by Alex | May 19, 2016 | group health insurance, Health Exchanges, Individual Exchanges, individual health insurance, NY News, PPACA, Small Business Group Health

NYS 2017 Rate Requests

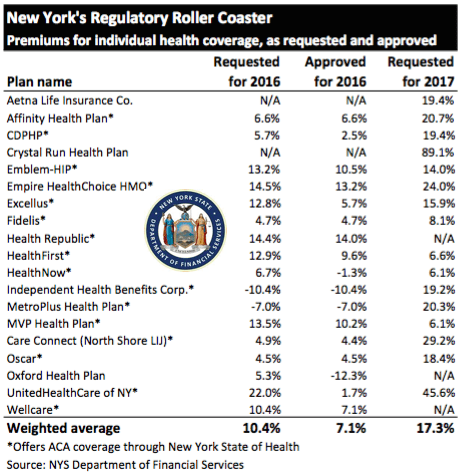

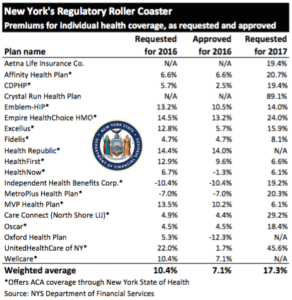

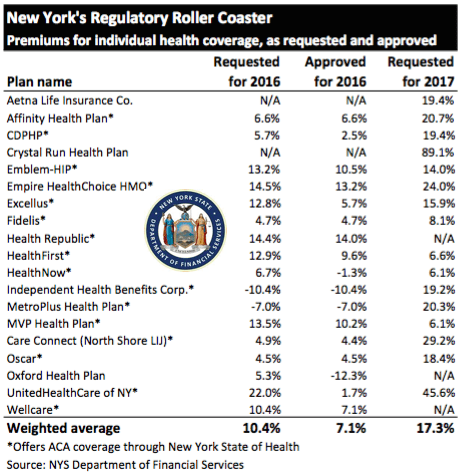

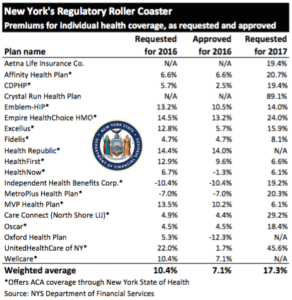

The State released NYS 2017 Rate Requests with average increases of 17.3% individual market and 12% for small groups. This early 5/12/16 deadline request requirement is not an Obamacare requirement. As per NY State Law carriers are required to send out notices of rate increase filings to groups and subscribers.

With only 3 months of mature claims in 2016 to work of off Insurance Actuaries have little experience to predict accurate projections. Typically the rate requests must be high and in the past final approvals after negotiations were only half, see https://360peo.com/nys-2016-rates-approved/. The national rate trend, however, has been much higher than in past years due to higher health care costs and the loss of Federal reinsurance fund known as risk reinsurance corridor.

This is one of the reasons why the individual market is significantly more costly to operate than small group as per recent United Healthcare pull out of most State Individual Exchanges, UnitedHealthcare will drop ACA Exchanges. In fact, the Health Republic NY is Shutting Down highlights how an insurer banked on the federal risk corridor reinsurance and underestimated NYS costs of care. Another local example is Oscar Health Insurance which has lost $105 million and is asking for up to 30% rate increase. The 3 year old company said the increase was necessary because medical costs have risen, government programs that helped cover costs are ending, and its members needed more care than expected. That all translates into the need for a price correction.

Importantly, the individual market subsides may be on borrowed time. Last week, The Federal Court ruled that Obamacare subsidies were illegally funded. The ruling while the Obama administration challenges it in D.C. Circuit Court of Appeals, is still allowing the reimbursements to continue for now. The practice of some small businesses dropping group health insuarnce in favor of the Individual Plans known as “cash for insurance” is put into question by this. While the IRS ruled that this is prohibited (see below) some small business are attracted to the simplicity of a public exchange and not getting involved in the managing of plans. Prohibited: The IRS prohibits employers from giving (or reimbursing) employees pre-tax funds to buy health insurance on their own—through the state-based and federally facilitated exchanges or private marketplaces alike.1 This practice may result in a $100 per day excise tax per applicable employee, according to an IRS Q&A released in May 2014.2

Instead, the correct approach for a small business in keeping with simplicity is a Private Exchange. This is a true defined contribution empowering employees with choice of leading insurers offering paperless technologies integrating HRIS/Benefits/Payroll. Both employee and employers still gain tax advantage benefits under the business. Also, the benefits, rates and network size are superior under a group plan as THE RISK OUTLINED ABOVE ARE HIGHER FOR INDIVIDUAL MARKETS THAN SMALL GROUP PLANS.

