Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start blogging!

Welcome to WordPress. This is your first post. Edit or delete it, then start blogging!

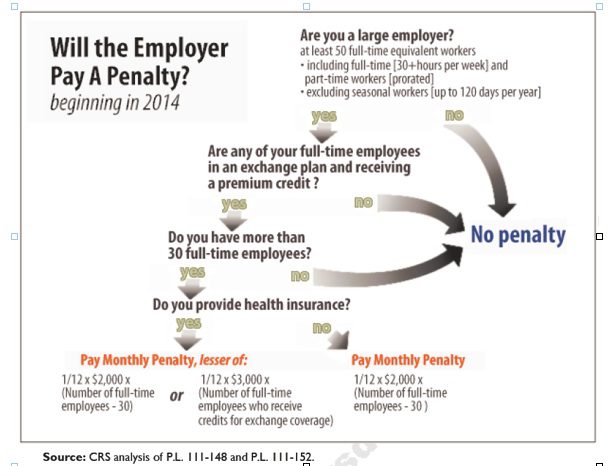

Larger employers that don’t offer minimum essential health coverage to full-time workers may face penalties under health care reform if any full-time employees receive a government premium credit or subsidy to buy their own insurance through an exchange.

The so-called employer mandate and the health insurance exchanges both go into effect in 2014 under the Patient Protection and Affordable Care Act.

The penalties generally apply to all employers with 50 or more full-time equivalent employees. An employer with at least 50 FTEs that provides access to coverage but fails to meet certain requirements, outlined below, may also be subject to a penalty.

To determine the FTE (Full Time Equivalent) you must count FT and PT employees. Full Time Employees are those working 30 hours+/week. See blog post “What does FTE mean?”

Affordability of the employer plan remains a consideration, however, since just one employee qualifying for federal premium assistance for exchange coverage will trigger a penalty for employers with 50 or more employees

Minimum essential coverage generally includes any coverage offered in the small or large group markets. Excepted benefits, such as limited-scope dental or vision offered under a separate policy, certificate or contract of insurance and Medicare supplemental plans, do not qualify.

Penalties explained

Starting in 2014, large employers that don’t offer coverage face a penalty of $2,000 per full-time employee (excluding the first 30) if at least one FTE receives a government subsidy to buy coverage on an exchange. This is sometimes referred to as the “play or pay” penalty.

Employers that offer coverage to employees may still face a “free rider” penalty if the coverage offered is deemed unaffordable or low in value.

If an employer offers coverage, but a full-time employee receives a premium credit subsidy through an exchange, the employer must pay an assessment equal to the lesser of:

The monetary penalties listed above are annual figures and may be pro-rated to the number of months for which the penalty applies.

Who’s eligible for a subsidy?

Employees who are offered coverage from their employer could be eligible for subsidies on the exchange if they don’t qualify for Medicaid or other programs, are not enrolled in their employer’s coverage and meet either of the following conditions:

After 2014, penalty amounts are indexed by a premium adjustment percentage for the calendar year.

The Congressional Budget Office expects the penalties to generate $52 billion toward the overall cost of health reform by 2019. The Department of Health and Human Services estimates that fewer than 2 percent of large American employers will have to pay the assessments.

Disclaimer: This blog is not intended to represent legal advise and one should consult with a tax and/or legal expert.

To determine the FTE (Full Time Equivalent) you must count FT and PT employees. Full Time Employees are those working 30 hours+/week.* The number of full-time employees excludes those full-time seasonal employees who work for less than 120 days during the year.4 The hours worked by part-time employees (i.e., those working less than 30 hours per week) are included in the calculation of a large employer, on a monthly basis, by taking their total number of monthly hours worked divided by 120.

For example, a firm has 35 full-time employees (30+ hours). In addition, the firm has 20 part time employees who all work 24 hours per week (96 hours per month). These part-time employees’ hours would be treated as equivalent to 16 full-time employees, based on the following calculation:

20 employees x 96 hours / 120 = 1920 / 120 = 16

Thus, in this example, the firm would be considered a “large employer,” based on a total full-time equivalent count of 51—that is, 35 full-time employees plus 16 full-time equivalents based on part-time hours.

This blog is not intended to represent legal advise and one should consult with a tax and/or legal expert.

* IRC 4980H(c)(4)

Disclaimer: This blog is not intended to represent legal advise and one should consult with a tax and/or legal expert.

At times a non related health care themes needs posting. This one is an important security measure that ought to be applied by all users whenevr possible. HTTPS connections are often used for payment transactions on the World Wide Web and for sensitive transactions in corporate information systems. Some of you are familiar with this when banking online you will see this prefix automatically This is easy to do and is being offered by many premier sites such as Facebook, Gmail, Twitter etc.

At times a non related health care themes needs posting. This one is an important security measure that ought to be applied by all users whenevr possible. HTTPS connections are often used for payment transactions on the World Wide Web and for sensitive transactions in corporate information systems. Some of you are familiar with this when banking online you will see this prefix automatically This is easy to do and is being offered by many premier sites such as Facebook, Gmail, Twitter etc.

This is an excerpt form a great article in PC World:

When you’re browsing the Web, protect yourself by using HTTPS (Hypertext Transfer Protocol Secure) whenever possible. HTTPS encrypts the connection between your PC and the Website you’re visiting. Though HTTPS doesn’t guarantee that a site is secure, it can help prevent other parties from hacking into the network and gaining access to your account.

