by Alex | Feb 15, 2017 | Health Care Reform, Obamacare, PPACA, State Exchanges

Leading article on the direction of TRUMPCARE we’ve read thus far. Former president Barack Obama’s budget director, Peter Orszak thinks Obamacare will be replaced through the waiver process.

Leading article on the direction of TRUMPCARE we’ve read thus far. Former president Barack Obama’s budget director, Peter Orszak thinks Obamacare will be replaced through the waiver process.

Here’s How Trump Will Change Obamacare

By Peter R. Orszag FEB 14, 2017 6:00 AM EST

Promises made by Donald Trump and Republicans in Congress to repeal and replace the Affordable Care Act are proving to be more complicated than they sounded on the campaign trail. With reality now setting in, what’s most likely to happen?

I expect to see Republicans stage a dramatic early vote to repeal, with legislation that includes only very modest steps toward replacement — and leave most of the work for later. Next, the new administration will aggressively issue waivers allowing states to experiment with different approaches, including changes to Medicaid and private insurance rules. At some point, then, the administration will declare that these state experiments have been so successful, Obamacare no longer exists.

In other words, the repeal vote will be just for show; the waivers will do most of the heavy lifting.

I predict something like this will happen because of two core challenges that stand in the way of Republicans’ replacing the ACA through legislation: the need for so-called community rating and the need to have 60 votes in the Senate to pass a comprehensive new health-care law.

First, community rating. It is one of the basic building blocks needed to create a workable private insurance market — whether Democrats or Republicans are doing the building. If your insurance covers a pre-existing condition but at a cost of, say, $100,000, that doesn’t really help. Community rating requires that your premium be the same as that of other people in your area, no matter how unhealthy you are.

With community rating in place, the next step is to recognize how easy it is to game the system: People can just wait until they get sick, then buy insurance at the community rate. To discourage that practice, the system needs to give people some strong incentive to purchase insurance before they get sick. The Affordable Care Act used an individual mandate; most Republican plans instead propose a requirement for continuous coverage. That is, people enjoy access to community-rated premiums in the future only if they have kept themselves insured over some period of time in the past.

Given the costs involved, subsidies are also needed to ensure that low- and moderate-income households can afford the coverage. This overall structure means that younger, healthier people implicitly subsidize older, sicker people.

Such are the inescapable constraints imposed by community rating. Community rating could be discarded, as Mark Pauly of the University of Pennsylvania has argued. Pauly instead proposes that insurance companies be allowed to vary people’s premiums according to their health status, and that general revenue be used to pay sicker people’s higher premiums. This would require substantial new taxes, however, which is presumably a nonstarter in a Republican plan. In any case, it would only make the transfers to older, sicker people more explicit.

The second challenge is more nakedly political: Without a substantial change in Senate procedure, a bill to fully replace the Affordable Care Act, including changes to insurance rules, will require 60 votes. Republicans have only 52, so at least eight Democratic senators would need to be persuaded to go along. This is a much tougher assignment, especially since the administration will already be calling in legislative favors on ongoing confirmations, the debt limit, tax reform and other issues.

The Republicans’ desire to hold an early partisan vote repealing the ACA (through the reconciliation process that requires only a simple majority in the Senate) seems too strong to resist. The repeal will probably be set to become effective in the future, perhaps 2019 or 2020.

This vote will probably be closer than many people think, given the concerns that some moderate Republican senators have expressed about repealing the ACA with no replacement ready. Some far-right Republicans may also balk at anything less than a full immediate repeal. For the White House, however, the closeness of the vote will be a feature rather than a bug, because it will create the impression that the vote is significant.

The repeal legislation will probably include some modest steps toward replacing the ACA, but these will be mostly symbolic measures such as allowing insurance companies to sell across state lines (which by itself would do little to lower people’s premiums). The hard work of a creating comprehensive replacement is then likely to get bogged down in legislative muck.

But the administration can use its expansive waiver authority to allow states to experiment with both Medicaid and the individual insurance markets. As these 50 flowers bloom, President Trump could at some point declare victory and assert that the ACA has been sufficiently reformed.

