by admin | Feb 12, 2013 | Health Care Reform, Health Exchanges, Individual Exchanges, individual health insurance, Small Business Group Health

Poor health plan for middle class?

An interesting NYT article today “Slower Growth of Health Costs Eases U.S. Deficit” describes the good news that actual spending has been reduced by 15% or $200 Billion than projected 3 years ago. New data also show overall health care spending growth continuing at the lowest rate in decades for a fourth consecutive year.

Its any ones guess to the exact cause of this good news I will venture to say a good part of is the severe escalating out of pocket costs. With average office copays $50 and $200 for ER and many replacing these plans with high deductibles is it any wonder there is lower utilization? One might argue are poor health plans the cause for middle class leading to lower usage? To get an updated picture of todays NY Small Business rates once can get instant quote on our site and implement strategies in “How to Reduce My Health Care Costs“. In some instances people are turning to self insured Health Savings Accounts carrying deductibles as high as $5000 Individual and $10,000 Family.

In 2014 Individual Health Exchanges will offer a subsidized rate for lower income. For example, a $25,000 Individual filer would get approximate 80% subsidized rate and pay approx. $100/month. However salaries are not geo-sensitive and the average NY Middle Class Household will not see this subsidy. There are a number of questions outstanding such as the quality of the network. Also some Governors such as Christy Has Rejected Exchange is capable of running this Exchange version.

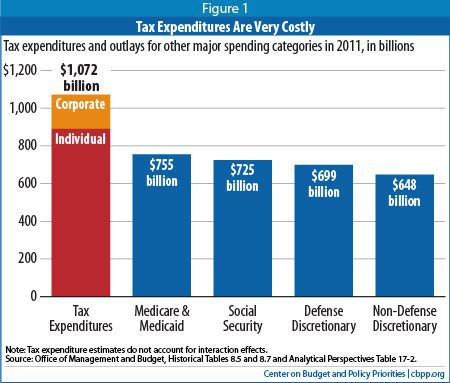

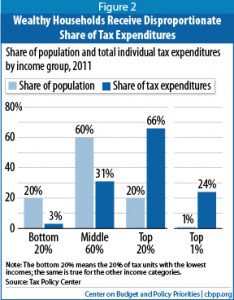

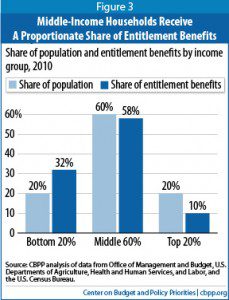

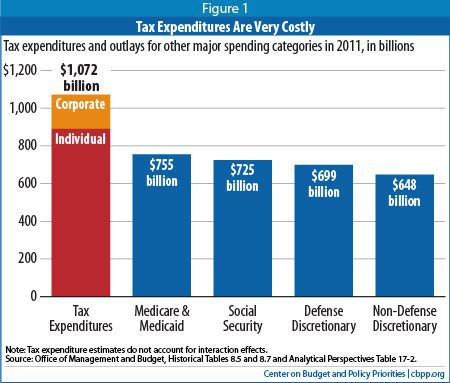

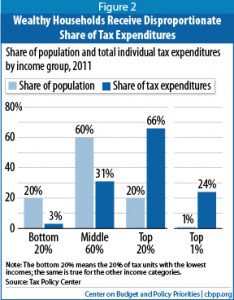

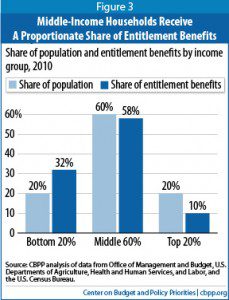

On the higher end according to CBO “tax expenditures disproportionately benefit the most well-off. As Figure 2 shows, the most affluent 20 percent of Americans receive 66 percent of all tax expenditure benefits (the richest 1 percent alone getting 24 percent of the benefits), while the middle 60 percent of households received just 31 percent of the benefits. In contrast, the middle 60 percent of households receive a proportionate share (58 percent) of the benefits of entitlement programs on the spending side of the budget (see Figure 3). The poorest fifth of households receive 32 percent of these benefits.”

