by Alex | Nov 2, 2020 | group health insurance, Obamacare, PPACA, Small Business Group Health

A little-known requirement but most important under Affordable Care Act (ACA) is for Health Insurers must waive their minimum employer-contribution and employee-participation rules once a year. ACA requires a one-month Special Open Enrollment Window for January 1st coverage.

The special open enrollment period occurs November 15th through December 15th of each year, allowing eligible small group employers to enroll for coverage effective January 1st of the following year.

Background

The ACA has a section in it called the “guaranteed issuance of coverage in the individual and group market.” It stipulates that “each health insurer that offers health insurance coverage in the individual or group market in the state must accept every employer and individual in the state that applies for such coverage.” The section also states that this guaranteed issuance of coverage can only be offered during (special) open enrollment periods, and that plans can only be offered to applicants that live in, work in, or reside in the plans’ service area(s).

Participation and Contribution Requirements

In many states (including California and Nevada), carriers can decline to issue group health coverage if fewer than 70% of employees elect to enroll in coverage. Some carriers may have even tighter participation requirements.

Generally speaking, employees with other coverage (Medicare, other group coverage, individual coverage through the Exchange, etc.) are removed from the participation requirement calculation – though it varies by insurance carrier.

Furthermore, employer contribution rules require employers to contribute a certain percentage of premium costs for all employees in order to attain group health coverage. Some businesses struggle to meet these contribution requirements for a variety of financial reasons.

Problem Solved: Special Open Enrollment Period

Many employers want to offer coverage to their employees, but are denied because they struggle to meet participation and/or contribution requirements. Employers cannot force employees to enroll in coverage unless the employer pays for 100% of the employees’ premiums, which many employers cannot afford. Even with moderate to generous employer contributions, many employers still find young and lower-income employees waiving coverage. This was even more evident in 2019 with the ACA’s federal Individual Mandate non-compliance penalty reduced to $0.00.

The U.S. Department of Health & Human Services provides final guidance on this in regulation 147.104(b)(1): “In the case of health insurance coverage offered in the small group market, a health insurance issuer may limit the availability of coverage to an annual enrollment period that begins November 15 and extends through December 15 of each year in the case of a plan sponsor that is unable to comply with a material plan provision relating to employer contribution or group participation rules.”

If your employer groups are struggling with participation and/or contribution, the Special Open Enrollment Window is the time to enroll them in coverage.

For more help with the Special Open Enrollment Window contact us at info@360peo.com or (855)667-4621.

Put You & Your Employees in Good Hands

Get In Touch

For more information on PEOs or a customized quote please submit your contact. We will be in touch ASAP.

by Alex | Feb 15, 2017 | Health Care Reform, Obamacare, PPACA, State Exchanges

Leading article on the direction of TRUMPCARE we’ve read thus far. Former president Barack Obama’s budget director, Peter Orszak thinks Obamacare will be replaced through the waiver process.

Leading article on the direction of TRUMPCARE we’ve read thus far. Former president Barack Obama’s budget director, Peter Orszak thinks Obamacare will be replaced through the waiver process.

Here’s How Trump Will Change Obamacare

By Peter R. Orszag FEB 14, 2017 6:00 AM EST

Promises made by Donald Trump and Republicans in Congress to repeal and replace the Affordable Care Act are proving to be more complicated than they sounded on the campaign trail. With reality now setting in, what’s most likely to happen?

I expect to see Republicans stage a dramatic early vote to repeal, with legislation that includes only very modest steps toward replacement — and leave most of the work for later. Next, the new administration will aggressively issue waivers allowing states to experiment with different approaches, including changes to Medicaid and private insurance rules. At some point, then, the administration will declare that these state experiments have been so successful, Obamacare no longer exists.

In other words, the repeal vote will be just for show; the waivers will do most of the heavy lifting.

I predict something like this will happen because of two core challenges that stand in the way of Republicans’ replacing the ACA through legislation: the need for so-called community rating and the need to have 60 votes in the Senate to pass a comprehensive new health-care law.

First, community rating. It is one of the basic building blocks needed to create a workable private insurance market — whether Democrats or Republicans are doing the building. If your insurance covers a pre-existing condition but at a cost of, say, $100,000, that doesn’t really help. Community rating requires that your premium be the same as that of other people in your area, no matter how unhealthy you are.

