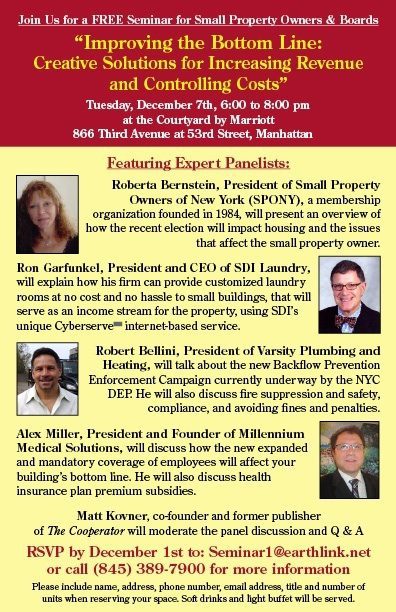

by admin | Oct 19, 2011 | Healthy NY, NY News, Small Business Group Health, Uncategorized

Healthy NY FAQ

The goal of the Healthy NY program is to promote and provide affordable insurance coverage to eligible small businesses that are not currently offering health insurance coverage to their employees. It is also available to eligible uninsured working individuals and sole proprietors. Listed below are some frequently asked questions by small employers about the Healthy NY Program.

This program does not allow employers to participate if they have “provided” group health insurance to their employees in the past year. Under what circumstances is my business considered to have “provided” group health insurance?

An employer is considered to have “provided” health insurance if the employer arranges for group health insurance and contributes more than $50 (or $75 if the business is located in the Bronx, Kings, Nassau, New York, Orange, Putnam, Queens, Richmond, Rockland, Suffolk, and Westchester counties) per month per employee towards the premiums for coverage. If an employer has merely arranged for health insurance coverage for employees but has not contributed more than the previously noted amounts, then the business may still be eligible for Healthy NY.

What if my business has provided other health insurance during the past twelve months, but the insurance had limited benefits?

If your business has provided other insurance during the past twelve months, but the coverage included only limited benefits (for example – only medical benefits or only hospital benefits, but not both) then your business may still be eligible for HNY.

What if my business has not provided group health insurance coverage in the past twelve months, but some of the employees have been covered through other sources, like their spouse’s employer plan?

The coverage of individual employees through other sources does not affect a small employer’s eligibility to participate in the HNY program.

I have 5 employees. One is enrolled in Medicare and two others receive health insurance through a spouse. The remaining two employees wish to enroll in Healthy New York. Is my business eligible?

Your business would be eligible because the three employees who have other coverage count towards satisfying the minimum 50% participation requirement.

Why is this program available only to small employers who did not provide insurance during the twelve months preceding application? Doesn’t this penalize the “good guys” who struggled to maintain coverage for their employees over the past few years?

HNY was designed to target those individuals who were completely uninsured. These so called “crowd out” provisions of the legislation are also designed to ensure that employers and individuals do not drop existing coverage in favor of this new product.

If my business offers family coverage through Healthy NY, does my business have to contribute towards the cost of the premiums for my employees’ dependents?

No. Employers are encouraged to share in the cost of the Healthy NY premium for their employees. However, there is no requirement that the employer contribute towards the cost of dependent coverage.

Can my business offer Healthy NY coverage to my employees’ families?

Yes, the employer may choose to offer coverage for dependents through the HNY program. Qualifying dependents include dependent children up to age 19 and full time students up to age 26. However, it may be financially beneficial to employees to obtain health insurance coverage for their children through New York’s Child Health Plus program, rather than Healthcore. For more information about Child Health Plus, contact New York’s toll free hotline at 1-800-698-4543.

Is there a re-certification process?

Yes. On an annual basis, employers participating in the HNY program are required to submit a re-certification that attests to their continued eligibility for the Healthcore program. The employer’s health plan will notify participating employers of when this re-certification is due and will provide them with the necessary forms.

What if my business qualifies for HNY and things change? What if I hire more employees and it brings my workforce total over 50? What if some of my employees drop coverage and my business no longer satisfies the 50% employee participation requirement? Would the coverage then be terminated?

Mid-year fluctuations in group size, wage levels and employee participation will not result in immediate termination of HNY coverage. However, HNY requires an annual re-certification process at which time your business’ eligibility would be reevaluated. If your business does not meet the eligibility criteria at the time of re-certification, you will be unable to continue to participate in the program. Please note that the wage levels set forth in the eligibility criteria for the HNY program are increased annually to account for inflation.

