by admin | May 21, 2013 | Health Care Reform, Health Care Refrom, Health Exchanges, Individual Exchanges, Millennium Medical Solutions Corp, PPACA, SHOP Exchanges, Small Business Group Health, Tax

With only 6 month away from full implementation of 2014 Patient Protection Affordability Care Act (PPACA) employers are understandably uncertain. Below are Health Care reform – five things employers can do now to prepare and take action.

UPDATE JULY 2nd: Since blog posting the President Administration has delayed 1 year Employed Shared Responsibility Mandate i.e. Pay or Play to Jan 2015.

1. Employee Communications

Employers must notify employees of the online insurance marketplace known as a Healthcare Exchange. Recently released federal guidelines require employers to notify their workers of eligibility requirements for their state exchange starting Oct. 1, 2013 Open Enrollments for Jan 2014 effective date. To the relief of many, the U.S. Labor Department also provided model notices that employers can give to their workers, which eliminates the need to develop their own notifications.

Additionally, Employers sponsoring a health plan must give employees a Summary of Benefits and Coverage (SBC). The purpose of the Summary of Benefits and Coverage, or SBC, is to present benefits and coverage information in clear language and in a consistent format. Inspired by the Nutrition Facts Label on packaged food, the SBC (pdf) includes two medical scenarios: having a baby and managing Type II diabetes. It estimates how much a patient would pay for medical care in each scenario with specific insurance plans.

Important things to know about the SBC:

- The health insurance companies will create the SBCs.

- It’s the employer’s responsibility to distribute the SBCs to employees.

- This requirement applies to health plan renewals after Sept. 23, 2012.

- Department of Labor will NOT impose penalties for non-compliance with the SBC notice during the first year as long as employers show a “good faith” effort to comply. Read the FAQ on SBC and ACA pdf here.

- Medicalsolutionscorp.com has suggestions to help employers comply with the SBC distribution requirements

2. Determining which Employers must offer health care.

Because employers with 50 full-time equivalents face penalties for not providing affordable, minimum value insurance an employer should know whether it is subject to these requirements or not. Common law employees of the employer and any commonly controlled company must be counted. Employers with temporary or leased employees will want to discuss with their advisors whether these employees will be considered “common law employees” for purposes of determining how many FTEs an employer has. Employers with employees who are paid based on unique payment models (stipends, work product, etc) will want to discuss how to calculate these employee hours with their benefits advisors.

- Employers with 50 or more employees will incur penalties of up to $2,000 per employee if they cancel their existing health care program (which up until 2014 would be considered an optional benefit to provide). They will also incur penalties if their plan is too costly, and they do not meet the affordability standards.

- Employers with less than 50 employees will not incur penalties if they cancel their health care plan, and that decision will need to be made on a business by business basis. They can also choose to offer partial coverage and contribute up to the minimum 50% of single coverage not to exceed 9.5% employee

The good news is Employers can subtract 30 FT employees. This portion is known as the Employer “play or pay” option. Specific case example and details are found at Pay or Play Employer Guide.

3 Health Care Small Business Tax Credit Calculator

To encourage businesses to offer health benefits to their employees, the federal government is offering tax credits to small businesses. These credits are available to an estimated 4 million small businesses, including nonprofits.The IRS has set up a web page with information: Small Business Health Care Tax Credit for Small Employers. The maximum “credit” (which offsets taxes dollar for dollar and is better than a “deduction” which reduces taxable income) is 35 percent of the amount an employer pays towards employee health insurance.

Who’s eligible?

To qualify, small employers must:

- Have fewer than the equivalent of 25 full-time workers

- Pay average annual wages below $50,000

- Cover at least 50% of the cost of health care coverage for their workers

Because of the high wages paid in most industries in NY/NJ/CT Tri State, few small employers that provide coverage pay such a low average wage. Note, however, that the calculation of average wages and number of employees excludes the wages of an owner and his or her family members.

medicalsolutionscorp.com help clients gather the appropriate information and do a preliminary estimate of the credit amount. This information will help you and your accountant determine whether applying for the credit makes financial sense. Find out what the new tax credit could mean for your coverage. Call us at 855-667-4621.

