by admin | Aug 18, 2011 | group health insurance, healthcare, Hospitals

After balancing the budget and announcing $2.4 trillion in government spending cuts over ten years, politicians and media pundit are insisting that it is only the beginning of the attack on health care, pensions and other social programs.

So why is balancing the budget and cutting medicare so bad for the Privately Insured? After all, the Democrats have made sure the automatic cuts leave Medicare benefits untouched, and the Republicans have blocked any new taxes.

Everyone is content right? Or so it seems. But the truth is that cutting payments to Medicare providers will mean some Americans are going to pay more. It may not be called a tax, but if you’re covered by private health insurance, money will be coming out of your pocket nonetheless.

Here’s how cuts in Medicare affects the rest: If a hospital provides a service that costs $1,000,000, and the government elects to pay just $980,000, the $20,000 gap doesn’t disappear. The hospital has to cover it somehow. It will likely do so by shifting the costs to commercial insurers, which eventually means higher premiums. This cost shifting is nothing new-it’s been happening for years-but more cuts will just make it worse.

NY Hospitals in particular have felt Federal Funding cuts for teaching hospitals over the last decade. This has been a contributing factor to St. Vincents declaring bankruptcy last January. Many surviving hospitals however have the size to negotiate effectively with private insurers to make up that funding short fall.

So guess who makes up that difference? The fact remains, if you don’t deal with underlying costs, you’re not fixing the problem, you’re just covering it up.

by admin | Aug 2, 2011 | Health Care Reform, healthcare, PPACA

Under Health-Care Reform Insurance Coverage for Contraception Is Required – NYT; The Health Resources and Services Administration (HRSA), an arm of HHS, developed the women’s services package to implement the preventive health services provisions of the Patient Protection and Affordable Care Act of 2010 (PPACA).

Federal recommended that major medical plans should include coverage for:

- well-woman visits

- contraception

- screening for the viruses that cause AIDS and human papillomavirus

- breast-feeding support in the basic package of preventive health services benefits.

Health plans must roll this out by Aug 1, 2012. These are in accordance with the preventive care provisions enacted in the Reform Law. Agencies are determining what falls into this category and have amended this provision, see

here. While states such as NY already have these benefits built into their plan at no charge the medications are presently not free.

The contraception coverage requirement applies to drugs and devices approved by the federal Food and Drug Administration.

Exemption to religious organizations will be made available. This can be done at renewal time by groups’ broker. Unfortunately, non group individual policies will not allow for this exemption.

While this is a noble reccomendation, this is not as significant to NY and neighboring states. Some argue that the costs will indeed rise even in our region since the Rx will be free. Also, some consumers who currently purchasing supplies over the counter will tap into this free benefit.

Conclusion, not exactly a cost cutting decision as promised by the President to lower medical expenses but he did win over half the voters in time for next election!

by admin | Jun 3, 2011 | healthcare, HSA

The IRS has announced the Health Savings Account (HSA) limits for 2012.

In 2012, HSA limits are as follows:

HDHP Minimum Annual Deductible (No change from calendar year 2011):

Single – $1200

Family – $2400

HDHP Out-of-Pocket Maximum:

Single – $6050

Family – $12,100

HSA Maximum Contribution Limit:

Single – $3100

Family – $6250

HSA/HDHP Market Growth

HSA holders own the assets in the accounts and can build up substantial sums over time. Enrollment in HSA-compatible insurance plans has increased to 10 million earlier this year, from 1 million in March 2005, according to, America’s Health Insurance Plans (AHIP), a trade group.

HSAs were authorized starting in January 2004. Since then, AHIP has conducted a periodic census of health plans participating in the HSA/HDHP market.

• Between January 2009 and January 2010, the fastest growing market for HSA/HDHP products was large-group coverage, which rose by 33 percent, followed by small-group coverage, which grew by 22 percent.

• 30 percent of individuals covered by an HSA plan were in the small group market, 50 percent were in the large-group market, and the remaining 20 percent were in the individual market.

