by Alex | Dec 22, 2015 | Health Care Reform, Obamacare, Tax

Breaking: Cadillac Tax Delayed

The Cadillac Tax has been delayed for two years from 2018 to 2020 by President Obama. With this delay, a repeal could be in reach for congressional leaders and business groups who oppose the Cadillac tax. The legislation also suspends the medical device tax until December 31, 2017 and delays the health insurance tax one year.

Whats a Cadillac Tax?

The 40% excise tax applies to the cost of employer health plan coverage exceeding certain threshold amounts, which were originally set for 2018 at $10,200 for individuals or $27,500 for families. These thresholds are indexed and will be higher on the delayed effective date in 2020. The Omnibus also calls for a study on how to determine adjustments to these thresholds to reflect age and gender differences between businesses. While the tax was originally non-tax deductible, the Omnibus changes that treatment and makes the tax deductible. Originally, the Cadillac Tax was pushed back by the behest of Unions to 2018 from the original proposed 2014 date. Most Unions with generous health care packages would not be complaint within that time frame.

Bipartisanship

The bipartisan vote on the Consolidated Appropriations Act was 316 to 113 in the House, and 65 – 33 in the Senate. Many employers, unions, insurers and industry groups have opposed the tax based on concerns around administrative and financial burdens for employers and adverse outcomes for employees.

Medical Device Tax

The tax bill will place a two-year moratorium on the ACA’s 2.3% tax on the sale of medical devices. The tax imposed under this provision will not apply to sales during the period beginning on January 1, 2016, and ending on December 31, 2017. This applies to sales after December 31, 2015.

Health Insurance Industry Tax

The tax bill places a one-year moratorium on the so-called HIT tax (Health Insurance Industry Tax). If passed, the industry tax will not apply for calendar year 2017, which should result in less of an increase to group health insurance premiums for 2017.

So who said Washington bipartisanship was over? There is hope going into the New Years.

Happy 2016!

by Alex | Dec 10, 2015 | NY News, Obamacare, Small Business Group Health

Aftermath of Health Republic Shut Down

The article below summarizes in full the Aftermath of Health Republic Shut Down. The original NYS announcement to shut down Nov 30th was released on Friday October 30th. There are countless anecdotal evidence of our client’s Providers not getting paid for work already done this Fall. Brokers , our Agency included, has NOT been paid since this Summer.

Should My Doctor and Broker be paid? That really ought to be the header for this article. At the same time Health Providers and Brokers honored clients despite the Health Republic’s precarious financial status. The approximate amount owed is $150 Million. If the State truly wants to correct this they have a $1Billion surplus. How can the State obligate Providers and Brokers to meet contractual licensing & professional standards and ignore them now?

As reported in Mahopac NY News 12/9/15 by BRETT FREEMAN

Doctors, Insurance Brokers Could Lose Millions After Health Republic’s Collapse

HUDSON VALLEY, N.Y. – When Health Republic Insurance of New York announced early last month that they were ceasing operations at the end of November, individual subscribers and small groups had to scramble for other options to keep themselves and their employees insured.

Doctors and individual insurance brokers weren’t so lucky.

Often overlooked in news reports is how Health Republic’s demise affected thousands of medical providers and individual insurance brokers, who may never see a dime from all that is owed to them.

Sign Up for E-News

Health Republic was a not-for-profit health insurance co-op (Consumer Operated and Oriented Plan) established under the Affordable Care Act. According to its website, at its height, it had over 215,000 members, making it the largest new health insurance cooperative in the country.

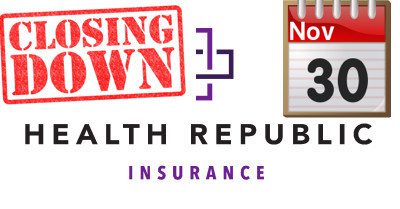

According to articles linked on Health Republic’s website, it borrowed a $265 million low-interest federal loan to begin its operations and was one of 23 co-ops receiving a total of $2.4 billion. According to reports, about half of them have since failed, with many analyses pointing to the low premiums as the cause of their collapse.

Dr. Scott D. Hayworth, president and CEO of the Mount Kisco Medical Group (MKMG), estimates that his practice, which provides medical care to 500,000 patients in the Hudson Valley (including thousands of patients in Mahopac, Somers, Yorktown and North Salem), has lost millions of dollars due to the collapse of Health Republic.

