by Alex | Aug 3, 2022 | NY News, Small Business Group Health

On September 1, 2022, Empire BlueCross BlueShield will begin partnering with CareMount Medical, the largest independent, multi-specialty group in New York State, to provide access to affordable care throughout New York City, Westchester, Putnam, Dutchess, Columbia, and Ulster counties.

CareMount will now be part of Empire’s Blue Access and Connection Networks for all Large Group and Small Group members. This will mean greater access to more affordable care throughout Westchester and surrounding markets.

Contact us to learn how Empire can fit your employee’s needs.

https://www.medicalsolutionscorp.com/empire-strikes-back-2022-health-plans/

Learn more about how we are successfully helping navigate SMB for 25+ years. If you have any questions or would like additional information, please contact us at 855-667-4621 or info@360peo.com.

For information about transparency providers and new tech tools contact us at info@medicalsolutionscorp.com or (855)667-4621.

Put You & Your Employees in Good Hands

Get In Touch

For more information on PEOs or a customized quote please submit your contact. We will be in touch ASAP.

by Alex | Sep 20, 2016 | group health insurance

Empire Strikes Back – 2017 Plans

Empire recently announced their re-entry back into the New York small group market for 2017. A legendary broad networked PPO is welcome news especially in the NY small group market of 1-100 employees. Recently, the broad national networks have diminished to only 2 national health insurers, Aetna and Oxford. As a result of Empire Blue Cross participation in the BlueCard PPO program members enjoy unparalleled national access network to 96% of hospitals and 93% of doctors across the country. This national program will be on 18 of 28 plans below.

3 distinct networks:

PPO Network Savings

- PPO/EPO Network – traditional non-gatekeeper large network of approximately 85,384 physicians, 160 facilities and the BlueCard PPO

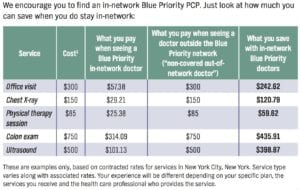

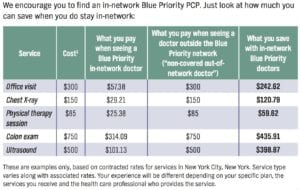

- Blue Priority Network – hybrid of broad PPO/EPO 160 facilities and similar Pathway’s 65,796 physicians network.

- Pathway Network – HMO value based narrower gatekeeper referral network of 109 facilities and 60,535 physicians. Limited to 28 NYS Counties.

Additional Features:

- Telemedicine will be available on all products

- Vision – Limited adult vision will be available on all products at no additional cost.

- Pharmacy – All plans use their large BCBS formulary Except the HMOs, and the Silver and Bronze Blue Priority Plans. They will be utilizing what they call the Select Formulary.

- Clinical Programs – health coaching/advocacy, disease management, behavioral health, maternity and Gaps in Care

- Online Resources – wellness coaching, discounts, health assessments and The Weight Center.

- Healthy Support – Wellness program offers easy ways to earn up to $900 per member, per year. Gym Reimbursement $400 single/$600 couple, $100 Wellness + Flu Shot, Online Wellness toolkit, up to $150 and $50 Tobacco-free certification online.

DOCTOR SEARCH: Click Here

BENEFITS SUMMARY: OXFORD Platinum, Gold, Silver AND Bronze

Small Group Rates: 1st Quarter 2017

Drug Formulary: Click Here

Blue Priority FAQ: Click Here

Pathway FAQ: Click Here

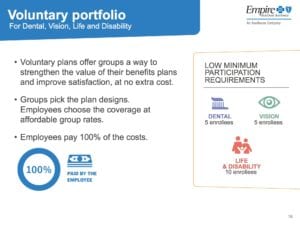

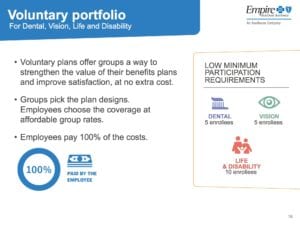

Ask us about Empire’s flexible low participation voluntary group dental, vision, disability and life insurance plans. Stay proactive and contact us today for a customized consult on how your organization can prepare ahead for ACA, Benefits, Payroll and HR @ (855) 667-4621 or info@medicalsolutionscorp.com.

by Alex | Jun 28, 2016 | NY News, Small Business Group Health

Empire Strikes Back

Empire recently announced that they will be re-entering the New York small group market in 2017. This is welcome news indeed especially in the NY small group market of 1-100 employees. Recently, the broad national networks have been diminished to only 2 health insurers, Aetna and Oxford.

market in 2017. This is welcome news indeed especially in the NY small group market of 1-100 employees. Recently, the broad national networks have been diminished to only 2 health insurers, Aetna and Oxford.

