waive the deductible for telehealth services for the plan year beginning in 2024

- Communicate plan changes for the upcoming year to participants through an updated SPD or SMM

Mental Health Parity – Required Comparative Analysis For NQTLs

The Mental Health Parity and Addiction Equity Act (MHPAEA) requires parity between a group health plan’s medical/surgical benefits and its mental health or substance use disorder (MH/SUD) benefits. These parity requirements apply to financial requirements and treatment limits for MH/SUD benefits. In addition, any nonquantitative treatment limitations (NQTLs) placed on MH/SUD benefits must comply with MHPAEA’s parity requirements. For example, NQTLs include prior authorization, step therapy protocols, network adequacy, and medical necessity criteria.

MHPAEA requires health plans and issuers to conduct comparative analyses of the NQTLs used for medical/surgical benefits compared to MH/SUD benefits. This analysis must contain a detailed, written, and reasoned explanation of the specific plan terms and practices and include the basis for the plan or issuer’s conclusion that the NQTLs comply with MHPAEA. Plans and issuers must make their comparative analyses available to specific federal agencies or applicable state authorities upon request.

- Employers should request that health plan issuers (or third-party administrators) confirm that comparative analyses of NQTLs will be updated, if necessary, for the plan year beginning in 2024 and make the analysis available to the employee.

Open Enrollment Notices

Employers who sponsor group health plans should provide certain benefits notices in connection with their open enrollment periods. Some of these notices must be provided at open enrollment time, such as the Summary of Benefit and Coverage (SBC). Other notices, such as the WHCRA notice, must be distributed annually. Although these annual notices may be provided at different times throughout the year, employers often include them in their open enrollment materials for administrative convenience.

In addition, employers should review their open enrollment materials to confirm that they accurately reflect the terms and cost of coverage. In general, any plan design changes for 2024 should be communicated to plan participants through an updated SPD or an SMM.

Summary Of Benefits And Coverage

The ACA requires health plans and health insurance issuers to provide an SBC to applicants and enrollees each year at open enrollment or renewal. Federal agencies have provided a template for the SBC, which health plans must use.

- Note that for self-funded plans, the plan administrator is responsible for providing the SBC. For insured plans, the issuer usually prepares the SBC. If the issuer prepares the SBC, an employer is not required to also prepare an SBC for the health plan, although the employer may need to distribute the SBC prepared by the issuer.

Medicare Part D Notices

Group health plan sponsors must provide a notice of creditable or non-creditable prescription drug coverage to Medicare Part D-eligible individuals covered by, or who apply for, prescription drug coverage under the health plan. The notice alerts the individuals about whether their prescription drug coverage is at least as good as Medicare Part D coverage. The notice generally must be provided at various times that cannot always be anticipated, including when an individual enrolls in the plan and each year before Oct. 15 (when the Medicare annual open enrollment period begins). Therefore, the best practice is to provide it annually at open enrollment, as that will ensure timely compliance. Model notices are available on the Centers for Medicare and Medicaid Services’ website.

Annual CHIP Notices

Group health plans covering residents in a state that provides a premium subsidy to low-income children and their families to help pay for employer-sponsored coverage must send an annual Children’s Health Insurance Program (CHIP) notice about the available assistance to all employees in that state. The U.S. Department of Labor (DOL) has provided a model notice.

Initial COBRA Notices

COBRA applies to employers with 20 or more employees who sponsor group health plans. Group health plan administrators must provide an initial COBRA notice to new participants and certain dependents within 90 days after plan coverage begins. The initial COBRA notice may be incorporated into the plan’s SPD. Because the COBRA election-period will not start until this notice is provided, it is helpful to many employers to include a copy in the open enrollment materials as a backup.

Notices Of Patient Protections

Under the ACA, group health plans and issuers that require the designation of a participating primary care provider must permit each participant, beneficiary, and enrollee to designate any available participating primary care provider (including a pediatrician for children). Additionally, plans and issuers that provide obstetrical/gynecological care and require a designation of a participating primary care provider may not require preauthorization or referral for such care. If a health plan requires participants to designate a participating primary care provider, the plan or issuer must provide a notice of these patient protections whenever the SPD or similar description of benefits is provided to a participant. If an employer’s plan is subject to this notice requirement, they should confirm that it is included in the plan’s open enrollment materials. This notice may be included in the plan’s SPD. Model language is available from the DOL.

Grandfathered Plan Notices

If an employer has a grandfathered plan, they should include information about its grandfathered status in plan materials describing the coverage under the plan, such as SPDs and open enrollment materials. Model language is available from the DOL.

Notices Of HIPAA Special Enrollment Rights

At or before enrollment, an employer’s group health plan must provide each eligible employee with a notice of their special enrollment rights under HIPAA. This notice may be included in the plan’s SPD.

