by Alex | Jun 14, 2017 | NY News, Small Business Group Health

HealthPass Adds Oscar

HealthPass New York will start offering OSCAR Health Plans effective Sept 1, 2017 to small employers. Oscar will offer eight plans with varying benefits package with 1 to 100 employees. The plans are available to small businesses located in New York City, Long Island, Westchester and Rockland counties. NJ residents can also access Hospitals & physicians through the NJ Qualcare PPO Network

HealthPass New York, a private insurance exchange for small employers. The addition of Oscar gives small businesses access to 3 health networks – Oxford, CareConnect and Oscar. Also, Guardian is the insurer of record for the ancillary benefits comprising dental, vision, life insurance, disability and accident insurance

Oscar entered the NY market on Jan 1, 2014 and had around 16,000 members. In 2015, it expanded coverage to New Jersey and grew to about 40,000 members. In 2016, Oscar had 145,000 members in New York, New Jersey, California, and Texas. Oscar’s cutting edge technology and pioneering benefits have simplified the consumer health insurance experience propelled easier access and understanding of health plans. Examples of success have been ease of physician locator, online appointment setting and no cost telemedicine 24/7. Additionally, some plans have $0 Copay generics and annual 3 free office visits

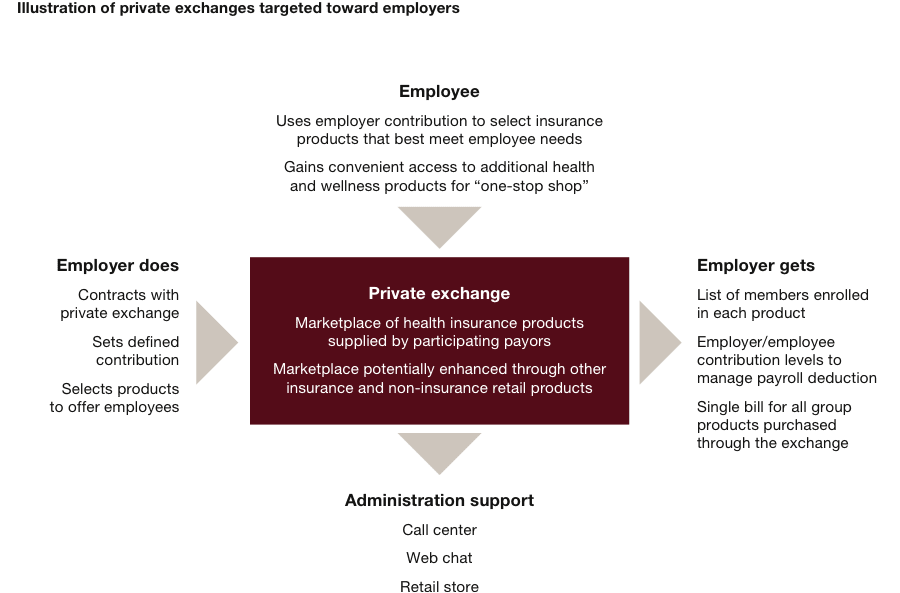

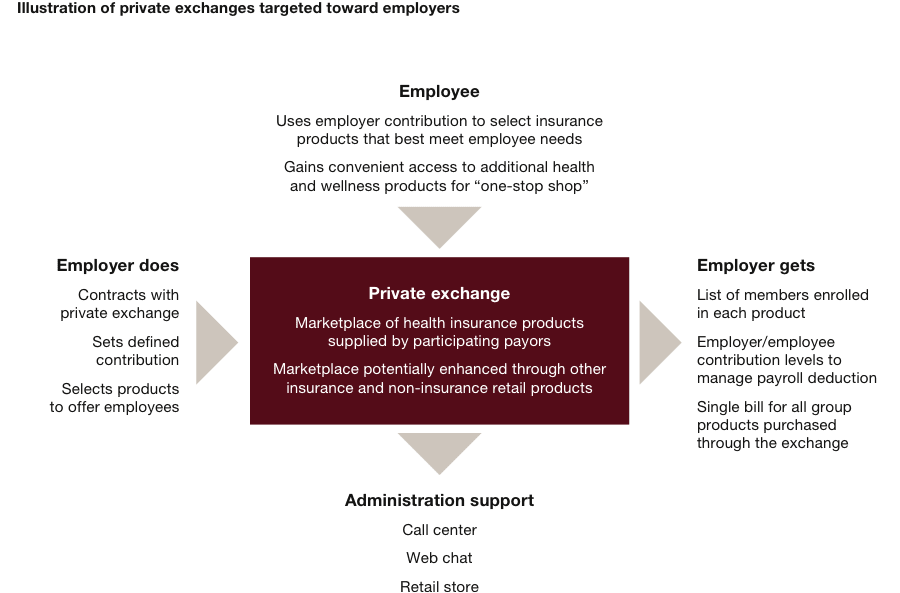

Why a Private Exchange? The advantage of a Private Exchange is the ability to empower employees with choice. Much like a 401K your employees can use a defined contribution allocation for benefits. As affordable health plan networks are increasingly smaller with specific coverage areas the one size show for all approach to benefits no longer works.

Is a Private Exchange Right For My Group?

If you’re a small business owner who has concerns about payroll, filing paperwork, and complying with government regulations, co-employment may be the service you’ve been looking for. In some cases, a Private Exchange may NOT be right for you. With Health Care Reform your company may qualify for a small business tax credit or a be eligible for a large group discount under a PEO.

Try us on a custom demo, contact us at (855)667-4621.

by Alex | Nov 3, 2016 | group health insurance, Millennium Medical Solutions Corp, Small Business Group Health

Why a Private Exchange? A Private Exchange Answers These Top 10 Questions.