There will be upcoming fall webinar in which we will share more about Empire’s new comprehensive product offerings and the ways you can partner together to bring a more valued health care experience to your employees. Please read the full announcement below.

We will be significantly expanding our small group products we offer in the New York market. Watch Empire President Larry Schreiber’s video announcement.

January 1, 2017, we will be offering a comprehensive portfolio of products and networks to the New York small group market in our 28-county service area. These additional product offerings will bring employers more choice and access, while providing you with competitive options for these groups.

Empire has participated in the small group market for more than 80 years. But in 2012 we began the process of reducing market share due to a cyclical inability to obtain necessary rate increases on our small group products.

However, a combination of evolving market dynamics has created what we believe is a new opportunity for us to work closely together again in the New York Small Group market. Three of the most influential factors are:

- The implementation of the new Risk Adjustment Model. This critical underpinning of the Affordable Care Act compensates health plans on a “net-neutral” basis for obtaining a disproportionate share of unhealthy, below-average risk.

- The definition of “Small Group Employer” has changed. As you all know, under the law, small groups have gotten bigger in New York and other states to include employers with up to 100 employees.

- Well-publicized carrier changes over the past 12 months have created the need for more options to help balance the Small Group market in New York.

With these in mind, since the start of the year, we have done extensive market research, worked with our regulators at the Department of Financial Services and built new small group market solutions from the ground up to address the unique needs of the New York market.

As you might imagine, this requires a strong combination of pricing, product and network. We are excited by this next chapter.

Stay proactive and contact us today for a customized consult on how your organization can prepare ahead for ACA, Benefits, Payroll and HR @ (855) 667-4621 or info@medicalsolutionscorp.com.

by admin | Feb 27, 2013 | Health Care Reform, HSA, Millennium Medical Solutions Corp, Small Business Group Health, Tax, Wellness

Is Emblem Leaving?

Is EmblemHealth (GHI formerly) leaving the small business market? Yes and no. The popular traditional EPO is slated to be chopped up for new business May 1 pending State approval. The remaining consumer driven health plans which have deductibles and coinsurance (a %) will stay in tact. With that Broker compensation commissions will be significantly cut as well. The family popular 2-tier rating is also phased out and new groups must submit everything clean within 30 days.

Our quote in todays Crains Health Pulse Crains EmblemHealth pulls small business plans Feb 2013 | Crain’s New York Business reflects our deep concerns on market consolidations. “The unintended consequences of legislative changes has created a de facto single-payer system where Oxford is empowered to dictate to the New York market,” said Alex Miller, founder of Millennium Medical Solutions Corp. in Armonk, N.Y. To be fair Emblem has been steadily streamlining plans with in network only plan offerings and lowest HSA (Health Savings Account) family deductible starting out at $11,600. They are not the first insurer to do this as Empire Blue Cross issued a broader exit back in Nov 2011.

A healthy health insurance marketplace depends on competition as we all agree. From approximately 12 insurers 15 years ago we are today down to 2 active insurers Aetna and Oxford with Oxford claiming approx 2/3 of the small business marketplace. In NYS the MLR (Minimum Loss Ratios) are higher than any other state with additional state taxes. See NYS Surcharge on Health Insurance. The tight State Regulators allowing for razor thin margins while requiring insurers to maintain high reserves makes a burden many insurers are not excited. This resembles more of a utility company environment except ConEd realizes a 10% operating profit and do not have to have insurance reserves to prove solvency. Is there any surprise why there is no rush by outside insurers to compete here?