But the greatest looming concern are costs. is behavior changing? Are people initiating preventive care more readily? Are they enrolled in wellness programs, managing chronic conditions, seeking Urgent Care vs. ER, using generics vs brands? Is technology playing a greater role such as mobile devices in managing care? Are modern medicine efficiencies such as avoiding testing redundancies and EMR helping?

No one argues that medical costs are a drag on the economy and are directly linked to our prosperity. “Slower cost growth would have ramifications far beyond the deficit. According to calculations by White House economists, slowing the annual growth rate of health care costs by 1.5 percentage points might increase economic output by 2 percent in 2020 and 8 percent in 2030. It might also lead to higher wages for workers and more room for productive investments in the budget.”

The hope is medical care is becoming more efficient. Whether or not the rate is subsidized it is still being paid for by someone. With this new finding it does offer hope but unless there are added incentives such a preventive medications under an Health Savings Account card covered without a deductible the concerns are Middle Class families will be reluctant to access care and we all end up paying for this.

You can self quote on our site. Contact us at 1-855-667-4621 for more customized information.

by admin | Nov 12, 2012 | Health Care Reform, Health Exchanges, Individual Exchanges, PPACA, SHOP Exchanges, Small Business Group Health, State Exchanges

Crains Brokers’ Commissions Face Uncertain Future. A quick comment on our quote in Crains “Crains Brokers’ Commissions Face Uncertain Future” today. Insurers are indeed cutting back on services resulting in cost containement measures such as layoffs, outsourcing and significant broker commissions cuts.

A significant negative development is the NYS decision to not allow licensed Agents/Brokers in the Individual Exchange. Many States such as Massachusettes, the inspiration for Health Care Reform, use a Connector which is an Exchange or an independent state agency that helps Massachusetts residents find health insurance coverage and avoid tax penalties. Instead NYS will allow Agents/Brokers to only work in the Commercial Exchange known as SHOP. HealthPass is a good pre-cursor of the SHOP Exchange offering Small Businesses a Defined Contribution Health Plan of full options form Health Insurance, Dental, Vision to Term Life Insurance and Disability.

The Individual Exchange will work with an “Assitor” or “Navigator”. In NYS Government and Non-Profit Agencies will comprise the “Navigator” which will only be allowed to operate in the Individual Exchange. By design an income subsidy will only pass through this Individual Exchange an not on the SHOP Exchange. Example: a $50,000 Family Household of 4 can get approximately 80% credited.

The Federal Gov has already spent $2.2 Billion on State Exchanges. And this figures does not include remaining States as there are only 19 States working on an Exchange for 2014. The Exchanges will be built up for 2 years and then must be fully independent by 2016. If 88% of small groups coverage purchased by Brokers acc. to Bostons Wakely Report in research study- Role of Producers and Other Third Party Assisters in New York’s Individual and SHOP Exchanges the distribution infrastructure is already there. Access to care is not the difficulty in finding a plan its the very cost of the plan! Why then does NYS decide to spend on building up new infrastructures? AgentsBrokers can easily outreach and council to uninsured as well. In fact many small businesses such as construction, consulting services and dining have many uninsured that an Agent/Broker already has a relationship with.

Despite all this and the rapid changes in reshaping health care we remain optimistic and look forward to taking on a greater role in health care reform.

With more choice, our groups and their employees will need more direction, allowing brokers to take on more of a consultative role. Healthcare plans are not a simple purchase and one plan doesn’t fit all. By delivering the latest cutting-edge benefits technologies, continued consumer focus approach and leveraging our long time relationships with Benefits/HR/Payroll partners our role will be pivotal in being part of the solution.

