by Alex | Dec 15, 2016 | individual health insurance

21st Century Cures Act Passed

On Tuesday The 21st Century Cures Act Passed and signed by President Obama. The ‘Act” has numerous components but the the greatest impact on small business is the HRA ( health reimbursement arrangement) component.

The Cures Act allows small employers to reimburse individual health coverage premiums up to a dollar limit through HRAs called “Qualified Small Employer Health Reimbursement Arrangements” (QSE HRA). This provision will go into effect on January 1, 2017.

The IRS previously limited Employer reimbursement of individual premiums in light of the requirements of the Patient Protection and Affordable Care Act (ACA). For many years, employers had been permitted to reimburse premiums paid for individual coverage on a tax-favored basis, and many smaller employers adopted this type of an arrangement instead of sponsoring a group health plan. However, these “employer payment plans” are often unable to meet all of the ACA requirements that took effect in 2014, and in a series of Notices and frequently asked questions (FAQs) the IRS made it clear that an employer may not either directly pay premiums for individual policies or reimburse employees for individual premiums on either an after-tax or pre-tax basis. This was the case whether payment or reimbursement is done through an HRA, a Section 125 plan, a Section 105 plan, or another mechanism.

Who is eligible?

The Cures Act now allows employers with less than 50 FT employees (under ACA counting methods) who do not offer group health plans to use QSE HRAs that are fully employer funded to reimburse employees for the purchase of individual health care.

What are the funding limits?

The reimbursement cannot exceed $4,950 annually for single coverage, and $10,000 annually for family coverage. The amount is prorated by month for individuals who are not covered by the arrangement for the entire year. Practically speaking, the monthly limit for single coverage reimbursement is $412, and the monthly limit for family coverage reimbursement is $833. The limits will be updated annually.

Impact on Individual Subsidy Eligibility?

For any month an individual is covered by a QSE HRA/individual policy arrangement, their subsidy eligibility would be reduced by the dollar amount provided for the month through the QSE HRA if the QSE HRA provides “unaffordable” coverage under ACA standards.

Employees applying for coverage on federal or state health insurance exchanges will need to disclose the amount that the employer is making available via the HRA. That amount will be used by the exchange in calculating whether an employee’s household income exceeds ACA affordability thresholds (2017 – 9.69 % of household income), as well as determining subsidy amounts for those that meet the eligibility requirements. Those employees eligible for a subsidy will have their monthly amount reduced by the monthly HRA amount available through their employer.

If the QSE HRA provides affordable coverage, individuals would lose subsidy eligibility entirely. Caution should be taken to fully education employees on this impact.

COBRA and ERISA Implications?

QSE HRAs are not subject to COBRA or ERISA.

Annual Notice Requirement?

The new QSE HRA benefit has an annual notice requirement for employers who wish to implement it. Written notice must be provided to eligible employees no later than 90 days prior to the beginning of the benefit year that contains the following:

- A statement to the employee that it is their responsibility to provide the federal or state health insurance exchange with the amount being provided in HRA funds, as this amount will be used by the exchange when calculating need based premium assistance.

- A statement that if the employee is not covered by minimum essential coverage for any month of the tax year, they could be subject to a penalty under the Individual Mandate provisions of the ACA.

Failure to provide this notice will result in a penalty to the employer of $50 per applicable employee, up to a $2,500 maximum per calendar year. Transition relief is available for plans starting in the first quarter 2017 – they will have until April 1, 2017 to provide notices to employees.

Record-keeping, IRS Reporting?

Because QSE HRAs can only provide reimbursement for documented healthcare expense, employers with QSE HRAs should have a method in place to obtain and retain receipts or confirmation for the premiums that are paid with the account. Employers sponsoring QSE HRAs would be subject to ACA related reporting with Form 1095-B as the sponsor of MEC. Money provided through a QSE HRA must be reported on an employee’s W-2 under the aggregate cost of employer-sponsored coverage. It is unclear if the existing safe harbor on reporting the aggregate cost of employer-sponsored coverage for employers with fewer than 250 W-2s would apply, as arguably many of the small employers eligible to offer QSE HRA’s would have fewer than 250 W-2s.