For more information on how a Private Exchange can help your group please Contact us at (855)667-4621.

Summary of 2017 Requested Rate Actions

INDIVIDUAL MARKET

| Company Name | 2017 Requested Rate Change |

|---|

| Aetna Life Insurance Company | 19.4% |

| Affinity Health Plan, Inc.* | 20.7% |

| Capital District Physicians’ Health Plan* | 11.2% |

| Crystal Run Health Plan, LLC* | 89.1% |

| Empire HealthChoice HMO, Inc.* | 24.0% |

| Excellus Health Plan, Inc.* | 15.9% |

| Health Insurance Plan of Greater New York* | 14.0% |

| Healthfirst PHSP, Inc.* | 6.6% |

| HealthNow New York Inc.* | 6.1% |

| Independent Health Benefits Corporation* | 19.2% |

| MetroPlus Health Plan, Inc.* | 20.3% |

| MVP Health Plan, Inc.* | 6.1% |

| New York State Catholic Health Plan, Inc. dba Fidelis Care New York* | 8.1% |

| North Shore-LIJ CareConnect Insurance Company, Inc.* | 29.2% |

| Oscar Insurance Corporation* | 18.4% |

| UnitedHealthcare of New York, Inc.* | 45.6% |

| Weighted Average Requested Rate Change – Individual Market | 17.3% |

*Indicates that the company makes products available on the “New York State of Health” marketplace.

SMALL GROUP MARKET

| Company Name | 2017 Requested Rate Change |

|---|

| Aetna Life Insurance Company | 12.0% |

| Capital District Physicians’ Health Plan, Inc. | 9.6% |

| CDPHP, Universal Benefits Inc.* | 11.6% |

| Crystal Run Health Insurance Company, Inc. | 61.9% |

| Crystal Run Health Plan, LLC | 66.6% |

| Empire Healthchoice Assur Inc | 10.0% |

| Empire HealthChoice HMO, Inc. | 12.6% |

| Excellus Health Plan, Inc.* | 12.3% |

| Health Insurance Plan of Greater New York* | 10.6% |

| Healthfirst Health Plan (Managed Health) | 5.0% |

| HealthNow New York Inc.* | 5.8% |

| Independent Health Benefits Corporation* | 11.2% |

| MetroPlus Health Plan, Inc.* | 13.1% |

| MVP Health Plan, Inc.* | 5.4% |

| MVP Health Services Corp. | 6.8% |

| North Shore-LIJ CareConnect Insurance Company, Inc.* | 16.8% |

| Oxford Health Insurance, Inc.* | 12.9% |

| UnitedHealthcare Insurance Company of New York | 12.8% |

| Weighted Average Requested Rate Change – Small Group Market | 12.0% |

*Indicates that the company makes products available on the “New York State of Health” marketplace.

Source: https://myportal.dfs.ny.gov/web/prior-approval/summary-of-2017-requested-rate-actions

Resource:

by admin | Sep 30, 2013 | Health Care Reform, Health Exchanges, Individual Exchanges, individual health insurance, SHOP Exchanges

Health Exchange Marketplace Top Ten List

The Health Exchange also known as The Health Marketplace or Obamacare Exchanges are set to open in less than 12 hours. Are you ready or aye you like most asking What is an Exchange? Starting Oct 1 you can enroll until March 31, 2014, though you’ll generally need to sign up by Dec. 15 of this year, to be covered as of Jan. 1. You can find your state’s marketplace at healthcare.gov. The prices for the marketplace plans are likely to be similar to those sold privately. A plan that is also available on the exchange may be eligible for subsidies. Heres an easy top 10 list of what you need to know.

10. Locate your State Exchange

Look up your state’s exchange here and Healthcare.gov. Some states are running their own exchange, others are running it through the federal government see www.healthcare.gov. For NY Tri-State the sites are:

NYS – http://info.nystateofhealth.ny.gov See rates here

NJ – https://www.healthcare.gov/how-do-i-choose-marketplace-insurance

CT – https://www.accesshealthct.com See rates here

9. Individual Mandate Penalty

For 2014, the annual penalty is $95 or 1% of your income, whichever is greater. The penalty will increase over the first three years. Coverage can include employer-provided insurance, individual health insurance, Medicare or Medicaid.

Health Insurance Individual Penalty for Not Having Insurance

Pay the greater of the two amounts |

| Year | Percentage of Income | Set Dollar Amount |

| 2014 | 1% | $95 & $285/family max |

| 2015 | 2% | $325 & $975/family max |

| 2016 | 2.5% | $695 & $2,085/family max |

8. Individual Subsidies

Individuals who do not have affordable minimum essential coverage from their employer will be eligible for tax credit subsidies for their health insurance purchase on a state exchange if their income is below 400 percent of federal poverty level.

