Medicare Part D Employer Notice

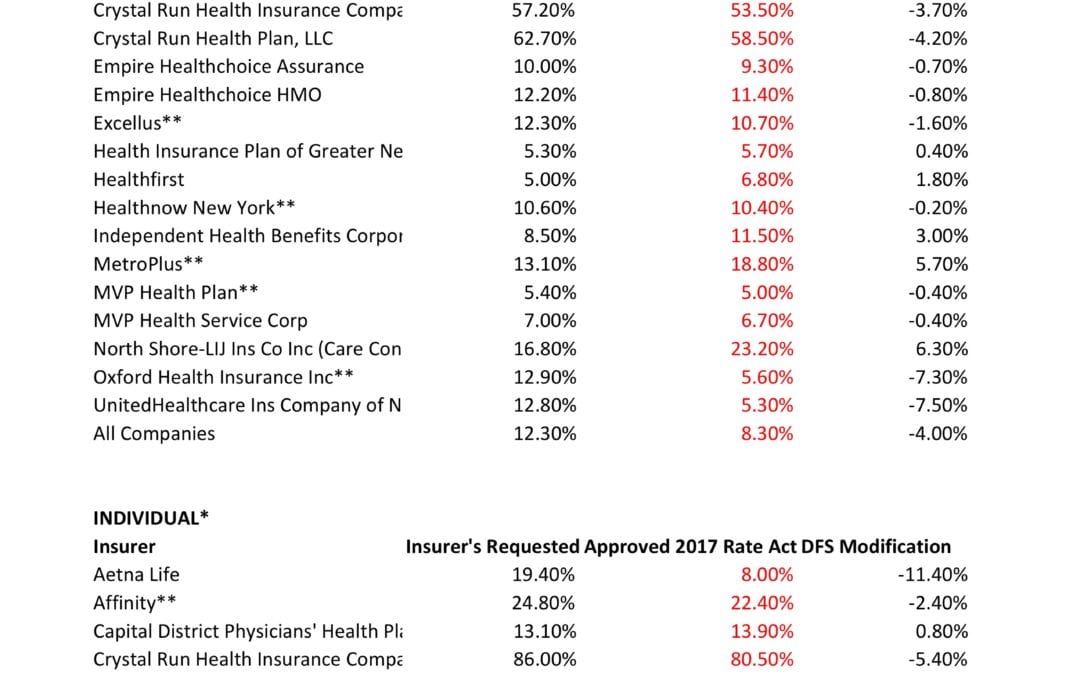

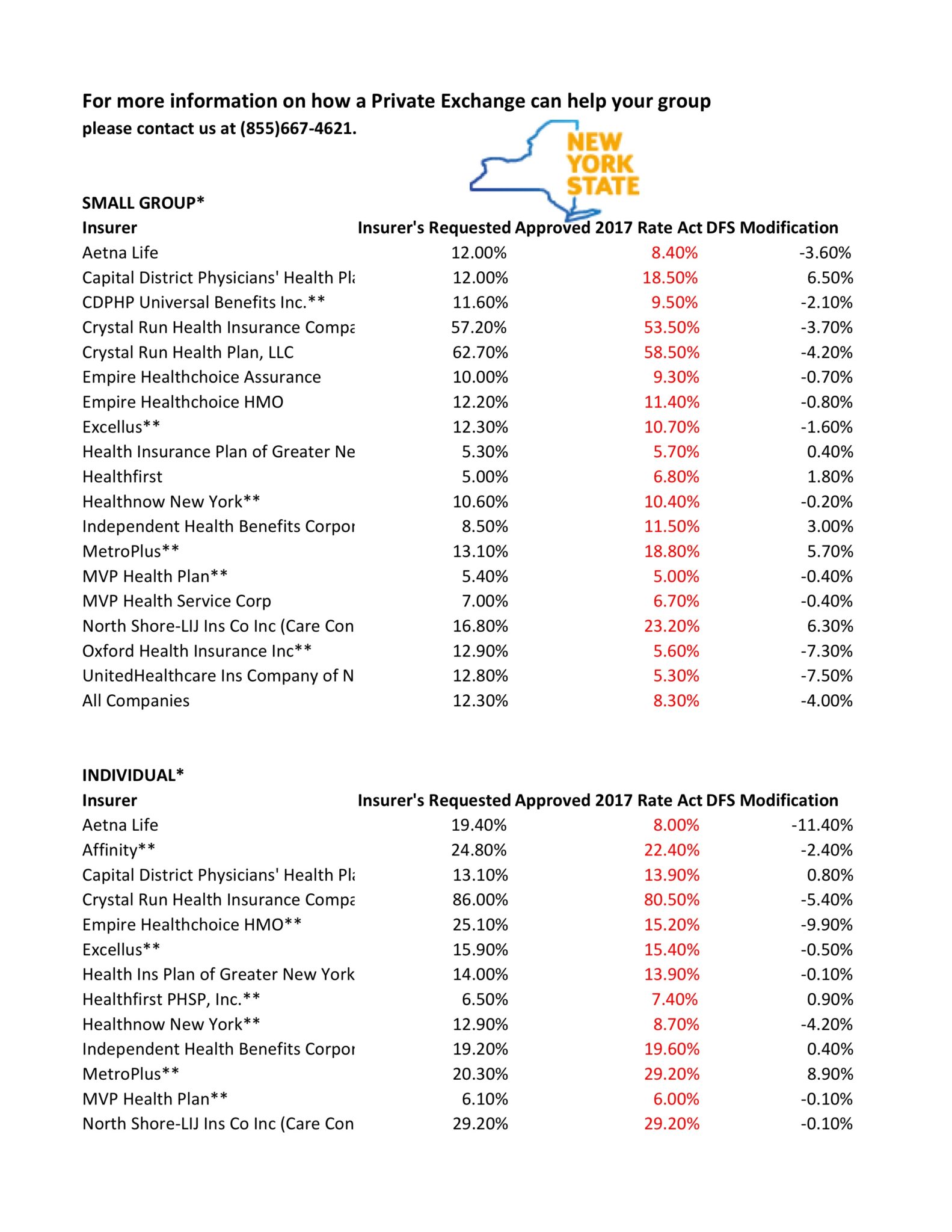

NYS has approved 2017 Final Rates. Small group rates will increase 8.3%, a reduction from the 12.3% average originally requested. In the individual market, the average increase will be 16.6%, a reduction from the originally requested 19.3%.

As per NY State Law carriers are required to send out early notices of rate request filings to groups and subscribers see original –NYS 2017 Rate Requests. With only 3 months of mature claims experience for 2016 health insurers’ requests are historically above average. Ultimately the State reduces this request substantially. This year, however, NYS acknowledged that medical costs increased, citing a 7-percent average increase on the individual market and an 8.5-percent increase on the small group market. The administration also acknowledged drug prices have impacted insurers, pointing specifically to blockbuster drugs for Hepatitis C.

The national rate trend, however, has been much higher than in past years due to higher health care costs Like other states throughout the nation, the 2017 rate of increase for individuals in New York is higher than in past years partly due to the termination of the federal reinsurance program. The lost of the program’s aka federal risk reinsurance corridor funds accounts for 5.5 percent of the rate increase.

How are neighboring States doing? In NJ, not that bad. According to a review of filings made public last week the expected rate increase will be likley ve half. Example: Horizon Blue Cross Blue Shield requested a 4.8% increase on their OMINA Plans. For CT market, on the other hand, things are much worse at least for individual marketplace with average 25% rate increases.

The new premium hikes ranged from as little as 5.6 percent for Oxford Small group to a whopping 58.5% percent increase for Crystal Run Health Insurance Company, an insurer that covers parts of the Hudson Valley and Catskills. Importantly, small group market are still more advantageous than individual markets unless one gets a sizable low income tax credit.

Overall, about 350,000 individual plan consumers will be affected by the price hike, while more than a million users will be hit by higher small group fees. Earlier this year, Blue Cross Blue Shield released a study showing Obamacare user costs were 22 percent higher than people with employer-sponsored health plans, while UnitedHealth plans to exit most Exchanges see – Breaking: Oxford Exits Metro Indiv & Oxford Liberty HMO 2017.

