by Alex | Jan 20, 2017 | PEO, Small Business Group Health

No Tax Restarts

No need to wait till next Jan 1st to make changes. No tax restarts are good news for PEO prospective groups. Federal Tax Restarts Are No Longer An Issue The significant added expense of having to pay tax restarts often postponed or ended the PEO conversation for many of our prospective clients. It was an important consideration since companies were not eligible for tax restart credits and the cost of the restarts often diminished the financial value proposition of partnering with a PEO.

Example: A group starting a plan in May would have to pay for annual FICA and FUTA all over again with new PEO. A PEO is considered a different employer group.

Moving forward, there are no federal tax restarts to worry about. FICA and FUTA wage bases will not restart when an employer joins a PEO. Ask us about our Quick Start Program to ensure a smooth start to our personalized PEO model, and offers perks for your staff.

Contact us to learn more about our Quick Start Program on-boarding processs but here are the high points:

- You’ll have access to the best healthcare providers, coupled with the pricing that is offered to much larger companies.

- Your Worker’s Compensation rate may favorably adjust since you will be “adopted” under the PEO and their typically much better rates.

- You’ll have a partner that will help build systems for recruiting, hiring, employee administration and more.

- You’ll also have experts who will work with you to establish and maintain policies and programs, including workplace safety, sexual harassment, diversity and others that are typically required by law.

While this certainly is not going to fix everything in the ever growing PEO industry, it’s a huge leap forward and offers clarity. If you would like to explore how a PEO can help your company, contact us and we will be happy to help you.

PEO White Paper

PEO Get Started

by Alex | Nov 3, 2016 | group health insurance, Millennium Medical Solutions Corp, Small Business Group Health

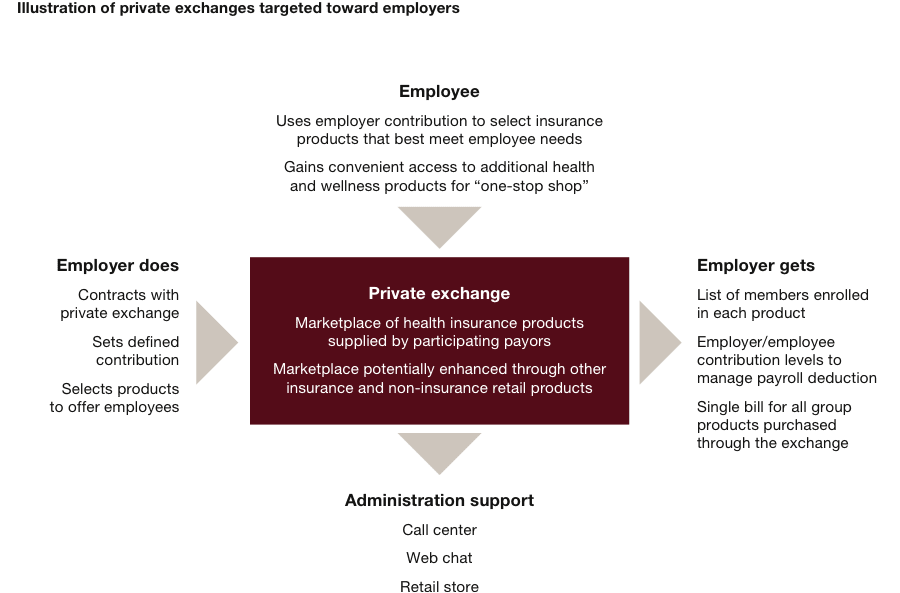

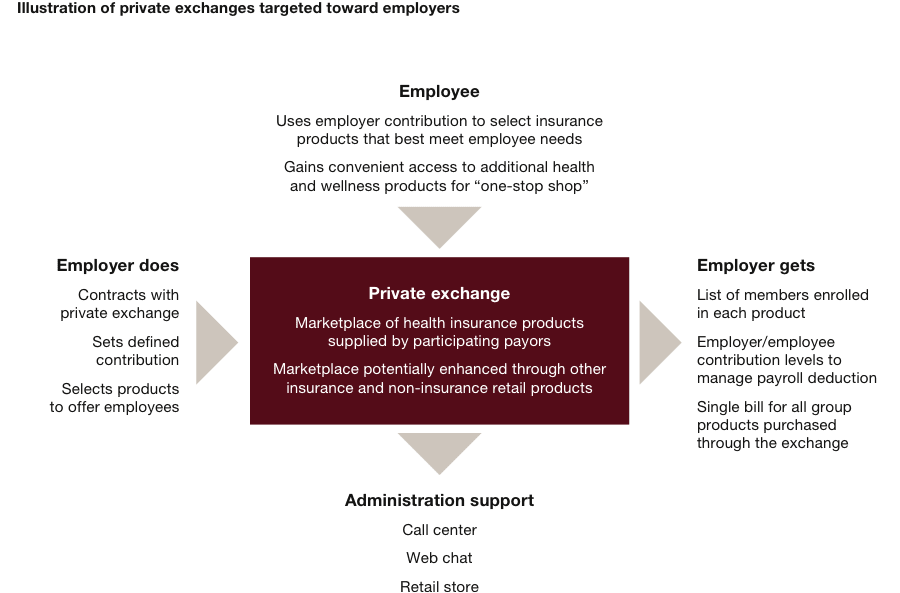

Why a Private Exchange? A Private Exchange Answers These Top 10 Questions.

- Defined Contribution: I don’t want to get involved in peoples individual health insurance needs. How does the Employer extricate from this very personal and important employee need and yet still offer this benefit? I like the defined contribution similar to a 401k.

- Tax Advantages: How do I offer the group and employee pre-tax advantages not offered on an individual basis?

- Group Insurance Upgrade: How do I upgrade from the diminishing individual market and meet strict group underwriting? Rates are higher, smaller networks and lower benefits in this segment.

- Full Fortune 500 Benefits: How do I offer balanced voluntary benefits similar to a Fortune 500 company? Some employees are asking for group discounted dental, vision, disability, life insurance and supplemental coverage such as AFLAC but we can’t guarantee the minimum participations.

- Simplify: I don’t have the time needed to make annual plan changes. How do I empower my employees with choice, education and various networks to make their own choices? Many times I’d just rather absorb the 10% increase than deal with the changes.

- Choice: I have employees all over the Metro area. How can you help me offer more than 1 or 2 health plans as benefits have become more complex and networks increasingly narrow geographic sensitive in nature?

- Technologies: Can you give me the technologies needed to make this paperless? Do you have a platform that I can use as an intranet communication portal? Can I securely store documents such Employee handbooks and notification?

- Added Value: Can you offer additional supporting tools aside from technology? Do you have COBRA and section 125 cafeteria documents?

- HR: Do you have an HR Services for Employers Support? Will you have employee support such as a 24/7 independent CS concierge services?

- Personalization: Will I have an in person experienced knowledgeable consultant available for support on plan design, metrics, and customer care and employee open enrollment?

Is a Private Exchange Right For My Group?

If you’re a small business owner who has concerns about payroll, filing paperwork, and complying with government regulations, co-employment may be the service you’ve been looking for. In some cases, a Private Exchange may NOT be right for you. With Health Care Reform your company may qualify for a small business tax credit or a be eligible for a large group discount under a PEO.

Try us on a custom demo, contact us at (855)667-4621 .

Resource:

Private Exchange White Papers