“It’s more than just the doctors’ fees,” said Hayworth, who oversees 450 physicians in dozens of locations throughout the Hudson Valley. Dr. Hayworth said that insurance reimbursements cover vaccines, chemotherapy and other ambulatory and pharmaceutical products that were paid for out of pocket by MKMG.

Despite its losses, MKMG continued to honor its contract with the insurance carrier to ensure any patients covered by Health Republic would continue to receive medical care.

“The thing we all have to remember is there is a patient in the middle of this,” Hayworth said. “Our first obligation is to our patients.”

Other health care providers, including local hospitals, have been in the same boat as MKMG.

Putnam Hospital Center is owed $1.8 million, according to Marcela Rojas, the manager of public and community affairs. Health Quest, which is the parent company of Putnam Hospital Center, is owed $4.4 million in total and doctors throughout its three hospitals are owed $350,000.

“In meetings with state officials, a discussion has focused on how to recoup any of these payments owed to individual patients as well as hospitals, physicians and other providers,” Rojas said in an email interview this past Friday. “There is a discussion on restructuring Health Republic, but the question is, what assets, if any, remain? Recouping any funds may be both a federal and state matter. There is currently no guarantee, emergency or recovery fund in Washington or Albany to cover those losses. Hospitals are meeting with state legislators this week to discuss how best to proceed to recoup at least some of the money owed.”

Officials at Northern Westchester Hospital estimate that they will be owed $2 million due to nonpayment of services provided to Health Republic patients.

“We believe NWH will recover some unknown portion of that amount,” said Joel Seligman, president and CEO of Northern Westchester Hospital. “Under New York State law, NWH must continue to provide services to patients for 60 days where continuity and transitions of care are an issue. Northern Westchester Hospital has a robust financial assistance policy applicable to all patients, including former Health Republic patients.”

All of these healthcare providers are receiving guidance and advocacy from the Healthcare Association of New York State (HANYS), a non-profit statewide association representing hospitals, health systems, nursing homes, home care agencies and other providers across the state.

In an interview, Melissa Mansfield, associate director of public and media relations for HANYS, explained that other states have something called a guarantee fund, which operates as an insurance company for the insurance company.

“New York is one of the few that does not have one yet,” she said, adding that medical providers statewide are owed $160 million, not including what will be owed for care rendered during the month of November.

“HANYS is aggressively advocating on behalf of our members with Cuomo administration officials and CMS (Centers for Medicare & Medicaid Services) to secure payment for money owed by Health Republic,” Mansfield said. “HANYS is exploring all available options for immediate payment and pursuing the establishment of a guarantee fund as a way to protect providers for Health Republic claims and from future insolvencies. Our members are obviously concerned about the impact Health Republic’s shutdown has had on patients and are committed to providing care during this transition. However, HANYS continues to raise very serious concerns about the consequences of such a tremendous financial loss when hospitals are already financially fragile.”

In Putnam County, there were 4,241 Health Republic enrollees, according to HANYS. In Westchester County, there were 20,404 enrollees, making it the third-most impacted county in the state, behind Nassau and Suffolk counties.

In a recent interview, state Sen. Terrence Murphy, who represents Mahopac, Somers, Yorktown and North Salem, among other communities, expressed outrage at the collapse of Health Republic, calling it, “at a minimum, gross mismanagement and negligence. Where the hell was DFS?” Murphy asked, referring to the Department of Financial Services, the state agency that oversees various industries that operate in the state, including all insurance companies. Murphy said DFS should be investigated.

On Sept. 25, DFS directed Health Republic to cease writing new health insurance policies and announced that the co-op would commence an orderly wind down after the expiration of its existing policies. Weeks later, after a review of Health Republic’s finances, finding it in worse financial condition than the company previously reported in its filings, DFS and New York State of Health, which is the official agency administering the Affordable Care Act, ordered Health Republic to end all of its policies on Nov. 30.

A spokesman for DFS did not return a phone call seeking comment, but on its website, officials with DFS said they opened an official investigation last week on Health Republic’s inaccurate financial reporting.

“NYDFS investigators are collecting and reviewing evidence relating to Health Republic’s substantial underreporting to NYDFS of its financial obligations,” according to the statement. “Among other issues, the investigation will examine the causes of the inaccurate representations to NYDFS regarding the company’s financial condition.”