Can my business offer coverage to part-time and seasonal workers?

Yes, employers may offer coverage to part-time and seasonal workers who work less than 20 hours weekly, but they are not required to do so. If they choose to offer coverage to these employees, the employer may choose to contribute toward the cost of their premium but is not required to do so.

Can I count the wages of part-time and seasonal workers in determining if my business is eligible for participation in the Healthy NY program?

Yes, the annual wages of part-time and seasonal workers may be included for the purpose of determining an employer’s eligibility if the employer also extends coverage to part-time workers.

Which employees must be offered Healthy NY coverage?

Small businesses must offer HNY to all employees working more than 20 hours weekly and earning $40,000 or less annually.

My child just graduated from college and will no longer be eligible to remain on my policy. Would my child be eligible for Healthy NY?

Students who are graduating from high school or college who are aging off a parent’s policy may be eligible for HNY if they meet the other eligibility guidelines of the program.

If I do not qualify for Healthy NY, are there other affordable health insurance products available?

Yes, there are several other affordable options available to individuals, sole proprietors and small businesses. For a list of other programs, contact information and general eligibility requirements, please visit Millennium Medical Solutions Corp.

by admin | Oct 19, 2011 | Uncategorized

HEALTHY NY SLASHED!

As reported by Crains, the Healthy NY program will be undergoing significant cuts. Beginning January 1 2012, the high deductible health plans (HDHP) option will only be offered by Healthy NY.

With rates averaging 30% below market and reasonable benefits such as $20 Office Copays this was an important safety net for NYS Small Businesses. Since its inception 10 years ago the program has enrolled approx.180,000 members covering small groups, sole proprietors and working individuals. The program is not Medicaid and allows members to keep their Doctors and enroll in private insurance EPO/HMOs such as Empire Blue Cross, Oxford, Emblem GHI etc. One of the reasons the program is 30% less expensive is that the state has a pooled stop loss fund that reinsures health care companies. This fund has been underfunded with rapid growth and stagnant funding the past 3 years.

Currently, the less expensive Healthy NY HIgh Deductible Plan is $1200/single and $2400/family. Outside of preventive care, members must self insure on the entire deductible including Pharmacy. The good news is that this plan is a qualified HSA (Health Savings Account) and can be reinsured by members. For healthy members the HSA unspent money is not use it or lose and can be rolled over year to year.

Existing Healthy NY groups can still keep their plans as long as long they qualify. However, Healthy NY only allows 1st of the month effective date with only an 11.1.11 and 12.1.11 still available to prospective new groups looking to lock in the regular Healthy NY.

To view current Healthy Benefits and rates click here. For more information or to enroll Contact us today.

by admin | May 25, 2011 | Uncategorized

Welcome to WordPress. This is your first post. Edit or delete it, then start blogging!

![Health Care Reform – Final House Bill Released!]()

by admin | Nov 2, 2009 | latest health insurance news, Uncategorized, United Healthcare

Health Care Reform!

Americans woke up earlier today to the new Health Care Reform House Bill, “Affordable Health Care for America Act. HR 392”, which completes an important 1st step of 3 stages of a final bill. While I didn’t quite make it through the 1990 page there are couple of items that stood out.

According to The Associated Press the Congressional Budget Office concludes that the public option might actually cost consumers more than private coverage. The bill is expected to fetch close to $1 trillion dollars over 10 years. However, the bill could lead to $104 billion net reduction in deficit by spending cuts, revenue raisers and other bill provisions.

- The bill would create a Health Insurance Exchange system that individuals could use to buy health insurance from private insurers and government-run plans.

- The bill also would provide incentives for the creation of nonprofit, state-based health insurance cooperatives.

- The public option plans would have to negotiate their own rates with providers, rather than using the ultra-low Medicare rates.

- Individual responsibility: A “shared responsibility” section that would take effect in 2013 and covers both individuals and employers. The max tax for individuals would be either 2.5% of persons AGI or cost of average health insurance premiums.

- Employer responsibility: would impose a tax equal to 8% of employee wages on employers over a minimum size that failed to provide health coverage. The payroll tax would be lower for employers with $500,000 to $750,000 in payroll, and 0% for employers with less than $500,000 in payroll costs.

- Forbid plans from basing premiums or denials of care on factors such as pre-existing conditions, race, or gender.