Pulse Nov 2012 Quote MMS

by admin | Aug 31, 2012 | Health Care Reform, MEDICARE, Obamacare, Small Business Group Health, Tax

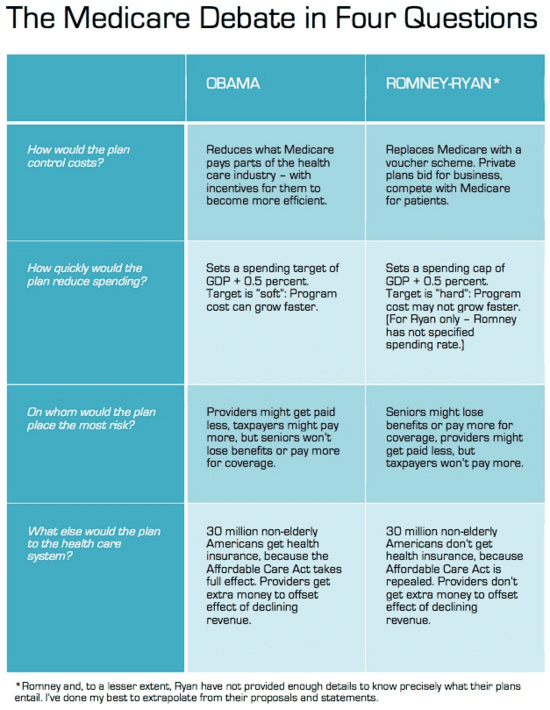

4 Questions Compare Ryan and Obama on Medicare

Published 2 hours ago by HealthCareIT News,

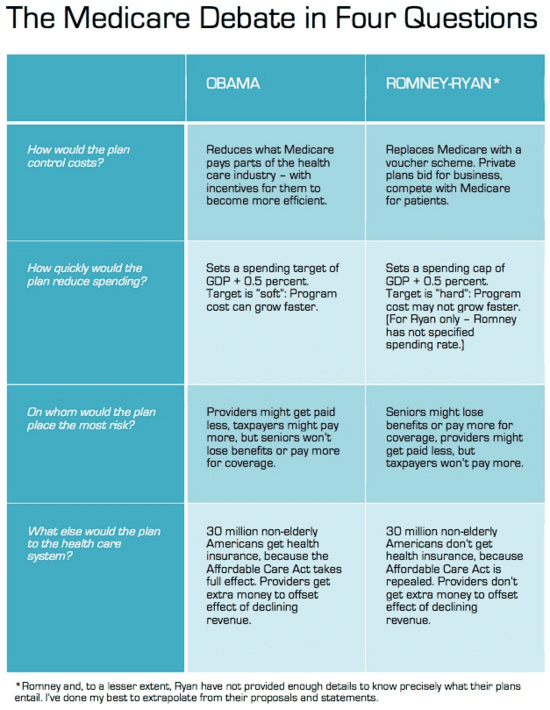

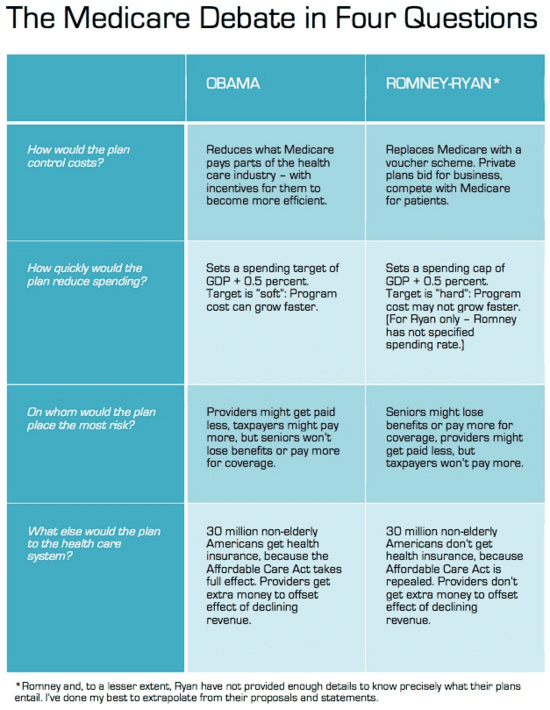

It may come as a surprise that President Barack Obama and GOP vice presidential nominee Paul Ryan are pushing the same target rate for controlling federal spending on Medicare. Each would set it at half a percentage point higher than the growth rate of the economy the gross domestic product after a phase-in period.