This approach, whatever its potential substantive shortcomings, provides a major political benefit: The administration would not necessarily own the many problems that inevitably would remain. In response to any particular complaint in a specific state, the administration could simply shrug its shoulders and direct the inquiry to the relevant governor.

This outlook assumes that the Republican leadership in Congress isn’t willing, or lacks the votes, to change the Senate’s traditional rules, and that a comprehensive replacement for the ACA will indeed require 60 votes. If that changes, all bets are off.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the author of this story:

Peter R. Orszag at porszag5@bloomberg.net

To contact the editor responsible for this story:

Mary Duenwald at mduenwald@bloomberg.net

by Alex | Oct 31, 2016 | family health insurance, Health Care Reform, Health Exchanges, Individual Exchanges, individual health insurance, State Exchanges

2017 Individual Open Enrollment

Everything you need to know ahead of tomorrow’s 2017 Individual Open Enrollment. This Open Enrollment marks the 4th anniversary of Obamacare a.ka. The Affordable Care Act. As a helpful resource, the new NY and NJ rates with important deadlines are listed below. 33 States such as NJ use the healthcare.gov website or at https://medicalsolutionscorp.demo.hcinternal.net/individual/individual/homePage. States such as NY and CT use their own Marketplace – NYS of Health and AccessHealth CT. Importantly, individuals not expecting a subsidy may also apply Off-Exchange which in many case has more options and Insurers.

2017 NY Individual Health Plans

These rates are for New York City unless otherwise indicated, and for a single person. For a family premium, multiply by 2.85, Husband/Wife

These rates are for New York City unless otherwise indicated, and for a single person. For a family premium, multiply by 2.85, Husband/Wife

multiply by 2.0 and Parent/Children multiply by 1.70. The non single deductibles are out of pocket maximums are doubled. These are for standard plans, which two-thirds of customers enrolled in during 2016.

While deductibles for platinum, gold and silver plans have stayed the same, many bronze plan deductibles have increased 33 percent. That means consumers who purchase a bronze plan — presumably for its lower monthly premium — are paying more out of pocket for their medical costs before their insurance company kicks in a dime. A family of four that purchased a bronze plan will have an $8,000 deductible in 2017, up from $6,000 in 2015. For someone young and relatively healthy, that might be OK, but that person is vulnerable to a very large bill if he or she needs expensive medical care. It’s the platinum plans where New York State really shows itself to be a national outlier. Roughly 18 percent of New Yorkers chose a platinum plan in 2016, compared to 2 percent across the nation, according to the Kaiser Family Foundation.

Here are the 2017 rates:

2017-nys-marketplace-rates-1

2017 NJ Individual Health Plans

NJ Dept of Banking and Insurance posted the 2017 NJ individual health plans Monday. Only two carriers will offer plans on the state’s Obamacare marketplace next year: Horizon Blue Cross Blue Shield of New Jersey and AmeriHealth.

Additional insurers are participating off-exchange or outside the Marketplace. Examples: Aetna, CIGNA and Oxford. There are additional 20 plan options available off exchange. A notable new entrant, Health Republic of NJ, will no longer be available for 2017. See – Health Republic NJ Shutting Down.

Here are the 2017 rates:

2017-new-jersey-individual-health-benefits-plans-and-rates

2017 Individual Open Enrollment Deadlines

- November 1, 2016: Open Enrollment starts — first day you can enroll in a 2017 insurance plan through the Health Insurance Marketplace. Coverage can start as soon as January 1, 2016.

- December 15, 2016: Last day to enroll in or change plans for new coverage to start January 1, 2017.

- January 1, 2017: 2017 coverage starts for those who enroll or change plans by December 15.

- January 15, 2017: Last day to enroll in or change plans for new coverage to start February 1, 2017

- January 31, 2017: 2016 Open Enrollment ends. Enrollments or changes between January 16 and January 31 take effect March 1, 2017.

If you don’t enroll in a 2016 health insurance plan by January 31, 2017, you can’t enroll in a health insurance plan for 2016 unless you qualify for a Marketplace Special Enrollment Period.

Penalty: The uninsured penalty rises to $695 or 2.5% of your income, whichever is higher.

