by Alex | Jun 28, 2016

Five ACA Penalties Employers are Facing

MMS Adds allCheck ACA Compliance Tool

1. Individual Mandate Penalty

When a person files their taxes they must indicate if they have maintained minimum essential coverage all year. According to healthcare.gov, “If you can afford health insurance but choose not to buy it, you must pay a fee called the individual shared responsibility payment.” The IRS then verifies their answer with the data they receive from insurance carriers and employers to determine if their answer was true. If not, they will be issued a penalty letter due for payment.

2. Form distribution to employees

By the end of January every year, employers must provide their employees with form 1005-B or 1095-C as applicable. Employees will need them while validating to the IRS and health exchanges of the type and cost of coverage they were offered and maintained. If employers miss the deadline by less than 30 days late on their delivery, the penalty is $50 per form. After the 30 days, employers will be penalized $250 per formthat was not distributed to the employees.

3. Form filing to the IRS

By the end of March every year, employers must submit forms 1094 and 1095 to the IRS. If employers miss the deadline to file, they will be penalized $250 per form.

4. ‘A’ Penalties

If the employer fails to offer compliant coverage they must indicate so on the 1094-C forms. The IRS will automatically calculate ‘A’ penalties due by the employer of $2,160 per employee per year(adjusts annually for inflation). The IRS will make their calculations from the information submitted in Section III of form and issue penalty letters to employers due for immediate payment.

5. ‘B’ Penalties

Employers will be receiving letters from the federal and state health insurance exchanges in regards to employees of theirs who went to these various exchanges, purchased coverage and received a premium subsidy. The combination of an employee purchasing coverage from an exchange and receiving a subsidy is the necessary element to trigger a ‘B’ penalty of $3,240(adjusts annually for inflation).

For more information on compliance please contact our team at Millennium Medical Solutions Corp (855)667-4621.

by admin | Feb 18, 2014 | Health Care Reform

2014 Health Care Penalties

While the Employer mandate has indeed been delayed – Obamacare Midsize Employer Mandate Delayed Till 2016 the following 2014 rules must be followed. The PPACA excise tax of $100/day may be levied.

- No waiting periods in excess of 90 days

- No preexisting condition exclusions

- No discrimination against individual participants and beneficiaries based on health status

- No discrimination in health care providers

- No lifetime or annual limits on essential health benefits – Essential Health Benefits Not Delayed

- No rescissions of coverage

- Cost-sharing limitations on essential health benefits

- Coverage for individuals participating in approved clinical trials

- Coverage of preventive health services – Preventive care coverage

- Extension of dependent coverage until age 26 –Dependent coverage extended

- Periodic disclosures required in summary of benefits and coverage – New Summary of Benefits Coverage Notice

- Health plan reporting requirements

- No discrimination in favor of highly compensated individuals – awaiting further guidance and definitions

- Health plan claim and appeals protections

- Patient protections, including the selection of primary care provider, coverage of emergency services, and access to pediatric, obstetrical and gynecological care providers

Importantly, the excise tax will not be assessed if an employer can demonstrate that it did not know, and exercising reasonable diligence would not have known, of a violation. Further, the excise tax will not be assessed if the failure is due to reasonable cause and not willful neglect and it is corrected within the 30-day period beginning on the first date an employer knows, or exercising reasonable diligence would have known, that the failure existed. This limited correction window makes identifying and promptly correcting any potential errors of utmost importance.

For more information on compliance please contact our team at Millennium Medical Solutions Corp (855)667-4621.

by admin | Mar 29, 2012 | Health Care Reform, individual health insurance, Obamacare

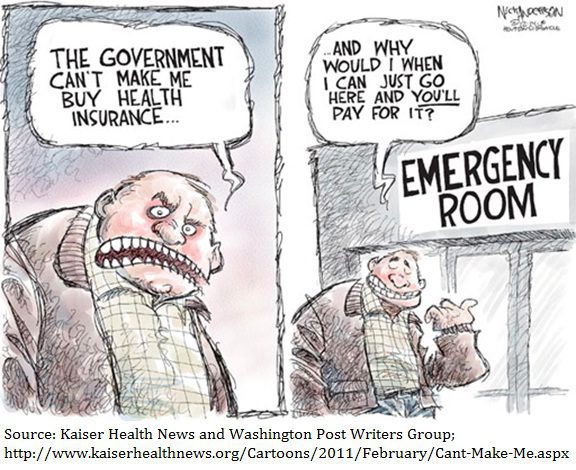

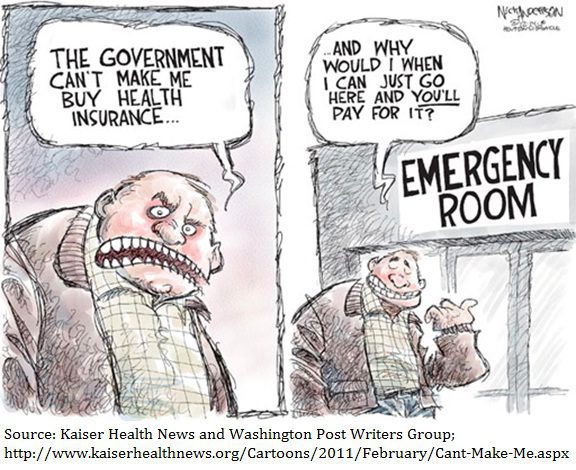

The same analogy would hold true with auto insurance where only the risky drivers would only participate making it impossible to afford coverage. Just imagine buying a health plan on the way to the hospital? Coining this as "ambulance-care" would be more fitting than "ObamaCare".