Individual Premium Reimbursement Prohibitions

Outside of the exception for small employers using QSE HRAs for reimbursement of individual premiums, all of the prior prohibitions from IRS Notice 2015-17 remain. There is no method for an employer with 50 or more full time employees to reimburse individual premiums, or for small employers with a group health plan to reimburse individual premiums. There is no mechanism for employers of any size to allow employees to use pre-tax dollars to purchase individual premiums. Reimbursing individual premiums in a non-compliant manner will subject an employer to a penalty of $100 a day per individual they provide reimbursement to, with the potential for other penalties based on the mechanism of the non-compliant reimbursement.

For analysis if this works for your small business? Please contact our payroll and reimbursement team on your HR/Payroll/Compliance needs at Millennium Medical Solutions Corp (855)667-4621 for immediate answers.

by Alex | Oct 31, 2016 | family health insurance, Health Care Reform, Health Exchanges, Individual Exchanges, individual health insurance, State Exchanges

2017 Individual Open Enrollment

Everything you need to know ahead of tomorrow’s 2017 Individual Open Enrollment. This Open Enrollment marks the 4th anniversary of Obamacare a.ka. The Affordable Care Act. As a helpful resource, the new NY and NJ rates with important deadlines are listed below. 33 States such as NJ use the healthcare.gov website or at https://medicalsolutionscorp.demo.hcinternal.net/individual/individual/homePage. States such as NY and CT use their own Marketplace – NYS of Health and AccessHealth CT. Importantly, individuals not expecting a subsidy may also apply Off-Exchange which in many case has more options and Insurers.

2017 NY Individual Health Plans

These rates are for New York City unless otherwise indicated, and for a single person. For a family premium, multiply by 2.85, Husband/Wife

These rates are for New York City unless otherwise indicated, and for a single person. For a family premium, multiply by 2.85, Husband/Wife

multiply by 2.0 and Parent/Children multiply by 1.70. The non single deductibles are out of pocket maximums are doubled. These are for standard plans, which two-thirds of customers enrolled in during 2016.

While deductibles for platinum, gold and silver plans have stayed the same, many bronze plan deductibles have increased 33 percent. That means consumers who purchase a bronze plan — presumably for its lower monthly premium — are paying more out of pocket for their medical costs before their insurance company kicks in a dime. A family of four that purchased a bronze plan will have an $8,000 deductible in 2017, up from $6,000 in 2015. For someone young and relatively healthy, that might be OK, but that person is vulnerable to a very large bill if he or she needs expensive medical care. It’s the platinum plans where New York State really shows itself to be a national outlier. Roughly 18 percent of New Yorkers chose a platinum plan in 2016, compared to 2 percent across the nation, according to the Kaiser Family Foundation.

Here are the 2017 rates:

2017-nys-marketplace-rates-1

2017 NJ Individual Health Plans

NJ Dept of Banking and Insurance posted the 2017 NJ individual health plans Monday. Only two carriers will offer plans on the state’s Obamacare marketplace next year: Horizon Blue Cross Blue Shield of New Jersey and AmeriHealth.

Additional insurers are participating off-exchange or outside the Marketplace. Examples: Aetna, CIGNA and Oxford. There are additional 20 plan options available off exchange. A notable new entrant, Health Republic of NJ, will no longer be available for 2017. See – Health Republic NJ Shutting Down.

Here are the 2017 rates:

2017-new-jersey-individual-health-benefits-plans-and-rates

2017 Individual Open Enrollment Deadlines

- November 1, 2016: Open Enrollment starts — first day you can enroll in a 2017 insurance plan through the Health Insurance Marketplace. Coverage can start as soon as January 1, 2016.

- December 15, 2016: Last day to enroll in or change plans for new coverage to start January 1, 2017.

- January 1, 2017: 2017 coverage starts for those who enroll or change plans by December 15.

- January 15, 2017: Last day to enroll in or change plans for new coverage to start February 1, 2017

- January 31, 2017: 2016 Open Enrollment ends. Enrollments or changes between January 16 and January 31 take effect March 1, 2017.

If you don’t enroll in a 2016 health insurance plan by January 31, 2017, you can’t enroll in a health insurance plan for 2016 unless you qualify for a Marketplace Special Enrollment Period.

Penalty: The uninsured penalty rises to $695 or 2.5% of your income, whichever is higher.