With community rating in place, the next step is to recognize how easy it is to game the system: People can just wait until they get sick, then buy insurance at the community rate. To discourage that practice, the system needs to give people some strong incentive to purchase insurance before they get sick. The Affordable Care Act used an individual mandate; most Republican plans instead propose a requirement for continuous coverage. That is, people enjoy access to community-rated premiums in the future only if they have kept themselves insured over some period of time in the past.

Given the costs involved, subsidies are also needed to ensure that low- and moderate-income households can afford the coverage. This overall structure means that younger, healthier people implicitly subsidize older, sicker people.

Such are the inescapable constraints imposed by community rating. Community rating could be discarded, as Mark Pauly of the University of Pennsylvania has argued. Pauly instead proposes that insurance companies be allowed to vary people’s premiums according to their health status, and that general revenue be used to pay sicker people’s higher premiums. This would require substantial new taxes, however, which is presumably a nonstarter in a Republican plan. In any case, it would only make the transfers to older, sicker people more explicit.

The second challenge is more nakedly political: Without a substantial change in Senate procedure, a bill to fully replace the Affordable Care Act, including changes to insurance rules, will require 60 votes. Republicans have only 52, so at least eight Democratic senators would need to be persuaded to go along. This is a much tougher assignment, especially since the administration will already be calling in legislative favors on ongoing confirmations, the debt limit, tax reform and other issues.

The Republicans’ desire to hold an early partisan vote repealing the ACA (through the reconciliation process that requires only a simple majority in the Senate) seems too strong to resist. The repeal will probably be set to become effective in the future, perhaps 2019 or 2020.

This vote will probably be closer than many people think, given the concerns that some moderate Republican senators have expressed about repealing the ACA with no replacement ready. Some far-right Republicans may also balk at anything less than a full immediate repeal. For the White House, however, the closeness of the vote will be a feature rather than a bug, because it will create the impression that the vote is significant.

The repeal legislation will probably include some modest steps toward replacing the ACA, but these will be mostly symbolic measures such as allowing insurance companies to sell across state lines (which by itself would do little to lower people’s premiums). The hard work of a creating comprehensive replacement is then likely to get bogged down in legislative muck.

But the administration can use its expansive waiver authority to allow states to experiment with both Medicaid and the individual insurance markets. As these 50 flowers bloom, President Trump could at some point declare victory and assert that the ACA has been sufficiently reformed.

This approach, whatever its potential substantive shortcomings, provides a major political benefit: The administration would not necessarily own the many problems that inevitably would remain. In response to any particular complaint in a specific state, the administration could simply shrug its shoulders and direct the inquiry to the relevant governor.

This outlook assumes that the Republican leadership in Congress isn’t willing, or lacks the votes, to change the Senate’s traditional rules, and that a comprehensive replacement for the ACA will indeed require 60 votes. If that changes, all bets are off.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the author of this story:

Peter R. Orszag at porszag5@bloomberg.net

To contact the editor responsible for this story:

Mary Duenwald at mduenwald@bloomberg.net

by Alex | Oct 31, 2016 | family health insurance, Health Care Reform, Health Exchanges, Individual Exchanges, individual health insurance, State Exchanges

2017 Individual Open Enrollment

Everything you need to know ahead of tomorrow’s 2017 Individual Open Enrollment. This Open Enrollment marks the 4th anniversary of Obamacare a.ka. The Affordable Care Act. As a helpful resource, the new NY and NJ rates with important deadlines are listed below. 33 States such as NJ use the healthcare.gov website or at https://medicalsolutionscorp.demo.hcinternal.net/individual/individual/homePage. States such as NY and CT use their own Marketplace – NYS of Health and AccessHealth CT. Importantly, individuals not expecting a subsidy may also apply Off-Exchange which in many case has more options and Insurers.

2017 NY Individual Health Plans

These rates are for New York City unless otherwise indicated, and for a single person. For a family premium, multiply by 2.85, Husband/Wife

These rates are for New York City unless otherwise indicated, and for a single person. For a family premium, multiply by 2.85, Husband/Wife

multiply by 2.0 and Parent/Children multiply by 1.70. The non single deductibles are out of pocket maximums are doubled. These are for standard plans, which two-thirds of customers enrolled in during 2016.

