by admin | Mar 12, 2012 | Health Care Reform, healthcare, Hospitals, PPACA, Small Business Group Health

Out of Control Out of Network Charges

Few healthcare changes have been more impacted than the out of control out of network charges billed to patients. The health care reform bill known as PPACA has for the most part been insignificant in the Northeast, in particular, as many state laws have already addressed issues such as pre-existing conditions, contraception, coverage rescissions and maximum loss ratios (MLR).

Instead, the market forces are reshaping the medical field into significant insurance & provider consolidation, larger hospital groups and flattening provider reimbursements. The problem is pointed out in Out of Network Medical Costs Affecting NY State Across investigation report commissioned by Governor Cuomo recognizing the unexpected out-of-network claim problem. Officials say that this is now “an overwhelming amount of consumer complaints.” Some examples cited in the report An Unwelcome Surprise – “a neurosurgeon charged $159,000 for an emergency procedure for which Medicare would have paid only $8,493.” Another example: ” a consumer went to an in-network hospital for gallbladder surgery with a participating surgeon. The consumer was not informed that a non-participating anesthesiologist would be used, and was stuck with a $1,800 bill. Providers are not currently required to disclose before they provide services whether they are in-network.” The average out-of-network radiology bill was 33 times what Medicare pays, officials say.

To make matters worse, Health Insurers have reduced their out of network recognized charges from private industry index UCR (usual customary and reasonable) to the Medicare Index known as RBRVS ( Resource Based Relative Value Scale ). Insurers moved away from UCR after then-NYS D.A. Mario Cuomo in 2009 forced Unitedhelatcare Group (owners of Inginex) to settle $50 Million in a conflict of interest allegation. D.A. Cuomo future hopes for UCR were to that it be overseen by a non-profit entity. So much for best laid plans.

Today, 90% of SMB members have in network only benefits but the few remaining consumers are paying for eroding out of network benefits with little transparencies and necessary protection from new out of network billing practices. The NY Dept of Financial services is calling for providers in non-emergency situations to disclose whether or not all services are in-network, what out-of-network charges will be and how much insurers will cover.

Insurers such as Aetna are taking action – with lawsuits throughout the country such as Aetna sues 9 N.J. doctors for “unconscionable” fees. Another Aetna lawsuit is discussed extensively in a law blog: In New Lawsuit, Health Insurers Allege Fraud and Kickbacks Against Out-of-Network Providers Who Forgive Patients’ Financial Responsibility.

In an ominous statement” “Failure to recognize this historical out-of-network avalanche will result in shocking financial disasters, as experienced by so many hospitals in 2003″

by admin | Aug 18, 2011 | group health insurance, healthcare, Hospitals

After balancing the budget and announcing $2.4 trillion in government spending cuts over ten years, politicians and media pundit are insisting that it is only the beginning of the attack on health care, pensions and other social programs.

So why is balancing the budget and cutting medicare so bad for the Privately Insured? After all, the Democrats have made sure the automatic cuts leave Medicare benefits untouched, and the Republicans have blocked any new taxes.

Everyone is content right? Or so it seems. But the truth is that cutting payments to Medicare providers will mean some Americans are going to pay more. It may not be called a tax, but if you’re covered by private health insurance, money will be coming out of your pocket nonetheless.

Here’s how cuts in Medicare affects the rest: If a hospital provides a service that costs $1,000,000, and the government elects to pay just $980,000, the $20,000 gap doesn’t disappear. The hospital has to cover it somehow. It will likely do so by shifting the costs to commercial insurers, which eventually means higher premiums. This cost shifting is nothing new-it’s been happening for years-but more cuts will just make it worse.

NY Hospitals in particular have felt Federal Funding cuts for teaching hospitals over the last decade. This has been a contributing factor to St. Vincents declaring bankruptcy last January. Many surviving hospitals however have the size to negotiate effectively with private insurers to make up that funding short fall.

So guess who makes up that difference? The fact remains, if you don’t deal with underlying costs, you’re not fixing the problem, you’re just covering it up.

by admin | Aug 2, 2011 | Health Care Reform, healthcare, PPACA

Under Health-Care Reform Insurance Coverage for Contraception Is Required – NYT; The Health Resources and Services Administration (HRSA), an arm of HHS, developed the women’s services package to implement the preventive health services provisions of the Patient Protection and Affordable Care Act of 2010 (PPACA).

Federal recommended that major medical plans should include coverage for:

- well-woman visits

- contraception

- screening for the viruses that cause AIDS and human papillomavirus

- breast-feeding support in the basic package of preventive health services benefits.

Health plans must roll this out by Aug 1, 2012. These are in accordance with the preventive care provisions enacted in the Reform Law. Agencies are determining what falls into this category and have amended this provision, see

here. While states such as NY already have these benefits built into their plan at no charge the medications are presently not free.

The contraception coverage requirement applies to drugs and devices approved by the federal Food and Drug Administration.

Exemption to religious organizations will be made available. This can be done at renewal time by groups’ broker. Unfortunately, non group individual policies will not allow for this exemption.

While this is a noble reccomendation, this is not as significant to NY and neighboring states. Some argue that the costs will indeed rise even in our region since the Rx will be free. Also, some consumers who currently purchasing supplies over the counter will tap into this free benefit.

