2020 Open Enrollment Checklist

In preparation of 2020 open enrollment, Employers should review their plan documents to confirm that they include these required changes. Learn how our Agency is helping businesses thrive in today’s economy. Please contact us at info@medicalsolutionscorp.com or (855)667-4621.

Top Five Employee Wellness Program for 2019

All businesses today are aware that a healthy workforce translates to a happier and more productive employees. Nearly a quarter of participants in SHRM’s latest benefits survey plan to increase their Health & Wellness benefits, whose percentage was a higher than other categories such as professional and career development, flexible work schedules, retirement and family-friendly policies. One unusual offering, workstations that allow people to stand, soared to 44% from just 13% in 2013 when the data was first tracked.

Helping your employees strive towards physical, emotional, mental, and even spiritual well-being can lead to increased productivity and employee longevity. But how can you offer wellness programs that your employees will actually use and find beneficial? There’s no one size fits all solution, and the best way to get started is to invite employee input. Need some inspiration? Here are 5 employee wellness programs that might be the right fit for your company this coming year:

1. Online Wellness/Health Screening

Did you know many health nurses today pay your employees to take an online health risk assessment? Covered members receive a lump sum benefit payment once a year if they complete certain health-related activities (i.e. routine screenings, programs like smoking cessation and weight reduction, and more). Payment options range from $50 to $150. Empire Blue Cross, for example, pays up to $300 for this including smoking cessation online questionnaire and a flu vaccination.

2. Gym Reimbursements

You might not be able to build a gym at the office, but that doesn’t mean you can’t take advantage of your neighborhood businesses. Did you know most health care compare today offer up to $400 annual gym reimbursement? Most include a $200 spousal gym reimbursement as well.

3. Start a Walking Group

This solution is easy, free, and can be employee-driven. Failing to take breaks leads to burnout and eventually employee resentment. Encourage employees to take frequent breaks, but not just to the break room for more artificial lighting and a caffeine boost. Rally eager employees to lead morning, lunch, and/or after-work walking groups. The fresh air is energizing, boosts creativity, and helps feed social wellness needs, too.

4. Create a Healthy Challenge That Isn’t Based on Numbers

Although some businesses have success with Biggest Loser-style in-office challenges, it can also trigger disordered eating. Instead of focusing on numbers, focus on more subjective goals—like how many consecutive days fresh, local fresh vegetables can be part of a lunch. Kicking off these challenges with a brief intro to the importance of a healthy diet for life can help employees re-think their choices.

5. Seek Help from Outside Resources

There are several organizations that employers can turn to for information, research and guidance on wellness programs. Below are just a few for you to explore for helpful ideas on how to develop a culture of health in your organization.

HERO is a national non-profit dedicated to identifying and sharing best practices in the field of workplace health and well-being (HWB). Their mission is to improve the health and well-being of workers, their spouses, dependents and retirees. Check out the wealth of information on their site, including research studies and a blog.

The Health Project is a tax-exempt not-for-profit corporation formed to bring about critical attitudinal and behavioral changes in addressing the health and well-being of Americans. The Health Project focuses on improving personal health care practices and supporting population health by reaching adults where they spend most of their waking hours: at work. Many organizations have adopted health promotion (wellness) programs that encourage good health habits and improved understanding of how individual workers and their families can more effectively use health services.

Harvard Health Newsletters are free newsletters targeted to individuals with the purpose of providing educational information to help them invest in their own health or the health of their families.

Contact us to learn more about how health and wellness benefits can help you attract and retain your top talent.

PEO Survey Top 3 SMB Challenges

PEO Survey Top 3 SMB Challenges For most SMB the two most important goals are revenue growth and cost controls. In a competitive employee benefits market, both objectives are easier said than done. However, partnering with a PEO can help make these key goals easier...

test MMS quoting

Small Business Tax Credit

Find out if you are eligible for a Small Business Tax Credit.

Full-time Equivalent (FTE) Employee Calculator

Use the full-time equivalent employee (FTE) calculator to count the number of FTEs you have.

messages[“SELF”] = “Employee Only”;

messages[“SELF_SPOUSE_DEPENDENT”] = “Employees and Dependents”;

messages[“medical”] = “Medical Insurance”;

messages[“dental”] = “Dental Insurance”;

messages[“vision”] = “Vision Insurance”;

messages[“HRA”] = “HRA”;

messages[“HSA”] = “HSA”;

messages[“FSA”] = “FSA”;

messages[“DCFSA”] = “DCFSA”;

messages[“LPFSA”] = “LPFSA”;

messages[“BASICLIFE”] = “Basic Life Insurance”;

messages[“SUPPLEMENTALLIFE”] = “Supplemental Life Insurance”;

messages[“BASICADD”] = “Basic AD&D Insurance”;

messages[“SUPPLEMENTALADD”] = “Supplemental AD&D Insurance”;

messages[“STD”] = “Short Term Disability Insurance”;

messages[“LTD”] = “Long Term Disability Insurance”;

messages[“commuter”] = “Commuter”;

Small Business Tax Credit

Find out if you are eligible for a Small Business Tax Credit.