While deductibles for platinum, gold and silver plans have stayed the same, many bronze plan deductibles have increased 33 percent. That means consumers who purchase a bronze plan — presumably for its lower monthly premium — are paying more out of pocket for their medical costs before their insurance company kicks in a dime. A family of four that purchased a bronze plan will have an $8,000 deductible in 2017, up from $6,000 in 2015. For someone young and relatively healthy, that might be OK, but that person is vulnerable to a very large bill if he or she needs expensive medical care. It’s the platinum plans where New York State really shows itself to be a national outlier. Roughly 18 percent of New Yorkers chose a platinum plan in 2016, compared to 2 percent across the nation, according to the Kaiser Family Foundation.

Here are the 2017 rates:

2017-nys-marketplace-rates-1

2017 NJ Individual Health Plans

NJ Dept of Banking and Insurance posted the 2017 NJ individual health plans Monday. Only two carriers will offer plans on the state’s Obamacare marketplace next year: Horizon Blue Cross Blue Shield of New Jersey and AmeriHealth.

Additional insurers are participating off-exchange or outside the Marketplace. Examples: Aetna, CIGNA and Oxford. There are additional 20 plan options available off exchange. A notable new entrant, Health Republic of NJ, will no longer be available for 2017. See – Health Republic NJ Shutting Down.

Here are the 2017 rates:

2017-new-jersey-individual-health-benefits-plans-and-rates

2017 Individual Open Enrollment Deadlines

- November 1, 2016: Open Enrollment starts — first day you can enroll in a 2017 insurance plan through the Health Insurance Marketplace. Coverage can start as soon as January 1, 2016.

- December 15, 2016: Last day to enroll in or change plans for new coverage to start January 1, 2017.

- January 1, 2017: 2017 coverage starts for those who enroll or change plans by December 15.

- January 15, 2017: Last day to enroll in or change plans for new coverage to start February 1, 2017

- January 31, 2017: 2016 Open Enrollment ends. Enrollments or changes between January 16 and January 31 take effect March 1, 2017.

If you don’t enroll in a 2016 health insurance plan by January 31, 2017, you can’t enroll in a health insurance plan for 2016 unless you qualify for a Marketplace Special Enrollment Period.

Penalty: The uninsured penalty rises to $695 or 2.5% of your income, whichever is higher.

Coverage start dates

If you enroll before the 15th of any month, your coverage starts the first day of the next month. If you enroll after the 15th of the month, you’ll have to wait until the month after that for your coverage to start. So, for example, if you enroll on January 16, your coverage would start on March 1.

Enroll using our online comparison shopping tool for both on and off-Exchange Marketplace to be released next week. Email us or Contact us at (855)667-4621.

by Alex | Sep 13, 2016 | Health Care Reform, Health Exchanges, Obamacare, regional health insurance co-ops, State Exchanges

Health Republic NJ Shutting Down

Health Republic NJ Shutting Down

In yesterday’s surprise announcement, NJ regulators will be shutting down Health republic NJ for 2017 “because of its hazardous financial condition”. This marks the demise of the second Metro area healthcare co-op with the same name-sake Health Republic but different managed healthcare co-op, see Health Republic NY Shutting Down Nov 30.