The correct approach for a small business in keeping with simplicity is a Private Exchange. This is a true defined contribution empowering employees with choice of leading insurers offering paperless technologies integrating HRIS/Benefits/Payroll. Both employee and employers still gain tax advantage benefits under the business. Also, the benefits, rates and network size are superior under a group plan as the risk are lower for small group plans than individual markets.

* All amounts are rounded to the nearest 1/10.

**Indicates that the company makes products available on the “New York State of Health” marketplace.

***After rate applications were filed on 5/9/2016, additional information, including the final results of the federal risk adjustment program, prompted several insurers to update their initially filed rates.

The Oxford Metro NetworkSM is a new network option available to businesses based in New York. The Oxford Metro

Network was developed specifically for the needs of New York employers and is made up of physicians and other health

care professionals in New York and New Jersey.

The Oxford Metro Network consists of over 30,000 physicians and 84 hospitals1 throughout the Oxford New York

service area.2 Members enrolled in an Oxford Metro Network plan will also have access to over 18,000 physicians

and 62 hospitals1 in New Jersey.

Yes, the Oxford Metro Network plan designs are available to both small and large group employers.

There are eight gated, in-network only plan designs. The same plan designs are available for large and small groups.

4. What license are Oxford Metro Network plans on?

Oxford Metro Network plans are written on the Oxford Health Insurance, Inc. (OHI) license.

5. Can we offer this product alongside other Oxford products?

Yes, you can offer Liberty and Freedom Network plan designs, which include plan designs that offer out-of-network

benefits, alongside Oxford Metro Network plan designs. To make it easier to offer these plans, we have updated our

Idea Management SystemSM (IDEA) tool. You can use it to enroll in up to three OHI plans.

If you wish to enroll in more than three plan designs, you must submit a completed paper application with the

required documents. Please refer to our New York Small Group Underwriting Guidelines for required documentation.

A complete copy of our New York Small Group Underwriting Guidelines may be found by logging in to the Employer

portal of oxfordhealth.com. From there, click on “Tools & Resources” and then “Forms” in the drop-down menu of

“Your Benefit Coverage” under the “Practical Resources” menu.

Enrollment is required in each plan design that is offered.

6. Do my employees have to live in New York to enroll in a product offered with the Oxford Metro Network?

No, employees do not have to live in New York to enroll in a product offered with the Oxford Metro Network as long

as they work for a New York-based company and live in New York or New Jersey.

7. Is there coverage outside of the service area?

No, these plan designs offer access to Oxford Metro Network providers in the service area only. Members will not

have access to the UnitedHealthcare Choice Plus Network or to the Freedom and Liberty Networks in New York,

New Jersey or Connecticut. Emergency care is always covered, in or out of the Oxford Metro Network service area.

8. How does the non-embedded family deductible benefit work?

All Oxford Metro Network plan designs will include a non-embedded family deductible. When a member enrolls

in family, couple or parent/child coverage, the entire family has one deductible that must be met before the full

insurance benefits begin. The deductible can be met by one family member or by a combination of family members.

Once the family deductible is met, all family members will be considered as having satisfied their deductible for the

remainder of the benefit year.

9. Do Oxford Metro Network plan designs require referrals?

Yes, all plan designs offered with the Oxford Metro Network require referrals. Upon enrolling in an Oxford Metro Network

plan design, members will need to select a participating primary care physician (PCP) to coordinate their care.

10. Are specialty products like dental and vision available with the Oxford Metro Network?

Yes, pre-packaged specialty benefit options through Oxford Benefit Management (OBM) or stand-alone dental, vision

and disability products may be purchased with Oxford Metro Network plan designs. For ease of administration,

when a group has Oxford medical benefits, we do not require tax documentation or a binder check when they

add specialty lines of coverage. Only two enrolled subscribers are needed for voluntary dental, and one enrolled

subscriber for voluntary vision.

11. How can my employees find a participating Oxford Metro Network provider?

There are several ways that employees can search for a participating Oxford Metro Network physician.

