by Alex | Sep 13, 2016 | Health Care Reform, Health Exchanges, Obamacare, regional health insurance co-ops, State Exchanges

Health Republic NJ Shutting Down

Health Republic NJ Shutting Down

In yesterday’s surprise announcement, NJ regulators will be shutting down Health republic NJ for 2017 “because of its hazardous financial condition”. This marks the demise of the second Metro area healthcare co-op with the same name-sake Health Republic but different managed healthcare co-op, see Health Republic NY Shutting Down Nov 30.

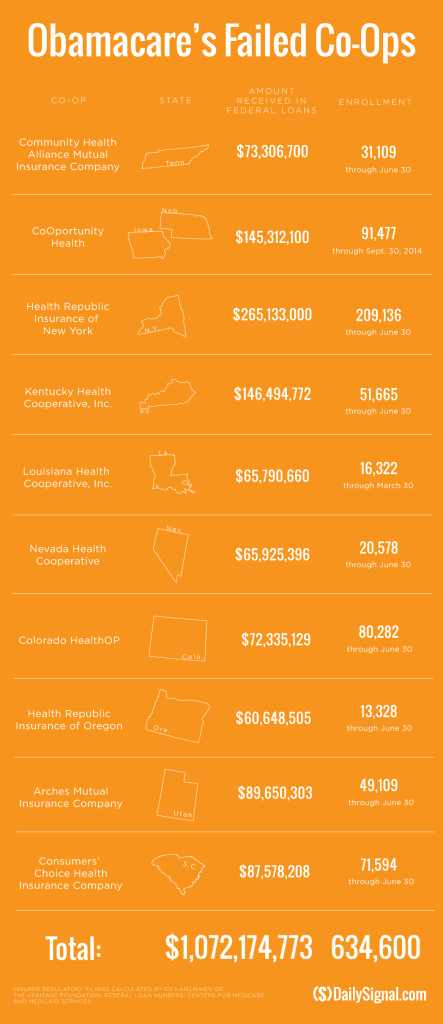

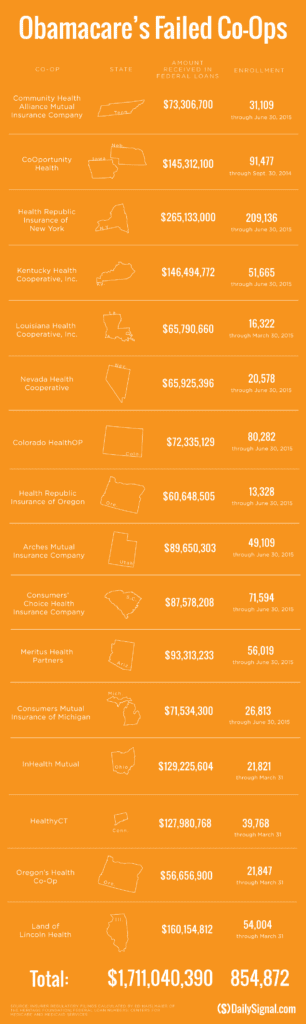

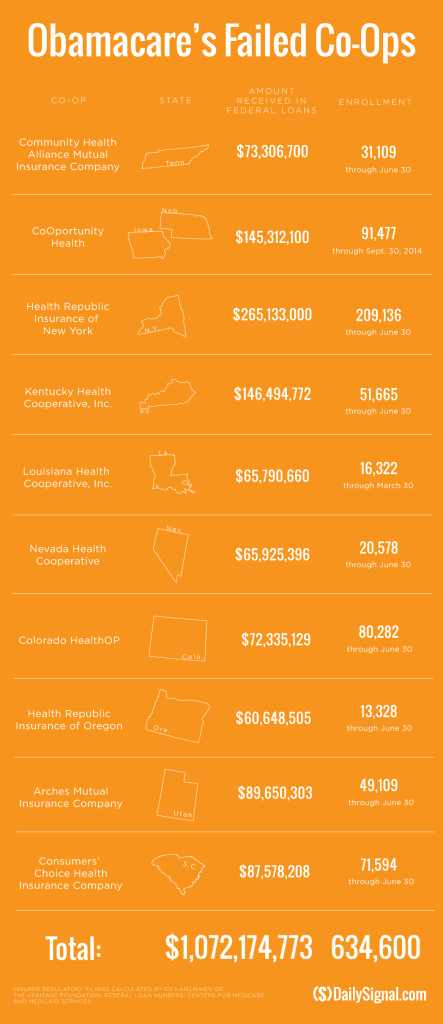

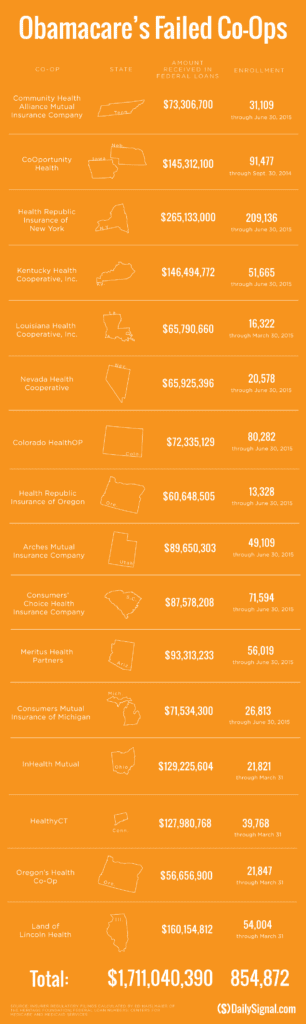

Since Obamacare’s rollout in the fall of 2013, 16 co-ops that launched with money from the federal government have collapsed. Now, just six co-ops—Wisconsin’s Common Ground Healthcare Cooperative; Maryland’s Evergreen Health Cooperative; Maine Community Health Options; Massachusetts’ Minuteman Health; Montana Health Cooperative; and New Mexico Health Connections—remain.

In a bizarre twist of fate or unintended Affordable Care Act design flaw small affordable startups not only have to gain new client footholds but also support large

established companies “with sicker patients”. Start-ups, by contrast, with much lower rate of diagnosed sick patients essentially pay into this tax. This tax is part of the risk adjustment program intended to stabilize Insurers who took on sicker patients and spread this risk. While some correctly blame too low pricing and some miscalculated business decision-making the inherent extra tax doomed the majority of the original 16 co-ops.

Health Republic in fact grew steadily and made money the first 9 months of 2015. However, HRNJ lost 17.6 million end of 2015 and is choking off at this $46.3 million payment to the government through the risk adjustment program. This is considered one of the 3 R’s of the reinsurance program – risk corridor, reinsurance and risk adjustment that