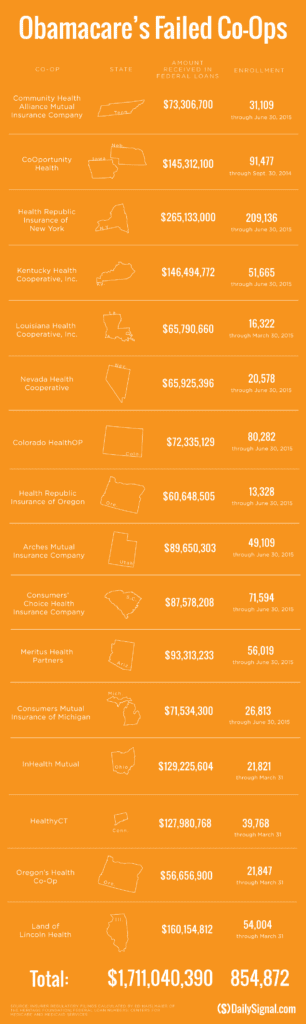

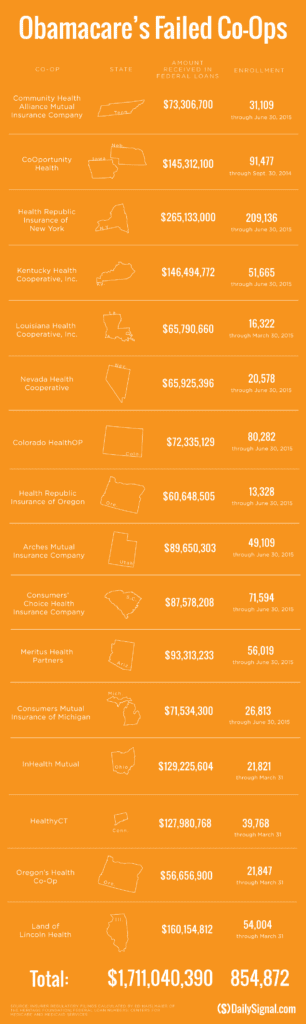

Since Obamacare’s rollout in the fall of 2013, 16 co-ops that launched with money from the federal government have collapsed. Now, just six co-ops—Wisconsin’s Common Ground Healthcare Cooperative; Maryland’s Evergreen Health Cooperative; Maine Community Health Options; Massachusetts’ Minuteman Health; Montana Health Cooperative; and New Mexico Health Connections—remain.

In a bizarre twist of fate or unintended Affordable Care Act design flaw small affordable startups not only have to gain new client footholds but also support large

established companies “with sicker patients”. Start-ups, by contrast, with much lower rate of diagnosed sick patients essentially pay into this tax. This tax is part of the risk adjustment program intended to stabilize Insurers who took on sicker patients and spread this risk. While some correctly blame too low pricing and some miscalculated business decision-making the inherent extra tax doomed the majority of the original 16 co-ops.

Health Republic in fact grew steadily and made money the first 9 months of 2015. However, HRNJ lost 17.6 million end of 2015 and is choking off at this $46.3 million payment to the government through the risk adjustment program. This is considered one of the 3 R’s of the reinsurance program – risk corridor, reinsurance and risk adjustment that were intended to level the playing field. The first “R”—“reinsurance”—subsidizes insurers that attract individual customers who rack up particularly high medical bills. The second—“risk adjustment”—requires insurers with low-cost patients to make payments to plans that share the benefits with those who insured higher-cost ones. And the third, called “risk corridors,” is a program to subsidize health plans whose total medical expenses for all their Obamacare customers overshoot a target amount.

The co-ops received less money than they initially anticipated last year under Obamacare’s risk corridor program, which resulted in the collapse of at least five co-ops and a $5 billion class action lawsuit

filed by 6 state’s co-ops – ” Oregon-based insurer Moda Health Plan Inc., Blue Cross Blue Shield of North Carolina, Pittsburgh-based Highmark Inc., and the failed CoOportunity Health, which was based in West Des Moines, Iowa, and Health Republic Insurance Co. of Oregon, which was based in Lake Oswego.”

From Politico’s “Obamacare’s sinking safety net”:

“The risk corridor program, however, has been an unmitigated debacle. In December 2014, the Republican Congress voted to prohibit the Obama administration from spending any money on the program, decrying it as a bailout for the insurance companies. Sen. Marco Rubio, then thought to be a leading GOP presidential contender for 2016, was particularly vocal in pillorying the program.

Unlike all those symbolic “repeal Obamacare” votes, Congress actually succeeded in blocking those risk corridor payments, and it hit Obamacare hard. Insurers filed claims seeking $2.9 billion, but under the limits imposed by the GOP there was less than $400 million available to make good on those payments. The end result: insurers initially received only 12.6 cents for each dollar they had counted on. Many of the new Obamacare co-op plans that went out of business blamed their collapse in part on the fact that they’d been counting on the full payments to keep them solvent.”

Regrettably, in a Presidential year no one wants to touch this burning hot potato. Perhaps NJ’s handling of this pressure cooker and taking 2017 off may be the best course of action after all.

9/16/16 Addendum:

As of Monday, September 19, 2016, the portal for Health Republic Insurance will be shut down, as they are no longer accepting new business for the year.

The New Jersey State Department of Banking and Insurance has also provided a list of FAQs related to the shutdown and how it affects individuals, small employers, brokers and providers. For more information, click here.

As always, our team is here to assist you and to help you grow your business.

by Alex | Jul 21, 2016 | Health Care Reform, healthcare, HSA, Obamacare, PPACA

CLINTON VS TRUMP ON HEALTH CARE

CLINTON VS TRUMP ON HEALTHCARE

Clinton vs Trump Healthcare. A helpful overview from SHRM on the differences between the Candidates. They presumably agree on repealing the Cadillac Tax and well-needed price transparencies.

