![NYS Legislation Action Alert]()

by admin | Nov 17, 2009 | group health insurance, NY News

NY State is trying to tack on additional taxes on health insurance. They’ve already quietly added a sales tax for the 1st time earlier this year.

NY State is trying to tack on additional taxes on health insurance. They’ve already quietly added a sales tax for the 1st time earlier this year.

According to NY POST Article NY eyes $1B tax slap on health

“I STRONGLY OPPOSE ANY ADDITIONAL HEALTHCARE TAXES OR HEALTH INSURANCE ASSESSMENTS AS PART OF THE DEFICIT REDUCTION PLAN (DRP), SINCE THIS WILL RAISE HEALTH INSURANCE PREMIUMS FOR CONSUMERS”

Here’s a list of officials and legislators to contact with the simple message above:

Executive Chamber:

Governor David Paterson – (518) 474-8390

Lt. Governor Richard Ravitch – (518) 474-4623

Senate Leadership:

Senator John Sampson (Democratic Conference Leader) – (518) 455-2788

Senator Carl Kruger (Finance Committee Chair) – (518) 455-2460

Senator Tom Duane (Health Committee Chair) – (518) 455-2451

Senator Neil Breslin (Insurance Committee Chair) – (518) 455-2225

Upstate Senate Caucus:

Senator David Valesky (Vice President Pro Tem) – (518) 455-2838

Senator Darrel Aubertine – (518) 455-2761

Senator William Stachowski – (518) 455-2426

Senator John DeFrancisco (Finance Committee Ranker) (518) 455-3511

Long Island:

Senator Craig Johnson (518) 455-2622

Senator Brian Foley (518) 455-2303

Senator Dean Skelos (Minority Leader) (518) 455-3171

Hudson Valley:

Senator Suzi Oppenheimer (518) 455-2031

Assembly Leadership:

Speaker Sheldon Silver (518) 455-3791

Assemblymember Denny Farrell (Ways & Means Chair) (518) 455-5491

Assemblymember Richard Gottfried (Health Comm. Chair) (518) 455-4941

Assemblymember Joseph Morelle (Insurance Comm. Chair) (518) 455-5373

![NYS Legislation Action Alert]()

by admin | Nov 4, 2009 | Health Care Reform

Share this site on other social networks.

As a member of the WellPoint Health Action Network,www.healthactionnetwork.com, I am writing to encourage you to join as well. The U.S. needs a strong, sustainable health care system. As a nation, we must take thoughtful steps that preserve what is best about American health care, while also working to extend coverage to the uninsured. Through the Health Action Network, I am able to stay informed about the ongoing public policy discussions on health care. The organization’s website also provides tools that make it easy for me to communicate with elected officials about health care issues. There is no cost to join and participate. Health care is critically important to all of us. Please visit the Health Action Network, www.healthactionnetwork.com, and join me in supporting public policies that will make our nation’s health care system stronger. Thank you.

![NYS Legislation Action Alert]()

by admin | Nov 2, 2009 | latest health insurance news, Uncategorized, United Healthcare

Health Care Reform!

Americans woke up earlier today to the new Health Care Reform House Bill, “Affordable Health Care for America Act. HR 392”, which completes an important 1st step of 3 stages of a final bill. While I didn’t quite make it through the 1990 page there are couple of items that stood out.

According to The Associated Press the Congressional Budget Office concludes that the public option might actually cost consumers more than private coverage. The bill is expected to fetch close to $1 trillion dollars over 10 years. However, the bill could lead to $104 billion net reduction in deficit by spending cuts, revenue raisers and other bill provisions.

- The bill would create a Health Insurance Exchange system that individuals could use to buy health insurance from private insurers and government-run plans.

- The bill also would provide incentives for the creation of nonprofit, state-based health insurance cooperatives.

- The public option plans would have to negotiate their own rates with providers, rather than using the ultra-low Medicare rates.

- Individual responsibility: A “shared responsibility” section that would take effect in 2013 and covers both individuals and employers. The max tax for individuals would be either 2.5% of persons AGI or cost of average health insurance premiums.

- Employer responsibility: would impose a tax equal to 8% of employee wages on employers over a minimum size that failed to provide health coverage. The payroll tax would be lower for employers with $500,000 to $750,000 in payroll, and 0% for employers with less than $500,000 in payroll costs.

- Forbid plans from basing premiums or denials of care on factors such as pre-existing conditions, race, or gender.

- Close the Medicare Part D prescription drug program “doughnut hole”.

- Provide “affordability credits” to help individuals and families who meet income requirements pay their health insurance premiums, and provide health insurance subsidies for small businesses.

- Require the secretary of Health and Human Services to negotiate drug prices on behalf of Medicare beneficiaries.

- Expand Medicaid.

How will this be paid for? The new costs would be paid for according House Democrats by “making Medicare and Medicaid more efficient, imposing 5.4% tax surcharge on individuals with adjusted gross incomes over $500,000 and married couples with adjusted gross incomes over $1 million; and adopting other tax measures.”

Our reaction is that without a greater focus on health care costs, families and employers will not be able to afford coverage. Health care has tripled in a span of 15 years since 1984 to over $2 trillion and is expected to increase to $3.1 trillion by 2012. Most uninsured have programs available that were absent when I was growing up. You can still be middle class and qualify for state subsidies. Example for NYS is Healthy NY for small businesses and sole prop. as well as Family Health Plus and Child Health Plus.