Full-time Equivalent (FTE) Employee Calculator

Use the full-time equivalent employee (FTE) calculator to count the number of FTEs you have.

Empire Strikes Back – 2017 Plans

Empire Strikes Back 2017 Plans

Empire Strikes Back 2017 Plans. Empire recently announced their re-entry back into the New York small group market for 2017. A legendary broad networked PPO is welcome news especially in the NY small group market of 1-100 employees. Recently, the broad national networks have diminished to only 2 national health insurers, Aetna and Oxford. As a result of Empire Blue Cross participation in the BlueCard PPO program members enjoy unparalleled national access network to 96% of hospitals and 93% of doctors across the country. This national program will be on 18 of 28 plans below.

Network Overview

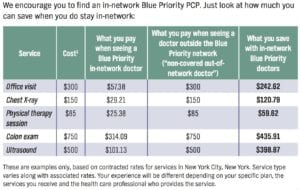

3 distinct networks:

- PPO/EPO Network – traditional non-gatekeeper large network of approximately 85,384 physicians, 160 facilities and the BlueCard PPO

- Blue Priority Network – hybrid of broad PPO/EPO 160 facilities and similar Pathway’s 65,796 physicians network.

- Pathway Network – HMO value based narrower gatekeeper referral network of 109 facilities and 60,535 physicians. Limited to 28 NYS Counties.

Additional Features:

- Telemedicine will be available on all products

- Vision – Limited adult vision will be available on all products at no additional cost.

- Pharmacy – All plans use their large BCBS formulary Except the HMOs, and the Silver and Bronze Blue Priority Plans. They will be utilizing what they call the Select Formulary.

- Clinical Programs – health coaching/advocacy, disease management, behavioral health, maternity and Gaps in Care

- Online Resources – wellness coaching, discounts, health assessments and The Weight Center.

- Healthy Support – Wellness program offers easy ways to earn up to $900 per member, per year. Gym Reimbursement $400 single/$600 couple, $100 Wellness + Flu Shot, Online Wellness toolkit, up to $150 and $50 Tobacco-free certification online.

DOCTOR SEARCH: Click Here

BENEFITS SUMMARY: OXFORD Platinum, Gold, Silver AND Bronze

Small Group Rates: 1st Quarter 2017

Drug Formulary: Click Here

Blue Priority FAQ: Click Here

Pathway FAQ: Click Here

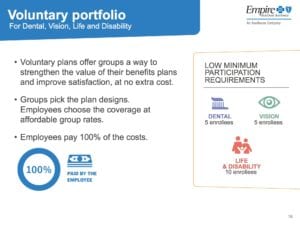

Ask us about Empire’s flexible low participation voluntary group dental, vision, disability and life insurance plans. Stay proactive and contact us today for a customized consult on how your organization can prepare ahead for ACA, Benefits, Payroll and HR @ (855) 667-4621 or info@medicalsolutionscorp.com.

Empire Strikes Back – 2017 Plans

Empire Strikes Back – 2017 Plans

Empire recently announced their re-entry back into the New York small group market for 2017. A legendary broad networked PPO is welcome news especially in the NY small group market of 1-100 employees. Recently, the broad national networks have diminished to only 2 national health insurers, Aetna and Oxford. As a result of Empire Blue Cross participation in the BlueCard PPO program members enjoy unparalleled national access network to 96% of hospitals and 93% of doctors across the country. This national program will be on 18 of 28 plans below.

Network Overview

3 distinct networks:

- PPO/EPO Network – traditional non-gatekeeper large network of approximately 85,384 physicians, 160 facilities and the BlueCard PPO

- Blue Priority Network – hybrid of broad PPO/EPO 160 facilities and similar Pathway’s 65,796 physicians network.

- Pathway Network – HMO value based narrower gatekeeper referral network of 109 facilities and 60,535 physicians. Limited to 28 NYS Counties.

Additional Features:

- Telemedicine will be available on all products

- Vision – Limited adult vision will be available on all products at no additional cost.

- Pharmacy – All plans use their large BCBS formulary Except the HMOs, and the Silver and Bronze Blue Priority Plans. They will be utilizing what they call the Select Formulary.

- Clinical Programs – health coaching/advocacy, disease management, behavioral health, maternity and Gaps in Care

- Online Resources – wellness coaching, discounts, health assessments and The Weight Center.

- Healthy Support – Wellness program offers easy ways to earn up to $900 per member, per year. Gym Reimbursement $400 single/$600 couple, $100 Wellness + Flu Shot, Online Wellness toolkit, up to $150 and $50 Tobacco-free certification online.

DOCTOR SEARCH: Click Here

BENEFITS SUMMARY: OXFORD Platinum, Gold, Silver AND Bronze

Small Group Rates: 1st Quarter 2017

Drug Formulary: Click Here

Blue Priority FAQ: Click Here

Pathway FAQ: Click Here

Ask us about Empire’s flexible low participation voluntary group dental, vision, disability and life insurance plans. Stay proactive and contact us today for a customized consult on how your organization can prepare ahead for ACA, Benefits, Payroll and HR @ (855) 667-4621 or info@medicalsolutionscorp.com.