While on topic of ConEd we all know how customer care was in the aftermath of Hurricane Sandy. When was the last time an independent veteran consultant (not an ESCO) worked with you on your utility bill, servicing, negotiating, educating, and maximizing savings? Sure you can use a different supplier or ESCO but its still the local singular utility company that you are using. In comparison, same is happening in the health insurance field and the consequential exit of Health Insurance Brokers. Sadly, this is precisely the time when their training is most in demand and the most in need will be least likely to afford them.

Error: Contact form not found.

by admin | Aug 14, 2012 | healthcare

Bluecard PPO – Outside members home region, the PPO medical plan is known as BlueCard PPO. The BlueCard plan offers a network of quality doctors and hospitals known as the BlueCard Provider Network.

Bluecard PPO – Outside members home region, the PPO medical plan is known as BlueCard PPO. The BlueCard plan offers a network of quality doctors and hospitals known as the BlueCard Provider Network.

- freedom to seek care in-network or out-of-network;

- no need to select a primary care physician to coordinate your care;

- visit specialists directly — no referrals are required;

- no claim forms to submit when using an in-network provider;

- no balance bills when using an in-nework provider;

- wellness programs, including fitness reimbursement and discounts on alternative health care services, at no additional cost;

- enhanced programs to control and manage chronic conditions;

- preventive care for children and adults;

- enjoy in-network coverage anywhere in the United States when you use providers that participate in the Personal Choice or BlueCard PPO networks;

- worldwide coverage and recognition of the Blue Cross® symbol.

How Does it Work?

Blank Suitcase Logo

A blank suitcase logo on a member’s ID card means that the patient has Blue Cross Blue Shield traditional, POS, or HMO benefits delivered through the BlueCard Program.

“PPO in a Suitcase” Logo

You’ll immediately recognize BlueCard PPO members by the special “PPO in a suitcase” logo on their membership card. BlueCard PPO members are Blue Cross and Blue Shield members whose PPO benefits are delivered through the BlueCard Program. It is important to remember that not all PPO members are BlueCard PPO members, only those whose membership cards carry this logo. BlueCard PPO members traveling or living outside of their Blue Plan’s area receive the PPO level of benefits when they obtain services from designated BlueCard PPO providers.

How to Verify Membership and Coverage

Once you’ve identified the alpha prefix, call BlueCard Eligibility to verify the patient’s eligibility and coverage.

| 1. Have the member’s ID card ready when calling. |

| 2. Dial 1.800.676.BLUE. |

Operators are available to assist you weekdays during regular business hours (7am – 10pm EST). They will ask for the alpha prefix shown on the patient’s ID card and will connect you directly to the appropriate membership and coverage unit at the member’s Blue Cross Blue Shield Plan. If you call after hours, you will get a recorded message stating the business hours.

Keep in mind BCBS Plans are located throughout the country and may operate on a different time schedule than Anthem Blue Cross and Blue Shield. It is possible you will be transferred to a voice response system linked to customer enrollment and benefits or you may need to call back at a later time.

International Claims

The claim submission process for international Blue Cross and Blue Shield Plan members is the same as for domestic Blue Cross and Blue Shield Plan members. You should submit the claim directly to Anthem Blue Cross and Blue Shield.

by admin | Dec 22, 2011 | healthcare, NY News

In a pleasant surprise, Empire will delay their April 2012 decision to “simplify” small group plans 1 more year from April 2012 to April 2013 instead. The Nov 4th Empire announcement to leave the NY Small Group Business was truly shocking after being in business for 75 years and insuring 35% of the market.

What this means for consumers is that insured members will now breath a sigh of relief and keep their contracted plan at least until their renewal. Evidentially, Empire was allowed to abruptly do a “hard shut down of their plans” for April and not allow a group to complete their 12 month contract. The negative consequence would have affected many unfairly as most members today have some kind of annual deductible and/or coinsurance on Rx plans, hospitalizations and surgeries. Example: a member signs up for a plan Oct 1 and has already met their deductible responsibilities would suddenly have to now change plans on April 2012. and start all over again.

A point needing further explanation is are they or they not exiting? Empire is stating that they are not in fact leaving but merely simplifying their offering to 6 plans but this is actually a red herring as the plans offered are not market friendly and allows Empire to stay within the market without having to really exit. Example: Their HMO monthly rate is $675/single when you can get the same plan from a leading competitor for $465/single.