According to DFS, medical providers who contracted with Health Republic had been legally bound to provide healthcare through the expiration of a patient’s plan with Health Republic, regardless of their concerns about reimbursement.

“NYDFS is taking actions that will apply a New York State law that prohibits providers from collecting or attempting to collect from Health Republic consumers amounts that are owed by Health Republic,” a statement on the website said. In addition, according to the DFS website, doctors must honor all new insurance policies of patients who are in an ongoing course of treatment with a provider for a life-threatening or a degenerative and disabling condition or disease, or in the second or third trimester of pregnancy for up to 60 days or through the pregnancy.

All of this is good for the patients, but Murphy expressed worry about how some local doctors might fare with all the lost reimbursements.

“You have practices that might go belly up,” said Murphy, who is a chiropractor in addition to being a legislator. “This is going to be a disaster…You will see some of them go out of business.”

While Dr. Hayworth at MKMG expressed confidence that his medical group would continue to offer top-notch care for its patients, he said that healthcare is a narrow-margin business and lost reimbursements will affect his group’s ability to recruit the best and brightest physicians, who he fears might be lured to other states.

Hayworth, who is married to former Congresswoman Nan Hayworth, declined to comment on the politics of the Affordable Care Act, but he said there definitely needs to be insurance reform. He also called on Albany and Washington, D.C. to provide “legislative relief” to the medical providers impacted by Health Republic’s collapse.

Sen. Murphy, who is chairman of the Administrative Regulations Review Commission, said he respects the legislative process, which calls for other committees to work on the problem, but has shared his concerns with state Sen. Kemp Hannon, chair of the Health Committee, who has started up round table discussions to determine the next steps.

“Anything to make sure this never happens again,” Murphy said.

Assemblyman David Buchwald, who represents North Salem, is also working on the problem.

“I have heard from constituents who are doctors and are concerned that they will not be paid for the services they provided to Health Republic patients,” Buchwald said in statement. “I have worked to raise this issue in Albany while the legislature is not in session. Understandably, the most immediate concern is ensuring that people who had Health Republic insurance are transitioned as smoothly as possible to new insurance. This is important to both patients and doctors, so that at least people are insured and health providers get paid going forward. Next, New York will hopefully see to it that insurance companies have adequate financial resources and address the needs of health professionals who have been left holding the bag. I expect that work to begin as soon as Health Republic customers are transitioned to their new insurance.”

Assemblyman Steve Katz, who represents Mahopac, Somers and Yorktown, did not return a call seeking comment. Nor did Congressman Sean Patrick Maloney, who represents Mahopac, Somers and North Salem in the U.S. House of Representatives, and Congresswoman Nita Lowey, who represents Yorktown.

In addition to the health care providers, local brokers are also out of luck. Mahopac resident Robert Simone, a broker with INS Brokers Inc., said he is owed thousands of dollars from Health Republic for his September and October commissions.

In an attempt to recoup his commissions, he called Health Republic, which told him to call DFS.

“DFS said, ‘We have nothing to do with it. Health Republic is holding your money.” Simone said he is not optimistic.

Nor is Chris Radding, one of the owners of the Forbes Agency in Katonah. Radding said he had 22 employer groups who had been members of Health Republic and he had lost thousands of dollars in commissions when Health Republic folded.

“Anything I’ve seen, there is no mention of the broker,” Radding said. Both Radding and Simone emphasized that their priority was ensuring that their clients had health coverage.

“The whole thing is pretty frustrating and really kind of disgusting,” Radding said.

In a press release issued Monday, the New York State Association of Health Underwriters estimated that insurance brokers in New York State will have lost millions of dollars due to unpaid commissions.

“What’s needed is a solution that avoids the usual outcomes of a failed insurance carrier,” the release said. It listed the usual outcome as reduced payments or no payments to those who provided their professional services even after the carrier ceased reimbursement for those services. It also said the solution should not inflate future insurance premiums or increase New York residents’ tax burden.

“We think that we have such a solution,” the release said. “NYS recently announced the existence of a $1 billion surplus, $680 million of which was generated by penalties levied by DFS. New York State should use some of that surplus to pay everyone what they are owed—doctors, hospitals and insurance brokers—and NYS should also ensure that Health Republic enrollees who have selected a licensed insurance advisor will continue to benefit from their advice by directing succeeding carriers to automatically appoint those brokers when their clients accept an auto-enrollment offer.”