If they already have a username and password for oxfordhealth.com:

1. Log in to the Member portal of oxfordhealth.com.

2. Click on “Find a Physician or Facility” on the home page.

3. On the next page, click the “Network” drop-down menu and choose “Metro.”

4. Enter additional criteria and click “Search.”

If they do not have a username and password, or want to search without logging in:

1. Go to oxfordhealth.com and click on “Members.”

2. Click on the “New Metro Plan – Important information for members” link.

3. On the next page, click the “Provider Search” link.

4. On the “Find a Physician” page, click the “Network” drop-down menu and choose “Metro.”

5. Enter additional criteria and click “Search.”

OR:

1. Go to oxfordhealth.com and click the “Browse our Provider/Facility Resources: Search for an Oxford doctor,

hospital or lab” link at the bottom of the home page.

2. Under “It’s in the details” on the right-hand side, click on “Doctor Search.”

3. On the next page (“Find a Physician”), click the “Network” drop-down menu and choose “Metro.”

4. Enter additional criteria and click “Search.”

Employees may also call the toll-free phone number on the back of their health plan ID card (if they are currently

enrolled in an Oxford plan) or 1-800-444-6222 to have a paper copy of the directory mailed to them. TTY users can

dial 711. Si usted necesita ayuda en español llame al número de teléfono en su tarjeta de identificación, 若需中文協

助, 請致電1-800-303-6719, 한국어로 도움이 필요하시면1-888-201-4746, or the phone number on their ID card

for help in English and other languages.

12. What pharmacies are available with the Oxford Metro Network?

The Oxford Metro Network provides access to retail pharmacies including major chains, mass merchants and

supermarkets. Among others, members can fill prescriptions at Duane Reade, Walgreens and Walmart.

13. How can my employees find a participating pharmacy?

Employees can search for a participating pharmacy from the Member portal on oxfordhealth.com by following the

steps below:

1. Go to oxfordhealth.com and click on “Members.”

2. Click on the “New Metro Plan – Important information for members” link.

3. On the next page, click the “Pharmacy Search” link.

4. Enter search criteria on the following “Find a Pharmacy” page and click “Search.”

Employees may also call the toll-free phone number on the back of their health plan ID card (if they are currently

enrolled in an Oxford plan) or 1-800-444-6222 to find out if a pharmacy is participating. TTY users can dial 711. Si

usted necesita ayuda en español llame al número de teléfono en su tarjeta de identificación, 若需中文協助, 請致

電1-800-303-6719, 한국어로 도움이 필요하시면1-888-201-4746, or the phone number on their ID card for help in

English and other languages.

14. What other resources and tools are available to members enrolled in an Oxford Metro Network plan?

• Oxfordhealth.com offers a convenient, secure way for members to search for doctors, check referrals, get a new

ID card, and access benefits.

• Online health and wellness tools such as Rally™, which is an interactive health and wellness enhancement to

oxfordhealth.com. With Rally, members receive personal lifestyle plans that focus on goals, competition, tracking

progress and healthy living. Rally offers a personalized interactive experience with step-based Challenges,

discussion Communities, individual action plans called Missions, health information and more.

• Oxford On-Call® nurses are available 24 hours a day, seven days a week by phone to give members helpful

information about illness or injury.

• Access to a fully-credentialed network dedicated to complementary and alternative medicine that includes more

than 5,900 providers.3

Alex Miller | Millennium Medical Solutions | (855) 667-4621 | alexm@medicalsolutionscorp.com.

Have you updated your Employee Handbook for Benefit Provisions? Handbooks are important for many reasons such as informing employees of their rights and duties, communicating available resources, and outlining paid time off policies. With respect to health and welfare benefits, here are a few things to consider:

Handbooks cannot change the terms of governing benefit documents such as summary plan descriptions (SPDs). Handbook provisions should mirror plan terms and/or refer

to plan documents. Any provisions purporting to amend plan documents are ineffective. However, handbooks may ll in the blanks where the plan documents are silent or refer to outside policies. For example, an SPD may indicate that certain eligibility criteria is determined by the employer. In this case, that criteria may be explained elsewhere such as a handbook or benefit booklet.