- Defined Contribution: I don’t want to get involved in peoples individual health insurance needs. How does the Employer extricate from this very personal and important employee need and yet still offer this benefit? I like the defined contribution similar to a 401k.

- Tax Advantages: How do I offer the group and employee pre-tax advantages not offered on an individual basis?

- Group Insurance Upgrade: How do I upgrade from the diminishing individual market and meet strict group underwriting? Rates are higher, smaller networks and lower benefits in this segment.

- Full Fortune 500 Benefits: How do I offer balanced voluntary benefits similar to a Fortune 500 company? Some employees are asking for group discounted dental, vision, disability, life insurance and supplemental coverage such as AFLAC but we can’t guarantee the minimum participations.

- Simplify: I don’t have the time needed to make annual plan changes. How do I empower my employees with choice, education and various networks to make their own choices? Many times I’d just rather absorb the 10% increase than deal with the changes.

- Choice: I have employees all over the Metro area. How can you help me offer more than 1 or 2 health plans as benefits have become more complex and networks increasingly narrow geographic sensitive in nature?

- Technologies: Can you give me the technologies needed to make this paperless? Do you have a platform that I can use as an intranet communication portal? Can I securely store documents such Employee handbooks and notification?

- Added Value: Can you offer additional supporting tools aside from technology? Do you have COBRA and section 125 cafeteria documents?

- HR: Do you have an HR Services for Employers Support? Will you have employee support such as a 24/7 independent CS concierge services?

- Personalization: Will I have an in person experienced knowledgeable consultant available for support on plan design, metrics, and customer care and employee open enrollment?

Is a Private Exchange Right For My Group?

If you’re a small business owner who has concerns about payroll, filing paperwork, and complying with government regulations, co-employment may be the service you’ve been looking for. In some cases, a Private Exchange may NOT be right for you. With Health Care Reform your company may qualify for a small business tax credit or a be eligible for a large group discount under a PEO.

Try us on a custom demo, contact us at (855)667-4621 .