In the absence of tort reform, however, and an expected 21% reduction in Medicare reimbursement this will negatively affect providers. In speaking with our client physician groups and national polls this could lead unintended consequences such 25% retirement and reduction of new physicians. Could this lead to more prescribing privileges and responsibilities for Physician Assistants, Nurses and Pharmacists?

Malpractice costs account for only 1% of spending but this leads to another estimated 9% is for “defensive medicine”. According to JAMA– “Defen

sive spending is described such as ordering tests, performing diagnostic procedures, and referring patients for consultation, was very common (92%). Among practitioners of defensive medicine who detailed their most recent defensive act, 43% reported using imaging technology in clinically unnecessary circumstances. Avoidance of procedures and patients that were perceived to elevate the probability of litigation was also widespread. Forty-two percent of respondents reported that they had taken steps to restrict their practice in the previous 3 years, including eliminating procedures prone to complications, such as trauma surgery, and avoiding patients who had complex medical problems or were perceived as litigious. Defensive practice correlated strongly with respondents’ lack of confidence in their liability insurance and perceived burden of insurance premiums.”

The issue of private competition is a big factor. According to Kelly Loussedes, of National Association of Health Underwriters, “By injecting more competition into the insurance market, this might seem like an intelligent way to lower overall health care costs. A “public option” would simply shift health care costs onto private payers — and undermine the private insurance system”. We question how real the private sector can compete with a public plan

however, well intentioned it may be.

In addition, most uninsured in progressive states such as NY are young people who elect not to pay now, illegal residents and people who earn over $50,000 but decide to opt out. The issue how strong is the requirement for individuals to participate? If its like Massachusetts with only a $1500 penalty or not enforced then this creates actually much more costs.

According to Mark Wagar President of Empire Blue Cross, “fewer businesses and individuals purchase private coverage and enrollment shifts to high cost Medicaid coverage, further increasing State funding burdens. In turn, too many people delay needed services, resulting in increased costs for urgent care for hospitals and physicians when care becomes critical.” He goes on to say that in NYS where the non group individual market is unaffordable now “The presence of an effective mandate – alone – would reduce the cost of individual coverage in New York by

over 60 percent and enroll 8 times as many New Yorkers in coverage than today because of improved affordability.”

Progressive countries such as Denmark and France have actually moved to private sector. According to our client Lisa Halpern of Euro Center USA , which works with a Danish travel insurance company for expatriates, “Denmark’s public single payer system had to include the private sector starting more than 20 years ago. This has become increasingly popular in recent years because the public had trouble accessing physicians without longer waiting times, diagnostics and private hospitals. The Private Insurance has also benefitted as a tax deduction for private companies offering additional health insurance.”

We support taking steps to lower costs as mentioned in prior newsletter

such as negotiating with drug manufacturers and implementation of healthcare cooperatives. On the other hand, we are wary of moving

too quickly on this road of reform and leading to unintended consequences. As debate and legislation is clarifying that a public option is a probability we are concerned if this will lead to big government, wasteful spending, higher taxes and the specter of no private sector.

As the saying goes the madness is in the details. As a fellow business owner we ask that you join us in staying active with your local chamber, legislative rep., editorials and social media forums on this road to reform. We have included some helpful links below.

Get Health Care Right!

Facebook Share

Message to your Senator

by admin | Oct 20, 2009 | Uncategorized

The Office

Be wary of the term “accidents happen” by an insurance rep as this can be easily mistaken for a threat.

A great laugh in challenging economic times.

by admin | Oct 19, 2009 | Uncategorized

This NY Times Op-Ed by David Brooks is what I mean by when discussing healthcare we need to discuss together the troika – healthcare, tort reform and military spending. Each one represents an incredible beaurocracy and big business with only the strong willed ready to tackle.

We think it’s still 1950s Americana and we can have it all. The very reason Europe can afford rich social, health and educational program is because we are de fatco their military protectors. Imaginge the kind of healthcare we can afford if suddenly 20% were freed up?

by admin | Aug 17, 2009 | COBRA, Dependent Coverage, family health insurance, group health insurance, latest health insurance news, Pharmaceutical Industry, regional health insurance co-ops

Health Care Reform!

Ok so unless you’ve been stuck in the Arctic for a year you’ve been hearing a lot about this heated topic. Everyone has strong feelings about it evidently, I myself included, but I have stayed away from the fray for the most part.

As congress takes their August recess and those who still have jobs are on vacation I thought its a good time to put my two cents into it.

This well done score card brought to you by Empire Blue Cross is a great illustration of the leading proposals and voices in Washington. A nicely published overview by the Lewin Group is actually a great read on the proposed Government Sponsored Health Plan. The analysis covers the bill as it appeared on July 15, 2009.

Bills Key Provisions:

- Require all Americans to purchase health insurance or be fined, although those making less than $88,000 annually would be able to get a subsidy.

- Get rid of copays and deductibles for preventative care

- Make it illegal to deny coverage for pre-existing conditions

- Create a public plan

- Raise taxes for the wealthy – as much at 5.4 percent for incomes above $350,000

But what are we really talking about? A Government Plan to compete with private payers? Really?

The assumption in the study is that the government plan pays Medicare Rates. Provider reimbursements are on average 70% of private insurance reimbursements. The specter of physicians opting out of this plan is rather daunting as they would be giving up the single largest payer.