were intended to level the playing field. The first “R”—“reinsurance”—subsidizes insurers that attract individual customers who rack up particularly high medical bills. The second—“risk adjustment”—requires insurers with low-cost patients to make payments to plans that share the benefits with those who insured higher-cost ones. And the third, called “risk corridors,” is a program to subsidize health plans whose total medical expenses for all their Obamacare customers overshoot a target amount.

The co-ops received less money than they initially anticipated last year under Obamacare’s risk corridor program, which resulted in the collapse of at least five co-ops and a $5 billion class action lawsuit

filed by 6 state’s co-ops – ” Oregon-based insurer Moda Health Plan Inc., Blue Cross Blue Shield of North Carolina, Pittsburgh-based Highmark Inc., and the failed CoOportunity Health, which was based in West Des Moines, Iowa, and Health Republic Insurance Co. of Oregon, which was based in Lake Oswego.”

From Politico’s “Obamacare’s sinking safety net”:

“The risk corridor program, however, has been an unmitigated debacle. In December 2014, the Republican Congress voted to prohibit the Obama administration from spending any money on the program, decrying it as a bailout for the insurance companies. Sen. Marco Rubio, then thought to be a leading GOP presidential contender for 2016, was particularly vocal in pillorying the program.

Unlike all those symbolic “repeal Obamacare” votes, Congress actually succeeded in blocking those risk corridor payments, and it hit Obamacare hard. Insurers filed claims seeking $2.9 billion, but under the limits imposed by the GOP there was less than $400 million available to make good on those payments. The end result: insurers initially received only 12.6 cents for each dollar they had counted on. Many of the new Obamacare co-op plans that went out of business blamed their collapse in part on the fact that they’d been counting on the full payments to keep them solvent.”