Resource:

Private Exchange White Papers

by Alex | Aug 8, 2016 | group health insurance, Health Exchanges, Individual Exchanges, individual health insurance, NY News, United Healthcare

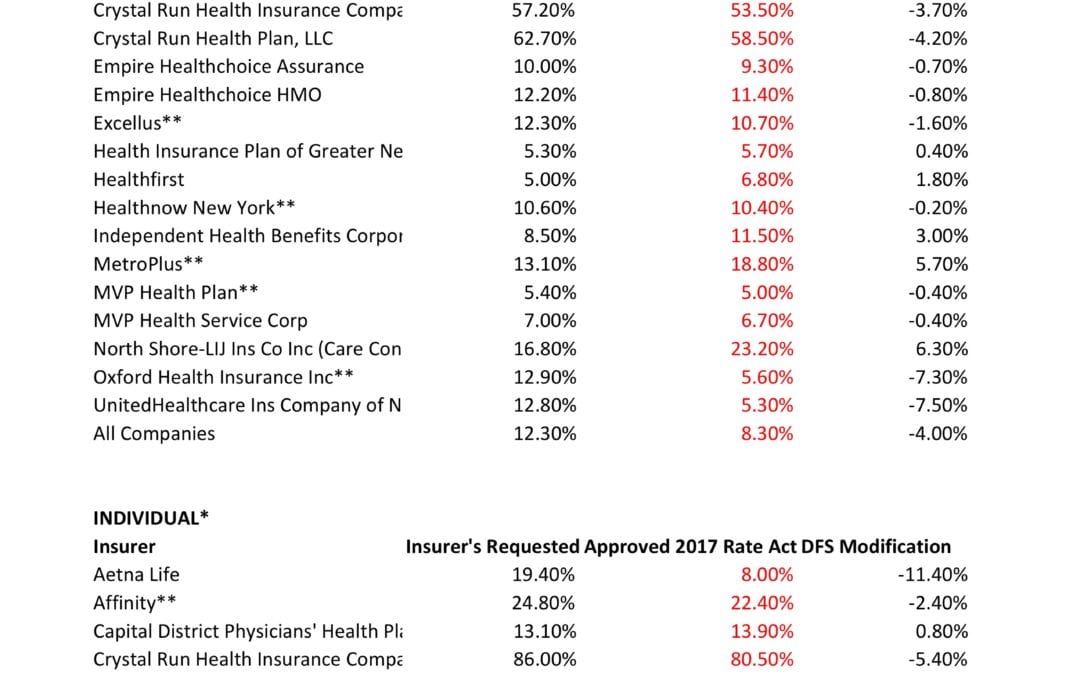

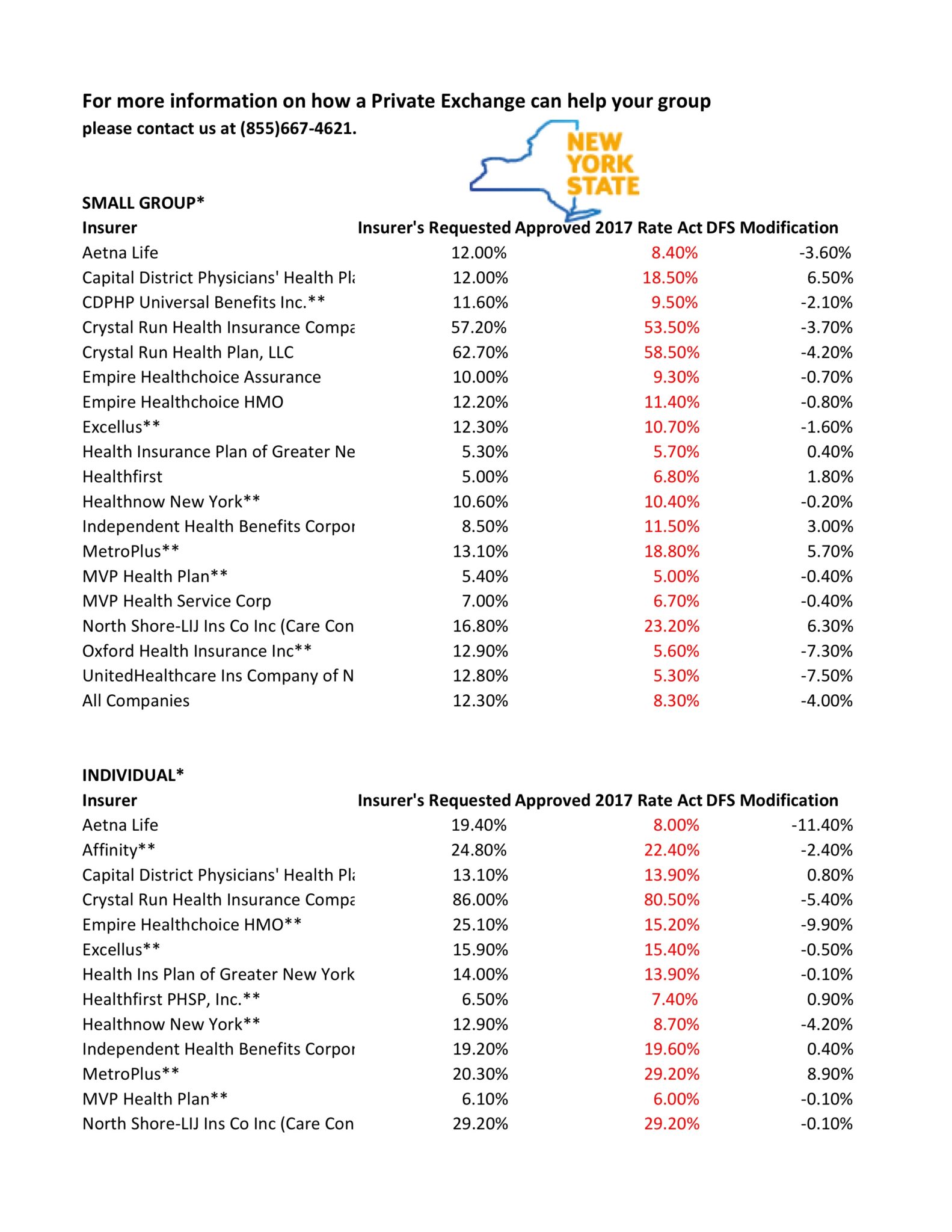

NYS 2017 FINAL Rates Approved

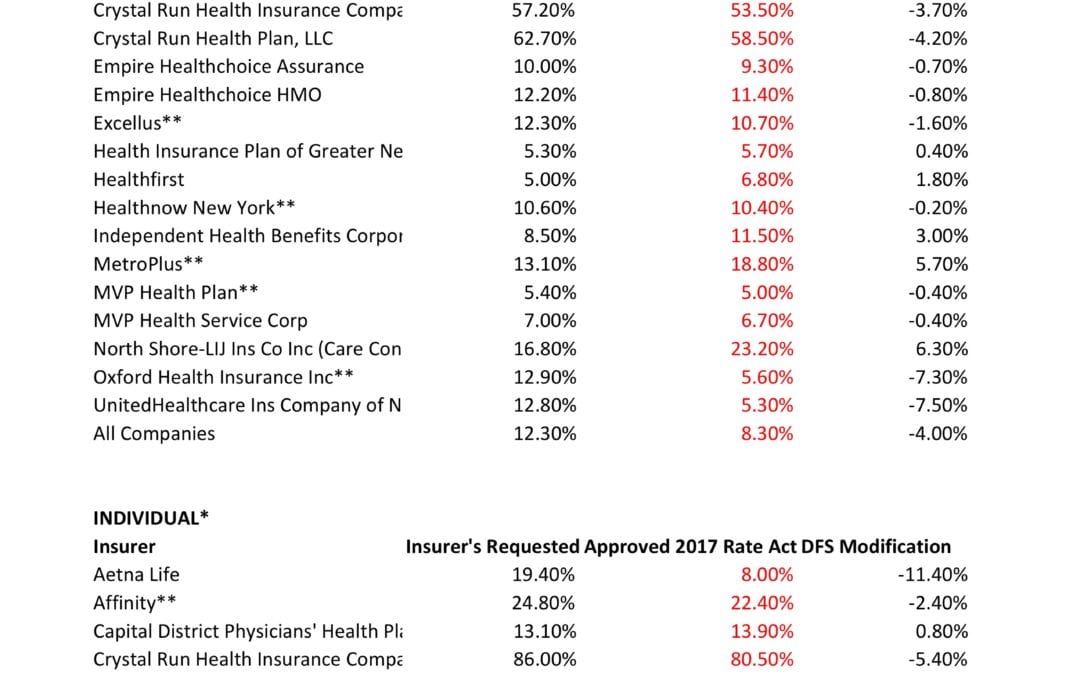

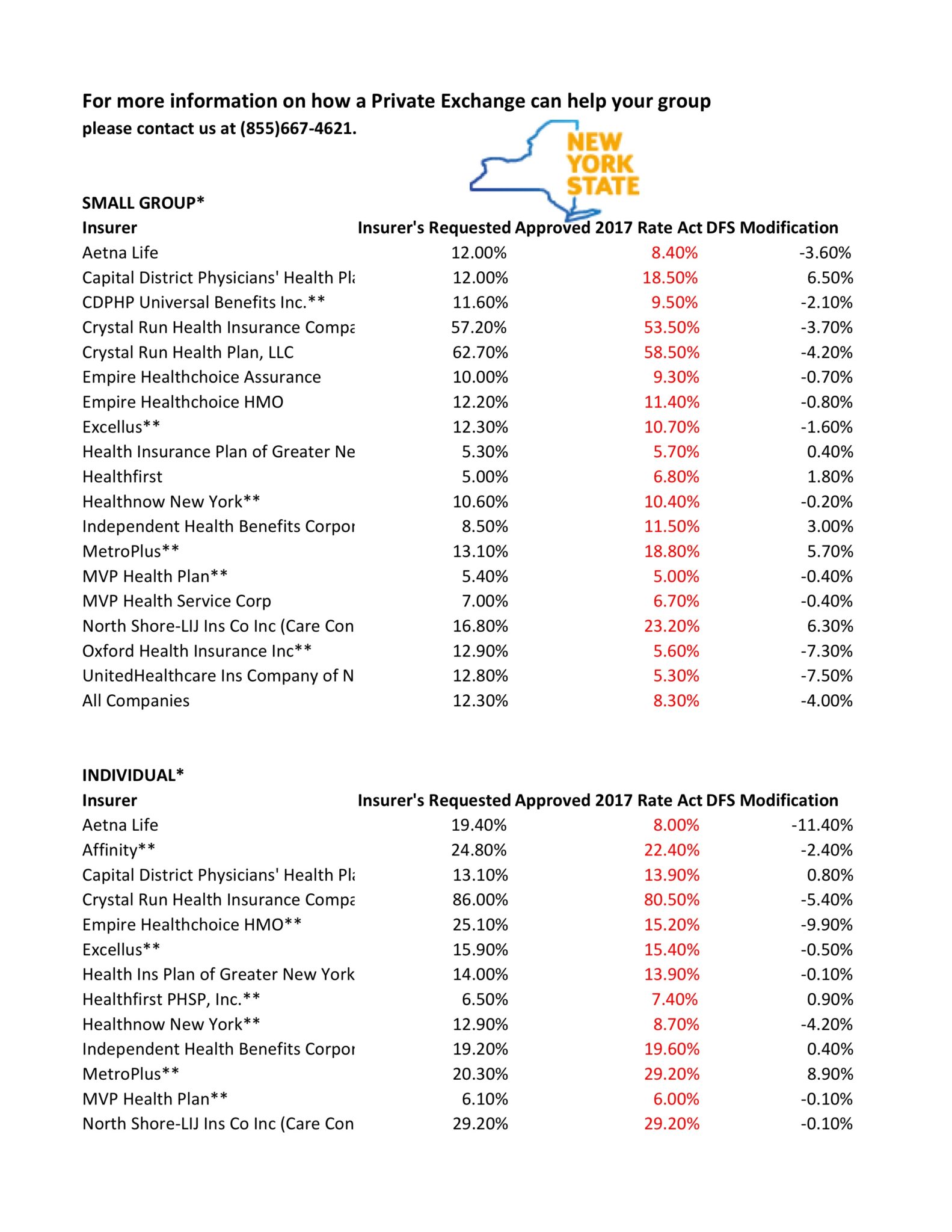

NYS has approved 2017 Final Rates. Small group rates will increase 8.3%, a reduction from the 12.3% average originally requested. In the individual market, the average increase will be 16.6%, a reduction from the originally requested 19.3%.

As per NY State Law carriers are required to send out early notices of rate request filings to groups and subscribers see original –NYS 2017 Rate Requests. With only 3 months of mature claims experience for 2016 health insurers’ requests are historically above average. Ultimately the State reduces this request substantially. This