How does a private insurer compete with a government plan? Imagine a Government-owned subsidized Automobile competing with private companies? Would they not print more tax payer money and pump them up? Oh wait that’s already happened in Detroit, bad example.

The President claims that a government plan does already work and its name is Medicare. Yet, Medicare we are also told will go broke as early as by 2018 reported by Washington Post. Medicare, meanwhile, now pays private insurers to take care of seniors under the Medicare Advantage Plans. It is cheaper for the government to do this than to manage it themselves

As brokers, we work with the AARP Oxford Secure Horizons Program where some plans are $0 premium and include a fairly sizable network.

So which one is it? Does the Medicare plan work now and is proof of what’s to come or is it costly and inefficient and unsustainable?

Clearly the costs are indeed high and I question what insurers are thinking with some of the rate increases. This year, especially, I’ve seen increases of over 20% from the top carriers.

Speaking of Medicare, the Part D Plan in 2003 was just a gift to the Pharmaceutical industry’s under the Bush administration. Many people didn’t realize that the language used barred the U.S. from negotiating drug pricing. How can Canada with an entire population of 33 mill pay 50% on the dollar while 40 million US seniors pay full retail? Coincidentally, the legislators of Medicare Part D earned themselves nice cushy paying Pharmaceutical jobs within 1 year.

Obama has easily gotten concessions from Big Pharma, Insurers and the AMA (provided there is tort reform) already and I applaud him for it. There probably is even more good news to come on this.

What may be an interesting possible outcome are Regional Health Insurance Co-ops. These are a bridge between government and non-government options. The co-op alternative, led by Sen. Kent Conrad (D-ND), continued to gain traction on both sides of the aisle. The plan would call for the creation of nonprofit health cooperatives in lieu of public health insurance options. Said Sen. Baucus, “.The Conrad approach has got legs…it’s quite viable.”

On the House side, Rep. Roy Blunt (R-MO), chairing the Health Care Solutions Group, released an alternative to the House Democratic plan that he “hopes will receive bipartisan support.”

An example of this is GroupHealth in Washington State. “At Group Health, doctors are rewarded for consulting by telephone and secure e-mail, which allows for longer appointments. Patients are assigned a team of primary care practitioners who are responsible for their well-being. Medical practices, and insurance coverage decisions, are driven by the company’s own research into which drugs and procedures are most effective.” A good piece in last months’ NYT. discusses this.

There are many versions of this and perhaps there ought to be Federal provisions and overall guidelines but with regional flexibility afforded to each state. This topic requires further discussion and I will tackle it next month.

Enjoy the rest of your summer!!!

by admin | Aug 7, 2009 | COBRA, Dependent Coverage, family health insurance, group health insurance, individual health insurance, latest health insurance news, NY News

As expected, Governor David Paterson has signed 3 of his healthcare reform proposals into law, to wit:

S.5471 (Breslin) / A.8400 (Peoples) – extends state mini-COBRA from 18 to 36 months. Effective date is July 1, 2009 and shall apply to all policies and contracts of insurance issued, renewed, modified, altered or amended on or after such date.

S.6030 (Breslin) / A.9038 (Morelle) – allows for dependent care coverage of children up to 29 years of age. Effective date is September 1, 2009 and shall apply to all policies and contracts of insurance issued, renewed, modified, altered or amended on or after such date.

S.5472-A (Breslin) / A.8402-A (Morelle) – HMO reform act. Various effective dates depending upon the specific provision of the bill.

Here’s a link to the Governor’s Press Release announcing the same:

Article in Newsday – “New state law eases medical coverage for 20-somethings”

by admin | Aug 4, 2009 | Social 2.0, Twitter

In my few moments of writers block (procrastination) last month I’ve been experimenting with the effect of Twitter’s microblogging. What have I learned? The primary thing that you need to know is that the world of Twitter is wide open to new participants, whether individuals or companies.

In my few moments of writers block (procrastination) last month I’ve been experimenting with the effect of Twitter’s microblogging. What have I learned? The primary thing that you need to know is that the world of Twitter is wide open to new participants, whether individuals or companies.

Thanks to the  Apple guys at The Westchester Store enclosed below are neat Twitter links and resources.

Apple guys at The Westchester Store enclosed below are neat Twitter links and resources.

www.twitter.com – This is the main site where you can go to sign up for a

free account.

www.twendz.com – This is the site that allows you to judge positive and

negative comments about a product.

www.twistori.com – This website is the art project that follows peopleʼs

emotions in real time.

www.twitcam.com – This website allows you to do a live video stream and

connects through twitter.

www.twitterbackgrounds.com – download free wallpapers for your twitter

homepage. also you can buy custom wallpaper here as well.

www.bit.ly – is a link shortening service that allows you to shorten URLs that

you tweet to your followers.

www.exectweets.com – a webpage that aggregates the tweets of business

people.

http://bit.ly/lyhlL – this is a shortened link bringing you to a great guide for

beginning work with twitter.

www.iconfactory.com – Here you can download the program Twitterific for

your computer. An excellent Twitter client for your mac.