• States with the highest levels of HSA/HDHP enrollment were California, Ohio, Florida, Texas, Illinois and Minnesota

HSA Advantages:

Opportunity to build savings – Unused money stays in your account from year to year and earns tax-free interest. The HSA also gives you an investment opportunity.

Tax-free contributions and earnings – You don’t pay taxes on contributions or earnings.

Tax Free Money allowed for non traditional Medical coverage– As per IRS Publication 502, unused moneys can be used for dental,vision, lasik eye surgery, acupuncture, yoga, infertility etc. Popular Examples

Portability – The funds belong to you, so you keep the funds if you change jobs or retire.

Our overall experience with HSAs have been positive when employer funding is at minimum 50% using either the HSA or an HRA (Health Reimbursement Account-employer keeps unspent money). Traditional plans trend of higher copays and new in network deductibles has also led to the popularity of an HSA.

For more customized information and how to navigate this please contact us:

Millennium Medical Solutions Corp.

200 Business Park Drive

Armonk, NY 10504

914-207-6161

by admin | May 12, 2011 | Health Care Reform, healthcare, PPACA

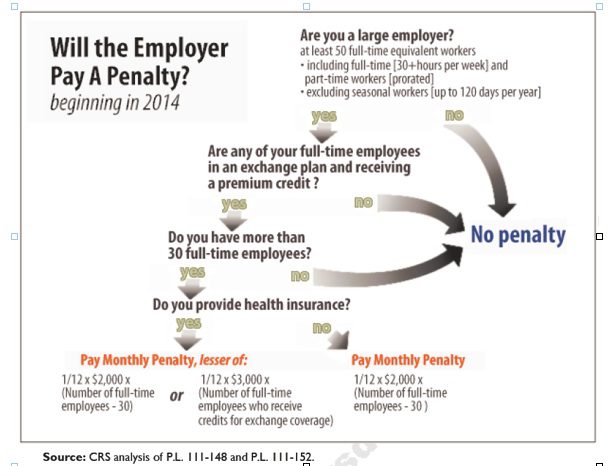

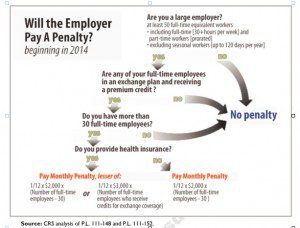

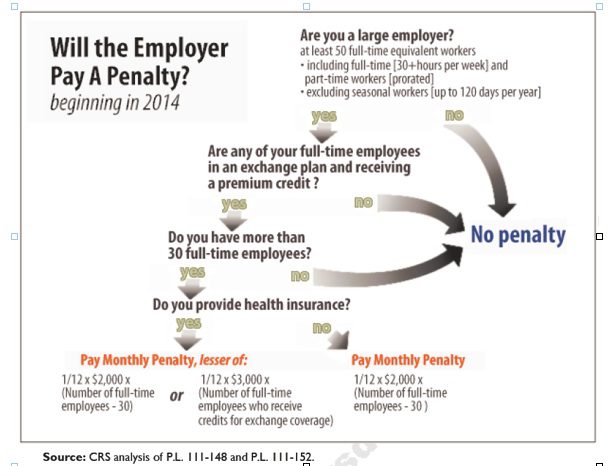

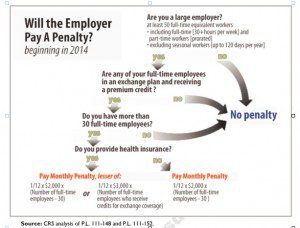

Larger employers that don’t offer minimum essential health coverage to full-time workers may face penalties under health care reform if any full-time employees receive a government premium credit or subsidy to buy their own insurance through an exchange.

The so-called employer mandate and the health insurance exchanges both go into effect in 2014 under the Patient Protection and Affordable Care Act.

The penalties generally apply to all employers with 50 or more full-time equivalent employees. An employer with at least 50 FTEs that provides access to coverage but fails to meet certain requirements, outlined below, may also be subject to a penalty.

To determine the FTE (Full Time Equivalent) you must count FT and PT employees. Full Time Employees are those working 30 hours+/week. See blog post “What does FTE mean?”