Many sites use HTTPS by default: When you purchase an item online or log in to online banking, for instance, your browser will probably connect to the site via HTTPS automatically. But you can go one step further by enabling HTTPS on Facebook, Twitter, and Gmail.

To use Facebook’s HTTPS feature, log in to Facebook and click Account in the upper-right corner. Select Account Settings from the drop-down menu, and look for ‘Account Security’ on the resulting page. Under the Account Security heading, click Change, check the box next to Browse Facebook on a secure connection (https) whenever possible, and click Save.

You can easily enable HTTPS on sites such as Twitter and Facebook and on services such as Gmail to introduce an extra level of security.For Twitter, first log in to your account. If you’re using the new Twitter interface, click your account name in the upper-right part of the screen, and select settings. (If you’re still using the old Twitter interface, click theSettings link in the upper right of the window.) From there, scroll down to the bottom of the resulting page, check the box next to Always use HTTPS, and click Save.

To enable HTTPS on Gmail, log in to your account, click the gear icon in the upper-right corner, and select Mail Settings from the drop-down menu. Next, under the Browser Connection heading, select the button labeled Always use https. When you’re all set, scroll to the bottom of the page and click Save Changes. To learn more about Gmail security, visit Google’s Gmail Security Checklist page.

Please browse responsibly as your sensitive information can comprise your data as well as your contact’s stored on your PC. Kindly pass this on!

This month on April 12th, 2011 marked the five-year anniversary of Massachusetts 2006 State Health Care Reform. The reform was signed into law by then-governor Mitt Romney with the goal of providing affordable health insurance coverage to the estimated 6% of Massachusetts residents that were uninsured at the time.

Massachusetts State Health Care Reform and the Affordable Care Act are virtually identical.Both reforms rely heavily on state-based health insurance exchanges, subsidies for qualifying individuals, and mandates for employers and individuals. As a result, Massachusetts presents the most appropriate example of what to expect from federal health care reform.

So, what have we learned from Massachusetts state reform? The 2006 Massachusetts State Health Care Reform:

Proponents of the law argue that Massachusetts Health Reform:

Opponents of the law argue that Massachusetts Health Reform:

Has Massachusetts health care reform been properly utilized as a test bed for Federal Reform? Will the costs associated with Massachusetts health care reform be sustainable over the long term?

A taxing provision for small businesses was officially repealed last Thursday. The widely unpopular provision would have had

businesses report transactions to IRS of $600 in a year paid to ALL businesses for goods and services. Suddenly businesses would have to report payments to Staples, local restaurants and the like.

The $22 billion cost of the 1099 legislation was offset by requiring some people, if their income level increases during the year, to pay back a portion of the subsidies they receive to join health insurance exchanges created under the law.

Nevertheless, small businesses are in a position to take advantage of new Tax Credit of up to 35% and 25% for non profit see: http://alexmillers.wordpress.com/2011/02/08/tax-credit-boosts-small-business-health-plan-enrollment/. Even IRS Tax Advocate official, Nina Olsen, admits on CBS Sunday Morning News to the”mess” and daunting confusion of the 65,000 page tax codes. There were 579 changes alone in 2010 – “I dont know how businesses keep up”?!

We have been helping businesses and Accounting professionals calculate this credit. Call us to see of how to qualify for the small business tax credit.

Aside from the many health care related questions that are popping up with the new Health Care Reform Act otherwise known as Patient Protection and Affordable Care Act there are also new Labor Law changes that affects businesses of all sizes. For the latest info please visit Healthcare.gov.

A downloadable form and respective gov hyperlinks are available here with a summary of the key labor laws (updated for 2011).

Stay tuned, with changing political make up of the House these laws may undergo changes and tweaks.

More small businesses are providing health insurance to their employees in 2011 as a result of the tax credit of up to 35% and 25% for non-profits offered through PPACA starting in 2010. Several insurers have reported significant increases in small group enrollments. Coventry Health Care added 115,000 small group enrollments, representing an 8% increase; and Blue Cross Blue Shield of Kansas City saw a 58% jump, 38% of which had never offered health benefits to employees before. Click video [vimeo http://vimeo.com/19716548].

Further information can be found at http://www.irs.gov/newsroom/article/0,,id=223666,00.html. In addition, we have a simple work sheet that can determine exactly how much the credit is worth to you. Importantly, the Tax Credit will increase to 50% for small businesses by 2014!

Please contact our office for further guidance on your group’s plan.

Yesterdays ruling on Individual Mandate by Florida Federal Judge on buying a health plan is unconstitutional changes everything. More importantly, Judge Vinison also struck down the entire bill as unconstitutional.

According to Politico, the health reform law lacks a severability clause, a common legal phrase that prevents an entire law from being invalidated in court if one portion of the law is deemed illegal. He added that the law, “like a defectively designed watch, needs to be redesigned and reconstructed by the watchmaker” (New York Times, 1/31). Put in another way, he has compared the individual mandate to requiring an individual to buy broccoli because its good for you.

The Plaintiff, Florida DA, argued:

“The Individual Mandate is unprecedented. It compels citizens to engage in commerce even though they have not themselves chosen to enter the marketplace. Never before has Congress purported to use its power over interstate commerce to compel activity, rather than to regulate existing economic activity.”

If this ruling is upheld on appeal, many of the major provisions of PPACA will need to be redesigned or removed altogether. Further details regarding this ruling can be viewed at CNN.

The IRS issued On December 22, 2010 a Notice http://www.irs.gov/pub/irs-drop/n-11-01.pdf which states compliance with the non-discrimination provisions of the Protection and Affordable Care Act (PPACA) are suspended for insured group health benefit plans….for now.