http://wefollow.com/ – directory of Twitter users organized by interests

![NYS Legislation Action Alert]()

by admin | Jul 31, 2009 | group health insurance, healthcare

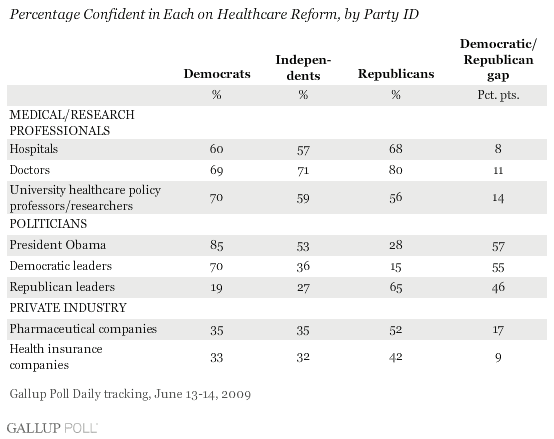

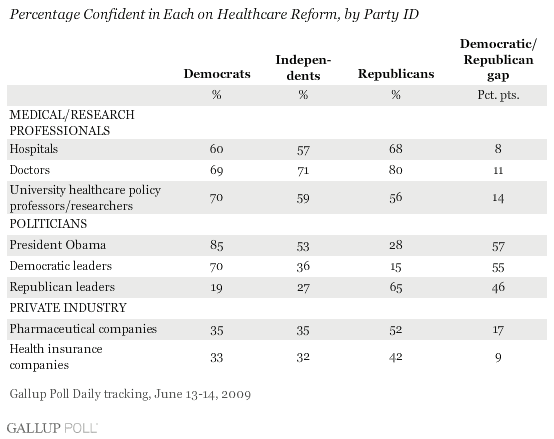

Not surprisingly the Gallup Poll shows that Americans generally will trust their healthcare professional over the politicians. If Pharmacists have long been considered the #1 trusted profession than there is natural inverse relationship with Pharmaceutical Industry ranked slightly ahead of insurers and a bit higher than used car salesmen.

Another no surprise is strong partisanship as The Democratic leadership had the confidence of 70% of Democrats, 36% of Independents and only 15% of Republicans. The Republican leadership had the confidence of 65% of Republicans, 27% of independents, and just 19% of Democrats.

With the AMA’s non-endorsement then endorsement but with tort reform caveat its not hard to see why American have been lukewarm to a Government Health Plan, see

Zogby.

by admin | Jul 21, 2009 | group health insurance, Health Net, latest health insurance news, United Healthcare

More mergers and less options yet we focus on telecommunications company antitrust.

See Article

UnitedHealthcare signed a definitive agreement to acquire Health Net of the Northeast’s licensed subsidiaries and obtain rights to renew membership in Connecticut, New York and New Jersey. UnitedHealthcare broadens choice and access to quality care with one of the largest local and national networks, robust clinical programs and a full range of affordable products.

by wpengine | Apr 27, 2009 | Uncategorized

Welcome to WordPress. This is your first post. Edit or delete it, then start blogging!

![NYS Legislation Action Alert]()

by admin | Mar 9, 2009 | latest health insurance news

Millennium Medical Solutions in the News: We were quoted in last issue’s CNN/MONEY article on “Health Care: The hidden business killer”.

Health care, in general, is the 2nd or 3rd largest cost of doing business and clients have been taking numerous steps to rein in costs. It is in these financially challenging times that we are troubled by the wisdom of possibly passing a NYS sales tax surcharge of 3%. The following recent print and audio interview with President of Empire Blue Cross, Mark Wager, was discussed at last Monday’s legislative budget hearings on health care and Medicaid.

Health care heavyweights from all across the state met before legislators today to warn them what will happen to their industry if cuts are made. The governor’s proposed budget slashes nearly $2.5 billion from health care alone. Randy Simons breaks down what this means for your coverage and also for the treatment that you receive.

![NYS Legislation Action Alert]()

by admin | Mar 9, 2009 | COBRA, healthcare

The American Resources and Recovery and Reinvestment Act of 2009 was signed into law by President Obama February 17th. Under the Act, certain individuals who are eligible for COBRA continuation health coverage, or similar coverage under State law, may receive a subsidy for 65 percent of the premiums for themselves and their families for up to nine months.

The American Resources and Recovery and Reinvestment Act of 2009 was signed into law by President Obama February 17th. Under the Act, certain individuals who are eligible for COBRA continuation health coverage, or similar coverage under State law, may receive a subsidy for 65 percent of the premiums for themselves and their families for up to nine months.

Click on the link below for detailed information on the American Recovery and Reinvestment Act of 2009 which went into effect February 17, 2009

http://www.dol.gov/ebsa/cobra.html

These individuals are required to pay only 35 percent of the premium.

The employer may recover the subsidy provided to assistance-eligible individuals by taking the subsidy amount as a credit on its quarterly employment tax return. The employer may provide the subsidy – and take the credit on its employment tax return – only after it has received the 35 percent premium payment from the individual.

To qualify, a worker must have been involuntarily separated between Sept. 1, 2008, and Dec. 31, 2009. Workers who lost their jobs between Sept. 1, 2008, and enactment, but failed to initially elect COBRA because it was unaffordable, get an additional 60 days to elect COBRA and receive the subsidy.

This subsidy phases out for individuals whose modified adjusted gross income exceeds $125,000, or $250,000 for those filing joint returns. Taxpayers with modified adjusted gross income exceeding $145,000, or $290,000 for those filing joint returns, do not qualify for the subsidy.

On February 26, the Internal Revenue Service released its first round of information for employers to use in administering the new subsidy program. Included are the subsidy reporting form, instructions and a very detailed questions-and-answers piece. The Department of Labor is still working on model notices and other guidance for release by March 17.

by admin | Jan 21, 2009 | group health insurance, United Healthcare

UnitedHealth announces class-action settlement.