Coverage start dates

If you enroll before the 15th of any month, your coverage starts the first day of the next month. If you enroll after the 15th of the month, you’ll have to wait until the month after that for your coverage to start. So, for example, if you enroll on January 16, your coverage would start on March 1.

Enroll using our online comparison shopping tool for both on and off-Exchange Marketplace to be released next week. Email us or Contact us at (855)667-4621.

by Alex | Oct 25, 2016 | individual health insurance, NJ

2017 NJ Individual Health Plans

NJ Dept of Banking and Insurance posted the 2017 NJ individual health plans Monday. Only two carriers will offer plans on the state’s Obamacare marketplace next year: Horizon Blue Cross Blue Shield of New Jersey and AmeriHealth.

Additional insurers are participating off-exchange or outside the Marketplace. Examples: Aetna, CIGNA and Oxford. There are additional 20 plan options available off exchange. A notable new entrant, Health Republic of NJ, will no longer be available for 2017. See – Health Republic NJ Shutting Down.

Here are the 2017 rates:

2017-new-jersey-individual-health-benefits-plans-and-rates

by Alex | Aug 8, 2016 | group health insurance, Health Exchanges, Individual Exchanges, individual health insurance, NY News, United Healthcare

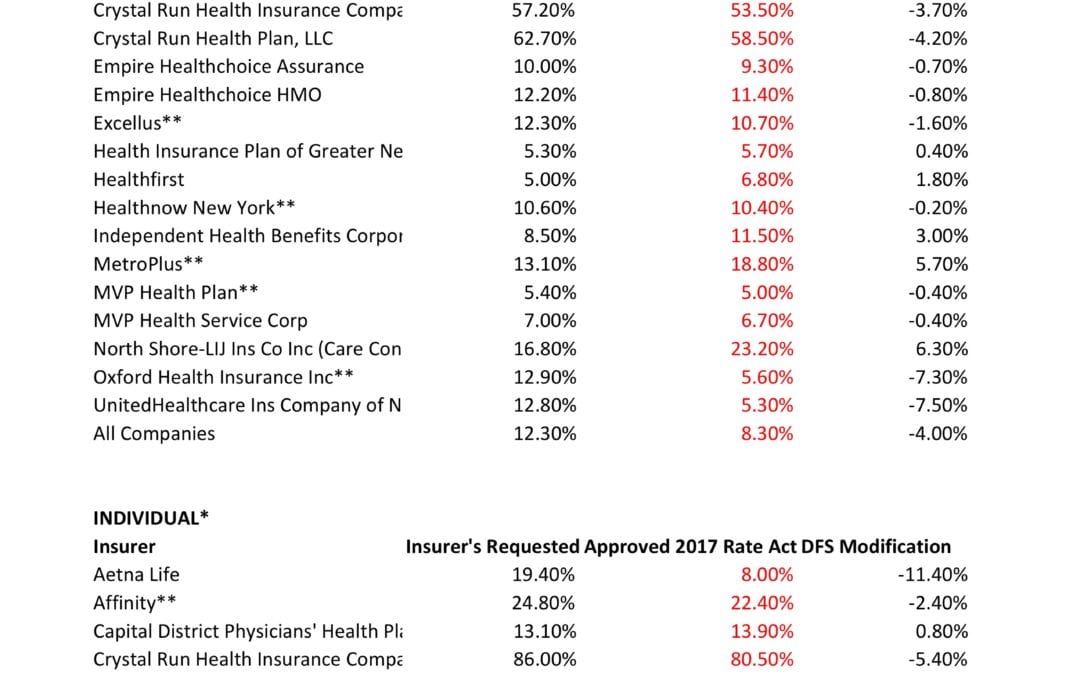

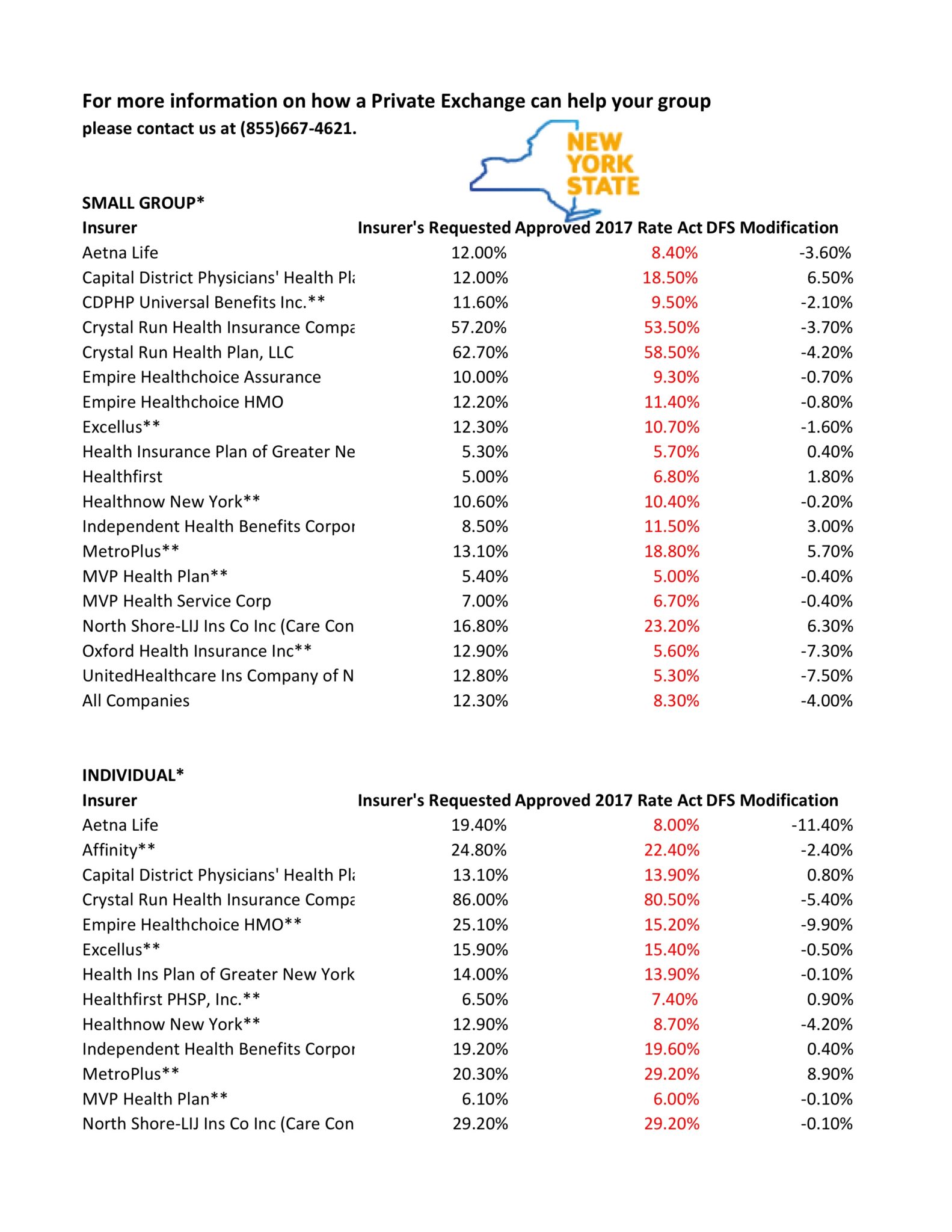

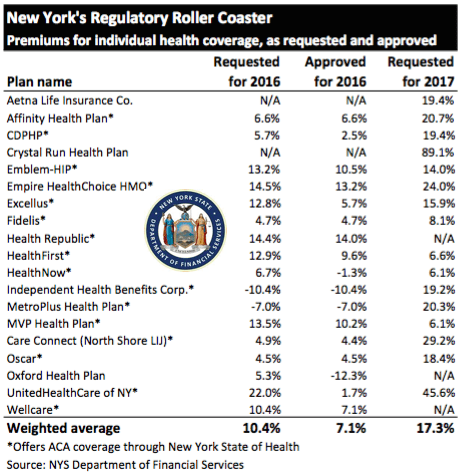

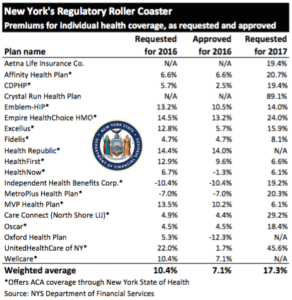

NYS 2017 FINAL Rates Approved

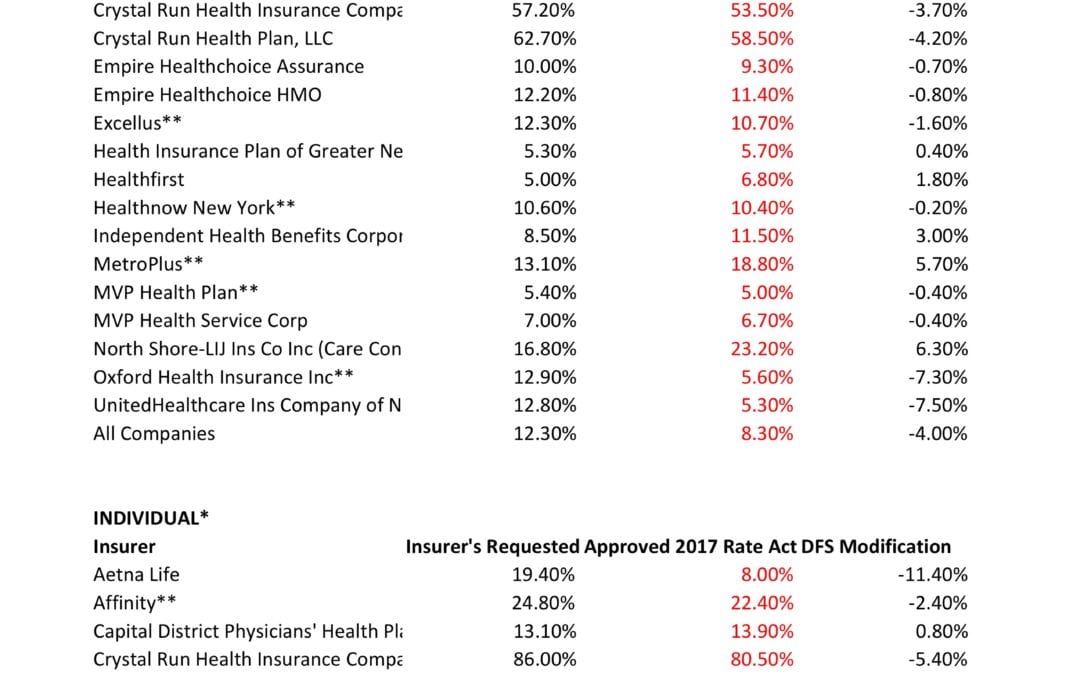

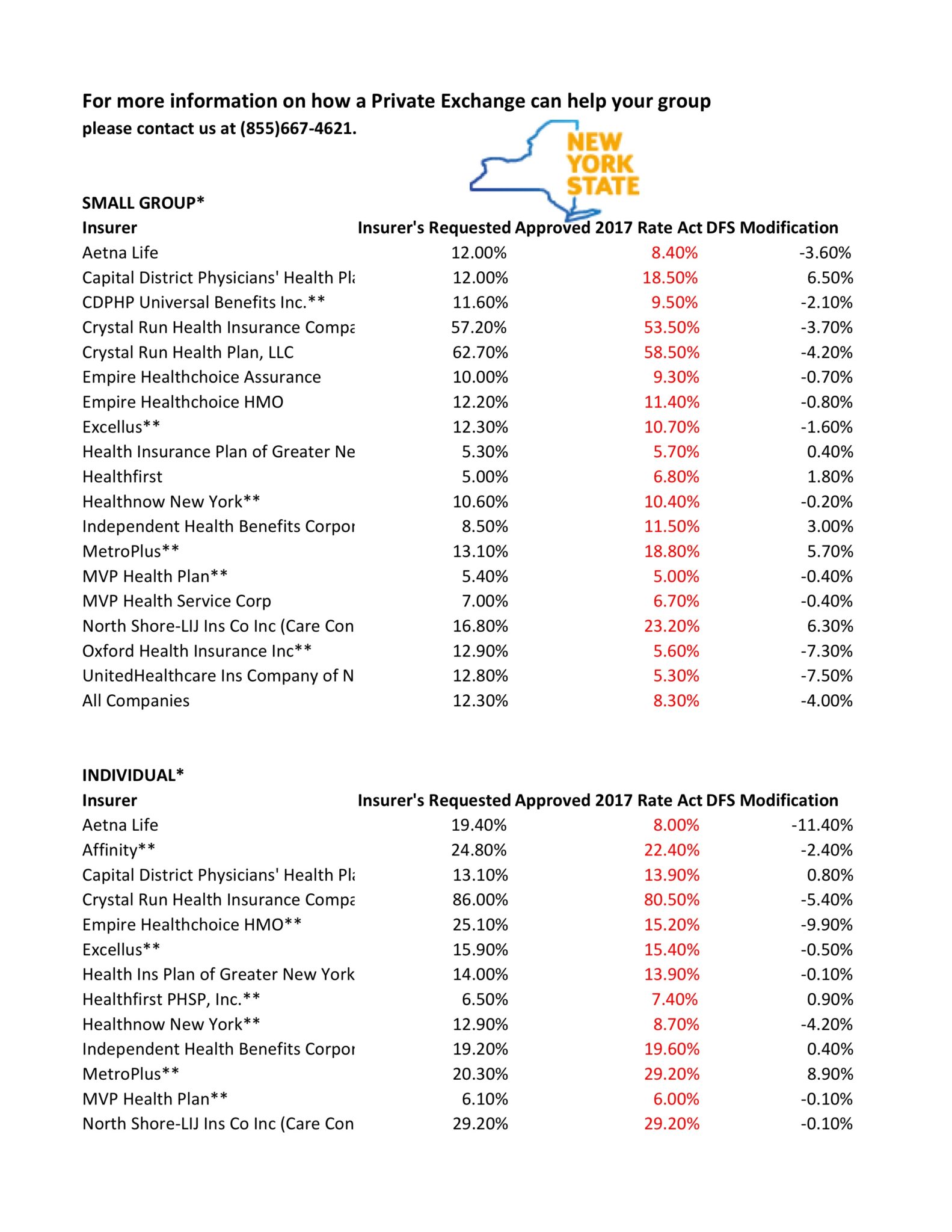

NYS has approved 2017 Final Rates. Small group rates will increase 8.3%, a reduction from the 12.3% average originally requested. In the individual market, the average increase will be 16.6%, a reduction from the originally requested 19.3%.

As per NY State Law carriers are required to send out early notices of rate request filings to groups and subscribers see original –NYS 2017 Rate Requests. With only 3 months of mature claims experience for 2016 health insurers’ requests are historically above average. Ultimately the State reduces this request substantially. This year, however, NYS acknowledged that medical costs increased, citing a 7-percent average increase on the individual