Coverage start dates

If you enroll before the 15th of any month, your coverage starts the first day of the next month. If you enroll after the 15th of the month, you’ll have to wait until the month after that for your coverage to start. So, for example, if you enroll on January 16, your coverage would start on March 1.

Enroll using our online comparison shopping tool for both on and off-Exchange Marketplace to be released next week. Email us or Contact us at (855)667-4621.

by Alex | Sep 13, 2016 | Health Care Reform, Health Exchanges, Obamacare, regional health insurance co-ops, State Exchanges

Health Republic NJ Shutting Down

Health Republic NJ Shutting Down

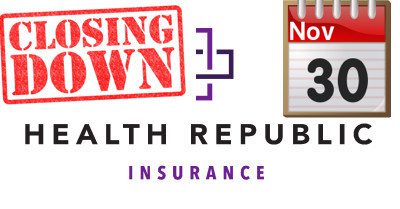

In yesterday’s surprise announcement, NJ regulators will be shutting down Health republic NJ for 2017 “because of its hazardous financial condition”. This marks the demise of the second Metro area healthcare co-op with the same name-sake Health Republic but different managed healthcare co-op, see Health Republic NY Shutting Down Nov 30.

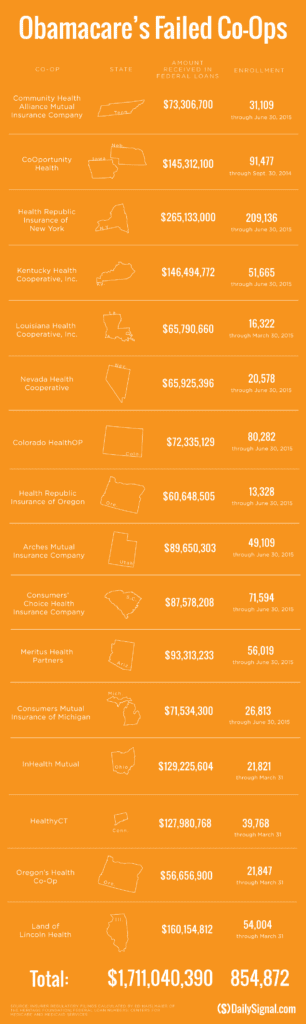

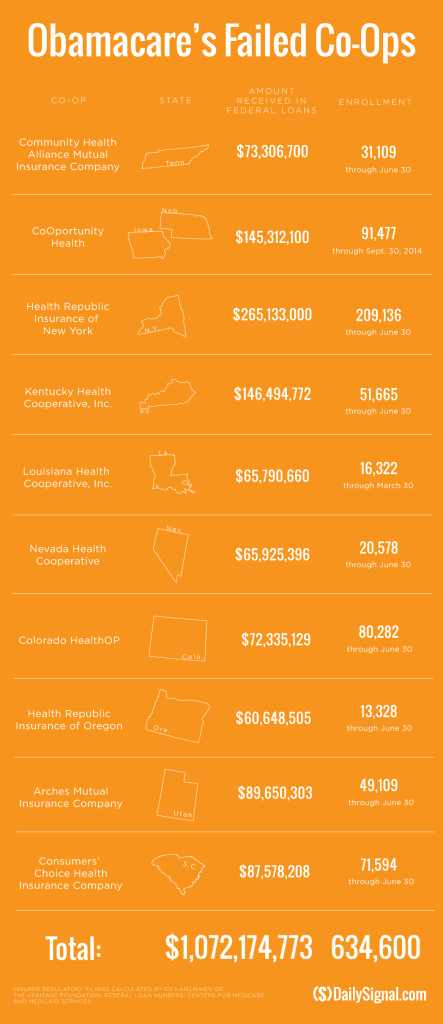

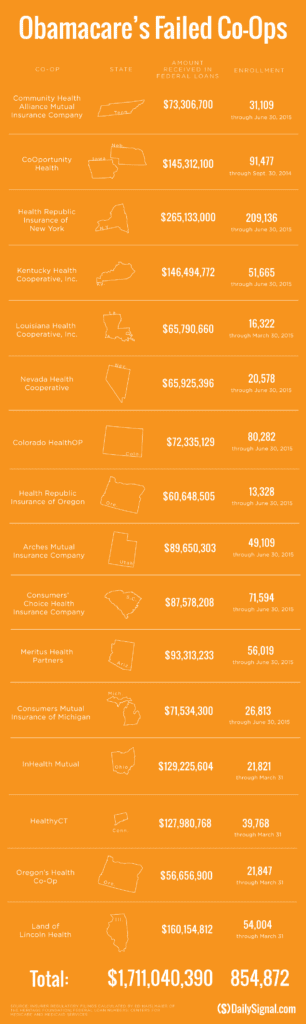

Since Obamacare’s rollout in the fall of 2013, 16 co-ops that launched with money from the federal government have collapsed. Now, just six co-ops—Wisconsin’s Common Ground Healthcare Cooperative; Maryland’s Evergreen Health Cooperative; Maine Community Health Options; Massachusetts’ Minuteman Health; Montana Health Cooperative; and New Mexico Health Connections—remain.

In a bizarre twist of fate or unintended Affordable Care Act design flaw small affordable startups not only have to gain new client footholds but also support large

established companies “with sicker patients”. Start-ups, by contrast, with much lower rate of diagnosed sick patients essentially pay into this tax. This tax is part of the risk adjustment program intended to stabilize Insurers who took on sicker patients and spread this risk. While some correctly blame too low pricing and some miscalculated business decision-making the inherent extra tax doomed the majority of the original 16 co-ops.

Health Republic in fact grew steadily and made money the first 9 months of 2015. However, HRNJ lost 17.6 million end of 2015 and is choking off at this $46.3 million payment to the government through the risk adjustment program. This is considered one of the 3 R’s of the reinsurance program – risk corridor, reinsurance and risk adjustment that were intended to level the playing field. The first “R”—“reinsurance”—subsidizes insurers that attract individual customers who rack up particularly high medical bills. The second—“risk adjustment”—requires insurers with low-cost patients to make payments to plans that share the benefits with those who insured higher-cost ones. And the third, called “risk corridors,” is a program to subsidize health plans whose total medical expenses for all their Obamacare customers overshoot a target amount.

The co-ops received less money than they initially anticipated last year under Obamacare’s risk corridor program, which resulted in the collapse of at least five co-ops and a $5 billion class action lawsuit

filed by 6 state’s co-ops – ” Oregon-based insurer Moda Health Plan Inc., Blue Cross Blue Shield of North Carolina, Pittsburgh-based Highmark Inc., and the failed CoOportunity Health, which was based in West Des Moines, Iowa, and Health Republic Insurance Co. of Oregon, which was based in Lake Oswego.”

From Politico’s “Obamacare’s sinking safety net”:

“The risk corridor program, however, has been an unmitigated debacle. In December 2014, the Republican Congress voted to prohibit the Obama administration from spending any money on the program, decrying it as a bailout for the insurance companies. Sen. Marco Rubio, then thought to be a leading GOP presidential contender for 2016, was particularly vocal in pillorying the program.

Unlike all those symbolic “repeal Obamacare” votes, Congress actually succeeded in blocking those risk corridor payments, and it hit Obamacare hard. Insurers filed claims seeking $2.9 billion, but under the limits imposed by the GOP there was less than $400 million available to make good on those payments. The end result: insurers initially received only 12.6 cents for each dollar they had counted on. Many of the new Obamacare co-op plans that went out of business blamed their collapse in part on the fact that they’d been counting on the full payments to keep them solvent.”

Regrettably, in a Presidential year no one wants to touch this burning hot potato. Perhaps NJ’s handling of this pressure cooker and taking 2017 off may be the best course of action after all.

9/16/16 Addendum:

As of Monday, September 19, 2016, the portal for Health Republic Insurance will be shut down, as they are no longer accepting new business for the year.

The New Jersey State Department of Banking and Insurance has also provided a list of FAQs related to the shutdown and how it affects individuals, small employers, brokers and providers. For more information, click here.