Regrettably, in a Presidential year no one wants to touch this burning hot potato. Perhaps NJ’s handling of this pressure cooker and taking 2017 off may be the best course of action after all.

9/16/16 Addendum:

As of Monday, September 19, 2016, the portal for Health Republic Insurance will be shut down, as they are no longer accepting new business for the year.

The New Jersey State Department of Banking and Insurance has also provided a list of FAQs related to the shutdown and how it affects individuals, small employers, brokers and providers. For more information, click here.

As always, our team is here to assist you and to help you grow your business.

by Alex | Oct 30, 2015 | Health Care Reform, Health Exchanges, Individual Exchanges, individual health insurance, latest health insurance news, NY News, Obamacare, regional health insurance co-ops, State Exchanges

Health Republic NY Shutting Down Nov 30

Health Republic NY Shutting Down Nov 30

Breaking: All Health Republic plans (Group and Individual) ending on 11/30. according to early reports the healthcare Co-Op Health Republic NY will be shutting down Nov 30, 2015. New York State Department of Financial Services (NYDFS), the New York State of Health Marketplace (NYSOH), and the Centers for Medicare and Medicaid Services (CMS) announced additional actions regarding Health Republic Insurance of New York (“Health Republic”) and a transition plan for Health Republic customers.

TIMELINE:

- Oct 28th – Utah Healthcare Co-Op shutting down end of 2015. This sis the 5th Co-Op to shut down

- Sept 25, 2015 – original announcement Health Republic NY is Shutting Down effective Dec 31, 2015.

- June 2015 – With a spike in rate increase of 15-20% for 2016 to reflect unexpected high costs of new 200,000 membership the most affordable health plan was experiencing difficulties. The insurer reported $130 million in losses during its first 18 months of operations, according to financial filings, even as it enrolled more customers than any other insurer. DFS did allow for a 13 percent increase in the second year and a 14 percent increase heading into 2016. Both were lower than what Health Republic requested, though, and were not enough to save the struggling insurer.

- May 2015- Health Republic was dealt its death blow when it became clear that the Affordable Care Act’s risk corridor program would not be fully funded, said one source familiar with the company’s finances. A report from Standard & Poor’s in May said the program had only 10 percent of the funds needed to make payments.

- Summer 2013 -Health Republic had borrowed $265 million to begin operations.

New Insurance Risk Corridors paid for by a combination of both consumer insurance premium surcharge tax of 2-3% and Health Insurers is suppose to reclaim capital to those that are less profitable. Health Republic was owed approximately $147 million but was told by the Centers for Medicare and Medicaid Services to expect less than half that according to sources.

Regrettably, we all suffer when an Insurer exits the market. Furthermore, it will be a while again when Federal funds earmarked to start a low cost affordable health plans will materialize again. We are pulling for neighboring co-op Health Republic of NJ and hope this trend discontinues.

Our agency will be working closely with our clients to mitigate this exposure and transition smoothly for Dec 1, 2015. Individuals on the Marketplace can contact the New York State Department of Financial Services Consumer Hot Line with questions regarding Health Republic by calling 1-800-342-3736. The Hot Line hours are weekdays (Monday through Friday) from 8:00 a.m. to 8:00 p.m., and Saturday from 9:00 a.m. to 1:00 p.m.

Please Click here to read the full Press Release from NYDFS.

Stay posted, more news to follow. Our Agency as in the past will be out and early in front positioning our clients for best options. For more information on this or to schedule a call please contact us info@medicalsolutionscorp.com today.

by admin | Aug 17, 2009 | COBRA, Dependent Coverage, family health insurance, group health insurance, latest health insurance news, Pharmaceutical Industry, regional health insurance co-ops

Health Care Reform!

Ok so unless you’ve been stuck in the Arctic for a year you’ve been hearing a lot about this heated topic. Everyone has strong feelings about it evidently, I myself included, but I have stayed away from the fray for the most part.

As congress takes their August recess and those who still have jobs are on vacation I thought its a good time to put my two cents into it.