market and an 8.5-percent increase on the small group market. The administration also acknowledged drug prices have impacted insurers, pointing specifically to blockbuster drugs for Hepatitis C.

OTHER STATES

The national rate trend, however, has been much higher than in past years due to higher health care costs Like other states throughout the nation, the 2017 rate of increase for individuals in New York is higher than in past years partly due to the termination of the federal reinsurance program. The lost of the program’s aka federal risk reinsurance corridor funds accounts for 5.5 percent of the rate increase.

How are neighboring States doing? In NJ, not that bad. According to a review of filings made public last week the expected rate increase will be likley ve half. Example: Horizon Blue Cross Blue Shield requested a 4.8% increase on their OMINA Plans. For CT market, on the other hand, things are much worse at least for individual marketplace with average 25% rate increases.

SMALL GROUP MARKET VS. INDIVIDUAL MARKET

The new premium hikes ranged from as little as 5.6 percent for Oxford Small group to a whopping 58.5% percent increase for Crystal Run Health Insurance Company, an insurer that covers parts of the Hudson Valley and Catskills. Importantly, small group market are still more advantageous than individual markets unless one gets a sizable low income tax credit.

Overall, about 350,000 individual plan consumers will be affected by the price hike, while more than a million users will be hit by higher small group fees. Earlier this year, Blue Cross Blue Shield released a study showing Obamacare user costs were 22 percent higher than people with employer-sponsored health plans, while UnitedHealth plans to exit most Exchanges see – Breaking: Oxford Exits Metro Indiv & Oxford Liberty HMO 2017.

The correct approach for a small business in keeping with simplicity is a Private Exchange. This is a true defined contribution empowering employees with choice of leading insurers offering paperless technologies integrating HRIS/Benefits/Payroll. Both employee and employers still gain tax advantage benefits under the business. Also, the benefits, rates and network size are superior under a group plan as the risk are lower for small group plans than individual markets.