As always, our team is here to assist you and to help you grow your business.

by Alex | Apr 20, 2016 | healthcare, Individual Exchanges, individual health insurance, latest health insurance news, Obamacare, State Exchanges, United Healthcare

UnitedHealthcare will drop ACA exchanges

UnitedHealthcare Individual by State

BREAKING:

So far, New York and Nevada have confirmed that UnitedHealth plans to remain on their ACA exchanges next year. The company has also filed plans to participate in Virginia for 2017. Wisconsin said it hasn’t received an exit notice from UnitedHealth, and that it doesn’t comment on insurers’ business plans. A representative of Covered California, the state’s Obamacare exchange, said plan participation is confidential until it’s announced later this year.

UnitedHealthcare will drop out of most ACA Exchanges by 2017 as reported in Modern Healthcare. Just how significant is this to the market? Realistically, United took a cautious wait and see approach. In NYS, for example, they have been the most expensive plan on the Obamacare Exchange Marketplace. They expect to lose over a billion dollars in this space for 2015 and 2016, so to them it makes no sense to stay in that market. The concern for the individual market is to expect large pricing increases in 2017 to reflect the higher risk than the safer Group Market.

UnitedHealth, which had about 795,000 ACA customers as of March 31, warned in November that it was posting losses on ACA policies. In December, the company said it should have stayed out of the individual exchange market longer. UnitedHealth also is withdrawing from some related state insurance markets for small businesses.