In conjunction with the suit from last week, United announced this yesterday. They have set aside $350 million dollars to fund the settlement for members who had used out of network providers dating back to 1994. If a member is eligible they will be notified by a form approved by the court.

by admin | Jan 21, 2009 | group health insurance

Obama Healthcare Reform Promises

HealthDay (1/20, Pallarito) reported, “Early indications now suggest that, despite an ailing economy — or perhaps because of it,” President Barack Obama “is resolved to keep his promise” to reform healthcare. He was praised for “his nomination of former South Dakota Sen. Tom Daschle to serve as Secretary of Health and Human Services,” who “is thought to have a solid grasp of health policy.” In addition, Obama has crafted “an economic stimulus plan that positions healthcare as a cornerstone of financial growth and recovery.” He has proposed “allowing Americans who can’t get insurance through employer plans or Medicaid/SCHIP to purchase insurance through a national health insurance exchange,” and “to expand eligibility under Medicaid and the State Children’s Health Insurance Program (SCHIP).” In addition, last week, the House “voted to reauthorize and expand SCHIP.”

HealthDay (1/20, Pallarito) reported, “Early indications now suggest that, despite an ailing economy — or perhaps because of it,” President Barack Obama “is resolved to keep his promise” to reform healthcare. He was praised for “his nomination of former South Dakota Sen. Tom Daschle to serve as Secretary of Health and Human Services,” who “is thought to have a solid grasp of health policy.” In addition, Obama has crafted “an economic stimulus plan that positions healthcare as a cornerstone of financial growth and recovery.” He has proposed “allowing Americans who can’t get insurance through employer plans or Medicaid/SCHIP to purchase insurance through a national health insurance exchange,” and “to expand eligibility under Medicaid and the State Children’s Health Insurance Program (SCHIP).” In addition, last week, the House “voted to reauthorize and expand SCHIP.”

“Reform advocates have largely fallen in line with Obama’s call for a health system overhaul, based on the use of electronic health records, new and expanded government programs and payment reform,” Modern Healthcare (1/21, DoBias) adds. And, Congress is expected to approve “about $100 billion in healthcare funding, the lion’s share going to a boost in the federal government’s share of Medicaid” as part of the stimulus package.

Obama mentions medical costs, health IT in his inaugural address. In the Wall Street Journal (1/20) Health Blog, Sarah Rubenstein wrote that “during President Obama’s inaugural address to the nation,” he mentioned healthcare twice. First, there “was an acknowledgement of the expense of healthcare in a long list of woes the nation faces.” She quotes Obama as saying, “Our healthcare is too costly; our schools fail too many; and each day brings further evidence that the ways we use energy strengthen our adversaries and threaten our planet.” Then, when he discussed “how the U.S. can ‘lay a new foundation for growth,'” Obama stated, “We will restore science to its rightful place, and wield technology’s wonders to raise healthcare’s quality and lower its costs.”

by admin | Jan 16, 2009 | healthcare, Pharmaceutical Industry

GENERIC VERSUS BRAND NAME MEDICATIONS

GENERIC VERSUS BRAND NAME MEDICATIONS

Many people have heard that switching to a generic medication will save them money. One of the questions we hear most often is, “How do generic medications compare to their brand name counterparts?” Knowing the facts about generics versus brand names can help make us all better consumers.

All generic drugs are reviewed and approved by the United States Food and Drug Administration (FDA) or in other countries, by an equivalent federal regulatory body. The regulatory boards all require that generic drugs have the same active ingredients, quality, strength, purity, and stability as brand name drugs. They also must have the same dosage form, whether you swallow it (pill/tablet/capsule/caplet), drink it (liquid), or inject the medication.

Many people are concerned that because generic drugs are often much cheaper than the brand-name versions, the quality and effectiveness have been compromised to make a less expensive product. The FDA requires that generic drugs be as safe and effective as the original brand name drugs. Generic drugs are copies of brand name drugs that have exactly the same dosage, intended use, effects, side effects, route of administration, risks, safety, and strength as the original drug. In other words, the pharmacological effects of generic medications are exactly the same as those of their brand name counterparts. Another common myth is that generic drugs take longer to work. The FDA requires that generic drugs work as fast and as effectively as the original brand name products.

Generic drugs are cheaper because the manufacturers do not have the expense of developing and marketing a new drug. When a company brings a new drug to the market, the firm has already spent substantial money on research, development, marketing and promotion of the drug. A patent is granted which gives the company that developed the drug exclusive rights to sell the drug for as long as the patent remains in effect.

As a patent nears expiration, manufacturers may apply to the FDA for permission to make and sell generic versions of a drug. Since there are no startup costs for development of a new drug, other companies can afford to make and sell it for a less expensive amount. When multiple companies produce and sell a drug, the competition drives the price down even further.

The FDA applies the same standards for all drug-manufacturing facilities. Many companies manufacture both brand name and generic drugs. In fact, the FDA estimates that 50% of the generic drugs are produced by the same company that created the initial brand name drug.

Generic versions of drugs have different colors, flavors, or combinations of inactive ingredients than the original medications because United States trademark laws do not allow the generic drugs to look exactly like the brand name medication. However, the active ingredients must be the same in both generic and brand name medications, ensuring that both have the same effectiveness in treating a medical condition.