This well done score card brought to you by Empire Blue Cross is a great illustration of the leading proposals and voices in Washington. A nicely published overview by the Lewin Group is actually a great read on the proposed Government Sponsored Health Plan. The analysis covers the bill as it appeared on July 15, 2009.

Bills Key Provisions:

- Require all Americans to purchase health insurance or be fined, although those making less than $88,000 annually would be able to get a subsidy.

- Get rid of copays and deductibles for preventative care

- Make it illegal to deny coverage for pre-existing conditions

- Create a public plan

- Raise taxes for the wealthy – as much at 5.4 percent for incomes above $350,000

But what are we really talking about? A Government Plan to compete with private payers? Really?

The assumption in the study is that the government plan pays Medicare Rates. Provider reimbursements are on average 70% of private insurance reimbursements. The specter of physicians opting out of this plan is rather daunting as they would be giving up the single largest payer.

How does a private insurer compete with a government plan? Imagine a Government-owned subsidized Automobile competing with private companies? Would they not print more tax payer money and pump them up? Oh wait that’s already happened in Detroit, bad example.

The President claims that a government plan does already work and its name is Medicare. Yet, Medicare we are also told will go broke as early as by 2018 reported by Washington Post. Medicare, meanwhile, now pays private insurers to take care of seniors under the Medicare Advantage Plans. It is cheaper for the government to do this than to manage it themselves

As brokers, we work with the AARP Oxford Secure Horizons Program where some plans are $0 premium and include a fairly sizable network.

So which one is it? Does the Medicare plan work now and is proof of what’s to come or is it costly and inefficient and unsustainable?

Clearly the costs are indeed high and I question what insurers are thinking with some of the rate increases. This year, especially, I’ve seen increases of over 20% from the top carriers.

Speaking of Medicare, the Part D Plan in 2003 was just a gift to the Pharmaceutical industry’s under the Bush administration. Many people didn’t realize that the language used barred the U.S. from negotiating drug pricing. How can Canada with an entire population of 33 mill pay 50% on the dollar while 40 million US seniors pay full retail? Coincidentally, the legislators of Medicare Part D earned themselves nice cushy paying Pharmaceutical jobs within 1 year.

Obama has easily gotten concessions from Big Pharma, Insurers and the AMA (provided there is tort reform) already and I applaud him for it. There probably is even more good news to come on this.

What may be an interesting possible outcome are Regional Health Insurance Co-ops. These are a bridge between government and non-government options. The co-op alternative, led by Sen. Kent Conrad (D-ND), continued to gain traction on both sides of the aisle. The plan would call for the creation of nonprofit health cooperatives in lieu of public health insurance options. Said Sen. Baucus, “.The Conrad approach has got legs…it’s quite viable.”

On the House side, Rep. Roy Blunt (R-MO), chairing the Health Care Solutions Group, released an alternative to the House Democratic plan that he “hopes will receive bipartisan support.”

An example of this is GroupHealth in Washington State. “At Group Health, doctors are rewarded for consulting by telephone and secure e-mail, which allows for longer appointments. Patients are assigned a team of primary care practitioners who are responsible for their well-being. Medical practices, and insurance coverage decisions, are driven by the company’s own research into which drugs and procedures are most effective.” A good piece in last months’ NYT. discusses this.

There are many versions of this and perhaps there ought to be Federal provisions and overall guidelines but with regional flexibility afforded to each state. This topic requires further discussion and I will tackle it next month.

Enjoy the rest of your summer!!!

established companies “with sicker patients”. Start-ups, by contrast, with much lower rate of diagnosed sick patients essentially pay into this tax. This tax is part of the risk adjustment program intended to stabilize Insurers who took on sicker patients and spread this risk. While some correctly blame too low pricing and some miscalculated business decision-making the inherent extra tax doomed the majority of the original 16 co-ops.

established companies “with sicker patients”. Start-ups, by contrast, with much lower rate of diagnosed sick patients essentially pay into this tax. This tax is part of the risk adjustment program intended to stabilize Insurers who took on sicker patients and spread this risk. While some correctly blame too low pricing and some miscalculated business decision-making the inherent extra tax doomed the majority of the original 16 co-ops.