Under the original health care reform law, non-grandfathered, fully insured health plans would have required companies to meet the non-discrimination rules of IRC 105(h). This provision of the law is effective for plan years beginning on or after September 23, 2010. Therefore, if your company’s health plan renews on January 1, 2011 and it is non-grandfathered, your plan is subject to these rules on January 1, 2011.

The anti-discriminatory provisions were enacted primarily to prohibit highly-compensated employees (such as company owners and senior management) from receiving health benefits that are materially better than the “rank and file” employees. As contemplated in the health care reform measure, failure to comply with the anti-discriminatory rules could result in the payment of penalties to the IRS.

Affected plans must satisfy two tests; eligibility test, and benefits test. The tests determine whether or not the plan disproportionately benefits highly compensated individuals (HCI). Please contact us for further information on these tests.

According to the notice, the decision to delay the effective date was because:

Regulatory guidance is essential to the operation of the statutory provisions, the Treasury Department and the IRS, as well as the Departments of Labor and Health and Human Services (collectively, the Departments), have determined that compliance with § 2716 should not be required (and thus, any sanctions for failure to comply do not apply) until after regulations or other administrative guidance of general applicability has been issued under § 2716.

There has been no indication of the length of the delayed implementation, other than the provision would become effective after further rules were promulgated.

The employer is responsible for monitoring non-discrimination compliance. If the plan is deemed discriminatory, fines could be assessed at $100 per day per individual discriminated against. If reasonable cause exists (the employer can show good faith belief that the plan was not discriminatory), the penalty can be capped at the lesser of 10% of group health plan costs or $500,000.

Importantly, this doesn’t apply to “grandfathered plans“. Employers of non-grandfathered, fully insured plans should review their contribution structures and benefit designs to ensure that plans are not favoring highly compensated employees.

Further information can be found at http://www.irs.gov/irb/2010-41_IRB/ar07.html . Please contact our office for further guidance on your group’s plan.

[vodpod id=Groupvideo.7904996&w=450&h=325&fv=]

Discovered Health Reform Hits Main Street – Kaiser Health … via adamsorensen

Follow my videos on vodpod

The Internal Revenue Service has released the 2011 limits for health savings accounts (HSAs) and for high-deductible health plans (HDHPs), to which HSAs must be linked. The amounts for 2011 are unchanged from 2010.

In Revenue Procedure 2010-22, issued on May 24, 2010, the IRS provides the inflation-adjusted HSA contribution and HDHP minimum deductible and out-of-pocket limits for 2011. Under the cost-of-living adjustment and rounding rules of Internal Revenue Code section 223, the 2011 amounts are unchanged from the amounts for 2010. The 2011 amounts are shown below.

2011 Limits for Health Savings Accounts and High-Deductible Health Plans

HDHP minimum deductible amounts

Individual: $1,200

Family: $2,400

HDHP maximum out-of-pocket amounts

Individual: $5,950

Family: $11,900

HSA statutory contribution amount

Individual: $3,050

Family $6,150

HSA catch-up contributions (age 55 or older)

$1,000

HSA/HDHP Market Growth

HSA holders own the assets in the accounts and can build up substantial sums over time. Enrollment in HSA-compatible insurance plans has increased to 10 million earlier this year, from 1 million in March 2005, according to, America’s Health Insurance Plans (AHIP), a trade group.

HSAs were authorized starting in January 2004. Since then, AHIP has conducted a periodic census of health plans participating in the HSA/HDHP market.

• Between January 2009 and January 2010, the fastest growing market for HSA/HDHP products was large-group coverage, which rose by 33 percent, followed by small-group coverage, which grew by 22 percent.

• 30 percent of individuals covered by an HSA plan were in the small group market, 50 percent were in the large-group market, and the remaining 20 percent were in the individual market.

• States with the highest levels of HSA/HDHP enrollment were California, Ohio, Florida, Texas, Illinois and Minnesota

HSA Advantages:

Opportunity to build savings – Unused money stays in your account from year to year and earns tax-free interest. The HSA also gives you an investment opportunity.

Tax-free contributions and earnings – You don’t pay taxes on contributions or earnings.

Tax Free Money allowed for non traditional Medical coverage– As per IRS Publication 502, unused moneys can be used for dental,vision, lasik eye surgery, acupuncture, yoga, infertility etc. Popular Examples

Portability – The funds belong to you, so you keep the funds if you change jobs or retire.

Our overall experience with HSAs have been positive when employer funding is at minimum 50% using either the HSA or an HRA (Health Reimbursement Account-employer keeps unspent money). Traditional plans trend of higher copays and new in network deductibles has also led to the popularity of an HSA.

For more customized information and how to navigate this please contact us:

Millennium Medical Solutions Corp.

200 Business Park Drive

Armonk, NY 10504

914-207-6161

The teaching hospital of Valhalla and Empire no longer have a contractual agreement effective 11/1. This effects the commercial product and not the Medicare plan – MediBlue.

This comes up on the heels of the rancorous recent dispute between Empire and Stellaris Hospital Systems which was finally resolved after 5 months without a contract. Disputes like these are becoming industry wide- see Hospital Contract Non-Negotiation. Unusually, the dispute between Empire and Westchester Medical Center came as a rather surprise without the typical 11th hour press releases by both parties.