HILLARY CLINTON’S HEALTH CARE REFORM PLAN:

- Defend the Affordable Care Act. Clinton will continue to defend the ACA against Republican efforts to repeal it.

- Lower out-of-pocket costs like copays and deductibles. The average deductible for employer-sponsored health plans rose from $1,240 in 2002 to about $2,500 in 2013. Clinton believes that workers should share in slower growth of national health care spending through lower costs.

- Reduce the cost of prescription drugs. Prescription drug spending accelerated from 2.5 percent in 2013 to 12.6 percent in 2014. It’s no wonder that almost three-quarters of Americans believe prescription drug costs are unreasonable. Clinton believes we need to demand lower drug costs for hardworking families and seniors.

- Build on the Affordable Care Act and require plans to provide three sick visits without counting toward deductibles every year. The Affordable Care Act required nearly all plans to offer many preventive services, such as blood pressure screening and vaccines, with no cost-sharing at all. But because average deductibles have more than doubled over the past decade, many Americans would have to pay a significant cost out-of-pocket toward their deductible if they get sick and need to see a doctor. Clinton’s plan will build on the Affordable Care Act by requiring insurers and employers to provide up to three sick visits to a doctor per year without needing to meet the plan’s deductible first.

- Provide a new, progressive refundable tax credit of up to $5,000 per family for excessive out-of-pocket costs. For families that still struggle with prescription drug costs even after out-of-pocket limits on drug spending and free primary care visits, Clinton’s plan will provide progressive, targeted new relief. Americans with health coverage will be eligible for a new refundable tax credit of up to $2,500 for an individual, or $5,000 for a family, available to those with substantial out-of-pocket health care costs. The credit will be available to insured Americans with qualifying out-of-pocket health expenses in excess of five percent of their income, and who are not eligible for Medicare or claiming existing deductions for medical costs. This refundable, progressive credit will help middle-class Americans who may not benefit as much from currently-available deductions for medical expenses. This tax cut will be fully paid for by demanding rebates from drug manufacturers and asking the most fortunate to pay their fair share.

- Enforce and Broaden the ACA’s Transparency Provisions. Americans deserve real-time, updated, and reliable information to guide them in selecting a health plan, navigating changes to their out-of-pocket costs in their existing plan, choosing a doctor, and determining how much they will need to pay for a prescription drug. Clinton’s plan will vigorously enforce existing law under the Affordable Care Act and adopt further steps to make sure that employers, providers, and insurers provide this information through clear and accessible forms of communication so that Americans can make informed choices about their coverage and realize meaningful savings.

- Repeal the ACA “Cadillac Tax”

Source: https://www.hillaryclinton.com/issues/health-care/

DONALD TRUMP’S HEALTH CARE REFORM PLAN:

- Repeal ACA -Modify existing law that inhibits the sale of health insurance across state lines. As long as the plan purchased complies with state requirements, any vendor ought to be able to offer insurance in any state. By allowing full competition in this market, insurance costs will go down and consumer satisfaction will go up.

- Tax deductible health insurance premium payments. Allow individuals to fully deduct health insurance premium payments from their tax returns under the current tax system. -Allow individuals to use Health Savings Accounts (HSAs). Contributions into HSAs should be tax-free and should be allowed to accumulate. These accounts would become part of the estate of the individual and could be passed on to heirs without fear of any death penalty. These plans should be particularly attractive to young people who are healthy and can afford high-deductible insurance plans. These funds can be used by any member of a family without penalty. The flexibility and security provided by HSAs will be of great benefit to all who participate.

- Price transparency. Require price transparency from all healthcare providers, especially doctors and healthcare organizations like clinics and hospitals. Individuals should be able to shop to find the best prices for procedures, exams or any other medical-related procedure.

- Reform mental health programs. Families, without the ability to get the information needed to help those who are ailing, are too often not given the tools to help their loved ones. There are promising reforms being developed in Congress that should receive bi-partisan support.

- Block-grant Medicaid to the states. Nearly every state already offers benefits beyond what is required in the current Medicaid structure. The state governments know their people best and can manage the administration of Medicaid far better without federal overhead. States will have the incentives to seek out and eliminate fraud, waste and abuse to preserve our precious resources.

- Remove barriers to entry into free markets for drug providers that offer safe, reliable and cheaper products. Though the pharmaceutical industry is in the private sector, drug companies provide a public service. Allowing consumers access to imported, safe and dependable drugs from overseas will bring more options to consumers.