A physician’s decision to prescribe a brand name over a generic is based on the needs of the patient. Three in four physicians allow generic substitutes for brand-name drugs, even though most of them do not have a “dispense as generic” box on their prescription pad.

Pennsylvania law allows pharmacists to substitute generic drugs for original brand named drugs, unless the person writing the prescription, or the patient, directs otherwise. If the physician writes “Brand Necessary” or “Dispense As Written (DAW)” on the prescription, the pharmacist may not substitute the brand name medication with a generic alternative.

All patients are encouraged to discuss generic alternatives with their physicians prior to filling a prescription. The doctor and the patient should agree on the best course of treatment for any diagnosed medical condition.

A Guide to Legal Issues in Health Care: Prescription Drugs Retrived September 16, 2006 from http://www.upenn.edu/ogc/legal/pred.html Are Generic Medications the Same as Branded Counterparts? Retrieved September 16, 2006 from http://counsellingresource.com/medications/discount-drugs/generics.html COMMONWEALTH OF PENNSYLVANIA GENERIC DRUG EQUIVALENCY/SUBSTITUTION LAWS & REGULATIONS Retrieved September 16, 2006 from http://ecapps.health.state.pa.us/pdf/ddc/generic33.ps.pdf#search=%22pennsylvania%20drug%20dispensing%22How Physicians Feel About Prescribing Generics Retrieved September 16, 2006 from http://www.aarp.org/health/affordable_drugs/physiciansandgenericdrugs.html

Prescription Drugs – Generic vs Brand Name Retrieved September 16, 2006 from http://www.crossborderpharmacy.com/Canadian-Generics-vs-Brand-Name.htmlStoppler, MD, M., Generic Drugs, Are They As Good as Brand-Names? Retrieved September 16, 2006 from http://www.medicinenet.com/script/main/art.asp?articlekey=46204

by admin | Jan 16, 2009 | healthcare, HSA, NY News, Pharmaceutical Industry

Happy Holidays!

We are pleased to present the Winter issue of the MMS newsletter. As we enter 2009 we want include some timely information on year end tips, house cleaning and helpful articles.

As guidance for 2009, we are seeing various industry patterns. These are heady economic times and we remain cautiously optimistic with the new presidential administration. There are many proposed legislations on the table as well as free reports from PriceWaterHouse Cooper reports on what “Employers Want” and “9 Trends for 2009”.

We have seen recent consolidations with recent mergers between GHI and HIP to form EmblemHealth. Both non profits follow the Empire Blue Cross for-profit conversion of 5 years ago and covered in my blog.

Insurers such as Aetna, Empire and Oxford have been dropping Pharmaceutical Benefits Management companies and using their own resources instead. As self acting PBMs’ they can negotiate effectively by using their large numbers. This trend has not gone unnoticed by Pharmacy retailers such as CVS and Walgreens who must compete with mail order PBMs’.

Pharmaceutical Corps are bracing themselves for brand expirations on 80% of the most commonly prescribed drugs within 2 years. They have issued double digit rate increases while simultaneously manufacturing generics of their own drugs. This will make sense as generics average 1/4 the cost of brands. In fact, this will be a significant future cost saver as Rx have doubled in 10 years and represents over 25% of our insurance costs.

Insurers are saving members 20-40% by including value added discounts or reimbursements for gym membership, weight management programs, alternative medicine & holistic healing, vision, laser vision care, dental , hearing care and vitamins/natural supplements.

The technology investments will improve patient care and the public is already seeing early payoffs. Various online medical sites have helped inform patients and advocacy. Insurers such as Empire actually offer a $5 Copay to interact with one’s doctor online.

In addition, “consumer driven healthcare plans” are taking off as copays have risen. Its not unusual to find plans with specialist $50 copay. As a result our consumers have been re-evaluating whether it makes sense to self insure on rare items such as hoispiatls and surgeries. The HSA (health Savings Account) a model, especially the one form Aetna, has become actually a high end plan since the savings are significant enough to self insure and have universal coverage. The average PPO plan is $650/single while an HSA at $370/single only asks that you self insure on $1500. The invisible hand leading you say? Agreed!

Perhaps things will be more localized as hospitals have consolidated and have a virtual monopoly in LI and Bronx as an example. Insurers such as Oxford, Aetna and Atlantis already offer localized NYC plans which are 30% less expensive but have a limited NYC network.

Our agency has strived to be ahead of the curve and keep our clients within budget regardless. We have employed creative tools, personalized advise and latest technologies in the past and plan on adding to this model going forward. We thank you all for reading our material, referring us business and most of all believing in us!

Once again thank you and we wish you and your family a wonderful Holiday Season!

by admin | Jan 16, 2009 | Uncategorized

UnitedHealth announces class-action settlement.