Conclusion, not exactly a cost cutting decision as promised by the President to lower medical expenses but he did win over half the voters in time for next election!

by admin | Jul 1, 2011 | Health Care Reform, Small Business Group Health, Tax

Small Business Tax Credit. From our blog http://alexmillers.wordpress.com/2011/04/18/president-kills-new-1099-reporting-of-ppaca/

More small businesses are providing health insurance to their employees in 2011 as a result of the tax credit of up to 35% and 25% for non-profits offered through PPACA starting in 2010. Several insurers have reported significant increases in small group enrollments. Coventry Health Care added 115,000 small group enrollments, representing an 8% increase; and Blue Cross Blue Shield of Kansas City saw a 58% jump, 38% of which had never offered health benefits to employees before.

Click video IRS – Health Care Small Business Health Care Tax Credit

Calculator – See How Much the Small Business Tax Credit Can Save Your Business

Further information can be found at http://www.irs.gov/newsroom/article/0,,id=223666,00.html. In addition, we have a simple work sheet that can determine exactly how much the credit is worth to you. Importantly, the Tax Credit will increase to 50% for small businesses by 2014!

Please contact our office for further guidance on your group’s plan.

by admin | May 12, 2011 | Health Care Reform, healthcare, PPACA

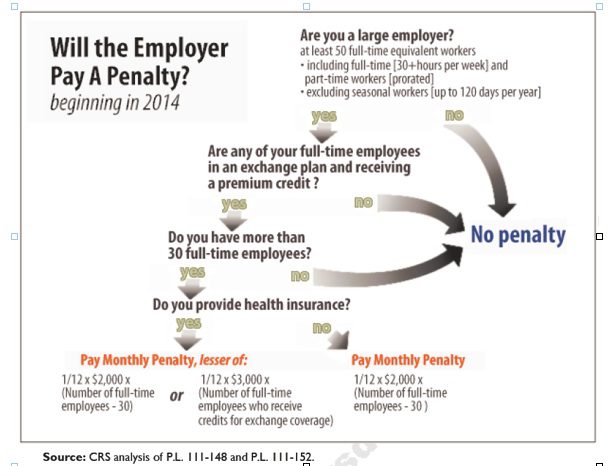

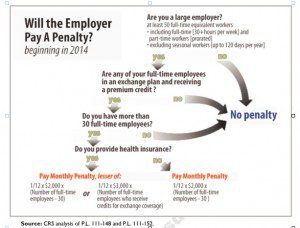

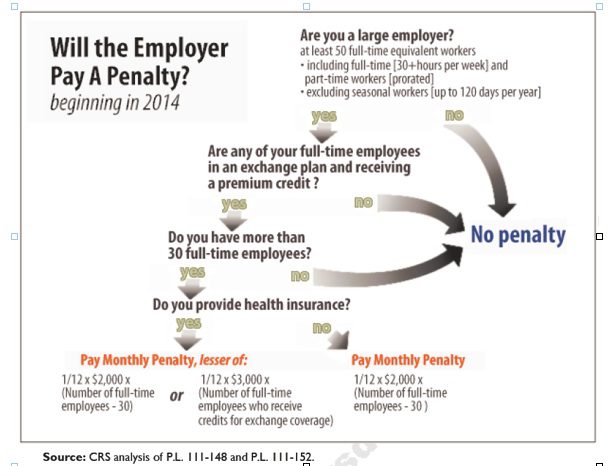

Larger employers that don’t offer minimum essential health coverage to full-time workers may face penalties under health care reform if any full-time employees receive a government premium credit or subsidy to buy their own insurance through an exchange.

The so-called employer mandate and the health insurance exchanges both go into effect in 2014 under the Patient Protection and Affordable Care Act.

The penalties generally apply to all employers with 50 or more full-time equivalent employees. An employer with at least 50 FTEs that provides access to coverage but fails to meet certain requirements, outlined below, may also be subject to a penalty.

To determine the FTE (Full Time Equivalent) you must count FT and PT employees. Full Time Employees are those working 30 hours+/week. See blog post “What does FTE mean?”

Affordability of the employer plan remains a consideration, however, since just one employee qualifying for federal premium assistance for exchange coverage will trigger a penalty for employers with 50 or more employees

Minimum essential coverage generally includes any coverage offered in the small or large group markets. Excepted benefits, such as limited-scope dental or vision offered under a separate policy, certificate or contract of insurance and Medicare supplemental plans, do not qualify.

Penalties explained

Starting in 2014, large employers that don’t offer coverage face a penalty of $2,000 per full-time employee (excluding the first 30) if at least one FTE receives a government subsidy to buy coverage on an exchange. This is sometimes referred to as the “play or pay” penalty.

Employers that offer coverage to employees may still face a “free rider” penalty if the coverage offered is deemed unaffordable or low in value.

If an employer offers coverage, but a full-time employee receives a premium credit subsidy through an exchange, the employer must pay an assessment equal to the lesser of:

- $3,000 for each employee that receives a subsidy

- $2,000 for each full-time employee after the first 30

The monetary penalties listed above are annual figures and may be pro-rated to the number of months for which the penalty applies.

Who’s eligible for a subsidy?

Employees who are offered coverage from their employer could be eligible for subsidies on the exchange if they don’t qualify for Medicaid or other programs, are not enrolled in their employer’s coverage and meet either of the following conditions:

- The employee’s share of the premium exceeds 9.5 percent of their household income

- The plan pays for less than 60 percent on average of covered health care expenses (e.g. coverage offered does not have at least a 60-percent actuarial value).

After 2014, penalty amounts are indexed by a premium adjustment percentage for the calendar year.

The Congressional Budget Office expects the penalties to generate $52 billion toward the overall cost of health reform by 2019. The Department of Health and Human Services estimates that fewer than 2 percent of large American employers will have to pay the assessments.

Disclaimer: This blog is not intended to represent legal advise and one should consult with a tax and/or legal expert.