Size matters when it comes to these disputes. Empire is still #1 insurer with close to 5 million members. While the hospital serves the Westchester community and is a vital resource they do not have the scale as the 4 member hospital like Stellaris Hospital Systems which includes Phelps Memorial, Lawrence Hosp, White Plains Hosp, and Northern Westchester Hosp.

More info on Empire Blue Cross’s position can be reviewed here. We are awaiting further the hospitals position to share with clients and partners. For more customized information and how to navigate this please contact us:

Millennium Medical Solutions Corp.

200 Business Park Drive

Armonk, NY 10504

914-207-6161

Interesting article of Pharmacies possibly expanding new role in health care: Pharmacies Embrace Expanding Medical Role.

With access to MDs expected to be reduced as has been felt in Massachusetts, an early adapter of universalized health care, the elevated roles of supporting medical providers such as Nurses, Physician Assistants and Pharmacists will be significant.

I agree with this article and the notion that public policy strategies should include and incorporate the value of pharmacy, and certainly should not jeopardize the viability or accessibility of pharmacies. Pharmacist-provided care can improve outcomes for patients with chronic disease, and reduce costs. In sited studies the failure of patients to take medications as prescribed costs over $150 Billion/year.

Pharmacy can help mitigate these costs, and foster better health. With a community pharmacy, on average, within about two miles of every American home, pharmacies present amazing potential.

In the last posting I very briefly mentioned how industry consolidations are shaping the future landscape of private health insurance. I want to briefly discuss some of regulatory costs results of the Massachusetts Health Care Model.

With the new Health Care Reform – PPACA (Patient Protection Affordability Care Act) there is a greater need to cut costs on administration in order to compete. New guidelines are becoming more and more onerous on insurers.

For example, a member who opts out of purchasing insurance coverage and only intends to buy a plan when sick with minimal penalty and no waiting period is a potential time bomb for insurers! When member drops out of plans when healthy again insurers have no “good years” to count on to save for the “bad years” when one is sick.

The NYS direct non-commercial market is 2 to 3 times as expensive for this very reason. A member can opt in and out any time. We are seeing the same results with the Massachusetts model of which the Reform Act mirrors. In an article by Washington DC’s media centrist , Dailey Caller, “Since the bill became law, the state’s total direct health-care spending has increased by a remarkable 52 percent. Medicaid spending has gone from less than $6 billion a year to more the $9 billion. Many consumers have seen double-digit percentage increases in their premiums.” The article goes on to quote a Boston Globe Report that found that in the first two years of the program, the state’s ER costs actually rose by 17 percent. “They said that ER visits would drop by 75 percent, and it hasn’t been even close to that,” said State Treasurer Tim Cahill, who is currently running for governor as an Independent. “It hasn’t changed people’s habits. It hasn’t been successful at getting people to use less expensive alternatives.”

In Massachusetts, people who get subsidized insurance from an exchange are in health plans that pay providers Medicaid rates plus 10 percent. That’s less than what Medicare pays, and a lot less than the rates paid by private plans. Since the state did nothing to expand the number of doctors as it cut its uninsured rate in half, people in plans with low reimbursement rates are being pushed to the rear of the waiting lines.

National factors:

We already see a small number of Physicians leaving private and public networks. Several more are contemplating reduced hours and early retirement. Not sure how this will affect Medical Students but the prospects of reduced reimbursement, higher workload, mounting malpractice insurance costs and a hefty tuition bill cannot be positive. Will further empowering Physician Assistants and Nurse Practitioners to fill in the gaps be the solution for this shortage?

Small businesses in that state have sought State relief form double digit rate increases. State programs that businesses previously didn’t qualify for have been tested and accepted. For example, the Commonwealth Care stipulated that only groups who’s members were uninsured for more than 6 months and employers contributions were less than 33% could qualify. But groups who voluntarily terminated their plans were also now being accepted.

Sounds great, public programs are cheaper and easy to qualify? The Catch 22 for the State is that the more the employer insurance system degrades, the higher the cost is going to be for the state in providing subsidies to low income workers. The affordability of health insurance coverage to small businesses is a critically important component of health reform. With lower profit margins, small businesses have a much more difficult time affording insurance coverage than their larger competitors. As a result, only 59% of businesses with between 2 and 199 employees offered coverage to their employees. Among the smallest employers, those with between 3 and 9 employees, only 45% offered coverage according to Kaiser Family Foundation.

Insurance is simply a tool to finance the underlying cost of health care, so unless spending is brought under control, all state and federal reforms will shift the financial burden from one group to another, but not solve the underlying problem. The challenge moving forward will be to overhaul the delivery system to promote prevention, quality, and results-based care, to encourage healthy lifestyles, and to eliminate waste and fraud in the system.

A healthy stable small business insurance market is a canary in the mines. From what we’re seeing in Massachusetts the canary is not doing too well.

Read more: http://dailycaller.com/2010/03/23/skyrocketing-massachusetts-health-costs-could-foreshadow-high-price-of-obamacare/#ixzz0yCe9vijY

So how does your Health Insurance Company rank? Click here to find out.

“Each year, NYSID and DOH receive complaints about health insurers from consumers and health care providers. After reviewing each complaint, the State determines if the health insurer acted appropriately. If the State determines that the insurer did not act in accordance with their statutory and contractual obligations, the health insurer must resolve the problem”

According to the report, a better rank means that the health insurer had fewer upheld complaints, relative to its size. If the ratios are the same, the health insurer with the largest premium is ranked higher.

