Crains Article on Broker Commissions Cuts

Crains Brokers’ Commissions Face Uncertain Future. A quick comment on our quote in Crains “Crains Brokers’ Commissions Face Uncertain Future” today. Insurers are indeed cutting back on services resulting in cost containement measures such as layoffs, outsourcing and significant broker commissions cuts.

A significant negative development is the NYS decision to not allow licensed Agents/Brokers in the Individual Exchange. Many States such as Massachusettes, the inspiration for Health Care Reform, use a Connector which is an Exchange or an independent state agency that helps Massachusetts residents find health insurance coverage and avoid tax penalties. Instead NYS will allow Agents/Brokers to only work in the Commercial Exchange known as SHOP. HealthPass is a good pre-cursor of the SHOP Exchange offering Small Businesses a Defined Contribution Health Plan of full options form Health Insurance, Dental, Vision to Term Life Insurance and Disability.

The Individual Exchange will work with an “Assitor” or “Navigator”. In NYS Government and Non-Profit Agencies will comprise the “Navigator” which will only be allowed to operate in the Individual Exchange. By design an income subsidy will only pass through this Individual Exchange an not on the SHOP Exchange. Example: a $50,000 Family Household of 4 can get approximately 80% credited.

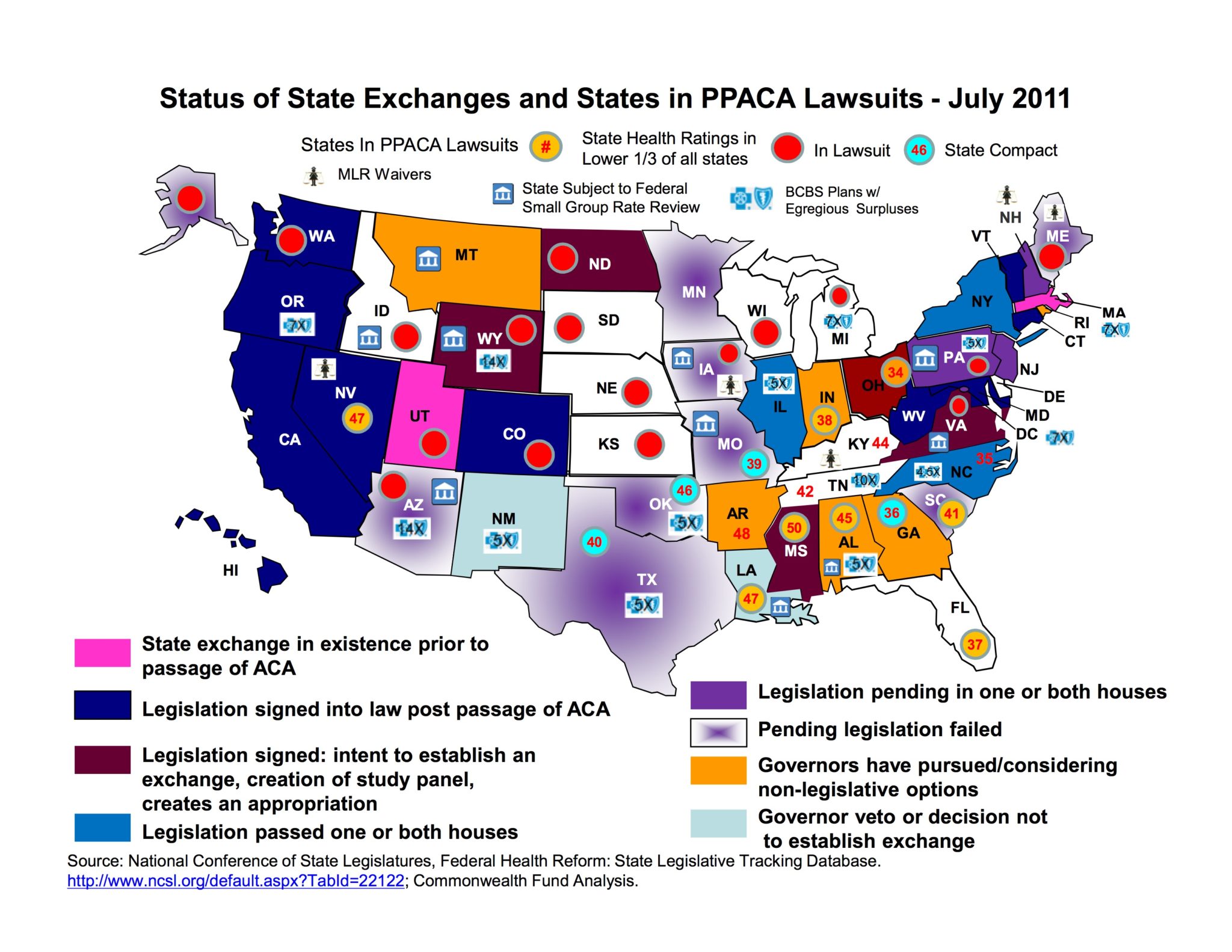

The Federal Gov has already spent $2.2 Billion on State Exchanges. And this figures does not include remaining States as there are only 19 States working on an Exchange for 2014. The Exchanges will be built up for 2 years and then must be fully independent by 2016. If 88% of small groups coverage purchased by Brokers acc. to Bostons Wakely Report in research study- Role of Producers and Other Third Party Assisters in New York’s Individual and SHOP Exchanges the distribution infrastructure is already there. Access to care is not the difficulty in finding a plan its the very cost of the plan! Why then does NYS decide to spend on building up new infrastructures? AgentsBrokers can easily outreach and council to uninsured as well. In fact many small businesses such as construction, consulting services and dining have many uninsured that an Agent/Broker already has a relationship with.