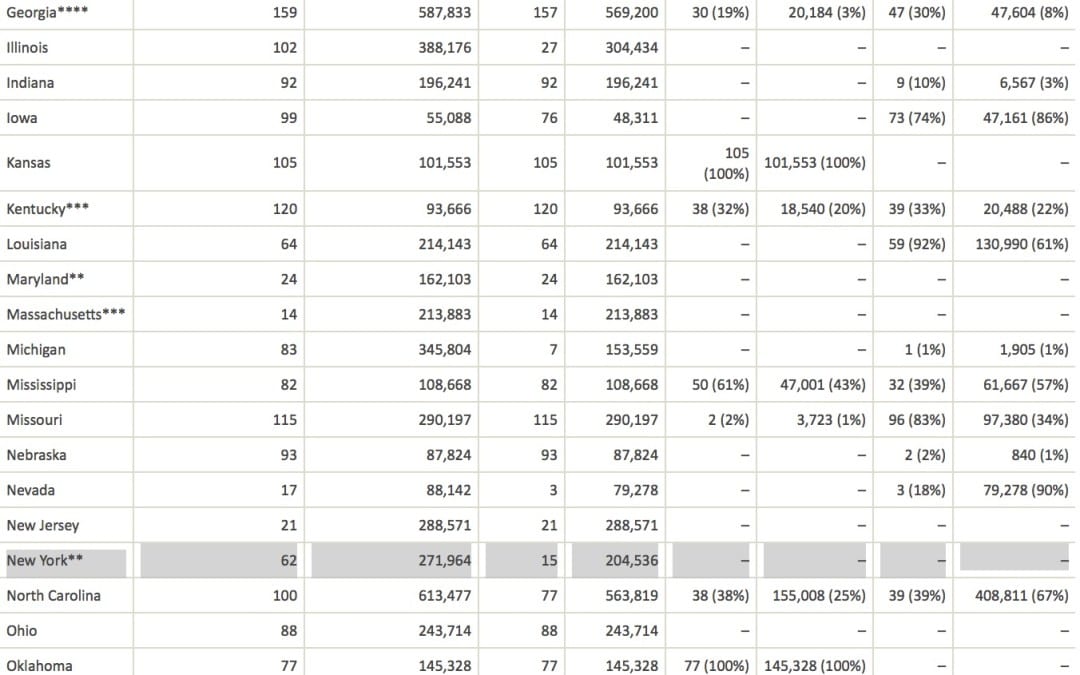

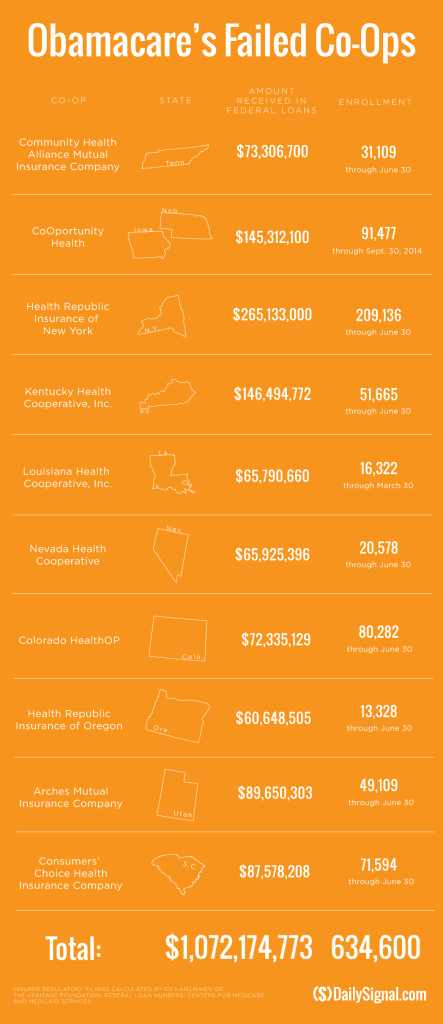

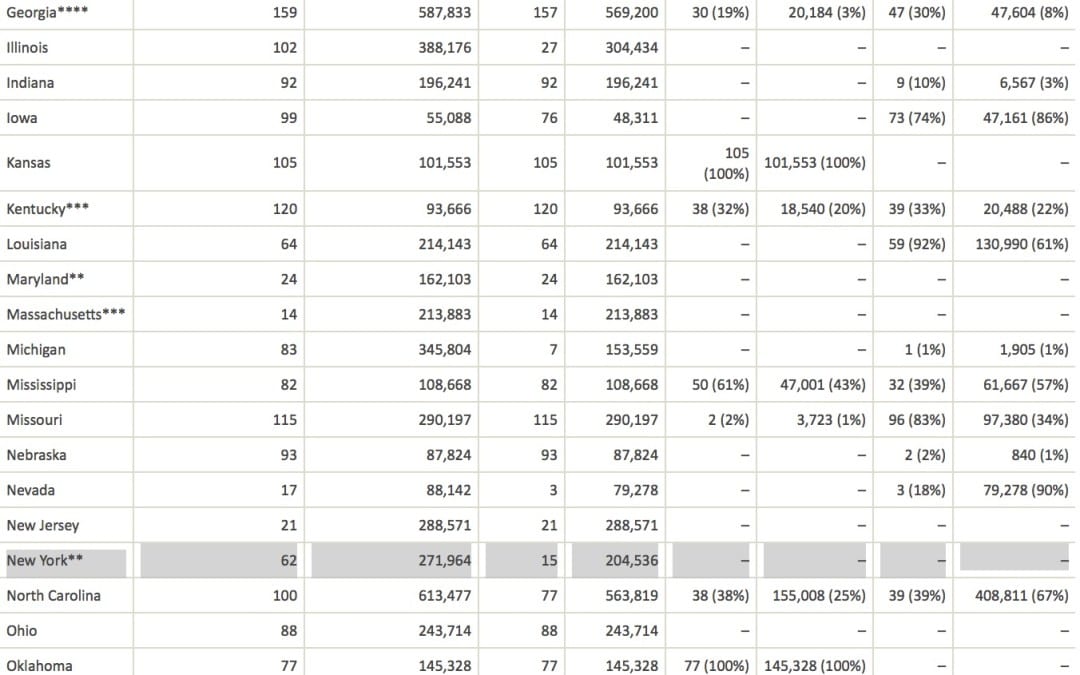

See United-healthcare Individual members enrolled by State:

UnitedHealthcare will drop ACA exchanges

MODERN HEALTHCARE

By Bob Herman

April 19, 2016

UnitedHealth Group CEO Stephen Hemsley said Tuesday the health insurance and services conglomerate will pull out of most of its Affordable Care Act marketplaces. But the company won’t bail on the exchanges completely and will sell individual plans in a “handful” of states.

“We cannot broadly serve it on an effective and sustained basis,” Hemsley told analysts and investors on a conference call. UnitedHealth has fully or partially exited five states so far—Arkansas, Georgia, Louisiana, Michigan and Oklahoma, according to various news reports.