As usual the leading insurers with the most market share rank in the middle. The #1 insurer based on membership, Empire Blue Cross, received # 6 ranking. Highly regarded Aetna got # 8. Using this as a gauge, highest ranked insurers such as MVP, Independent Health and Community Blue (Healthnow) ought to be the way to go. As an example, local Mid Hudson Valley privately owned MVP had 117 complaints with just 7 upheld or 6%.

The numbers would suggest that the smaller size of an insurer the better they are at customer service and reducing complaints. This is unfortunately contrary to what we are seeing in the industry. Health Net has existed the northeast recently, GHI and HIP merged to form Emblem, Oxford was taken over by United Health Care and Empire is owned by Anthem and no longer a non profit. We are seeing recent examples of this turned outside the region as well. Moody’s, New York, points to recent notifications that Blue Cross Blue Shield of Delaware, Wilmington, Del., signed an affiliation agreement with Highmark Inc., Pittsburgh, and that HealthSpring, Nashville, Tenn., agreed to acquire Bravo Health, Baltimore.

So how does an MVP afford to invest in technology and new products? Regulators may frown on the big boys from swallowing them up but its a good guess that new affiliations with similarly sized small companies will be shaping the future landscape of private Health Care.

[vodpod id=Video.4196761&w=425&h=350&fv=%26rel%3D0%26border%3D0%26]

“A promise to keep your health plan? …..Plans that existed on March 23 can make routine changes while remaining exempt form some of the new provisions. Americans who like their plan are extended security.” Really?

While there are a few small advantages the main advantage is for businesses with class-out situations where they have a Management vs. Non-Management plans. Industries commonly likely to get affected are medical offices, construction and restaurants. By using this clause they are afforded reprieve form non-discrimination. This affects groups renewing post Sept 23, 2010.

But how likely is allowing the Grandfathering Clause a benefit in real life situations. As per the attached June video press conference , if an insurance company decides to increase their costs sharing significantly they automatically lose this status. As an example, if an Oxford raises the deductible from $1000 to $1200 or by “15% + medical inflation rate”. Think this is unusual? Just check your benefits form 3 years ago and see if a $10 copay is still available.

How about if a Healthnet decides to exit the Northeast market and sells to United Healthcare? Yes folks you’re out of luck.

How about if a Healthnet decides to exit the Northeast market and sells to United Healthcare? Yes folks you’re out of luck.

So what are the odds that small group will have this imposed on them? According to Gov Estimates the projections are 58%-80% in 2011 and dropping to 20%-51% in 2014 still remaining grandfathered. When calculating small employees the number is less than 100 employees. I suspect for groups under 50 employees the numbers are further skewed.

Which is why in summation this is a red herring issue and wont pose as a viable advantage for most groups. An excerpt below form our Crains interview earlier this summer discusses the Grandfathering Clause further.

“The prohibition on changing carriers, in particular, takes an important cost-control tool away from small businesses, which already lack the flexibility and leverage of larger companies. Many change carriers every couple of years in search of better rates or new offerings as insurers offer deals to drum up new business. Westchester broker Alex Miller says that for most of his small business clients, trying to keep their grandfathered status is probably not worth it, especially if rates continue to climb 15% to 20% a year as they have in New York. With limits on cost-sharing, employers could get further behind every year.

“I think a small handful of my clients will stay put because they have a unique health care plan, such as an indemnity plan that is no longer sold,” says Mr. Miller, president of Millennium Medical Solutions Corp. in Armonk. “But for the great majority of my clients, how are they going to take a 20% [premium] increase and not make any changes?””

The showdown is over and 45,000 Westchester Empire Blue Cross residents can now breathe a sigh of relief. The majority of the Westchester hospitals belong to this network – Lawrence Hospital Center,Northern Westchester Hospital, Phelps Memorial Hospital Center and White Plains Hospital Center.

While these hospitals were covered on emergencies and the physicians were unaffected it still posed an inconvenience. physicians were rerouting patients to participating hospitals such as Westchester Medical Center in Valhalla.

As I posted in prior blogs these tight negotiations will be the new norm as regional hospital systems have logically evolved to gain leverage in the market. Unlike in past negotiations this one has been a thriller as contracts have not been renewed since April 1. The PR campaign was heavy on both sides with political pressures coming down form the State, board of directors and passionate letter writing campaigns.

Ironically we are seeing the opposite trend from insurers who are building smaller networks focused on smaller regional hospitals and medical centers. The article in NYT, Insurers Push Plans That Limit Choice of Doctor, discusses how this model may possibly work in the new Obama Care. Many may be willing to make network concessions with savings of 15%. We are seeing this trend already with offshoots from insurers such as a 5 Boroughs plan – Aetna NYC HMO, Atlantis and Emblem CompreHealth HMO. We expect Empire and Oxford to come out with something similar. Our clients will be closely monitoring these networks.

So in an odd twist a Stellaria Hospital system may be the only hospital a Westchester resident can go to with a possible NYC hospital systems alliance such as Columbia Presbyterian Hospital/New York Cornell.

Either way Empire residents here will be sleeping soundly knowing that they are not limited, for now.

Yes its finally out there, the big issue came out this week! Sure some of you are thinking Time’s Person of the Year or Sports Illustrated Swim Suit issue(that’s in February) but those in the medical field know what I’m talking about. Ahhhh the long awaited annual 2010 NY Magazine’s Best Doctors issue is out. Is it HS all over again or is it for real?

Yes its finally out there, the big issue came out this week! Sure some of you are thinking Time’s Person of the Year or Sports Illustrated Swim Suit issue(that’s in February) but those in the medical field know what I’m talking about. Ahhhh the long awaited annual 2010 NY Magazine’s Best Doctors issue is out. Is it HS all over again or is it for real?