4. Determine affordability

Beginning Jan. 1, 2014, an employer with 50 or more employees must pay a tax penalty if they either: a) Do not provide health insurance with minimum benefits or 60 percent of healthcare expenses; b) Require employees to contribute more than 9.5 percent of an employee’s household income for the health insurance and those employees obtain a government subsidy for coverage.

Companies will be required to pay $3,000 per employee without affordable coverage. (Note: there are a number of caveats that might affect the actual penalty paid, so consult your tax advisor.)

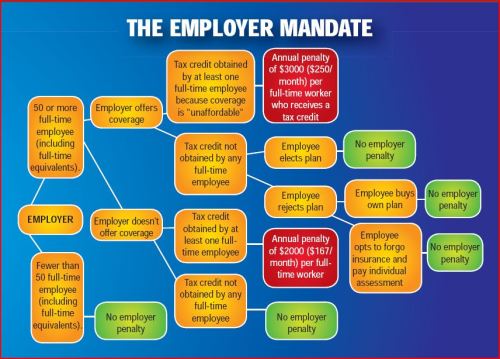

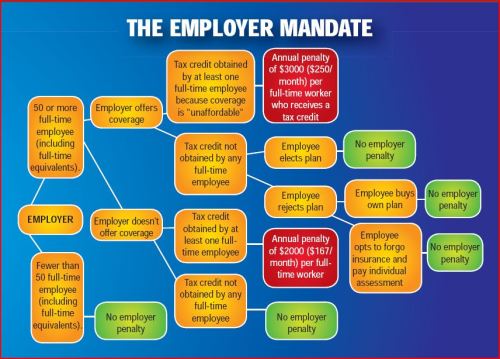

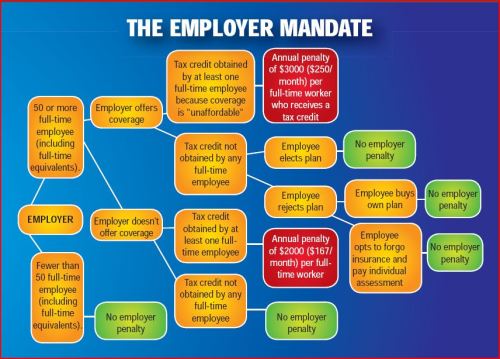

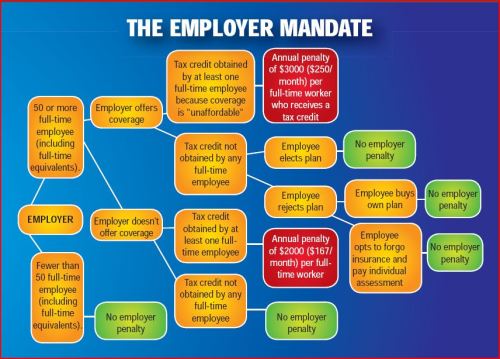

This chart shows employer penalties under the ACA, referred to as “shared responsibility.” Employers wishing to more precisely calculate their potential penalty liability should read the document we prepared, Calculating the Potential ACA Employer Tax Penalty.

5. What does Full Time Equivalent Mean?

It is crucial to Understand the difference between FT and Full Time Equivalent. To determine the FTE (Full Time Equivalent) you must count FT and PT employees. Full Time Employees are those working 30 hours+/week.* The number of full-time employees excludes those full-time seasonal employees who work for less than 120 days during the year.4 The hours worked by part-time employees (i.e., those working less than 30 hours per week) are included in the calculation of a large employer, on a monthly basis, by taking their total number of monthly hours worked divided by 120.

For example, a firm has 35 full-time employees (30+ hours). In addition, the firm has 20 part time employees who all work 24 hours per week (96 hours per month). These part-time employees’ hours would be treated as equivalent to 16 full-time employees, based on the following calculation:

20 employees x 96 hours / 120 = 1920 / 120 = 16

Thus, in this example, the firm would be considered a “large employer,” based on a total full-time equivalent count of 51—that is, 35 full-time employees plus 16 full-time equivalents based on part-time hours.