Source: https://www.donaldjtrump.com/positions/healthcare-reform

Add our blog & sign up for newsletter on latest in Healthcare Reform News. Please contact us for a free evaluation on your group’s benefits at 855-667-4621.

by Alex | May 19, 2016 | group health insurance, Health Exchanges, Individual Exchanges, individual health insurance, NY News, PPACA, Small Business Group Health

NYS 2017 Rate Requests

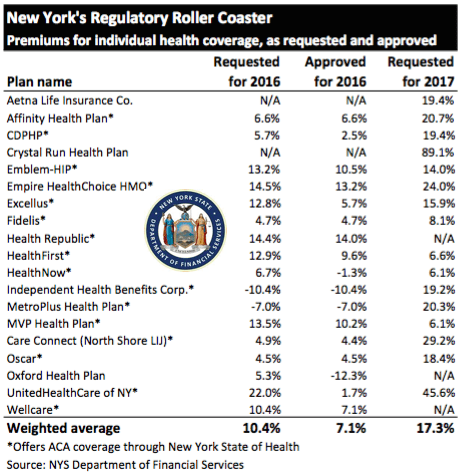

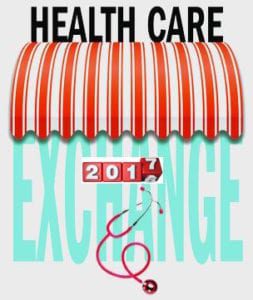

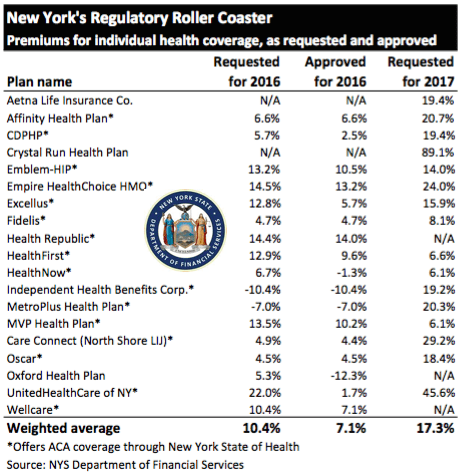

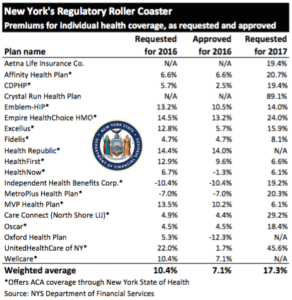

The State released NYS 2017 Rate Requests with average increases of 17.3% individual market and 12% for small groups. This early 5/12/16 deadline request requirement is not an Obamacare requirement. As per NY State Law carriers are required to send out notices of rate increase filings to groups and subscribers.

With only 3 months of mature claims in 2016 to work of off Insurance Actuaries have little experience to predict accurate projections. Typically the rate requests must be high and in the past final approvals after negotiations were only half, see https://360peo.com/nys-2016-rates-approved/. The national rate trend, however, has been much higher than in past years due to higher health care costs and the loss of Federal reinsurance fund known as risk reinsurance corridor.

This is one of the reasons why the individual market is significantly more costly to operate than small group as per recent United Healthcare pull out of most State Individual Exchanges, UnitedHealthcare will drop ACA Exchanges. In fact, the Health Republic NY is Shutting Down highlights how an insurer banked on the federal risk corridor reinsurance and underestimated NYS costs of care. Another local example is Oscar Health Insurance which has lost $105 million and is asking for up to 30% rate increase. The 3 year old company said the increase was necessary because medical costs have risen, government programs that helped cover costs are ending, and its members needed more care than expected. That all translates into the need for a price correction.

Importantly, the individual market subsides may be on borrowed time. Last week, The Federal Court ruled that Obamacare subsidies were illegally funded. The ruling while the Obama administration challenges it in D.C. Circuit Court of Appeals, is still allowing the reimbursements to continue for now. The practice of some small businesses dropping group health insuarnce in favor of the Individual Plans known as “cash for insurance” is put into question by this. While the IRS ruled that this is prohibited (see below) some small business are attracted to the simplicity of a public exchange and not getting involved in the managing of plans. Prohibited: The IRS prohibits employers from giving (or reimbursing) employees pre-tax funds to buy health insurance on their own—through the state-based and federally facilitated exchanges or private marketplaces alike.1 This practice may result in a $100 per day excise tax per applicable employee, according to an IRS Q&A released in May 2014.2

Instead, the correct approach for a small business in keeping with simplicity is a Private Exchange. This is a true defined contribution empowering employees with choice of leading insurers offering paperless technologies integrating HRIS/Benefits/Payroll. Both employee and employers still gain tax advantage benefits under the business. Also, the benefits, rates and network size are superior under a group plan as THE RISK OUTLINED ABOVE ARE HIGHER FOR INDIVIDUAL MARKETS THAN SMALL GROUP PLANS.

