by Alex | Nov 3, 2016 | group health insurance, Millennium Medical Solutions Corp, Small Business Group Health

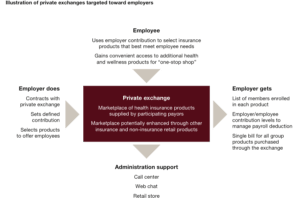

Why a Private Exchange? A Private Exchange Answers These Top 10 Questions.

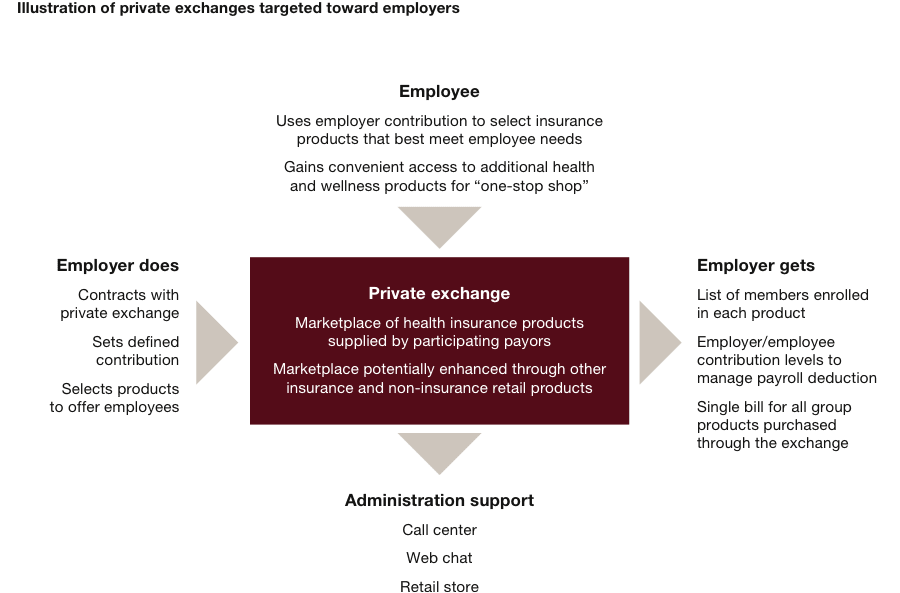

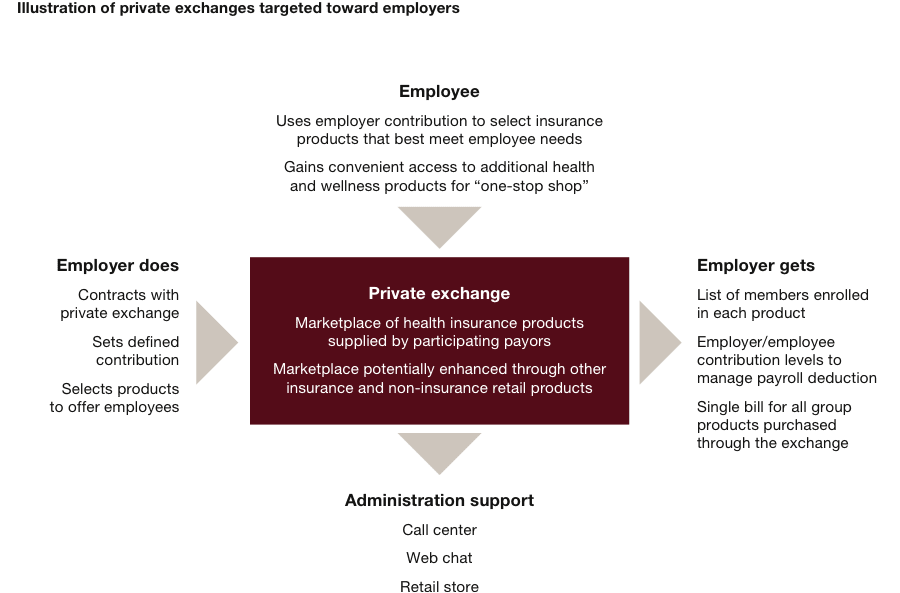

- Defined Contribution: I don’t want to get involved in peoples individual health insurance needs. How does the Employer extricate from this very personal and important employee need and yet still offer this benefit? I like the defined contribution similar to a 401k.

- Tax Advantages: How do I offer the group and employee pre-tax advantages not offered on an individual basis?