The New York Times (1/16, B3, Abelson) reports, “The insurance giant UnitedHealth Group said Thursday that it had reached a $350 million deal to settle class-action lawsuits claiming it had underpaid patients and doctors.” The agreement resolves three suits against the insurer. The proposed settlement, however, is being contested by “one of the lawyers for the plaintiffs” who “says the money is not enough and has filed an objection with one of the judges overseeing the cases.” Nevertheless, the company stated that it is “confident the agreement will be approved by the court.” The company’s announcement comes two days after UnitedHealth “settled allegations from New York Attorney General Andrew Cuomo by paying $50 million and transferring to a nonprofit group its database that set the amount to be reimbursed when patients used doctors outside their network,” Bloomberg News (1/16, Goldstein, Freifeld) adds. UnitedHealth’s Ingenix subsidiary “maintains the out-of-network fee database to determine the ‘usual and customary’ fees.” The database is used by “hundreds of insurers,” according to UnitedHealth. Cuomo claimed that these insurers “used Ingenix’s ‘defective and manipulated’ database to set artificially low reimbursement rates.” The class-action suit against UnitedHealth “alleged that insurers lowered the data they contributed, which then helped them lower their payment obligations,” the AP (1/16, Murphy) notes. As a result, “doctors or other providers often billed patients for the difference.” According to the Chicago Tribune (1/16, Japsen), UnitedHealth stated that its agreement “contains no admission of wrongdoing.” The money is expected to “fund a settlement with health plan members and providers in connection with claims dating back to 1994.” In addition, Thursday’s agreement may “lead to settlements from other insurers” that used Ingenix as well. Minnesota’s Star Tribune (1/16, Yee) and the Minneapolis/St. Paul Business Journal (1/15, Stevens) also covered the story. Aetna agrees to $20 million settlement in reimbursement system probe. The AP (1/16) reports, “Health insurer Aetna Inc. said Thursday it will pay $20 million to help set up a database to calculate out-of-network medical payments in an effort to end a dispute with UnitedHealth Group Inc. over a system that allegedly passed more costs to plan members.” Working with the office of New York Attorney General Andrew Cuomo, Aetna is expected to “set up an independent public database,” as well as “a system to help plan members find out what they will have to pay out of pocket before they visit a doctor who is not part of Aetna’s network,” under the agreement. Earlier this week, Cuomo announced that UnitedHealth had agreed “to shut the database operated by its Ingenix subsidiary, which insurers use to help determine ‘reasonable and customary’ costs for claims for out-of-network physicians,” Bloomberg News (1/15, Freifeld, Goldstein) added. After conducting “an industrywide probe of out-of-network claims,” Cuomo determined that “the Ingenix database was rigged.” He contended that the “corrupted reimbursement system…took hundreds of millions of dollars from the pockets of patients nationwide.” Under UnitedHealth’s settlement, the insurer will “pay $50 million to fund a nonprofit entity to provide independent data on costs.” Dow Jones Newswires (1/16, Bray) also covers the story.

by admin | Sep 2, 2008 | family health insurance, group health insurance, individual health insurance, latest health insurance news

JD Power and Associates Ranks U.S. Health Insurance Companies

. Tags: Arizona, Benefits, BlueCross BlueShield of Alabama, BlueCross BlueShield of Arizona, BlueCross BlueShield of Florida, BlueCross BlueShield of Illinois, Coverage, Health Alliance Plan of Michigan, Health Insurance Companies, Health Insurance Study, Health Plans, Humana of Ohio, Humana of Texas, Insurance Study, JD Power and Associates, Kaiser Health Plan of California, Kaiser Health Plan of Colorado, National Health Insurance Plans, Utah, Wellmark BlueCross BlueShield of Iowa.

Always an advocate for business and consumers alike, JD Power and Associates has administered an insurance study for the last two years. The study measures member satisfaction among 107 health plans in 17 regions across the United States. They focus on seven key areas: coverage and benefits; choice of doctors; hospitals and pharmacies; information and communication; approval processes; claims processing; insurance statements; and customer service.

The 2008 National Health Insurance Plan Study included responses from over 37,000 members of large commercial health plans. To be included in the study, plans had to contain at least 250,000 members across all commercial products, excluding Medicare and Medicaid. They were ranked on 1,000-point scale.

And the winners are…

* Arizona and Utah region: BlueCross BlueShield of Arizona, 763 points

* California Region: Kaiser Foundation Health Plan of California, 755 points

* Colorado Region: Kaiser Foundation Health Plan of Colorado, 748 points

* East South Central Region: BlueCross BlueShield of Alabama, 759 points

* Florida Region: BlueCross BlueShield of Florida, 751 points

* Heartland Region: Wellmark BlueCross BlueShield of Iowa, 742 points

* Illinois and Indiana Region: BlueCross BlueShield of Illinois, 729 points

* Michigan Region: Health Alliance Plan of Michigan, 772 points

* Minnesota and Wisconsin Region: HealthPartners, 768 points

* New England Region: Anthem BlueCross BlueShield of Connecticut, 772 points

* New York and New Jersey Region: United Healthcare (New Jersey/New York), 749 points

* Northwest Region: Group Health Cooperative, 778 points

* Ohio Region: Humana of Ohio, 748 points

* Pennsylvania and Delaware Region: Highmark Blue Cross and Blue Shield, 784 points (** Highest score across all regions**)

* South Atlantic Region: Kaiser Foundation Health Plan of Georgia, 746 points

* Texas Region: Humana of Texas, 753 points

* Virginia and Maryland Region: CareFirst BlueCross BlueShield, 740 points

For more information on the JD Power and Associates Health Insurance Study, view their Press Release.

by admin | May 20, 2008 | Uncategorized

Greetings!

We are pleased to announce our 10th year anniversary this past March. Back in 1998, the average HMO was only $325/month with office copays at only $10. Then again, gas prices were $2.50, there was Monicagate saga, Google was just a neophyte startup, the Y2K looming as the world’s demise, Seinfeld was still funny, and the US dollar dominated.