The annual list collects opinions of local doctors and asks whom they would refer a family member to. After this you get voila a ready to go Zagat-style guide of Best Doctors. Simple right?

Just like any profession there are politics and old boy cronyism with powerful medical departments overly represented while small offices are forgotten.

Nevertheless whats a New Yorker to do in a fast harried life style? This can be used as a general guide but much like a friendship the doctor-patient relationship happens organically. Well where there’s demand there’s supply. Insurers are indeed working on giving access to members with what else The Zagat Health Survey. Empire Blue Cross offers this to their members. Don’t simply sneer at this. Research has shown that patients who have a good relationship with their doctor are more likely to ask questions and follow the doctor’s advice – which can lead to better health.

So with both auspicious fine tools and a little leg work one is now empowered to get the best doctors. Now if we can only afford the copays and get an appointment.

According to a 2010 Athena Health Survey Humana is named as the Top Payor by Physicians.

According to a 2010 Athena Health Survey Humana is named as the Top Payor by Physicians.

For the second year in a row and third time in five years, Humana Inc. ranks #1 in overall performance — making it the easiest payer for health care providers to do business with — in a review of 2009 claims-payment data conducted by athenahealth Inc., a provider of Internet-based business services to doctors, and Physician’s Practice magazine.

Humana offers solutions such as real-time adjudication, which enables health-plan members to have a claim processed instantly before leaving the doctor’s office . A weighted measure is the metrics used are Days in Accounts Receivable.

Its too bad Humana is inactive in the northeast. With Health Care Reform changes, progressive states such as NY will less likely be hazardous and more welcoming to an outside insurer as most state laws are being mimicked by the Federal Government. Aetna was ranked second.

http://www.athenahealth.com/our-services/PayerView.php?intcmp=PAYERVIEW

Just a heads up on a topic that will be all too familiar going forward. We see this as a trend and not the exception. As hospital systems have consolidated in reaction to negative market condition and increasing costs of doing business. But size is better when it comes to negotiating with insurers. We are seeing profitable hospitals asking for 15% rate increase form prior years. They can do this because insurer network marketability is on the quality and size of network.

Just a heads up on a topic that will be all too familiar going forward. We see this as a trend and not the exception. As hospital systems have consolidated in reaction to negative market condition and increasing costs of doing business. But size is better when it comes to negotiating with insurers. We are seeing profitable hospitals asking for 15% rate increase form prior years. They can do this because insurer network marketability is on the quality and size of network.

Current News:

Aetna: Effective 4/5/2010, Beth Israel Medical Center – Petrie Division, Beth Israel Medical Center – Kings Highway Division; Long Island College Hospital; New York Eye & Ear Infirmary; and St. Luke’s Roosevelt Hospital Center – Roosevelt Division, and St. Luke’s Roosevelt Hospital Center – St. Luke’s Division (the “Continuum Hospitals”) were terminated from the Metro NY Aetna network. The hospitals will remain participating and will be accepting In Network Rates until the end of the cooling off period on 6/5/2010.

Continuum had almost lost United/Oxford Health Net in march and Empire or Wellpoint last Spring.

Empire Effective 4/1/10 has lost Stellaris Health Network in Westchester. Those hospitals include Phelps Memorial, Lawrence Hosp, White Plains Hosp, and Northern Westchester Hosp. They were asking for double digit increases for each year of a mutli-year contract, which would have had to be passed on to our members in the form of higher premiums. Our Empire clients will be covered in those facilities for emergencies, as well as services that have already been pre-authorized and approved.

A released Empire Fact Sheet of the contract termination is available

While this happened somewhat in prior years things usually were worked out at 11th hour after a cooling of period. Whats troubling now is that there is little common ground to stand on. We believe in the short term they will get reworked as both Mammoth Corp need each other but this will be a serious concern worth watching.

“…This bill explodes the deficit, it explodes the debt…” Paul Ryan

Paul Ryan on taxing future generations for today’s health care, unfunded mandates and the travesty that is the socialist-style Obama health care reform bill.

Recorded 3-21-2010

[vodpod id=Video.2797081&w=425&h=350&fv=%26rel%3D0%26border%3D0%26]

The President earlier today has signed The Health Care and Education Affordability Reconciliation Act of  2010, a historic health care reform that’s been 14 months in the making. This is after Sunday’s Congressional passage by the slim margins of 219-212.

2010, a historic health care reform that’s been 14 months in the making. This is after Sunday’s Congressional passage by the slim margins of 219-212.

The Bill for the most part follows the President’s version of the Reform Health Bill which tweaked measures such as elimination of Nebraska’s politically wrangled special Medicaid deal, delays on Cadillac Tax enactment and the establishment of a new Health Insurance Rate Authority to give guidance and oversight to states and monitor insurance market behavior. “If a rate increase is unreasonable and unjustified, health insurers must lower premiums, provide rebates, or take other actions to make premiums affordable.” The 21% Medicare cuts to providers were rescinded.

The $940 billion over 10 year bill wont see most significant provisions until 2014.

Here’s a quick rundown of some of the expected changes.

Changes This Year:

Long Term Changes:

Individual Mandate:

Employer Requirements:

There is no employer mandate but employers with more than 50 employees will be assessed a fee of $2000 per full-time employee (excluding the first 30 employees from the assessment)

Small Business Tax Credit

American Health Benefit Exchanges

A more comprehensive chart is available through NAHU (National Association of health Underwriters).