In the coming months, Millennium Medical Solutions Inc will host seminars and will share information you’ll need to know as the countdown continues to October 1st. Error: Contact form not found.

This blog is not intended to represent legal advise and one should consult with a tax and/or legal expert.

* IRC 4980H(c)(4)

Disclaimer: This blog is not intended to represent legal advise and one should consult with a tax and/or legal expert.

by admin | Mar 4, 2013 | Health Care Reform, Health Exchanges, Individual Exchanges, PPACA, SHOP Exchanges, Small Business Group Health, State Exchanges, Tax

Pay or Pay Employer Guide

Pay or Play Employer Guide

Tick! tick! tick! As the 2014 Employer Mandate to either pay or play gets closer the nation’s employers move a step closer to having to make a decision: Do I play or pay? This Employer mandate under Patient Protection and Affordable Care Act (PPACA) does not apply to smaller groups under 50 FTE (full time equivalent) employees. Many small groups such as food service industry, retailers, construction etc. in fact have many FTE and while they may work minimal hours can trigger the “pay or play” mandate.

The IRS has released recently guidance published in the form of a Notice of Proposed Rulemaking (NPRM), addresses a number of issues tightly linked to an array of practical considerations related to the employer mandate. These include defining a “large employer,” determining “full-time” status for employees, clarifying the meaning of “dependents,” and determining what constitutes “affordable” coverage.

The guidance also tackles several stickier questions such as how and whether to count foreign or seasonal workers, as well as how to calculate the full-time status of employees who work unusual hours, such as teachers or airline pilots.

Three safe harbors relating to the provision of “affordable” coverage to employees in order to avoid exposure to the mandate penalties are also included in the guidance. Transition relief is offered in recognition of certain employers’ needing time to bring their plans into compliance.

Still, there are several regs that the IRS is awaiting commentary and resolution on due on March 18, 2013.

A Q&A summary of the rule has been released by the IRS and is available by clicking here.

Some employers assert that the play-or-pay mandate will raise their costs and force them to make workforce cutbacks. As a result, a number are considering eliminating their health care coverage altogether and instead paying the penalty on their full-time employees. While the “pay” option might be worth considering, there are strong reasons why employers should look carefully at all of their options and do their best to calculate the actual outcomes of each.

Other Key Issues Addressed in the Proposed Rules

Additional issues addressed in the proposed regulations include:

- Determining which employers are subject to the “pay or play” requirements;

- Determining who is a full-time employee, including approaches that can be used for employees who work variable hour schedules, seasonal employees, and teachers who have time off between school years;

- Determining whether coverage is affordable and provides minimum value; and

- Calculating the amount of the penalty due and how the penalty will be assessed.

When conducting a cost-benefit analysis, the key tax issues the employer should consider are:

- Employer Tax Penalty for Not Offering “Qualified” Group Health

- Not applicable for employers with less than 50 FTEs

- $2,000 penalty per full-time employee (minus 30 employee credit)****

- Employer Tax Penalty for Offering “Qualified” Health That is Not “Affordable”

- Not applicable for employers with less than 50 FTEs

- $3000 per employee receiving subsidy

Example:

Jungle Corp. has 100 full-time employees and is a leader in its market, using a talent differentiation strategy. Jungle’s family coverage costs $15,000, of which employees pay $3,000. Bob Smith, a highly skilled worker with a strong performance record, earns $50,000 and has family coverage through Jungle’s plan.

On Jan. 1, 2014, Jungle Corp. announces it is dropping its group health plan coverage and will instead pay the $2,000-per-full-time-employee penalty. On Jan. 2, Bob walks into HR and asks about receiving replacement compensation for the $12,000 that the business had been paying toward his family coverage.