A handbook should reflect current, compliant provisions such as those addressing benefits, eligibility, and termination.

Under the Employer Penalty rules, an employee must be offered an effective opportunity to accept coverage at least once with respect to the plan year. Final regulations do not apply any specific rules for demonstrating that an offer of coverage was made.

Many employers require an affirmative waiver of medical benefits. This is the best method to prove an offer was made, provided that a waiver can be collected from every single employee waiving. Otherwise, any waiver not returned by the employee arguably proves that he was never made the offer.

When an affirmative waiver is not required, otherwise documenting information regarding the election process is key. An employer will want to show that employees received sufficient information about the offer so that they must have known medical coverage was available.A widely-distributed handbook with clear information about the offer and its terms can be a valuable part of an employer’s distribution of information as well as benefit booklets, email correspondence, posters, mandatory meetings, etc., as applicable.

If you need assistance with creating or modifying your handbook, please contact us and we can help you with a solution.

NOTE: This document is designed to highlight various employee benefit matters of general interest to our readers. It is not intended to interpret laws or regulations, or to address specific client situations. You should not act or rely on any information contained herein without seeking the advice of an attorney or tax professional.

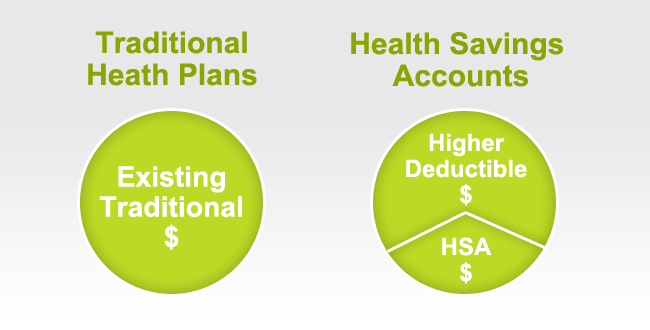

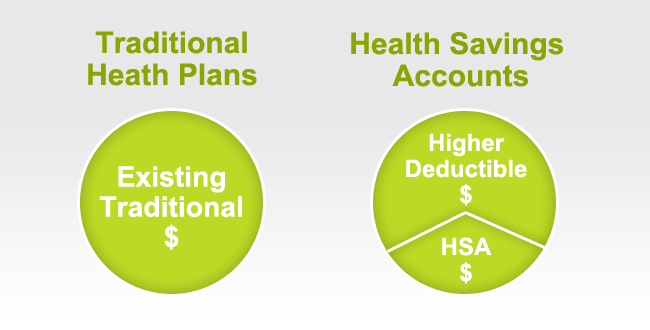

The IRS has released the 2017 Health Savings Account (HSA) inflation adjustments. To be eligible to make HSA contributions, an individual must be covered under a high deductible health plan (HDHP) and meet certain other eligibility requirements.

New HSA 2016 limits are as follows:

HSA Annual Contribution Limit:

Single – $3,400 ($3,350 in 2016)

Family – $6,750 ($6,750 in 2016)

Catch-up – $1,000 ($1,000 in 2016) for age 55+.

HDHP Minimum Annual Deductible:

Single – $1,300

Family – $2,600

HDHP Out-of-Pocket Maximum:

Single – $6,550 ($6,550 in 2016)

Family – $13,100 ($13,000 in 2016)

Age 55 Catch Up Contribution-As in 401k and IRA contributions, you are allowed to contribute extra if you are above a certain age. If you are age 55 or older by the end of year, you can contribute additional $1,000 to your HSA. If you are married, and both of you are age 55, each of you can contribute additional $1,000.

HSA holders own the assets in the accounts and can build up substantial sums over time. Enrollment in HSA-compatible insurance plans has increased to 10 million earlier this year, from 1 million in March 2005, according to, America’s Health Insurance Plans (AHIP), a trade group.

HSAs were authorized starting in January 2004. Since then, AHIP has conducted a periodic census of health plans participating in the HSA/HDHP market.