Several states have already challenged this law as an over extension of Federal powers. Additionally, the requirement of mandating an individual to buy insurance is not so clear.

Many additional questions will arise such as:

-How will plans with Federal minimum standards reconcile with progressive states like NY that have numerous state mandates already?

-Afterall, a Healthy NY plan can operate commercially without mandates that an ordinary group plan must comply with?

-What happens to community rated states like NY?

-Will they drop this rating methodology altogether?

-Since there will be no longer pre-existing conditions is it just cheaper for an individual to just withdraw pay the penalty and then hop in when in need of coverage?

Lastly and importantly, the bending of the cost curve is weak. There is language, however, on attacking fraud & billing abuses as well successful Pharmaceutical concession for Medicare Part D. But Rome was not built in a day and this lays the foundation for a path of extending coverage to as many people as possible. Heavy topics such as Tort Reform, exorbitant malpractice insurance, federal medical reimbursements cuts must wait for another day.

President Obama Tuesday night signed into law legislation that provides a stopgap, 31-day extension of federal subsidies of COBRA health care premiums.

President Obama Tuesday night signed into law legislation that provides a stopgap, 31-day extension of federal subsidies of COBRA health care premiums.

The Senate approved this on a 78-19 vote, while the House cleared it last week.

Under H.R. 4691, the 65%, 15-month premium subsidy for laid-off workers is extended to those involuntarily terminated from March 1 through March 31.

Without the extension, employees laid off after Feb. 28 would have been ineligible for the subsidy.

With unemployment at a 25-year high, more than 14 million are eligible for subsidized COBRA, according to Hewitt.

According to USA Today, unemployed workers who signed up in March lost their subsidy on Dec. 1, and thousands more were facing the end of subsidized premiums within the next few weeks.

Additionaly, the measure will allow employees to receive the subsidy if they first lost group coverage due to a reduction in hours and then were terminated after enactment of the legislation, if certain conditions are met.

The latest extension is just a 31-day stop gap measure. The Senate is currently considering HR 4213, the “American Workers, State, and Business Relief Act,” that would include extending the premium subsidy to employees laid off through December 31, 2010.

The President yesterday released with great anticipation his own version of the Reform Health Bill. This is the opening bid before Thursday’s Bipartisan Summit.

The President yesterday released with great anticipation his own version of the Reform Health Bill. This is the opening bid before Thursday’s Bipartisan Summit.

The proposed Bill for the most part is similar to the Senate Bill passed in December with a few minor changes anticipated to cost almost $1 trillion over 10 years. The comprehensive bill adds cost saving measures and more affordability for lower income Americans.

As expected and in step with both Houses the proposal eliminates pre-existing condition but raises the penalty for individuals not paying into a mandatory health plan to 2.5% of adjusted gross income by 2016. Included, also, is an increase in the tax credits for health insurance premiums a sort of carrot and the stick model.

Spurred by recent rate increases by insurers such as Anthem’s 39% planned rate hike in California there is a provision to establish a new Health Insurance Rate Authority to give guidance and oversight to states and monitor insurance market behavior. “If a rate increase is unreasonable and unjustified, health insurers must lower premiums, provide rebates, or take other actions to make premiums affordable.”

Also included is elimination of Nebraska’s politically wrangled special deal to help pay for a proposed Medicaid expansion, and would instead provide more help for all states to pay for their new Medicaid enrollees. It would delay enactment of a the Cadillac tax (40% tax in excess of $10,200/$27,500 for single/ families) on high-cost employer-sponsored insurance plans with no special exceptions to Union groups.

There is elimination of the Medicare Rx “doughnut hole” for Part D. There will be a 25% coinsurance fee instead for seniors in this gap. Currently, the gap starts after the first covered $2830 and continues on the next $4550 with only a 5% member responsibility thereafter.

Our small employer groups will be relieved to know that groups under 50 employees are exempt form the mandate. Under the Senate plan, employers with more than 50 employees that do not offer coverage would pay a $750 assessment for each full-time employee. The White House proposal would bump up that assessment to $2,000 for each full-time employee. However, in determining the assessment, an employer’s first 30 employees would be excluded from the calculation. Taking the case of an employer with 100 employees that did not offer coverage, for example, its assessment would be 70 times $2,000.

The proposal also is believed to retain a provision in the House and Senate bills that would impose a $2,500 annual cap, starting in 2011, on the maximum annual contributions that could be made to health care flexible spending accounts such as HRA and FSA.

Our position is that Health Care Reform done responsibly is important and inevitable for the sustainability of our country. While the current leaves millions uninsured it just as importantly leaves many who are already insured struggling to pay and possibly drop out going forward. Addressing the cost factors for those already insured is being understated.

Stay tuned till the end of the week for the Bipartisan Summit. We expect to see proposals on creating tax credits for employers who already offer benefits. Also allowing insurers to easily cross state lines and increase competition by creating a basic Federal health package. This will allow strong reputable companies like Humana to enter the NY/NJ/CT market and side step the choke full of mandates. NY already includes almost 20% of overall costs going to these add-ons.

http://www.crainsnewyork.com/article/20100126/FREE/100129916#

“Facing crushing cash flow crunch it seeks deal that could keep system from returning to bankruptcy court; Continuum Health Partners says it has entered discussions.”

Hospitals are obligated to accept all patients regardless if insured and yet face the free market alone. Is it any wonder Lenox Hill is the lone independent hospital left….for now.