* All amounts are rounded to the nearest 1/10.

**Indicates that the company makes products available on the “New York State of Health” marketplace.

***After rate applications were filed on 5/9/2016, additional information, including the final results of the federal risk adjustment program, prompted several insurers to update their initially filed rates.

For more information on how a Private Exchange can help your group please contact us at (855)667-4621.

by Alex | Jun 28, 2016 | individual health insurance, latest health insurance news, NY News, United Healthcare

Breaking: Oxford Exits Metro Indiv & Oxford Liberty HMO 2017

A neat quote mentioned in yesterday’s Crains Health Pulse. I only wish it were for better news.

1. Oxford will be leaving NY Individual health plans. The popular Oxford Metro plan offered off-exchange marketplace will no longer be offered next year. Notably, this is the only plan that contained par excellence cancer hospitals such as Memorial Sloan Kettering.

Oxford Metro will still be available for NY Small groups.

2. Oxford Liberty HMO plans will be leaving ALL segments – Individuals to commercial large groups. For restaurants and retail shops, as an example, this is a very popular platform as this allowed flexibility of NO minimum participation. If only 1 person wanted to enroll on plan out 20 that was OK.

Oxford will be sending these letters out to Employers starting with Jan 2017 renewals.

Oxford Health Plans (NY), Inc. (OHP) License Withdrawal, Effective January 1, 2017, Upon Renewal

Please note the following:

- This change does not affect their regular Oxford Health Insurance, Inc. (OHI) plans. Their OHI portfolio in New York offers a wide range of coverage options for employers of all sizes.

- Impacted groups and members will receive a notice from us approximately 180-days prior to their 2017 coverage end date. The notice will outline the actions they need to take and other available coverage options.

Stay proactive and contact us today for a customized consult on how your organization can prepare ahead for ACA, Benefits, Payroll and HR @ (855) 667-4621 or info@medicalsolutionscorp.com.

by Alex | May 19, 2016 | group health insurance, Health Exchanges, Individual Exchanges, individual health insurance, NY News, PPACA, Small Business Group Health

NYS 2017 Rate Requests

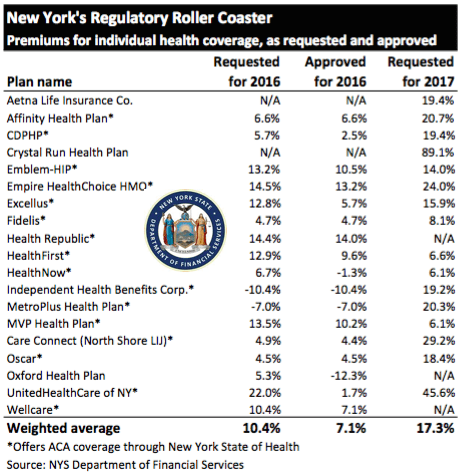

The State released NYS 2017 Rate Requests with average increases of 17.3% individual market and 12% for small groups. This early 5/12/16 deadline request requirement is not an Obamacare requirement. As per NY State Law carriers are required to send out notices of rate increase filings to groups and subscribers.

With only 3 months of mature claims in 2016 to work of off Insurance Actuaries have little experience to predict accurate projections. Typically the rate requests must be high and in the past final approvals after negotiations were only half, see https://360peo.com/nys-2016-rates-approved/. The national rate trend, however, has been much higher than in past years due to higher health care costs and the loss of Federal reinsurance fund known as risk reinsurance corridor.

This is one of the reasons why the individual market is significantly more costly to operate than small group as per recent United Healthcare pull out of most State Individual Exchanges, UnitedHealthcare will drop ACA Exchanges. In fact, the Health Republic NY is Shutting Down highlights how an insurer banked on the federal risk corridor reinsurance and underestimated NYS costs of care. Another local example is Oscar Health Insurance which has lost $105 million and is asking for up to 30% rate increase. The 3 year old company said the increase was necessary because medical costs have risen, government programs that helped cover costs are ending, and its members needed more care than expected. That all translates into the need for a price correction.