For more information on how a Private Exchange can help your group please Contact us at (855)667-4621.

Summary of 2017 Requested Rate Actions

INDIVIDUAL MARKET

| Company Name | 2017 Requested Rate Change |

|---|

| Aetna Life Insurance Company | 19.4% |

| Affinity Health Plan, Inc.* | 20.7% |

| Capital District Physicians’ Health Plan* | 11.2% |

| Crystal Run Health Plan, LLC* | 89.1% |

| Empire HealthChoice HMO, Inc.* | 24.0% |

| Excellus Health Plan, Inc.* | 15.9% |

| Health Insurance Plan of Greater New York* | 14.0% |

| Healthfirst PHSP, Inc.* | 6.6% |

| HealthNow New York Inc.* | 6.1% |

| Independent Health Benefits Corporation* | 19.2% |

| MetroPlus Health Plan, Inc.* | 20.3% |

| MVP Health Plan, Inc.* | 6.1% |

| New York State Catholic Health Plan, Inc. dba Fidelis Care New York* | 8.1% |

| North Shore-LIJ CareConnect Insurance Company, Inc.* | 29.2% |

| Oscar Insurance Corporation* | 18.4% |

| UnitedHealthcare of New York, Inc.* | 45.6% |

| Weighted Average Requested Rate Change – Individual Market | 17.3% |

*Indicates that the company makes products available on the “New York State of Health” marketplace.

SMALL GROUP MARKET

| Company Name | 2017 Requested Rate Change |

|---|

| Aetna Life Insurance Company | 12.0% |

| Capital District Physicians’ Health Plan, Inc. | 9.6% |

| CDPHP, Universal Benefits Inc.* | 11.6% |

| Crystal Run Health Insurance Company, Inc. | 61.9% |

| Crystal Run Health Plan, LLC | 66.6% |

| Empire Healthchoice Assur Inc | 10.0% |

| Empire HealthChoice HMO, Inc. | 12.6% |

| Excellus Health Plan, Inc.* | 12.3% |

| Health Insurance Plan of Greater New York* | 10.6% |

| Healthfirst Health Plan (Managed Health) | 5.0% |

| HealthNow New York Inc.* | 5.8% |

| Independent Health Benefits Corporation* | 11.2% |

| MetroPlus Health Plan, Inc.* | 13.1% |

| MVP Health Plan, Inc.* | 5.4% |

| MVP Health Services Corp. | 6.8% |

| North Shore-LIJ CareConnect Insurance Company, Inc.* | 16.8% |

| Oxford Health Insurance, Inc.* | 12.9% |

| UnitedHealthcare Insurance Company of New York | 12.8% |

| Weighted Average Requested Rate Change – Small Group Market | 12.0% |

*Indicates that the company makes products available on the “New York State of Health” marketplace.

Source: https://myportal.dfs.ny.gov/web/prior-approval/summary-of-2017-requested-rate-actions

Resource:

These rates are for New York City unless otherwise indicated, and for a single person. For a family premium, multiply by 2.85, Husband/Wife

These rates are for New York City unless otherwise indicated, and for a single person. For a family premium, multiply by 2.85, Husband/Wife

established companies “with sicker patients”. Start-ups, by contrast, with much lower rate of diagnosed sick patients essentially pay into this tax. This tax is part of the risk adjustment program intended to stabilize Insurers who took on sicker patients and spread this risk. While some correctly blame too low pricing and some miscalculated business decision-making the inherent extra tax doomed the majority of the original 16 co-ops.

established companies “with sicker patients”. Start-ups, by contrast, with much lower rate of diagnosed sick patients essentially pay into this tax. This tax is part of the risk adjustment program intended to stabilize Insurers who took on sicker patients and spread this risk. While some correctly blame too low pricing and some miscalculated business decision-making the inherent extra tax doomed the majority of the original 16 co-ops.