So why be in the market without actually being in the market? The state’s regulation would not permit an insurer to re-enter for 3 years. With Health Care Reform changes in the subsequent years there are variables that may help NYS such as add’l federal funding. Additionally, it is an election year and with many unknown Health Care Reform variables still evolving such as Supreme Court hearing on individual mandate by June 2012 – WSJ Supreme Test for Health Law.

Either way this is welcome news to our existing clients and for the marketplace at large however short term it is.

Happy Holidays!!

[polldaddy poll=5783128]

Error: Contact form not found.

by admin | Nov 4, 2011 | family health insurance, Health Care Reform, healthcare, Healthy NY, Small Business Group Health

As per todays Crains article, Empire Blue Cross will be exiting the majority of small group health plans effective April 1, 2012. The news was swirling earlier this week with official Empire communication going out today.

This affects 1/3 of New York Small Businesses as defined by 50 or less FT and eligible employees. Since with large group market the insurer is allowed to rate a group based on true census and make up of a group’s sex, age and family status as well as claims experience of the prior year. In NY State where the small group market is Community rated and independent of census this becomes an important point that I will get back to.

As healthcare has become regulated by MLR(Max Loss ratios) or revenue controls its not surprising that insurers are unhappy but why does it seem that in NYS regulations run deeper than in other states? We are licensed in multiple states and we are not seeing the same pattern this quickly. Numerous companies have already exited such as CIGNA, HealthNet, Horizon, Guardian not to mention M&A of HIP/GHI, Oxford/UnitedHealthcare and Aetna/US Healthcare/NYLCare etc. I can go on.

In NYS the insurance regulations go beyond Health Care Reform (PPACA) with higher MLR than the national one. The Federal level is 80% for small groups and in NYS its 82%

There are new NYS price controls where insurers must anticipate risk a year in advance and ask for larger rate increases to protect on anticipated uncertain risks. With so many unknown variables its almost like asking one to predict who’s going to win the Super Bowl in 2013. Rate increase of 15-20% requests must be higher than usual since after all there are no State protection on the loss side. Furthermore, increases of 10%+ must now require public hearings 60 days prior.

Today, we have so many State mandates that many of the mandates(overage dependents coverage, preventive care, pre-existing for kids) in PPACA didnt even affect NY since they were already in place. Mandates account for approx 17% of the costs of which Small Businesses pay more than fair share. Large corporations and Unions can self insure and avoid some mandates as they are governed by ERISA and not State. To the relief of of our struggling clients on subsidized Healthy NY the State doesn’t play by their own rules and instead opts out of its very own mandates.

So what happened with Empire? The tipping point evidently was rate increase denials of 5 consecutive quarters and that Empire quite frankly got caught with great pricing and products just when healthcare reform came around. Many insurers raised their rates in advance of the law. Emblem (GHI) raised rates 25% on average and even as high as 60% on HSA. Granted they have also removed many plans recently.

Much like in the 70’s its a regulaed oligipoly with insurers too too big to fail. Our clients will have access to only 3 insurer – Aetna, Emblem and Oxford. Just imagine how high your Auto Insurance would cost in the same scenario? This remarkable in a 25 million metropolis like NYC. Insurers do not have to be in NYS, no new carrier is looking to enter the NY market. After 75 years in business and insuring 4 generations of small businesses this should be a shock to the system and a wake up call to every politician.

We ask for greater oversight on Mergers and Acquisition of health insurers,providers and hospitals. Its begining to dawn on everyone that a too big to fail environment is poison and will be the tail that wags the dog. I can only imagine what the other remaining insurers must be thinking whats in store for next year.

Importantly, the community rating ought to be dropped as most states such as NJ, CT are census based. With Health Exchanges coming in 2014 individuals will be able to purchase health insurance on their own which will make Community Rating less relevant. This will be a positive step in allowing great competitors like Humana to enter the market.

If this is not a wake up call for small businesses to have a seat at the table I dont know what is. Anyone in for an Occupy Albany?

by admin | Aug 5, 2010 | healthcare, latest health insurance news

The showdown is over and 45,000 Westchester Empire Blue Cross residents can now breathe a sigh of relief. The majority of the Westchester hospitals belong to this network – Lawrence Hospital Center,Northern Westchester Hospital, Phelps Memorial Hospital Center and White Plains Hospital Center.