The company sold plans in 34 states for this policy year and did not disclose which states it will stay in. Insurers that sell plans through the federal HealthCare.gov portal have until May 11 to file rates for 2017 plans.

A new analysis from the Kaiser Family Foundation, however, notes that UnitedHealth’s exits would only have a modest effect on competition and prices nationally since it has a small ACA footprint and charged higher premiums from the outset.

UnitedHealth recorded an additional $125 million loss on its individual ACA plans, meaning the company’s total ACA losses for 2015 and 2016 will exceed $1 billion. UnitedHealth signed up many sicker-than-expected members, ending the first quarter with 795,000 public exchange enrollees, which is only a fraction of the ACA’s individual market.

The insurer also overpriced its plans in 2015 after barely participating on the exchanges in 2014. UnitedHealth expects its exchange membership will decline to 650,000 by the end of the year.

But despite those heavy losses, which UnitedHealth previewed late last year, the company’s other lines of business like Medicare Advantage and Optum have been making money at a healthy clip. UnitedHealth’s profit climbed 14% year over year, totaling $1.6 billion in the first three months of this year. Adjusted earnings per share rose 17% to $1.81, beating estimates on Wall Street.

Revenue soared almost 25% to $44.5 billion in the first quarter, putting UnitedHealth on pace to hit $182 billion of revenue for the year. The Minnetonka, Minn.-based company recorded double-digit revenue growth across every major segment, including employer, Medicaid, Medicare Advantage and its Optum health services business. UnitedHealth now covers the medical care of nearly 47.7 million Americans.

UnitedHealth’s medical-loss ratio, which shows how much of its premium dollars were spent on medical care or “quality improvement” programs, was 81.7% in the quarter. That was up slightly from the 81.4% posted in the same quarter last year, which UnitedHealth attributed to the leap day.

by Alex | Oct 30, 2015 | Health Care Reform, Health Exchanges, Individual Exchanges, individual health insurance, latest health insurance news, NY News, Obamacare, regional health insurance co-ops, State Exchanges

Health Republic NY Shutting Down Nov 30

Health Republic NY Shutting Down Nov 30

Breaking: All Health Republic plans (Group and Individual) ending on 11/30. according to early reports the healthcare Co-Op Health Republic NY will be shutting down Nov 30, 2015. New York State Department of Financial Services (NYDFS), the New York State of Health Marketplace (NYSOH), and the Centers for Medicare and Medicaid Services (CMS) announced additional actions regarding Health Republic Insurance of New York (“Health Republic”) and a transition plan for Health Republic customers.

TIMELINE:

- Oct 28th – Utah Healthcare Co-Op shutting down end of 2015. This sis the 5th Co-Op to shut down

- Sept 25, 2015 – original announcement Health Republic NY is Shutting Down effective Dec 31, 2015.

- June 2015 – With a spike in rate increase of 15-20% for 2016 to reflect unexpected high costs of new 200,000 membership the most affordable health plan was experiencing difficulties. The insurer reported $130 million in losses during its first 18 months of operations, according to financial filings, even as it enrolled more customers than any other insurer. DFS did allow for a 13 percent increase in the second year and a 14 percent increase heading into 2016. Both were lower than what Health Republic requested, though, and were not enough to save the struggling insurer.

- May 2015- Health Republic was dealt its death blow when it became clear that the Affordable Care Act’s risk corridor program would not be fully funded, said one source familiar with the company’s finances. A report from Standard & Poor’s in May said the program had only 10 percent of the funds needed to make payments.

- Summer 2013 -Health Republic had borrowed $265 million to begin operations.

New Insurance Risk Corridors paid for by a combination of both consumer insurance premium surcharge tax of 2-3% and Health Insurers is suppose to reclaim capital to those that are less profitable. Health Republic was owed approximately $147 million but was told by the Centers for Medicare and Medicaid Services to expect less than half that according to sources.

Regrettably, we all suffer when an Insurer exits the market. Furthermore, it will be a while again when Federal funds earmarked to start a low cost affordable health plans will materialize again. We are pulling for neighboring co-op Health Republic of NJ and hope this trend discontinues.

