Hunterdon Healthcare employees and Aetna members in 5 NJ counties will benefit from new ACO committed to higher quality more coordinated care

HARTFORD, Conn.–(BUSINESS WIRE)–Aetna (NYSE: AET) and Hunterdon HealthCare Partners today announced a new accountable care agreement that will improve the quality and cost of patient care, helping members and plan sponsors save money. Hunterdon Healthcare is establishing an Accountable Care Organization (ACO) to deliver a better patient experience, and aims to improve the quality of patient care while reducing the overall cost of care.

“Becoming an ACO not only supports our mission to deliver better access to primary care and specialist physicians, but will allow us to better provide integrated healthcare to improve the health of our community.”

“We are excited to bring our industry-leading technology and care management capabilities together with Hunterdon’s quality-driven team to offer highly coordinated and comprehensive care management to members in New Jersey,” said John Lawrence, president, Aetna New Jersey market. “Beginning this summer, 8,000 Hunterdon Healthcare employees and Aetna members will receive health care in this new patient-focused, accountable care model.”

An ACO is a group of health care providers who coordinate care and are accountable for cost, quality and patient satisfaction for the health care they provide.

“In the past several years, the healthcare industry has changed with the demands of health care reform. The industry trend is shifting from paying for services, regardless of patient outcomes, to paying for care that delivers better value, quality and patient satisfaction. Collaborating with Aetna will help Hunterdon Healthcare deliver better care at a better price. We think patients will see direct benefit from this approach,” explained Robert P. Wise, president and CEO, Hunterdon Healthcare.” Jeffrey Weinstein, executive director for Hunterdon HealthCare Partners added, “Becoming an ACO not only supports our mission to deliver better access to primary care and specialist physicians, but will allow us to better provide integrated healthcare to improve the health of our community.”

About the Hunterdon HealthCare Partners ACO

Under the new ACO agreement, 2,200 members in the Hunterdon Healthcare employee benefits plan, and approximately 5,700 fully insured Aetna members who live in Hunterdon, Mercer, Warren, Morris and Somerset Counties will be served by the ACO. Aetna members served by this new model are ones who primarily received care from Hunterdon Healthcare’s providers in the last 24 months, as well as those who seek care from Hunterdon Healthcare physicians following the start of the agreement.

Hunterdon Medical Center, more than 225 affiliated primary care physicians and specialists, and the affiliated ambulatory surgery, radiology, hospice, and other Hunterdon Healthcare facilities and providers will all be part of the ACO. Working together, and supported by a full suite of Aetna health information technology and care management capabilities, the providers will become part of a coordinated health care network and receive notices of any treatments and medications the patient may be receiving. As a result, the patients will receive an enhanced level of coordinated care in addition to the member benefits of their current Aetna plan.

Aetna and Hunterdon HealthCare Partners are implementing a payment model that will change the way Hunterdon Healthcare is reimbursed for care. Under the ACO agreement, Hunterdon Healthcare will be paid based on achieving certain quality, efficiency and patient satisfaction measures, which are designed to:

- improve the patient’s health care experience through greater care coordination and patient engagement;

- improve the health of populations; and

- reduce the cost of health care by aligning payment with quality, patient outcomes and value.

The measures include, but are not limited to:

- the percentage of Aetna members who receive recommended preventive care and screenings, such as increased cancer screenings, flu shots and other vaccinations;

- improved management of patients with chronic conditions such as diabetes, heart failure and asthma;

- reductions in hospital readmission rates; and

- reductions in Emergency Room visits by improving primary care access hours.

Aetna’s Technology Support

To support the full success of the ACO, Aetna will implement the following integrated technologies and capabilities for Hunterdon HealthCare Partners:

- health information exchange technology from Medicity, a wholly-owned subsidiary of Aetna, to enable the secure, two-way exchange of health information across a patient’s entire care team, including hospitals, physicians, labs, pharmacies and other ambulatory services;

- point-of-care clinical decision support services and the Active CareTeamSM desktop-based workflow tool to track, monitor, coordinate and report on patient health outcomes from ActiveHealth Management a wholly-owned subsidiary of Aetna; and,

- reporting tools that will help Hunterdon Healthcare providers evaluate how they are performing against their targeted clinical and financial outcomes.

About Hunterdon HealthCare Partners

Hunterdon HealthCare Partners was created by physicians and the Hunterdon Healthcare System, the parent organization of the Hunterdon Medical Center. The partnership’s goal is to provide the residents of Hunterdon County and the surrounding areas better access to integrated care delivered through their network of primary care and specialist physicians. For more information, contact Jeffrey Weinstein at Weinstein.Jeffrey@hunterdonhealthcare.org.

About Aetna

Aetna is one of the nation’s leading diversified health care benefits companies, serving approximately 36.1 million people with information and resources to help them make better informed decisions about their health care. Aetna offers a broad range of traditional, voluntary and consumer-directed health insurance products and related services, including medical, pharmacy, dental, behavioral health, group life and disability plans, and medical management capabilities, Medicaid health care management services and health information technology services. Our customers include employer groups, individuals, college students, part-time and hourly workers, health plans, health care providers, governmental units, government-sponsored plans, labor groups and expatriates. For more information, see www.aetna.com.

Photos/Multimedia Gallery Available: http://www.businesswire.com/cgi-bin/mmg.cgi?eid=50342381&lang=en

(Source: Business Wire )

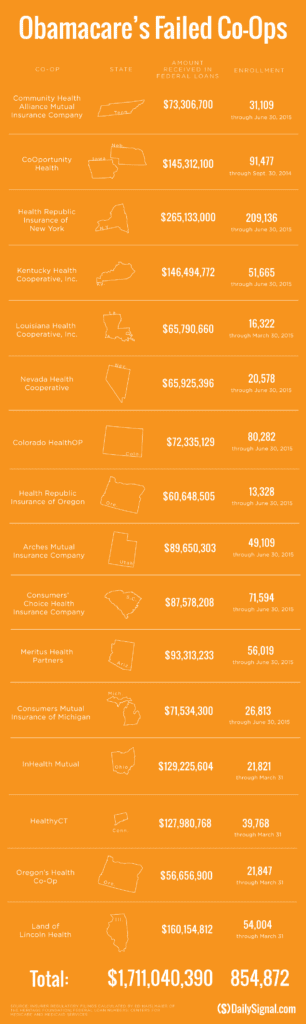

established companies “with sicker patients”. Start-ups, by contrast, with much lower rate of diagnosed sick patients essentially pay into this tax. This tax is part of the risk adjustment program intended to stabilize Insurers who took on sicker patients and spread this risk. While some correctly blame too low pricing and some miscalculated business decision-making the inherent extra tax doomed the majority of the original 16 co-ops.

established companies “with sicker patients”. Start-ups, by contrast, with much lower rate of diagnosed sick patients essentially pay into this tax. This tax is part of the risk adjustment program intended to stabilize Insurers who took on sicker patients and spread this risk. While some correctly blame too low pricing and some miscalculated business decision-making the inherent extra tax doomed the majority of the original 16 co-ops.