If you make under $45,960 or your family makes under $94,200, you could get a real break on health insurance costs More low-income people will also be eligible for free coverage under Medicaid For those eligible, the subsidies will cap the amount you pay for your exchange policy at between 2% and 9.5% of your income (on a sliding scale, based on your income). To find out how much you would pay, estimate your income for this year and plug it into any health subsidy calculator. You can also see estimate subsidies with these “health subsidy charts”.

7. Small Business Subsidy – SHOP Exchange

A key change is that the small business health care tax credits will only be available ONLY through the SHOP Exchange marketplace in 2014. Small businesses with 25 or fewer employees who receive less than $50,000 a year in wages may be eligible for tax credits if they purchase the plan through the SHOP marketplace. These credits will cover up to 50% of the employer’s cost (35% for non-profits) for the first two years of coverage. Click here to read more about the small business health care tax credits.

6. Your income

not your assets, such as your house, stocks or retirement accounts – will count toward determining whether you can get tax credits. When you buy your plan, you estimate your income for next year, and your tax credit is based on that estimate. The next year, your tax returns will be checked by the IRS and compared against your estimate.

5. Pre-Existing Conditions Eliminated

Your insurer generally can’t drop you, as long as you keep up with your insurance premiums and don’t lie on your application. Generally, people will be able to enroll in or change plans once a year during the annual open enrollment period. This first year, open enrollment on the exchanges will run for six months, from Oct. 1 through March of next year. But in subsequent years the time period will be shorter, running from October 15 to December 7.

4. Essential Health Benefits Covered

Each plan covers 10 “essential health benefits,” which include prescription drugs, emergency and hospital care, doctor visits, maternity and mental health services, rehabilitation and lab services, among others. In addition, recommended preventive services, such as mammograms, must be covered without any out-of-pocket costs to you. More info here.

3. Ninety-Day Maximum Waiting Period

Group health plans and health insurance issuers may not impose waiting periods of more than ninety days before coverage becomes effective. This also applies to grandfathered plans.

2. Annual or Lifetime Limits

Group health plans, including grandfathered plans, may no longer include more than restricted annual or any lifetime dollar limits on essential health benefits for participants. Limits may exist in and after 2014 for non-essential benefits.

1. Not Everyone is Eligible

- Immigrants who are in the country illegally will be barred from buying insurance on the exchanges. However, legal immigrants are permitted to use the marketplaces and may qualify for subsidies if their income is no more than 400 percent of the federal poverty level (about $46,000 for an individual and $94,200 for a family of four).

- members of certain religious groups and Native American tribes

- incarcerated individuals

- people whose incomes are so low they don’t have to file taxes (currently $9,500 for individuals and $19,000 for married couples)

Conclusion:

There has been a lot of news about individual Obamacare provisions getting delayed – Obamacare Employer mandate Delayed. Some people may assume that means the health law is being slowly dismantled, or put off for an additional several years. .The Affordable Care Act is an extremely complicated law with a lot of moving parts, but ultimately, the biggest provisions are still moving forward. There will likely be more hiccups along the way. As the enrollment period opens for Obamacare’s new exchanges, industry experts predict there will probably be other issues that need to be ironed out — but that doesn’t mean the whole law is collapsing

Still confused?

Don’t be. These are the common questions that we are working through with our clients daily. Am I better off going SHOP Exchange vs. Individual for my business? Am I better off going off Exchanges or onto Private Exchanges? Whats my minimum employer contribution? Do I have to cover employee and dependents? Is dental and vision included? What happens to my Healthy NY when it shuts down Jan 1, 2014? What employer notices must I be posting?

Please contact our team at Millennium Medical Solutions Corp if you have additional questions regarding how SHOP Exchanges and Individual Exchanges can benefit you Stay tuned to our site for updates as more information gets released. Sign up for latest news updates.

Looking for Affordable Health Insurance? You can use this SINGLE PAGE form to get affordable health insurance quotes outside exchange and save money. If you are above 64 years, then use this link to Get FREE Medicare quotes from the most trusted carriers.

You can use this SINGLE PAGE form to get affordable health insurance quotes outside exchange and save money. If you are above 64 years, then use this link to Get FREE Medicare quotes from the most trusted carriers.

Resource:

- Click Above

Federal government health care site: www.healthcare.gov

Kaiser Health Reform Subsidy Calculator:http://healthreform.kff.org/subsidycalculator.aspx

Error: Contact form not found.