After 3 days of Health Care Reform Supreme Court Hearings, a central components debated is the constitutionality of forcing an individual to purchase health insurance. Certainly it would be costly if one could just opt out at any time and then come back in you would be left with a high risk pool.

The same analogy would hold true with auto insurance where only the risky drivers would only participate making it impossible to afford coverage. Just imagine buying a health plan on the way to the hospital? Coining this alternative as “ambulance-care” would be more fitting than “ObamaCare”.

Of course there are Individual Mandate penalties. So how does the penalty work?

In 2014, the penalty for being without health insurance is $95 per adult and $47.50 per child (up to $285 for a family) or 1.0% of family income, whichever is greater.

In 2015, the penalty for being without health insurance is $325 per adult and $162.50 per child (up to $975 for a family) or 2.0% of family income, whichever is greater.

In 2016, the penalty for being without health insurance is $695 per adult and $347.50 per child (up to $2,085 for a family) or 2.5% of family income, whichever is greater.

As of now, there are no known method to enforcing the penalty if you don’t buy insurance and you don’t pay the penalty. In fact, the law specifically states that no criminal action or liens can be imposed on you but I am certain that will change. I would also think that if a large numbers of people continue to choose not to enroll and the cost of premiums increase, the chance to revise the low penalties and increased enforcement are inevitable.

In conclusion, the Supreme Court ruling set for June is worth watching but only for legal wonks. With average health insurance single rates costing $600/month wouldnt you pay the penalty and just opt out?

by Alex | Sep 5, 2023 | COVID-19, group health insurance, Health Care Reform, HR, HSA, Tax, Wellness

To prepare for 2024 open enrollment, health plan sponsors should be aware of the legal changes affecting the design and administration of their plans for plan years beginning on or after Jan.

by Alex | Oct 3, 2021 | healthcare, HR, HSA

2022 Open Enrollment Tools. A handy checklist of Employers s for the upcoming 2022 renewals. PLAN DESIGN CHANGES, ACA EMPLOYER MANDATE 855-667-4621.

by Alex | Nov 2, 2020 | Uncategorized

2021 Open Enrollment Checklist To download this entire document as a PDF, click here: Open Enrollment eBook This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal...

by Alex | Oct 6, 2019

In preparation of 2020 open enrollment, Employers should review their plan documents to confirm that they include these required changes. Learn how our Agency is helping businesses thrive in today’s economy. Please contact us at info@medicalsolutionscorp.com or (855)667-4621.

by Alex | Jul 23, 2019

What is a PEO? PEO manages the full employee life cycle under one roof: payroll, employee benefits, workers comp, HR, etc. – Contact info@360peo.com or 855-667-4621

by Alex | Nov 29, 2018 | Health Care Reform, HR, Obamacare

Breaking: IRS released Notice extending the due dates for the 2018 inf ormation reporting requirements for employers to furnish information on returns and statements regarding minimum essential coverage provided to individuals.

ormation reporting requirements for employers to furnish information on returns and statements regarding minimum essential coverage provided to individuals.

Specifically, the notice extends the due date for furnishing the following to individuals: the 2018 Form 1095-B, Health Coverage, and the 2018 Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, from January 31, 2019 to March 4, 2019.

Lastly, IRS extends the good-faith relief in Notice 2016-70 that applied to filings in 2015 to 2016 and 2017 and now to 2018. This relief applies to missing and inaccurate taxpayer identification numbers and dates of birth, as well as other information required on the return or statement.

To show good faith efforts to qualify for this relief, filers must meet applicable deadlines. However, IRS recognizes that late filers may still be able avoid penalties by showing reasonable cause for missing the due dates.

Contact Us Now Sign up for compliance alerts. Learn how our Agency is helping businesses thrive in today’s economy. Please contact us at info@360PEO.com or (855)667-4621.

The information provided herein is not written or intended as tax or legal advice and may not be relied on for purposes of avoiding any federal tax penalties. Entities or persons distributing this information are not authorized to give tax or legal advice. Individuals are encouraged to seek specific advice from their personal tax or legal counsel.

by Alex | Feb 9, 2017 | Health Care Reform

Trump Order and ACA

Trump Order and ACA

President Trump signed an Executive Order on Jan 20 Minimizing the Economic Burden of the Patient Protection and Affordable Care Act Pending Repeal. As a practical matter, he can’t repeal it “line-by-line on day one” of his Presidency. So he did the next best thing: sign an Executive Order.

While lawmakers work on a repeal and replacement plan, here are 5 things you should know. The executive order will:

- End the individual mandate.

- Expand Medicaid waivers and provide states more flexibility to implement healthcare programs.

- Encourage the creation of interstate insurance markets to “the maximum extent permitted by the law.”

- Remove ACA taxes, including some placed on health insurance and pharmaceutical companies, in addition to waiving PPACA taxes, fees, and penalties.

- Grant leaders of the Department of Health and Human Services (HHS) and other agencies to exercise greater discretion. This includes the ability to waive, defer, or grant an exception to any provision that would impose a fiscal burden on a state or place a financial or regulatory burden (cost, fee tax, penalty) on individuals, families, healthcare providers, and patients.

We will soon know whether the Executive Order is more symbolic or has practical effects. Employers should continue to comply with the provisions in current law, until official guidance provides otherwise.

ormation reporting requirements for employers to furnish information on returns and statements regarding minimum essential coverage provided to individuals.

ormation reporting requirements for employers to furnish information on returns and statements regarding minimum essential coverage provided to individuals.