Empire Strikes Back

Empire Strikes Back

Empire recently announced that they will be re-entering the New York small group market in 2017. This is welcome news indeed especially in the NY small group market of 1-100 employees. Recently, the broad national networks have been diminished to only 2 health insurers, Aetna and Oxford.

market in 2017. This is welcome news indeed especially in the NY small group market of 1-100 employees. Recently, the broad national networks have been diminished to only 2 health insurers, Aetna and Oxford.

There will be upcoming fall webinar in which we will share more about Empire’s new comprehensive product offerings and the ways you can partner together to bring a more valued health care experience to your employees. Please read the full announcement below.

We will be significantly expanding our small group products we offer in the New York market. Watch Empire President Larry Schreiber’s video announcement.

January 1, 2017, we will be offering a comprehensive portfolio of products and networks to the New York small group market in our 28-county service area. These additional product offerings will bring employers more choice and access, while providing you with competitive options for these groups.

Empire has participated in the small group market for more than 80 years. But in 2012 we began the process of reducing market share due to a cyclical inability to obtain necessary rate increases on our small group products.

However, a combination of evolving market dynamics has created what we believe is a new opportunity for us to work closely together again in the New York Small Group market. Three of the most influential factors are:

- The implementation of the new Risk Adjustment Model. This critical underpinning of the Affordable Care Act compensates health plans on a “net-neutral” basis for obtaining a disproportionate share of unhealthy, below-average risk.

- The definition of “Small Group Employer” has changed. As you all know, under the law, small groups have gotten bigger in New York and other states to include employers with up to 100 employees.

- Well-publicized carrier changes over the past 12 months have created the need for more options to help balance the Small Group market in New York.

With these in mind, since the start of the year, we have done extensive market research, worked with our regulators at the Department of Financial Services and built new small group market solutions from the ground up to address the unique needs of the New York market.

As you might imagine, this requires a strong combination of pricing, product and network. We are excited by this next chapter.

Stay proactive and contact us today for a customized consult on how your organization can prepare ahead for ACA, Benefits, Payroll and HR @ (855) 667-4621 or info@medicalsolutionscorp.com.

Breaking: Oxford Exits Metro Indiv & Oxford Liberty HMO 2017

Breaking: Oxford Exits Metro Indiv & Oxford Liberty HMO 2017

Oxford Health Plans (NY), Inc. (OHP) License Withdrawal, Effective January 1, 2017, Upon Renewal

Please note the following:

- This change does not affect their regular Oxford Health Insurance, Inc. (OHI) plans. Their OHI portfolio in New York offers a wide range of coverage options for employers of all sizes.

- Impacted groups and members will receive a notice from us approximately 180-days prior to their 2017 coverage end date. The notice will outline the actions they need to take and other available coverage options.

Stay proactive and contact us today for a customized consult on how your organization can prepare ahead for ACA, Benefits, Payroll and HR @ (855) 667-4621 or info@medicalsolutionscorp.com.

Final 2017 Marketplace Guidance

Final 2017 Marketplace Guidance

Health and Human Services had released earlier this year the final version of its 2017 Notice of Benefit and Payment Parameters. Under the Affordable Care Act (ACA) this is issued annually. While the guidance is mostly relate dot the individual marketplace itt does, however, include several items relevant to employers and group health plans, specifically:

- Annual limits for cost sharing (out-of-pocket limits)

- Marketplace eligibility notifications to employers

- Marketplace annual open enrollment period

- Small Business Health Options (SHOP) Exchange

ANNUAL LIMITS FOR COST SHARING:

The annual out of pocket limits for plan years beginning on or after January 1, 2017 are $7,150 for individual coverage and $14,300 for family coverage. These cost sharing limits apply to in-network essential health benefits offered under non-grandfathered health plans, both fully and self-insured. Annual deductibles, in-network co-insurance and other types of in-network cost sharing accumulate toward the out-of-pocket limit, including prescription drug copayments. Not included are premium payments, out-of-network cost sharing and spending on non-essential health benefits.

MARKETPLACE ELIGIBILITY NOTIFICATIONS TO EMPLOYERS:

Beginning in 2017, the Marketplace will notify an employer as soon as possible when one of its employee’s first enrolls in subsidized Marketplace coverage. Since some employers may be liable for a penalty under the ACA’s employer mandate when an employee qualifies for a subsidized Marketplace coverage, this change to a more proactive notification process will hopefully provide employers with the opportunity to work with CMS in cases where an improper subsidy has been provided.

MARKETPLACE ANNUAL OPEN ENROLLMENT PERIOD:

Open Enrollment in the Health Insurance Marketplace, Healthcare.gov, for 2017 and 2018 will take place from November 1, 2016 through January 31, 2017 and November 1, 2017 through January 31, 2018, respectively.

SMALL BUSINESS HEALTH OPTIONS (SHOP) EXCHANGE:

Beginning in 2017, small employers electing coverage in the SHOP Exchange will have the option of “vertical choice,” offering plans across all metal levels (platinum, gold, silver and bronze) from one insurer. States who opt out of the vertical choice option will continue to offer employers the choice of selecting health plans that are available at one single metal level of coverage.