READ FULL ARTICLE

Youtube Video-Pros & Cons of the Health Care Reform Bill

Medicare Obama Romney comparsion chart

by admin | Mar 12, 2012 | Health Care Reform, healthcare, Hospitals, PPACA, Small Business Group Health

Out of Control Out of Network Charges

Few healthcare changes have been more impacted than the out of control out of network charges billed to patients. The health care reform bill known as PPACA has for the most part been insignificant in the Northeast, in particular, as many state laws have already addressed issues such as pre-existing conditions, contraception, coverage rescissions and maximum loss ratios (MLR).

Instead, the market forces are reshaping the medical field into significant insurance & provider consolidation, larger hospital groups and flattening provider reimbursements. The problem is pointed out in Out of Network Medical Costs Affecting NY State Across investigation report commissioned by Governor Cuomo recognizing the unexpected out-of-network claim problem. Officials say that this is now “an overwhelming amount of consumer complaints.” Some examples cited in the report An Unwelcome Surprise – “a neurosurgeon charged $159,000 for an emergency procedure for which Medicare would have paid only $8,493.” Another example: ” a consumer went to an in-network hospital for gallbladder surgery with a participating surgeon. The consumer was not informed that a non-participating anesthesiologist would be used, and was stuck with a $1,800 bill. Providers are not currently required to disclose before they provide services whether they are in-network.” The average out-of-network radiology bill was 33 times what Medicare pays, officials say.

To make matters worse, Health Insurers have reduced their out of network recognized charges from private industry index UCR (usual customary and reasonable) to the Medicare Index known as RBRVS ( Resource Based Relative Value Scale ). Insurers moved away from UCR after then-NYS D.A. Mario Cuomo in 2009 forced Unitedhelatcare Group (owners of Inginex) to settle $50 Million in a conflict of interest allegation. D.A. Cuomo future hopes for UCR were to that it be overseen by a non-profit entity. So much for best laid plans.

Today, 90% of SMB members have in network only benefits but the few remaining consumers are paying for eroding out of network benefits with little transparencies and necessary protection from new out of network billing practices. The NY Dept of Financial services is calling for providers in non-emergency situations to disclose whether or not all services are in-network, what out-of-network charges will be and how much insurers will cover.

Insurers such as Aetna are taking action – with lawsuits throughout the country such as Aetna sues 9 N.J. doctors for “unconscionable” fees. Another Aetna lawsuit is discussed extensively in a law blog: In New Lawsuit, Health Insurers Allege Fraud and Kickbacks Against Out-of-Network Providers Who Forgive Patients’ Financial Responsibility.

In an ominous statement” “Failure to recognize this historical out-of-network avalanche will result in shocking financial disasters, as experienced by so many hospitals in 2003″

by admin | Jan 8, 2012 | Health Care Reform, healthcare, NY News, Small Business Group Health, State Exchanges

In the wake of Empire Blue Cross’s recent major SMB changes the 2 new Crains article below point to the early shake up results.

Tough Decisions on Health Coverage

Insurance Good Luck

Empire’s Small Group “simplification” did indeed cause groups to escape Empire’s rate increases and reduced plan selections. Additional, not mentioned in the article was that groups are facing plan modifications such as Rx changes switch to % from fixed $ copay and loss of Walgreen/Duane Reades chains. By being the largest insurer on the block heavy provider negotiations have been de rigieur as evidenced by loss of Westchester Medical Center for 14 months and counting.