Wanting to retain Bob in accordance with its strategy of maintaining market leadership with an experienced workforce, Jungle offers him another $12,000. But clever Bob points out that his share of Social Security and Medicare payroll (FICA) taxes will take a bite out of that $12,000, as will federal and state income taxes, so the HR manager agrees to make good on those amounts as well. Of course, the company will also have to pay its share of FICA taxes on Bob’s additional compensation. As a result, instead of paying $12,000 toward Bob’s family coverage using pre-tax dollars, Jungle Corp. now finds itself paying an additional:

- Bob’s salary adjustment: $14,500

- Employer’s share of FICA taxes: $1,109

- Excise tax (penalty): $2,000

———————————- - Total: $17,609

(versus $12,000 currently)

Similar per-employee costs will be reflected across the company’s workforce. A move that seemed like a no-brainer, the consequences could make you look silly.

For More Information

Due to the complexity of the law in this area, and the absence of finalized guidance, employers are strongly advised to review their benefit plans to prepare for the changes ahead. Additional information regarding the penalty is featured on our Employer Shared Responsibility page.

Ask us about our Health Care Reform Compliance Audit Assessments. See Health Care Reform Timeline and Preparing for Reform by UHC.

In the coming months, Millennium Medical Solutions Inc will host seminars and will share information you’ll need to know as the countdown continues to October 1st. Please contact us for immediate information on how to implement these initiatives for your group-specific needs at info@medicalsolutionscorp.com or Call (855) 667-4621.

by admin | Nov 12, 2012 | Health Care Reform, Health Exchanges, Individual Exchanges, PPACA, SHOP Exchanges, Small Business Group Health, State Exchanges

Crains Brokers’ Commissions Face Uncertain Future. A quick comment on our quote in Crains “Crains Brokers’ Commissions Face Uncertain Future” today. Insurers are indeed cutting back on services resulting in cost containement measures such as layoffs, outsourcing and significant broker commissions cuts.

A significant negative development is the NYS decision to not allow licensed Agents/Brokers in the Individual Exchange. Many States such as Massachusettes, the inspiration for Health Care Reform, use a Connector which is an Exchange or an independent state agency that helps Massachusetts residents find health insurance coverage and avoid tax penalties. Instead NYS will allow Agents/Brokers to only work in the Commercial Exchange known as SHOP. HealthPass is a good pre-cursor of the SHOP Exchange offering Small Businesses a Defined Contribution Health Plan of full options form Health Insurance, Dental, Vision to Term Life Insurance and Disability.

The Individual Exchange will work with an “Assitor” or “Navigator”. In NYS Government and Non-Profit Agencies will comprise the “Navigator” which will only be allowed to operate in the Individual Exchange. By design an income subsidy will only pass through this Individual Exchange an not on the SHOP Exchange. Example: a $50,000 Family Household of 4 can get approximately 80% credited.

The Federal Gov has already spent $2.2 Billion on State Exchanges. And this figures does not include remaining States as there are only 19 States working on an Exchange for 2014. The Exchanges will be built up for 2 years and then must be fully independent by 2016. If 88% of small groups coverage purchased by Brokers acc. to Bostons Wakely Report in research study- Role of Producers and Other Third Party Assisters in New York’s Individual and SHOP Exchanges the distribution infrastructure is already there. Access to care is not the difficulty in finding a plan its the very cost of the plan! Why then does NYS decide to spend on building up new infrastructures? AgentsBrokers can easily outreach and council to uninsured as well. In fact many small businesses such as construction, consulting services and dining have many uninsured that an Agent/Broker already has a relationship with.

Despite all this and the rapid changes in reshaping health care we remain optimistic and look forward to taking on a greater role in health care reform.

With more choice, our groups and their employees will need more direction, allowing brokers to take on more of a consultative role. Healthcare plans are not a simple purchase and one plan doesn’t fit all. By delivering the latest cutting-edge benefits technologies, continued consumer focus approach and leveraging our long time relationships with Benefits/HR/Payroll partners our role will be pivotal in being part of the solution.

Pulse Nov 2012 Quote MMS