- Group Insurance Upgrade: How do I upgrade from the diminishing individual market and meet strict group underwriting? Rates are higher, smaller networks and lower benefits in this segment.

- Full Fortune 500 Benefits: How do I offer balanced voluntary benefits similar to a Fortune 500 company? Some employees are asking for group discounted dental, vision, disability, life insurance and supplemental coverage such as AFLAC but we can’t guarantee the minimum participations.

- Simplify: I don’t have the time needed to make annual plan changes. How do I empower my employees with choice, education and various networks to make their own choices? Many times I’d just rather absorb the 10% increase than deal with the changes.

- Choice: I have employees all over the Metro area. How can you help me offer more than 1 or 2 health plans as benefits have become more complex and networks increasingly narrow geographic sensitive in nature?

- Technologies: Can you give me the technologies needed to make this paperless? Do you have a platform that I can use as an intranet communication portal? Can I securely store documents such Employee handbooks and notification?

- Added Value: Can you offer additional supporting tools aside from technology? Do you have COBRA and section 125 cafeteria documents?

- HR: Do you have an HR Services for Employers Support? Will you have employee support such as a 24/7 independent CS concierge services?

- Personalization: Will I have an in person experienced knowledgeable consultant available for support on plan design, metrics, and customer care and employee open enrollment?

Is a Private Exchange Right For My Group?

If you’re a small business owner who has concerns about payroll, filing paperwork, and complying with government regulations, co-employment may be the service you’ve been looking for. In some cases, a Private Exchange may NOT be right for you. With Health Care Reform your company may qualify for a small business tax credit or a be eligible for a large group discount under a PEO.

Try us on a custom demo, contact us at (855)667-4621 .

Resource:

Private Exchange White Papers

by admin | May 21, 2013 | Health Care Reform, Health Care Refrom, Health Exchanges, Individual Exchanges, Millennium Medical Solutions Corp, PPACA, SHOP Exchanges, Small Business Group Health, Tax

With only 6 month away from full implementation of 2014 Patient Protection Affordability Care Act (PPACA) employers are understandably uncertain. Below are Health Care reform – five things employers can do now to prepare and take action.

UPDATE JULY 2nd: Since blog posting the President Administration has delayed 1 year Employed Shared Responsibility Mandate i.e. Pay or Play to Jan 2015.

1. Employee Communications

Employers must notify employees of the online insurance marketplace known as a Healthcare Exchange. Recently released federal guidelines require employers to notify their workers of eligibility requirements for their state exchange starting Oct. 1, 2013 Open Enrollments for Jan 2014 effective date. To the relief of many, the U.S. Labor Department also provided model notices that employers can give to their workers, which eliminates the need to develop their own notifications.

Additionally, Employers sponsoring a health plan must give employees a Summary of Benefits and Coverage (SBC). The purpose of the Summary of Benefits and Coverage, or SBC, is to present benefits and coverage information in clear language and in a consistent format. Inspired by the Nutrition Facts Label on packaged food, the SBC (pdf) includes two medical scenarios: having a baby and managing Type II diabetes. It estimates how much a patient would pay for medical care in each scenario with specific insurance plans.

Important things to know about the SBC:

- The health insurance companies will create the SBCs.

- It’s the employer’s responsibility to distribute the SBCs to employees.

- This requirement applies to health plan renewals after Sept. 23, 2012.

- Department of Labor will NOT impose penalties for non-compliance with the SBC notice during the first year as long as employers show a “good faith” effort to comply. Read the FAQ on SBC and ACA pdf here.

- Medicalsolutionscorp.com has suggestions to help employers comply with the SBC distribution requirements