The people have spoken it seems as Democrats lost a key Senate seat occupied for nearly 50 years to Republican Scott Brown. The irony of course is that Massachusetts is a progressive state taking the lead in health care reform. The state has had mix success with reform. According to a Money.com article http://money.cnn.com/2009/01/26/smallbusiness/massachusettes_healthcare_mandate.fsb/index.htm the the real danger of reform is that regulators keep adding mandates and reforms that adds to the costs.

Small businesses are struggling in this uncertain economy and are fearful of regulators. NYS has already added a sales tax in Summer of 2009 and almost passed a second surcharge in the Fall. The real concerns are costs and the Health Care Reform Bill barely touches 1.5%/year savings over 10 years, http://www.reuters.com/article/idUSTRE54A01P20090511.

Flaws in the Reform Bill are that people can choose to go uninsured and come back on when they’re sick without a pre-existing condition waiting period. This adds to the cost as someone could defray costs by not paying into the system and just buy back into it as needed. Imagine if we can do that with Auto Insurance? With so many progressive state programs for low income the people most commonly winging it are high middle income and younger people.

Secondly, the sole prop and individual markets in state such as NY are unaffordable. This is the soft underbelly of the system that we also see as going uninsured especially with so many out of work employees who are working as 1099 consultants. Extending COBRA to 36 months from 18 months staves this problem somewhat. Perhaps extending COBRA even further may work as well even with a small added premium to extend form 36 month 60 month would still be a saving. For example, a single NY non group HMO is $1000/month vs. $400/month for a group plan.

Finally and most importantly is Malpractice and Tort Reform. You cannot discuss Health Care Reform without attacking this issue and The Reform Bill falls short of doing this. The actual cost of Malpractice is less than we realize. Malpractice costs account for only 1% of spending but this leads to another estimated 9% is for “defensive medicine”. According to JAMA– “Defensive spending is described such as ordering tests, performing diagnostic procedures, and referring patients for consultation, was very common (92%). Among practitioners of defensive medicine who detailed their most recent defensive act, 43% reported using imaging technology in clinically unnecessary circumstances. Avoidance of procedures and patients that were perceived to elevate the probability of litigation was also widespread. Forty-two percent of respondents reported that they had taken steps to restrict their practice in the previous 3 years, including eliminating procedures prone to complications, such as trauma surgery, and avoiding patients who had complex medical problems or were perceived as litigious. Defensive practice correlated strongly with respondents’ lack of confidence in their liability insurance and perceived burden of insurance premiums.”

WIll this shape up to be a repeat of 1994 and dismissed as another failed attempt by Democrats? Perhaps not, so long as premiums are rising 10-20% a change must take place. The President’s singular focus on this issue has moved government to act this far is an a testament to his will. No other president in 50 years has wanted to touch this controversial topic with a ten foot pole Trying to accomplish this in his first term is hubris and a bit naive but at least we have something on the table. A true bipartisan bill may be the most lasting in the long run.

As we enter 2010 we want to include some timely information on year end health reform and its possible impacts.

Right before Christmas, The Senate has passed 60-39 its version of a health care reform bill that, if enacted, will impact your business benefits plan more than any federal law in the past half century. The Senate’s bill must still be merged with legislation passed by the House before President Obama could sign a final bill in the new year.

Most measures are expected to take place in 2014. As for the impact on small businesses, The Senate would exempt companies with fewer than 50 workers from having to offer insurance. The House excuses companies with annual payrolls of less than $500,000; firms that are bigger would pay a fee equivalent to a portion of their payroll costs if they don’t offer insurance. That payment would rise to 8 percent of payroll for the largest firms.

Brief Comparison of Senate and House Health Reform Bills

The 10-year, $871 billion health reform bill is designed to extend insurance coverage to 31 million uninsured Americans.

Barring any major changes, the final health care reform bill is expected to:

Most of these changes will likely be phased in beginning of 2013 and continue up until 2016, although changes to health care Flexible Spending Accounts could occur in 2011. The legislation would place an annual limit of $2,500 on the amount of funds employees can contribute to FSAs.

For more on specifics and timing of the pending legislation, please see Health Care Reform Frequently Asked Questions for employers by clicking here.

It’s important to remember that any dramatic changes would not be immediate. However, there are some things employers can do right now in preparation for the passage of a bill. The most important of these are to stay informed, follow developments and involve your benefits staff and partners.

Employers may also want to begin evaluating their employee demographics and assessing their current health plan design.

Health care reform is estimated to cost between $890 billion and $1 trillion over 10 years. It would be paid for by a combination of savings to Medicare and Medicaid, along with new sources of revenue from tax changes.

Once a bill is signed into law, we will help our clients with the practical implications of the legislation and its potential impact to organizations.

Our agency has strived to be ahead of the curve and keep our clients within budget regardless. We realize your organization – now more than ever – needs up-to-date information, industry-leading expertise and the assurance a reliable benefits partner can bring to your business. We thank you all for reading our material, referring us business and most of all believing in us!

Once again thank you and we wish you and your family a wonderful Holiday Season!

Highlights of the new dependent coverage legislation

The legislation has two dependent coverage features, the “make available option” and the “young adult option” (also called “NY DU30 option”). Under the make available option, Insurers offer customers the option to provide dependent coverage to age 30. This option is similar to adding a rider to a benefits plan.

Under the NY DU30 option, dependents who reach the maximum age can elect extended coverage to age 30.

For either option, a dependent must meet these requirements:

For an FAQ and more information click here