Our overall experience with HSAs have been positive when employer funding is at minimum 50% using either the HSA or an HRA (Health Reimbursement Account-employer keeps unspent money). Traditional plans trend of higher copays and new in network deductibles has also led to the popularity of an HSA.

|

| |||||||||||||||||||||||||||||

COBRA New Notice

Under the Consolidated Omnibus Budget Reconciliation Act (COBRA), an individual who was covered by a group health plan on the day before the occurrence of a qualifying event (such as a termination of employment or a reduction in hours that causes loss of coverage under the plan) may be able to elect COBRA continuation coverage upon that qualifying event. Individuals with such a right are referred to as qualified beneficiaries.

Under COBRA, group health plans must provide covered employees and their families with certain notices explaining their COBRA rights. A group health plan must provide each covered employee and spouse (if any) with a written notice of COBRA rights “at the time of commencement of coverage” under the plan (general notice). A group health plan must also provide qualified beneficiaries with a notice which describes their rights to COBRA continuation coverage and how to make an election (election notice).

General Notice: The general notice must be furnished to each covered employee (and their spouse if covered under the plan) not later than the earlier of: (1) 90 days from the date on which the covered employee or spouse first becomes covered under the plan or, if later, the date on which the plan first becomes subject to the continuation coverage requirements; or (2) the date on which the administrator is required to furnish an election notice to the employee or to his or her spouse or dependent.

Election Notice: The election notice must be provided to the qualified beneficiaries within 14 days after the plan administrator receives notice that a qualifying event has occurred.

Some qualified beneficiaries may want to consider and compare health coverage alternatives to COBRA continuation coverage, such as coverage that is available through the Health Insurance Marketplace (Exchange). Qualified beneficiaries may be eligible for a premium tax credit (a tax credit to help pay for some or all of the cost of coverage in plans offered through the Exchange) and cost-sharing reductions (amounts that lower out-of-pocket costs for deductibles, coinsurance, and copayments), and may find that Exchange coverage is more affordable than COBRA.

The Children’s Health Insurance Program Reauthorization Act of 2009 (CHIPRA) specifies that an employer that maintains a group health plan in a State that provides premium assistance for the purchase of coverage under a group health plan is required to notify each employee of potential opportunities currently available for premium assistance in the State in which the employee resides.

The Department of Labor has model notices that plans may use to satisfy the requirement to provide the general notice and election notice under COBRA, and the notice regarding premium assistance under CHIPRA. The COBRA model election notice was revised on May 8, 2013 to help make qualified beneficiaries aware of other coverage options that would soon become available in the Marketplace. Recently the DOL issued a Notice of Proposed Rulemaking, as well as updated versions of the model general notice and model election notice that reflect that the Exchange is now open and that better describes special enrollment rights in Exchange coverage. The DOL is also issuing a revised CHIPRA notice with similar updates related to Marketplace coverage.

Link to the COBRA model notices: http://www.dol.gov/ebsa/cobra.html

Link to the CHIPRA model notice: http://www.dol.gov/ebsa/pdf/chipmodelnotice.pdf

Millennium Medical Solutions Corp. is proud to have formed a partnership with HR360. This partnership will help us deliver state-of-the-art online Human Resources and Benefits Library to our clients.This partnership with HR360 will help The Millennium Medical Solutions Corp. clients access HR360’s premier online HR library which features a single point for access to the most current and updated federal and state laws. The HR360 website will help Millennium Medical Solutions Corp.’s clients by providing easy, step-by-step guidance on how to comply with a broad range of topics such as how to properly interview, hire and terminate employees to how to comply with laws from Health Care Reform, FMLA and COBRA.This online library of HR and benefits information provides extensive resources in the areas of:

| If you have already been registered to access HR360, please login below. |

| HR360 is managed by a professional team of attorneys, HR specialists, editors and advisors who have years of experience in developing and maintaining award-winning online HR and benefits content.If you would like to be provided with access to the HR360 portal, please contact your account rep or fill out our contact form on the contact page of our website. | |

(PPACA) is the establishment of state based health insurance exchanges by the year 2014.