At the time, I was working out of my home office wondering will I get a client before my unemployment checks run out? I was short on time and money for creating a web presence, organizing a marketing plan and seeking outside lending. I was way in over my head as they say.

Healthcare was volatile at the time with carriers shifting the costs burden onto businesses. I suppose nothing has changed in 10 years with the exception of less companies vying for our business as consolidation was abound. Since that time, Aetna bought U.S. healthcare which bought NYL Care and PruCare. Oxford almost went out of business, their stock dropping from $86 to $6 in a matter of weeks. Five years later United Healthcare bought out Oxford. Empire survived 9/11 but was bought by WellPoint 2 years later. The Blue Crosses stopped competing against each other with Horizon Blue Cross dropping out of NY and Empire leaving NJ.

At the same time, new players have entered the industry. Healthpass has become a great way for small businesses to offer multiple plan options and carriers and compete with larger corporations. Atlantis Health Plans has become a medical inflation controller with rates still below $300/month. There was no Healthy NY to offer state supplemented corporate plans. The online functionalities has also evened the playing field for small businesses by keeping costs down, reaching the end users quickly and carving market niches.

By being a small business ourselves, this experience has made us more in tune and sensitive to our client needs. We are batting virtually 100% with claim and billing disputes and help employers maximize their benefits while discovering market inefficiencies. Borrowing from Google’s creed, “don’t be evil”, has helped us grow to over 300 employer groups and over 3500 members strong.

We are proud of our achievements and have been awarded the industry’s 2008 NAHU Golden Eagle Award for outstanding sales & achievement. Last summer’s move to Armonk, NY has allowed us to merge with a long time Property & Casualty brokerage firm, Avanti Associates. This will give our clients competitive markets for building, auto, malpractice insurance, professional liability and workman’s comp that they may not have had.

What’s next? We are ramping up an HR Kiosk service from the existing “physician locator” and “forms warehouse” links on our website. Many of you have already been using these tools when shopping for the annual plan renewals. But what about offering an intranet like kiosk where your employees can view, for example, their Aetna medical and Oxford dental plans from on one site? Or having the ability to post HR policies on vacation days, COBRA information or 401k documents?

We’ve enjoyed our experience and learned a lot from challenges faced but we really learn the most from our clients at the end of the day. You are the reason we have been fortunate to be in business and we depend on your suggestions and referrals to sustain our business model. We offer many extra’s and help you stretch your healthcare dollars as a way of thanking you and hope to continue to grow as a valuable part of your business.

Finally, I want to congratulate my brother Jonathan on his recent marriage this past Valentine’s Day. Also, he has dedicated 5 years at MMS, Inc. and I owe him a world of gratitude for realizing many of the goals of the firm. He has distinguished himself from a young college grad to a marketing and accounts manager who runs everything from renewal proposals to managing the day to day nuts and bolts that makes the agency work.

Sincerely,

Alex Miller

by admin | Mar 27, 2008 | NY News

HIP and GHI merger. GHI and HIP have been working since 2005 on merging under a common parent, EmblemHealth, serving more than four million members across the tri-state area. As sister companies, GHI and HIP has continued to operate separately until they get NY State Approval. Affiliation is the first step as GHI and HIP begin the process of combining and integrating as they move toward an eventual merger. Existing group coverage will not change as a result of the affiliation. Over time, their stated mission is to will develop and make available an expanded range of cost effective products and new services to you and your employee’s. There have been a recent executive fall out of the changes and expect more to come. NY will be losing the last few non-profits left in the state. The state is running public forums to review this, see state insurance site on recent meetings. Will this be NY State politics as usual and allow political leaders to dole out the stock market gains for personal gains or will citizens stand to gain? Unlike our state, California took a long term view for the medical care of its citizens. They set up a non-profit with a mission that the Blue Cross conversion set up a fund of not less than $100 million to be spent on charitable activities in 1994 and not less than 40 percent of WellPoint stock ($1.2 billion) to be contributed to a newly formed foundation. Pataki on the other hand used 90% of the $1.1Billion Empire Blue Cross 2002 conversion for Mr. Rivera’s powerful 1199 Union. I’m sure that this did not harm his 2002 reelection campaign but I wish New Yorkers did as well as California. See article in NY Times for your consideration.

by admin | Mar 25, 2008 | Uncategorized

Today, march 25th, 2008 I will start a blog. Blogging has fascinated me as a way of sharing ideas with people. Unlike my website, I can quickly share topical points of interest, highlight links, and info on the local NY Healthcare market. In today’s age, I can’t imagine 2 more compelling topics than Gotham and Healthcare.

One day I stumbled upon http://www.techcrunch.com/, and immediately thought that I would enjoy creating my own healthcare blog.

My opinions are my own. I hope that I make readers think. I look forward to interacting with readers and seeing their perspectives. I have always learned more from clients in my line of work than any other source especially from physician groups.

Thanks for visiting my personal place to rant and pontificate.

The American Resources and Recovery and Reinvestment Act of 2009 was signed into law by President Obama February 17th. Under the Act, certain individuals who are eligible for COBRA continuation health coverage, or similar coverage under State law, may receive a subsidy for 65 percent of the premiums for themselves and their families for up to nine months.

The American Resources and Recovery and Reinvestment Act of 2009 was signed into law by President Obama February 17th. Under the Act, certain individuals who are eligible for COBRA continuation health coverage, or similar coverage under State law, may receive a subsidy for 65 percent of the premiums for themselves and their families for up to nine months.