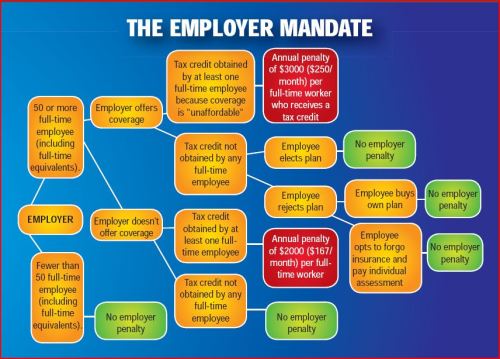

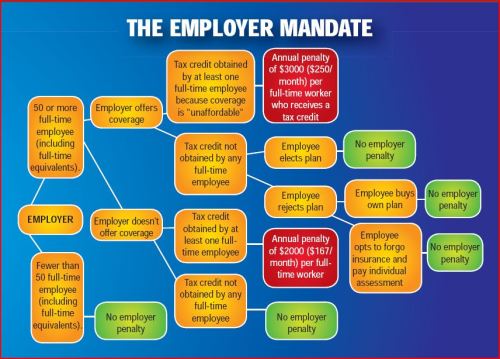

2. Determining which Employers must offer health care.

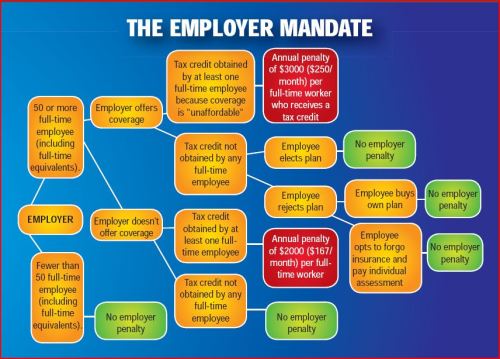

Because employers with 50 full-time equivalents face penalties for not providing affordable, minimum value insurance an employer should know whether it is subject to these requirements or not. Common law employees of the employer and any commonly controlled company must be counted. Employers with temporary or leased employees will want to discuss with their advisors whether these employees will be considered “common law employees” for purposes of determining how many FTEs an employer has. Employers with employees who are paid based on unique payment models (stipends, work product, etc) will want to discuss how to calculate these employee hours with their benefits advisors.

- Employers with 50 or more employees will incur penalties of up to $2,000 per employee if they cancel their existing health care program (which up until 2014 would be considered an optional benefit to provide). They will also incur penalties if their plan is too costly, and they do not meet the affordability standards.

- Employers with less than 50 employees will not incur penalties if they cancel their health care plan, and that decision will need to be made on a business by business basis. They can also choose to offer partial coverage and contribute up to the minimum 50% of single coverage not to exceed 9.5% employee

The good news is Employers can subtract 30 FT employees. This portion is known as the Employer “play or pay” option. Specific case example and details are found at Pay or Play Employer Guide.

3 Health Care Small Business Tax Credit Calculator

To encourage businesses to offer health benefits to their employees, the federal government is offering tax credits to small businesses. These credits are available to an estimated 4 million small businesses, including nonprofits.The IRS has set up a web page with information: Small Business Health Care Tax Credit for Small Employers. The maximum “credit” (which offsets taxes dollar for dollar and is better than a “deduction” which reduces taxable income) is 35 percent of the amount an employer pays towards employee health insurance.

Who’s eligible?

To qualify, small employers must:

- Have fewer than the equivalent of 25 full-time workers

- Pay average annual wages below $50,000

- Cover at least 50% of the cost of health care coverage for their workers

Because of the high wages paid in most industries in NY/NJ/CT Tri State, few small employers that provide coverage pay such a low average wage. Note, however, that the calculation of average wages and number of employees excludes the wages of an owner and his or her family members.

medicalsolutionscorp.com help clients gather the appropriate information and do a preliminary estimate of the credit amount. This information will help you and your accountant determine whether applying for the credit makes financial sense. Find out what the new tax credit could mean for your coverage. Call us at 855-667-4621.

4. Determine affordability

Beginning Jan. 1, 2014, an employer with 50 or more employees must pay a tax penalty if they either: a) Do not provide health insurance with minimum benefits or 60 percent of healthcare expenses; b) Require employees to contribute more than 9.5 percent of an employee’s household income for the health insurance and those employees obtain a government subsidy for coverage.

Companies will be required to pay $3,000 per employee without affordable coverage. (Note: there are a number of caveats that might affect the actual penalty paid, so consult your tax advisor.)

This chart shows employer penalties under the ACA, referred to as “shared responsibility.” Employers wishing to more precisely calculate their potential penalty liability should read the document we prepared, Calculating the Potential ACA Employer Tax Penalty.

5. What does Full Time Equivalent Mean?

It is crucial to Understand the difference between FT and Full Time Equivalent. To determine the FTE (Full Time Equivalent) you must count FT and PT employees. Full Time Employees are those working 30 hours+/week.* The number of full-time employees excludes those full-time seasonal employees who work for less than 120 days during the year.4 The hours worked by part-time employees (i.e., those working less than 30 hours per week) are included in the calculation of a large employer, on a monthly basis, by taking their total number of monthly hours worked divided by 120.