Importantly, the individual market subsides may be on borrowed time. Last week, The Federal Court ruled that Obamacare subsidies were illegally funded. The ruling while the Obama administration challenges it in D.C. Circuit Court of Appeals, is still allowing the reimbursements to continue for now. The practice of some small businesses dropping group health insuarnce in favor of the Individual Plans known as “cash for insurance” is put into question by this. While the IRS ruled that this is prohibited (see below) some small business are attracted to the simplicity of a public exchange and not getting involved in the managing of plans. Prohibited: The IRS prohibits employers from giving (or reimbursing) employees pre-tax funds to buy health insurance on their own—through the state-based and federally facilitated exchanges or private marketplaces alike.1 This practice may result in a $100 per day excise tax per applicable employee, according to an IRS Q&A released in May 2014.2

Instead, the correct approach for a small business in keeping with simplicity is a Private Exchange. This is a true defined contribution empowering employees with choice of leading insurers offering paperless technologies integrating HRIS/Benefits/Payroll. Both employee and employers still gain tax advantage benefits under the business. Also, the benefits, rates and network size are superior under a group plan as THE RISK OUTLINED ABOVE ARE HIGHER FOR INDIVIDUAL MARKETS THAN SMALL GROUP PLANS.

For more information on how a Private Exchange can help your group please Contact us at (855)667-4621.

Summary of 2017 Requested Rate Actions

INDIVIDUAL MARKET

| Company Name | 2017 Requested Rate Change |

|---|

| Aetna Life Insurance Company | 19.4% |

| Affinity Health Plan, Inc.* | 20.7% |

| Capital District Physicians’ Health Plan* | 11.2% |

| Crystal Run Health Plan, LLC* | 89.1% |

| Empire HealthChoice HMO, Inc.* | 24.0% |

| Excellus Health Plan, Inc.* | 15.9% |

| Health Insurance Plan of Greater New York* | 14.0% |

| Healthfirst PHSP, Inc.* | 6.6% |

| HealthNow New York Inc.* | 6.1% |

| Independent Health Benefits Corporation* | 19.2% |

| MetroPlus Health Plan, Inc.* | 20.3% |

| MVP Health Plan, Inc.* | 6.1% |

| New York State Catholic Health Plan, Inc. dba Fidelis Care New York* | 8.1% |

| North Shore-LIJ CareConnect Insurance Company, Inc.* | 29.2% |

| Oscar Insurance Corporation* | 18.4% |

| UnitedHealthcare of New York, Inc.* | 45.6% |

| Weighted Average Requested Rate Change – Individual Market | 17.3% |

*Indicates that the company makes products available on the “New York State of Health” marketplace.

SMALL GROUP MARKET

| Company Name | 2017 Requested Rate Change |

|---|

| Aetna Life Insurance Company | 12.0% |

| Capital District Physicians’ Health Plan, Inc. | 9.6% |

| CDPHP, Universal Benefits Inc.* | 11.6% |

| Crystal Run Health Insurance Company, Inc. | 61.9% |

| Crystal Run Health Plan, LLC | 66.6% |

| Empire Healthchoice Assur Inc | 10.0% |

| Empire HealthChoice HMO, Inc. | 12.6% |

| Excellus Health Plan, Inc.* | 12.3% |

| Health Insurance Plan of Greater New York* | 10.6% |

| Healthfirst Health Plan (Managed Health) | 5.0% |

| HealthNow New York Inc.* | 5.8% |

| Independent Health Benefits Corporation* | 11.2% |

| MetroPlus Health Plan, Inc.* | 13.1% |

| MVP Health Plan, Inc.* | 5.4% |

| MVP Health Services Corp. | 6.8% |

| North Shore-LIJ CareConnect Insurance Company, Inc.* | 16.8% |

| Oxford Health Insurance, Inc.* | 12.9% |

| UnitedHealthcare Insurance Company of New York | 12.8% |

| Weighted Average Requested Rate Change – Small Group Market | 12.0% |

*Indicates that the company makes products available on the “New York State of Health” marketplace.

Source: https://myportal.dfs.ny.gov/web/prior-approval/summary-of-2017-requested-rate-actions

Resource:

These rates are for New York City unless otherwise indicated, and for a single person. For a family premium, multiply by 2.85, Husband/Wife

These rates are for New York City unless otherwise indicated, and for a single person. For a family premium, multiply by 2.85, Husband/Wife