Our agency will be working closely with our clients to mitigate this exposure and transition smoothly for Dec 1, 2015. Individuals on the Marketplace can contact the New York State Department of Financial Services Consumer Hot Line with questions regarding Health Republic by calling 1-800-342-3736. The Hot Line hours are weekdays (Monday through Friday) from 8:00 a.m. to 8:00 p.m., and Saturday from 9:00 a.m. to 1:00 p.m.

Please Click here to read the full Press Release from NYDFS.

Stay posted, more news to follow. Our Agency as in the past will be out and early in front positioning our clients for best options. For more information on this or to schedule a call please contact us info@medicalsolutionscorp.com today.

by admin | Jun 25, 2015 | Health Care Reform, Health Care Refrom, Individual Exchanges, Obamacare, State Exchanges

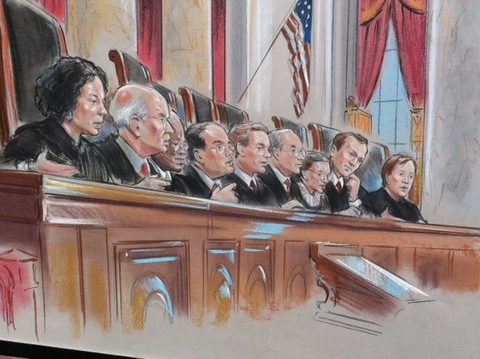

Supreme Court Upholds ACA Again

The U.S. Supreme Court ruled this morning that the Affordable Care Act may provide nationwide tax subsidies for people who purchase health insurance through an exchange. The Court considered a challenge to a provision of the ACA concerning whether subsidies were available only to those who purchased health insurance on an exchange “established by the state.” The Court, in King v. Burwell, ruled 6 to 3 in favor of upholding the eligibility for people to receive subsidies through either a state or federal health insurance exchange.

The opposite ruling would have had serious implications for the country due to the number of states relying on a federally-run exchange (37 states) and the number of customers who qualify for subsidies based on their income (about 85% of customers nationwide). The Government’s argument prevailing: defending the subsidies, the Government argued that if you look at the entire ACA and its history, it is clear that the subsidies are available to everyone who purchases insurance on an exchange, no matter who created it.

Please join us for upcoming Webinar on How to Prepare for Current and Future ACA Requirements.

Are you able to identify and address all of the ACA requirements? Have you developed a plan of action to help stay in compliance? This webinar will walk you through a three year case study and provide you with current and future solutions to help your group prepare for ACA challenges including the Cadillac Tax.

Some of the key webinar highlights include:

- Will Federal subsidies stop in some states making residents unable to access subsidized Exchange coverage?

- 3 year case study providing a practical view

- Will IRS information reporting still be required?

- Could Congress step in and propose changes to the existing ACA law?

- 2015 – Section 125 changes including eligibility, PRAs, excepted benefits and FSA plans for higher OOP exposure

- 2016 – Renewal focus on HSA’s with a dollar for dollar matching contribution

- 2017 – Further conversation of reducing benefit costs utilizing post deductible HRA’s and consideration of Defined Contributions

Practical information you can use – a webinar you will not want to miss!

These rates are for New York City unless otherwise indicated, and for a single person. For a family premium, multiply by 2.85, Husband/Wife

These rates are for New York City unless otherwise indicated, and for a single person. For a family premium, multiply by 2.85, Husband/Wife

established companies “with sicker patients”. Start-ups, by contrast, with much lower rate of diagnosed sick patients essentially pay into this tax. This tax is part of the risk adjustment program intended to stabilize Insurers who took on sicker patients and spread this risk. While some correctly blame too low pricing and some miscalculated business decision-making the inherent extra tax doomed the majority of the original 16 co-ops.

established companies “with sicker patients”. Start-ups, by contrast, with much lower rate of diagnosed sick patients essentially pay into this tax. This tax is part of the risk adjustment program intended to stabilize Insurers who took on sicker patients and spread this risk. While some correctly blame too low pricing and some miscalculated business decision-making the inherent extra tax doomed the majority of the original 16 co-ops.