For example, a firm has 35 full-time employees (30+ hours). In addition, the firm has 20 part time employees who all work 24 hours per week (96 hours per month). These part-time employees’ hours would be treated as equivalent to 16 full-time employees, based on the following calculation:

20 employees x 96 hours / 120 = 1920 / 120 = 16

Thus, in this example, the firm would be considered a “large employer,” based on a total full-time equivalent count of 51—that is, 35 full-time employees plus 16 full-time equivalents based on part-time hours.

In the coming months, Millennium Medical Solutions Inc will host seminars and will share information you’ll need to know as the countdown continues to October 1st. Error: Contact form not found.

This blog is not intended to represent legal advise and one should consult with a tax and/or legal expert.

* IRC 4980H(c)(4)

Disclaimer: This blog is not intended to represent legal advise and one should consult with a tax and/or legal expert.

by admin | May 9, 2013 | Millennium Medical Solutions Corp, Wellness

From our wellness partner, the Cleveland Clinic

By Jill Provost

Want to cook up a plan to keep your immune system in tip-top shape? Some experts believe that even slight deficiencies in certain nutrients can lower our defenses. hile an apple a day is a good start, it definitely takes a bigger — and brighter — cornucopia to boost your disease-fighting ability. Here below are natural best foods to boost immunity.

Quick, Don’t Get Sick!

We’ve all been there: We feel a cold coming on, so we start popping megadoses of vitamin C. We’ve been doing it for decades even though there’s little evidence to suggest it will keep us from getting sick. According to the Cochrane Database of Systematic Reviews, which looked at 30 trials involving a total of 11,350 participants,vitamin C had no effect on how often people caught colds. It did slightly reduce the cold’s duration — by 8 percent, or roughly 9.5 hours for a five-day illness — but only if taken before symptoms arose.

However, a Canadian over-the-counter pill (available in the U.S.) called COLD-fX, made from North American ginseng, has shown dramatic results. Healthy people reduced their risk of colds by 56 percent, the severity by 31 percent and duration by 35 percent. And in nursing home seniors, it reduced their risk of the flu by 89 percent. The only downside: You have to take it twice a day for the entire cold and flu season (four months).

Color of Health

A healthy diet full of antioxidant-rich fruits and vegetables is a vital part of a well-functioning immune system. Antioxidants are food-based chemicals, such as vitamins and minerals, that neutralize free radicals in our bloodstream. Free radicals — toxic by-products of digestion, pollution and cigarette smoke — damage DNA, cause many types of cancer and suppress the immune system.

Eating fortified, processed foods, supplemented with a multivitamin, might get you all of the vitamins you need, but, explains Joel Fuhrman, MD, author of Eat for Health and Eat to Live, we’re depriving ourselves of thousands of micronutrients that we haven’t even discovered yet. “It’s very hard to duplicate Mother Nature,” he says. “More than half of the micronutrients in plants are phytochemicals, not vitamins.” Phytochemicals are compounds produced by plants to protect themselves from environmental stresses like UV damage. Research shows that by eating foods rich in phytochemicals, we can boost our health as well. According to Dr. Fuhrman, these chemicals keep our cells from aging, while some even cause cancer cells to self-destruct. A few of the heavy hitters you’ve probably heard of include lycopene (tomatoes), polyphenols (tea) and resveratrol (grapes). Broccoli and other cruciferous vegetables, like cabbage, brussels sprouts and cauliflower, contain some of the most powerful cancer fighters that we know of — actually shrinking tumors in laboratory experiments.

For the best protection, David Katz, MD, MPH, director of the Yale University Prevention Center, and Dr. Fuhrman recommend eating a wide variety of fruits and vegetables that cover the entire color spectrum. “Foods work together to maximize immune function, which then prolongs health and helps prevent chronic disease,” Dr. Fuhrman says.

Good Fat, Bad Fat

To beef up your immune system, try to reduce the amount of red meat and saturated fat that you eat, and replace them with fish and omega-3 fatty acids, recommends Charles Stephensen, PhD, a research scientist with the USDA at the Western Human Nutrition Research Center. “Saturated fats activate the immune system, promote inflammation and are associated with increased cardiovascular risk,” Dr. Stephensen says.