While these hospitals were covered on emergencies and the physicians were unaffected it still posed an inconvenience. physicians were rerouting patients to participating hospitals such as Westchester Medical Center in Valhalla.

As I posted in prior blogs these tight negotiations will be the new norm as regional hospital systems have logically evolved to gain leverage in the market. Unlike in past negotiations this one has been a thriller as contracts have not been renewed since April 1. The PR campaign was heavy on both sides with political pressures coming down form the State, board of directors and passionate letter writing campaigns.

Ironically we are seeing the opposite trend from insurers who are building smaller networks focused on smaller regional hospitals and medical centers. The article in NYT, Insurers Push Plans That Limit Choice of Doctor, discusses how this model may possibly work in the new Obama Care. Many may be willing to make network concessions with savings of 15%. We are seeing this trend already with offshoots from insurers such as a 5 Boroughs plan – Aetna NYC HMO, Atlantis and Emblem CompreHealth HMO. We expect Empire and Oxford to come out with something similar. Our clients will be closely monitoring these networks.

So in an odd twist a Stellaria Hospital system may be the only hospital a Westchester resident can go to with a possible NYC hospital systems alliance such as Columbia Presbyterian Hospital/New York Cornell.

Either way Empire residents here will be sleeping soundly knowing that they are not limited, for now.

by admin | Jun 11, 2010 | healthcare

Yes its finally out there, the big issue came out this week! Sure some of you are thinking Time’s Person of the Year or Sports Illustrated Swim Suit issue(that’s in February) but those in the medical field know what I’m talking about. Ahhhh the long awaited annual 2010 NY Magazine’s Best Doctors issue is out. Is it HS all over again or is it for real?

Yes its finally out there, the big issue came out this week! Sure some of you are thinking Time’s Person of the Year or Sports Illustrated Swim Suit issue(that’s in February) but those in the medical field know what I’m talking about. Ahhhh the long awaited annual 2010 NY Magazine’s Best Doctors issue is out. Is it HS all over again or is it for real?

The annual list collects opinions of local doctors and asks whom they would refer a family member to. After this you get voila a ready to go Zagat-style guide of Best Doctors. Simple right?

Just like any profession there are politics and old boy cronyism with powerful medical departments overly represented while small offices are forgotten.

Nevertheless whats a New Yorker to do in a fast harried life style? This can be used as a general guide but much like a friendship the doctor-patient relationship happens organically. Well where there’s demand there’s supply. Insurers are indeed working on giving access to members with what else The Zagat Health Survey. Empire Blue Cross offers this to their members. Don’t simply sneer at this. Research has shown that patients who have a good relationship with their doctor are more likely to ask questions and follow the doctor’s advice – which can lead to better health.

So with both auspicious fine tools and a little leg work one is now empowered to get the best doctors. Now if we can only afford the copays and get an appointment.

by admin | Mar 27, 2008 | NY News

HIP and GHI merger. GHI and HIP have been working since 2005 on merging under a common parent, EmblemHealth, serving more than four million members across the tri-state area. As sister companies, GHI and HIP has continued to operate separately until they get NY State Approval. Affiliation is the first step as GHI and HIP begin the process of combining and integrating as they move toward an eventual merger. Existing group coverage will not change as a result of the affiliation. Over time, their stated mission is to will develop and make available an expanded range of cost effective products and new services to you and your employee’s. There have been a recent executive fall out of the changes and expect more to come. NY will be losing the last few non-profits left in the state. The state is running public forums to review this, see state insurance site on recent meetings. Will this be NY State politics as usual and allow political leaders to dole out the stock market gains for personal gains or will citizens stand to gain? Unlike our state, California took a long term view for the medical care of its citizens. They set up a non-profit with a mission that the Blue Cross conversion set up a fund of not less than $100 million to be spent on charitable activities in 1994 and not less than 40 percent of WellPoint stock ($1.2 billion) to be contributed to a newly formed foundation. Pataki on the other hand used 90% of the $1.1Billion Empire Blue Cross 2002 conversion for Mr. Rivera’s powerful 1199 Union. I’m sure that this did not harm his 2002 reelection campaign but I wish New Yorkers did as well as California. See article in NY Times for your consideration.