HIPAA Privacy Notices

The HIPAA Privacy Rule requires covered entities (including group health plans and issuers) to provide a Notice of Privacy Practices (or Privacy Notice) to everyone who is the subject of protected health information (PHI). Health plans are required to send the Privacy Notice at certain times, including to new enrollees at the time of enrollment. Also, at least once every three years, health plans must either redistribute the Privacy Notice or notify participants that the Privacy Notice is available and explain how to obtain a copy. Self-insured health plans are required to maintain and provide their own Privacy Notices. However, special rules apply for fully insured plans, where the health insurance issuer, not the plan itself, is primarily responsible for the Privacy Notice.

Special Rules for Fully Insured Plans

The plan sponsor of a fully insured health plan has limited responsibilities with respect to the Privacy Notice, including the following:

- If the sponsor of a fully insured plan has access to PHI for plan administrative functions, they are required to maintain a Privacy Notice and to provide the notice upon request.

- If the sponsor of a fully insured plan does not have access to PHI for plan administrative functions, they are not required to maintain or provide a Privacy Notice.

- A plan sponsor’s access to enrollment information, summary health information, and PHI that is released pursuant to a HIPAA authorization does not qualify as having access to PHI for plan administration purposes.

Model Privacy Notices are available through the Department of Health and Human Services.

WHCRA Notices

Plans and issuers must provide notice of participants’ rights to mastectomy-related benefits under the WHCRA at the time of enrollment and annually. The DOL’s compliance assistance guide includes model language for this disclosure.

SARs

Plan administrators required to file Form 5500 must provide participants with a narrative summary of the information in Form 5500, called a summary annual report (SAR). A model notice is available from the DOL.

Group health plans that are unfunded (that is, benefits are payable from the employer’s general assets and not through an insurance policy or trust) are not subject to the SAR requirement. The plan administrator generally must provide the SAR within nine months of the close of the plan year. If an extension of time to file Form 5500 is obtained, the plan administrator must furnish the SAR within two months after the close of the extension period.

Wellness Program Notices

Group health plans that include wellness programs may be required to provide certain notices regarding the program’s design. As a general rule, these notices should be provided when the wellness program is communicated to employees and before employees provide any health-related information or undergo medical examinations. These notices are required in the following situations:

- HIPAA Wellness Program Notice—HIPAA imposes a notice requirement on health-contingent wellness programs offered under group health plans. Health-contingent wellness plans require individuals to satisfy standards related to health factors (e.g., not smoking) to obtain rewards. The notice must disclose the availability of a reasonable alternative standard to qualify for the reward (and, if applicable, the possibility of waiver of the otherwise applicable standard) in all plan materials describing the terms of a health-contingent wellness program. The DOL’s compliance assistance guide includes a model notice that can be used to satisfy this requirement.

- ADA Wellness Program Notice—Employers with 15 or more employees are subject to the Americans with Disabilities Act (ADA). Wellness programs that include health-related questions or medical exams must comply with the ADA’s requirements, including an employee notice requirement. Employers must give participating employees a notice that tells them what information will be collected as part of the wellness program, with whom it will be shared, and for what purpose, as well as the limits on disclosure and the way information will be kept confidential. The U.S. Equal Employment Opportunity Commission (EEOC) has provided a sample notice to help employers comply with this ADA requirement.

ICHRA Notices

Employers may use individual coverage HRAs (ICHRAs) to reimburse their eligible employees for insurance policies purchased in the individual market or Medicare premiums. Employers with ICHRAs must notify eligible participants about the ICHRA and its interaction with the ACA’s premium tax credit. In general, this notice must be provided at least 90 days before the start of each plan year. Employers may provide this notice at open enrollment time if it is at least 90 days before the beginning of the plan year. A model notice is available for employers to use to satisfy this notice requirement.

________________________________

Enhance Your Employee Benefits Package. A competitive benefits package is key to keeping and attracting top talent. Assess your current benefits package and consider making necessary adjustments to include options, such as expanded mental health support, for example.

GENERAL HR

Review Employee Records. The fourth quarter is a good time to review your employee records and check record retention guidelines. Don’t forget to dispose of outdated termination and outdated job applications properly. With W2s around the corner, make sure all addresses and information are updated.

Develop and Distribute Your 2024 Calendar. Create and distribute a calendar outlining important dates, vacation time, pay dates, and company-observed holidays for 2024.

Review and Update Employee Handbook. Review your employee handbook to make sure it is up-to-date and addresses areas, such as employment law mandates, new COVID-related policies, guidelines for remote working, privacy policies, compensation and performance reviews, social media policies, attendance, and time-off, break periods, benefits, and procedures for termination, discipline, workplace safety, and emergency procedures.

PLEASE NOTE: This Checklist is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice. This information is for general reference purposes only. Because laws, regulations, and filing deadlines are likely to change, please check with the appropriate organizations or government agencies for the latest information and consult your employment attorney and/or benefits advisor regarding your responsibilities. In addition, your business may be exempt from certain requirements and/or be subject to different requirements under the laws of your state. (Updated Sept 3, 2023)

Contact us at (855) 667-4621 or email us at info@360peo.com

Learn more about

Liability Protection • Employee Benefits • HR Consulting