Inflammation occurs when the immune system senses an intruder, so in a sense, these fats make the body think there’s an invader that has to be isolated and wiped out. Chronic inflammation can result in Alzheimer’s, diabetes, heart disease and arthritis.

“Omega-3s, on the other hand, seem to have the opposite effect on the immune system,” Dr. Stephensen says. Eating fatty fish or taking a fish oil supplement (one to two grams a day) reduces levels of inflammation in the body.

D Is for Defense

When we talk about boosting the immune system, what we’re really discussing is making it run optimally, Dr. Stephensen says. Once an infection or virus is gone, the immune system needs to be able to stop its attack. An overactive response can lead to autoimmune diseases, where the body turns on itself, attacking its own tissue as if it were a foreign threat. Some examples are rheumatoid arthritis, type 1 diabetes and lupus. According to Dr. Stephensen, it is now suspected that a vitamin D deficiency may increase our risk of flu and worsen the effects of autoimmune diseases. “Vitamin D can act directly on the immune system. It seems to be able to protect against bacterial infections and regulate our immune response. A deficiency allows an overstimulation of the system,” he explains.

Vitamin D is produced in our body when our skin absorbs the sun’s ultraviolet rays. Because it’s present in very few foods, and sunscreen blocks the sun’s effects, it’s very difficult to get your daily recommended dose. In fact, a recent study published in the Archives of Internal Medicine reports that 75 percent of U.S. teenagers and adults are vitamin D deficient. What’s more, Dr. Stephensen says that the recommended daily allowance, which ranges from 200 to 600 IU, depending on your age, may be too low. Thomas Morledge, MD, of the Center for Integrative Medicine at the Cleveland Clinic,recommends aiming for 1,000 IU daily. Although higher doses may be needed, this should be guided by your doctor. Good sources include fortified milk and fish; a 3.5-ounce serving of salmon contains 360 IU, while a glass of milk has about 100 IU. Ten minutes of sun (sans sunscreen) is also a good source of vitamin D. That said, Dr. Morledge recommends that everyone take a vitamin D supplement since it’s unlikely you will get your required daily allowance through food and limited, unprotected sun exposure.

by admin | Feb 27, 2013 | Health Care Reform, HSA, Millennium Medical Solutions Corp, Small Business Group Health, Tax, Wellness

Is Emblem Leaving?

Is EmblemHealth (GHI formerly) leaving the small business market? Yes and no. The popular traditional EPO is slated to be chopped up for new business May 1 pending State approval. The remaining consumer driven health plans which have deductibles and coinsurance (a %) will stay in tact. With that Broker compensation commissions will be significantly cut as well. The family popular 2-tier rating is also phased out and new groups must submit everything clean within 30 days.

Our quote in todays Crains Health Pulse Crains EmblemHealth pulls small business plans Feb 2013 | Crain’s New York Business reflects our deep concerns on market consolidations. “The unintended consequences of legislative changes has created a de facto single-payer system where Oxford is empowered to dictate to the New York market,” said Alex Miller, founder of Millennium Medical Solutions Corp. in Armonk, N.Y. To be fair Emblem has been steadily streamlining plans with in network only plan offerings and lowest HSA (Health Savings Account) family deductible starting out at $11,600. They are not the first insurer to do this as Empire Blue Cross issued a broader exit back in Nov 2011.

A healthy health insurance marketplace depends on competition as we all agree. From approximately 12 insurers 15 years ago we are today down to 2 active insurers Aetna and Oxford with Oxford claiming approx 2/3 of the small business marketplace. In NYS the MLR (Minimum Loss Ratios) are higher than any other state with additional state taxes. See NYS Surcharge on Health Insurance. The tight State Regulators allowing for razor thin margins while requiring insurers to maintain high reserves makes a burden many insurers are not excited. This resembles more of a utility company environment except ConEd realizes a 10% operating profit and do not have to have insurance reserves to prove solvency. Is there any surprise why there is no rush by outside insurers to compete here?

While on topic of ConEd we all know how customer care was in the aftermath of Hurricane Sandy. When was the last time an independent veteran consultant (not an ESCO) worked with you on your utility bill, servicing, negotiating, educating, and maximizing savings? Sure you can use a different supplier or ESCO but its still the local singular utility company that you are using. In comparison, same is happening in the health insurance field and the consequential exit of Health Insurance Brokers. Sadly, this is precisely the time when their training is most in demand and the most in need will be least likely to afford them.

Error: Contact form not found.