Affordability of the employer plan remains a consideration, however, since just one employee qualifying for federal premium assistance for exchange coverage will trigger a penalty for employers with 50 or more employees

Minimum essential coverage generally includes any coverage offered in the small or large group markets. Excepted benefits, such as limited-scope dental or vision offered under a separate policy, certificate or contract of insurance and Medicare supplemental plans, do not qualify.

Penalties explained

Starting in 2014, large employers that don’t offer coverage face a penalty of $2,000 per full-time employee (excluding the first 30) if at least one FTE receives a government subsidy to buy coverage on an exchange. This is sometimes referred to as the “play or pay” penalty.

Employers that offer coverage to employees may still face a “free rider” penalty if the coverage offered is deemed unaffordable or low in value.

If an employer offers coverage, but a full-time employee receives a premium credit subsidy through an exchange, the employer must pay an assessment equal to the lesser of:

- $3,000 for each employee that receives a subsidy

- $2,000 for each full-time employee after the first 30

The monetary penalties listed above are annual figures and may be pro-rated to the number of months for which the penalty applies.

Who’s eligible for a subsidy?

Employees who are offered coverage from their employer could be eligible for subsidies on the exchange if they don’t qualify for Medicaid or other programs, are not enrolled in their employer’s coverage and meet either of the following conditions:

- The employee’s share of the premium exceeds 9.5 percent of their household income

- The plan pays for less than 60 percent on average of covered health care expenses (e.g. coverage offered does not have at least a 60-percent actuarial value).

After 2014, penalty amounts are indexed by a premium adjustment percentage for the calendar year.

The Congressional Budget Office expects the penalties to generate $52 billion toward the overall cost of health reform by 2019. The Department of Health and Human Services estimates that fewer than 2 percent of large American employers will have to pay the assessments.

Disclaimer: This blog is not intended to represent legal advise and one should consult with a tax and/or legal expert.

by admin | May 12, 2011 | healthcare

To determine the FTE (Full Time Equivalent) you must count FT and PT employees. Full Time Employees are those working 30 hours+/week.* The number of full-time employees excludes those full-time seasonal employees who work for less than 120 days during the year.4 The hours worked by part-time employees (i.e., those working less than 30 hours per week) are included in the calculation of a large employer, on a monthly basis, by taking their total number of monthly hours worked divided by 120.

For example, a firm has 35 full-time employees (30+ hours). In addition, the firm has 20 part time employees who all work 24 hours per week (96 hours per month). These part-time employees’ hours would be treated as equivalent to 16 full-time employees, based on the following calculation:

20 employees x 96 hours / 120 = 1920 / 120 = 16

Thus, in this example, the firm would be considered a “large employer,” based on a total full-time equivalent count of 51—that is, 35 full-time employees plus 16 full-time equivalents based on part-time hours.

This blog is not intended to represent legal advise and one should consult with a tax and/or legal expert.

* IRC 4980H(c)(4)

Disclaimer: This blog is not intended to represent legal advise and one should consult with a tax and/or legal expert.

![President kills new 1099 reporting of PPACA]()

by admin | Apr 18, 2011 | healthcare

A taxing provision for small businesses was officially repealed last Thursday. The widely unpopular provision would have had

businesses report transactions to IRS of $600 in a year paid to ALL businesses for goods and services. Suddenly businesses would have to report payments to Staples, local restaurants and the like.

The $22 billion cost of the 1099 legislation was offset by requiring some people, if their income level increases during the year, to pay back a portion of the subsidies they receive to join health insurance exchanges created under the law.

Nevertheless, small businesses are in a position to take advantage of new Tax Credit of up to 35% and 25% for non profit see: http://alexmillers.wordpress.com/2011/02/08/tax-credit-boosts-small-business-health-plan-enrollment/. Even IRS Tax Advocate official, Nina Olsen, admits on CBS Sunday Morning News to the”mess” and daunting confusion of the 65,000 page tax codes. There were 579 changes alone in 2010 – “I dont know how businesses keep up”?!

We have been helping businesses and Accounting professionals calculate this credit. Call us to see of how to qualify for the small business tax credit.