Update: Oxford/United and Mt Sinai Health Systems Split

Mount Sinai, UnitedHealthcare dispute terminating contract March 1, 2024 . What Oxford/United members need to know.

Mount Sinai, UnitedHealthcare dispute terminating contract March 1, 2024 . What Oxford/United members need to know.

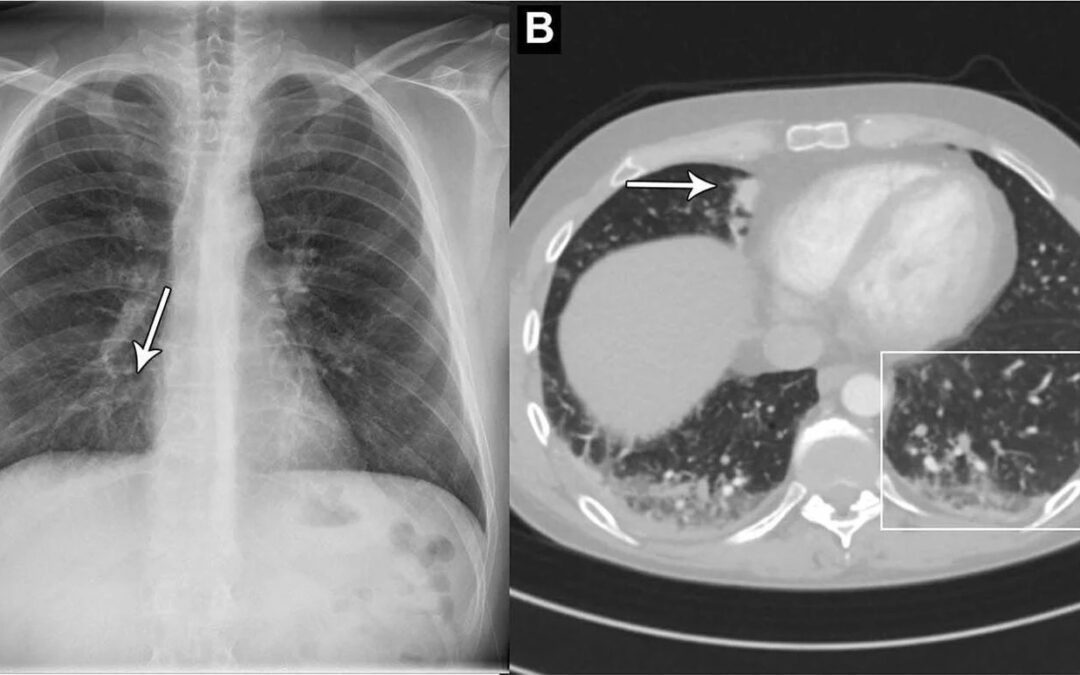

Artificial intelligence can help spot early signs of cancer in chest x-rays. AI tool identified abnormal chest X-rays with a 99% sensitivity.

Good news Bronx/Westchester. Oxford and Montefiore Health System announced moments ago that they have reached an agreement effective December 1, 2021 for UnitedHealthcare and Oxford employer-sponsored plans, as well as UnitedHealthcare’s Medicare Dual Special Needs Plan.

2022 Open Enrollment Tools. A handy checklist of Employers s for the upcoming 2022 renewals. PLAN DESIGN CHANGES, ACA EMPLOYER MANDATE 855-667-4621.

In preparation of 2020 open enrollment, Employers should review their plan documents to confirm that they include these required changes. Learn how our Agency is helping businesses thrive in today’s economy. Please contact us at info@medicalsolutionscorp.com or (855)667-4621.

NYS 2020 Final Rates Approved. Small group rates increase 7.9% and 6.8% for individuals.Learn about Private Exchange and PEO Partnership (855)667-4621.

HealthPass New York will start offering OSCAR Health Plans effective Sept 1, 2017 to small employers. Oscar will offer eight plans with varying benefits package with 1 to 100 employees. The plans are available to small businesses located in New York City, Long Island, Westchester and Rockland counties. NJ residents can also access Hospitals & physicians through the NJ Qualcare PPO Network

HealthPass New York, a private insurance exchange for small employers. The addition of Oscar gives small businesses access to 3 health networks – Oxford, CareConnect and Oscar. Also, Guardian is the insurer of record for the ancillary benefits comprising dental, vision, life insurance, disability and accident insurance

Oscar entered the NY market on Jan 1, 2014 and had around 16,000 members. In 2015, it expanded coverage to New Jersey and grew to about 40,000 members. In 2016, Oscar had 145,000 members in New York, New Jersey, California, and Texas. Oscar’s cutting edge technology and pioneering benefits have simplified the consumer health insurance experience propelled easier access and understanding of health plans. Examples of success have been ease of physician locator, online appointment setting and no cost telemedicine 24/7. Additionally, some plans have $0 Copay generics and annual 3 free office visits

Why a Private Exchange? The advantage of a Private Exchange is the ability to empower employees with choice. Much like a 401K your employees can use a defined contribution allocation for benefits. As affordable health plan networks are increasingly smaller with specific coverage areas the one size show for all approach to benefits no longer works.

If you’re a small business owner who has concerns about payroll, filing paperwork, and complying with government regulations, co-employment may be the service you’ve been looking for. In some cases, a Private Exchange may NOT be right for you. With Health Care Reform your company may qualify for a small business tax credit or a be eligible for a large group discount under a PEO.

Small Business Tax Credit

Full-time Equivalent (FTE) Employee Calculator

messages[“SELF”] = “Employee Only”;

messages[“SELF_SPOUSE_DEPENDENT”] = “Employees and Dependents”;

messages[“medical”] = “Medical Insurance”;

messages[“dental”] = “Dental Insurance”;

messages[“vision”] = “Vision Insurance”;

messages[“HRA”] = “HRA”;

messages[“HSA”] = “HSA”;

messages[“FSA”] = “FSA”;

messages[“DCFSA”] = “DCFSA”;

messages[“LPFSA”] = “LPFSA”;

messages[“BASICLIFE”] = “Basic Life Insurance”;

messages[“SUPPLEMENTALLIFE”] = “Supplemental Life Insurance”;

messages[“BASICADD”] = “Basic AD&D Insurance”;

messages[“SUPPLEMENTALADD”] = “Supplemental AD&D Insurance”;

messages[“STD”] = “Short Term Disability Insurance”;

messages[“LTD”] = “Long Term Disability Insurance”;

messages[“commuter”] = “Commuter”;

Small Business Tax Credit

Full-time Equivalent (FTE) Employee Calculator

Empire Strikes Back 2017 Plans. Empire recently announced their re-entry back into the New York small group market for 2017. A legendary broad networked PPO is welcome news especially in the NY small group market of 1-100 employees. Recently, the broad national networks have diminished to only 2 national health insurers, Aetna and Oxford. As a result of Empire Blue Cross participation in the BlueCard PPO program members enjoy unparalleled national access network to 96% of hospitals and 93% of doctors across the country. This national program will be on 18 of 28 plans below.

DOCTOR SEARCH: Click Here

BENEFITS SUMMARY: OXFORD Platinum, Gold, Silver AND Bronze

Small Group Rates: 1st Quarter 2017

Drug Formulary: Click Here

Blue Priority FAQ: Click Here

Pathway FAQ: Click Here

Ask us about Empire’s flexible low participation voluntary group dental, vision, disability and life insurance plans. Stay proactive and contact us today for a customized consult on how your organization can prepare ahead for ACA, Benefits, Payroll and HR @ (855) 667-4621 or info@medicalsolutionscorp.com.