Groups have been fortunate to find comparable alternatives despite these changes but we see little public evidence of concern form NYS legislature. We are not seeing the long term vision to open up markets to strong national insurance competitors. On the contrary we have deep concerns of allowing the past 2 non-profits of GHI and HIP merger and latest talks of going for profit.

Lastly, the article makes mention of possible “Health Exchanges” entering the market and lowering rates. Where is there evidence of this decrease? I’m not seeing why an insurer working in an oligopoly environment with price controls would be motivated to lower rates. Would Con Ed or Blue Bell lower rates in the 70s because now SMB can shop online??

by admin | Nov 4, 2011 | family health insurance, Health Care Reform, healthcare, Healthy NY, Small Business Group Health

As per todays Crains article, Empire Blue Cross will be exiting the majority of small group health plans effective April 1, 2012. The news was swirling earlier this week with official Empire communication going out today.

This affects 1/3 of New York Small Businesses as defined by 50 or less FT and eligible employees. Since with large group market the insurer is allowed to rate a group based on true census and make up of a group’s sex, age and family status as well as claims experience of the prior year. In NY State where the small group market is Community rated and independent of census this becomes an important point that I will get back to.

As healthcare has become regulated by MLR(Max Loss ratios) or revenue controls its not surprising that insurers are unhappy but why does it seem that in NYS regulations run deeper than in other states? We are licensed in multiple states and we are not seeing the same pattern this quickly. Numerous companies have already exited such as CIGNA, HealthNet, Horizon, Guardian not to mention M&A of HIP/GHI, Oxford/UnitedHealthcare and Aetna/US Healthcare/NYLCare etc. I can go on.

In NYS the insurance regulations go beyond Health Care Reform (PPACA) with higher MLR than the national one. The Federal level is 80% for small groups and in NYS its 82%

There are new NYS price controls where insurers must anticipate risk a year in advance and ask for larger rate increases to protect on anticipated uncertain risks. With so many unknown variables its almost like asking one to predict who’s going to win the Super Bowl in 2013. Rate increase of 15-20% requests must be higher than usual since after all there are no State protection on the loss side. Furthermore, increases of 10%+ must now require public hearings 60 days prior.

Today, we have so many State mandates that many of the mandates(overage dependents coverage, preventive care, pre-existing for kids) in PPACA didnt even affect NY since they were already in place. Mandates account for approx 17% of the costs of which Small Businesses pay more than fair share. Large corporations and Unions can self insure and avoid some mandates as they are governed by ERISA and not State. To the relief of of our struggling clients on subsidized Healthy NY the State doesn’t play by their own rules and instead opts out of its very own mandates.

So what happened with Empire? The tipping point evidently was rate increase denials of 5 consecutive quarters and that Empire quite frankly got caught with great pricing and products just when healthcare reform came around. Many insurers raised their rates in advance of the law. Emblem (GHI) raised rates 25% on average and even as high as 60% on HSA. Granted they have also removed many plans recently.

Much like in the 70’s its a regulaed oligipoly with insurers too too big to fail. Our clients will have access to only 3 insurer – Aetna, Emblem and Oxford. Just imagine how high your Auto Insurance would cost in the same scenario? This remarkable in a 25 million metropolis like NYC. Insurers do not have to be in NYS, no new carrier is looking to enter the NY market. After 75 years in business and insuring 4 generations of small businesses this should be a shock to the system and a wake up call to every politician.

We ask for greater oversight on Mergers and Acquisition of health insurers,providers and hospitals. Its begining to dawn on everyone that a too big to fail environment is poison and will be the tail that wags the dog. I can only imagine what the other remaining insurers must be thinking whats in store for next year.

Importantly, the community rating ought to be dropped as most states such as NJ, CT are census based. With Health Exchanges coming in 2014 individuals will be able to purchase health insurance on their own which will make Community Rating less relevant. This will be a positive step in allowing great competitors like Humana to enter the market.

If this is not a wake up call for small businesses to have a seat at the table I dont know what is. Anyone in for an Occupy Albany?