- Close the Medicare Part D prescription drug program “doughnut hole”.

- Provide “affordability credits” to help individuals and families who meet income requirements pay their health insurance premiums, and provide health insurance subsidies for small businesses.

- Require the secretary of Health and Human Services to negotiate drug prices on behalf of Medicare beneficiaries.

- Expand Medicaid.

How will this be paid for? The new costs would be paid for according House Democrats by “making Medicare and Medicaid more efficient, imposing 5.4% tax surcharge on individuals with adjusted gross incomes over $500,000 and married couples with adjusted gross incomes over $1 million; and adopting other tax measures.”

Our reaction is that without a greater focus on health care costs, families and employers will not be able to afford coverage. Health care has tripled in a span of 15 years since 1984 to over $2 trillion and is expected to increase to $3.1 trillion by 2012. Most uninsured have programs available that were absent when I was growing up. You can still be middle class and qualify for state subsidies. Example for NYS is Healthy NY for small businesses and sole prop. as well as Family Health Plus and Child Health Plus.

In the absence of tort reform, however, and an expected 21% reduction in Medicare reimbursement this will negatively affect providers. In speaking with our client physician groups and national polls this could lead unintended consequences such 25% retirement and reduction of new physicians. Could this lead to more prescribing privileges and responsibilities for Physician Assistants, Nurses and Pharmacists?

Malpractice costs account for only 1% of spending but this leads to another estimated 9% is for “defensive medicine”. According to JAMA– “Defen

sive spending is described such as ordering tests, performing diagnostic procedures, and referring patients for consultation, was very common (92%). Among practitioners of defensive medicine who detailed their most recent defensive act, 43% reported using imaging technology in clinically unnecessary circumstances. Avoidance of procedures and patients that were perceived to elevate the probability of litigation was also widespread. Forty-two percent of respondents reported that they had taken steps to restrict their practice in the previous 3 years, including eliminating procedures prone to complications, such as trauma surgery, and avoiding patients who had complex medical problems or were perceived as litigious. Defensive practice correlated strongly with respondents’ lack of confidence in their liability insurance and perceived burden of insurance premiums.”

The issue of private competition is a big factor. According to Kelly Loussedes, of National Association of Health Underwriters, “By injecting more competition into the insurance market, this might seem like an intelligent way to lower overall health care costs. A “public option” would simply shift health care costs onto private payers — and undermine the private insurance system”. We question how real the private sector can compete with a public plan

however, well intentioned it may be.

In addition, most uninsured in progressive states such as NY are young people who elect not to pay now, illegal residents and people who earn over $50,000 but decide to opt out. The issue how strong is the requirement for individuals to participate? If its like Massachusetts with only a $1500 penalty or not enforced then this creates actually much more costs.

According to Mark Wagar President of Empire Blue Cross, “fewer businesses and individuals purchase private coverage and enrollment shifts to high cost Medicaid coverage, further increasing State funding burdens. In turn, too many people delay needed services, resulting in increased costs for urgent care for hospitals and physicians when care becomes critical.” He goes on to say that in NYS where the non group individual market is unaffordable now “The presence of an effective mandate – alone – would reduce the cost of individual coverage in New York by

over 60 percent and enroll 8 times as many New Yorkers in coverage than today because of improved affordability.”

Progressive countries such as Denmark and France have actually moved to private sector. According to our client Lisa Halpern of Euro Center USA , which works with a Danish travel insurance company for expatriates, “Denmark’s public single payer system had to include the private sector starting more than 20 years ago. This has become increasingly popular in recent years because the public had trouble accessing physicians without longer waiting times, diagnostics and private hospitals. The Private Insurance has also benefitted as a tax deduction for private companies offering additional health insurance.”

We support taking steps to lower costs as mentioned in prior newsletter

such as negotiating with drug manufacturers and implementation of healthcare cooperatives. On the other hand, we are wary of moving

too quickly on this road of reform and leading to unintended consequences. As debate and legislation is clarifying that a public option is a probability we are concerned if this will lead to big government, wasteful spending, higher taxes and the specter of no private sector.

As the saying goes the madness is in the details. As a fellow business owner we ask that you join us in staying active with your local chamber, legislative rep., editorials and social media forums on this road to reform. We have included some helpful links below.

Get Health Care Right!

Facebook Share

Message to your Senator