An “Exchange” is a mechanism for organizing the health insurance marketplace to help consumers and small businesses shop for coverage in a way that permits easy comparison of available plan options based on price, benefits, service and quality. By pooling individuals and small groups together, transaction costs can be reduced and transparency can be increased. Exchanges can create more efficient and competitive markets for individuals and small employers.

Historically, the individual and small group health insurance markets have suffered from adverse

selection and high administrative costs, resulting in low value for consumers. “Exchanges” will

allow individuals and small businesses to benefit from the pooling of risk, market leverage, and

economies of scale that large businesses currently enjoy.

Beginning with an open enrollment period in 2013, Insurance agents and Benefits professionals

will help individuals and small employers shop, select, and enroll in high-quality, affordable

private health plans in these “Exchanges” to fit their specific needs at competitive prices.

Individuals in these “Exchanges” may also be eligible to receive premium subsidies through the

Federal or State government. By providing one-stop shopping, we will make purchasing health

insurance easier and more understandable through these “Exchanges” and provide the same level

of service that you have become accustomed to.

Middle-class people will be able to pick from a range of private insurance plans, and most people will be eligible for help from the government to pay their premiums.

Low-income people will be steered to safety-net programs for which they might qualify. This could be a problem in states that choose not to expand their Medicaid programs under a separate part of the health care law. In that case, many low-income residents in those states would remain uninsured.

A: You’ll disclose your income to the exchange at the time you apply for coverage and they’ll let you know. Only legal residents of the United States can get financial assistance.

The health care law offers sliding-scale subsidies based on income for individuals and families making up to four times the federal poverty level, about $44,700 for singles, $92,200 for a family of four.

But do yourself a favor and read the fine print because the government’s help gets skimpier as household income increases.

For example, a family of four headed by a 40-year-old making $35,000 will get a $10,742 tax credit toward an annual premium of $12,130. They’d have to pay $1,388, about 4 percent of their income, or about $115 a month.

A similar hypothetical family making $90,000 will get a much smaller tax credit, $3,580, meaning they’d have to pay $8,550 of the same $12,130 policy. That works out to more than 9 percent of their income, or about $710 a month.

The estimates were made using the nonpartisan Kaiser Family Foundation’s online calculator. Some people will also be eligible for help with their copayments.

Final note: Though it’s called a “tax credit” the government assistance goes directly to the insurer. You won’t see a check.

A: The coverage will be more comprehensive than what’s now typically available in the individual health insurance market, dominated by bare-bones plans. It will be more like what an established, successful small business offers its employees. Premiums are likely to be higher for some people, but government assistance should mostly compensate for that.

All plans in the exchange will have to cover a standard set of “essential health benefits,” including hospitalization, doctor visits, prescriptions, emergency room treatment, maternal and newborn care, and prevention. Insurers cannot turn away the sick or charge them more. Middle-aged and older adults can’t be charged more than three times what young people pay. Insurers can impose penalties on smokers.

Because the benefits will be similar, the biggest difference among plans will be something called “actuarial value.” A new term for consumers, it’s the share of expected health care costs that the plan will cover.

There will be four levels of coverage, from “bronze,” which will cover 60 percent of expected costs, to “platinum,” which will cover 90 percent. “Silver” and “gold” are in between. Bronze plans will charge the lowest premiums, but they’ll have the highest annual deductibles. Platinum plans will have the highest premiums and the lowest out-of-pocket cost sharing.

This part is insurance nerdy but an important point – The government’s subsidy will be tied to the premium for the second-lowest-cost plan at the silver coverage level that’s available in your area. You could take it and buy a lower cost bronze plan, saving money on premiums. But you’d have to be prepared for the higher annual deductible and copayments.

If you have additional questions regarding how SHOP Exchanges and Individual Exchanges can benefit you please contact our team at Millennium Medical Solutions Corp. Stay tuned for updates as more information gets released. We’re inside of 75 days until exchanges open, and information will be coming quickly in the next few months. Sign up for latest news updates.

Federal government health care site: www.healthcare.gov

Kaiser Health Reform Subsidy Calculator:http://healthreform.kff.org/subsidycalculator.aspx