year, however, NYS acknowledged that medical costs increased, citing a 7-percent average increase on the individual market and an 8.5-percent increase on the small group market. The administration also acknowledged drug prices have impacted insurers, pointing specifically to blockbuster drugs for Hepatitis C.

OTHER STATES

The national rate trend, however, has been much higher than in past years due to higher health care costs Like other states throughout the nation, the 2017 rate of increase for individuals in New York is higher than in past years partly due to the termination of the federal reinsurance program. The lost of the program’s aka federal risk reinsurance corridor funds accounts for 5.5 percent of the rate increase.

How are neighboring States doing? In NJ, not that bad. According to a review of filings made public last week the expected rate increase will be likley ve half. Example: Horizon Blue Cross Blue Shield requested a 4.8% increase on their OMINA Plans. For CT market, on the other hand, things are much worse at least for individual marketplace with average 25% rate increases.

SMALL GROUP MARKET VS. INDIVIDUAL MARKET

The new premium hikes ranged from as little as 5.6 percent for Oxford Small group to a whopping 58.5% percent increase for Crystal Run Health Insurance Company, an insurer that covers parts of the Hudson Valley and Catskills. Importantly, small group market are still more advantageous than individual markets unless one gets a sizable low income tax credit.

Overall, about 350,000 individual plan consumers will be affected by the price hike, while more than a million users will be hit by higher small group fees. Earlier this year, Blue Cross Blue Shield released a study showing Obamacare user costs were 22 percent higher than people with employer-sponsored health plans, while UnitedHealth plans to exit most Exchanges see – Breaking: Oxford Exits Metro Indiv & Oxford Liberty HMO 2017.

The correct approach for a small business in keeping with simplicity is a Private Exchange. This is a true defined contribution empowering employees with choice of leading insurers offering paperless technologies integrating HRIS/Benefits/Payroll. Both employee and employers still gain tax advantage benefits under the business. Also, the benefits, rates and network size are superior under a group plan as the risk are lower for small group plans than individual markets.

* All amounts are rounded to the nearest 1/10.

**Indicates that the company makes products available on the “New York State of Health” marketplace.

***After rate applications were filed on 5/9/2016, additional information, including the final results of the federal risk adjustment program, prompted several insurers to update their initially filed rates.

For more information on how a Private Exchange can help your group please contact us at (855)667-4621.