![Pharmacists Role Expanding?]()

by admin | Oct 29, 2010 | Health Care Reform, healthcare, Pharmaceutical Industry

Interesting article of Pharmacies possibly expanding new role in health care: Pharmacies Embrace Expanding Medical Role.

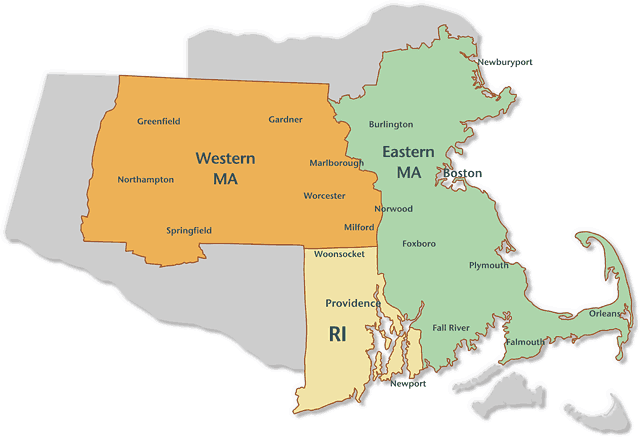

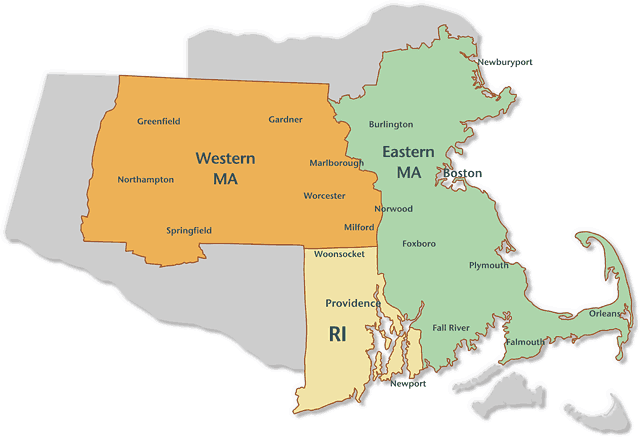

With access to MDs expected to be reduced as has been felt in Massachusetts, an early adapter of universalized health care, the elevated roles of supporting medical providers such as Nurses, Physician Assistants and Pharmacists will be significant.

I agree with this article and the notion that public policy strategies should include and incorporate the value of pharmacy, and certainly should not jeopardize the viability or accessibility of pharmacies. Pharmacist-provided care can improve outcomes for patients with chronic disease, and reduce costs. In sited studies the failure of patients to take medications as prescribed costs over $150 Billion/year.

Pharmacy can help mitigate these costs, and foster better health. With a community pharmacy, on average, within about two miles of every American home, pharmacies present amazing potential.

![Pharmacists Role Expanding?]()

by admin | Sep 1, 2010 | Health Care Reform, healthcare, Small Business Group Health

In the last posting I very briefly mentioned how industry consolidations are shaping the future landscape of private health insurance. I want to briefly discuss some of regulatory costs results of the Massachusetts Health Care Model.

With the new Health Care Reform – PPACA (Patient Protection Affordability Care Act) there is a greater need to cut costs on administration in order to compete. New guidelines are becoming more and more onerous on insurers.

For example, a member who opts out of purchasing insurance coverage and only intends to buy a plan when sick with minimal penalty and no waiting period is a potential time bomb for insurers! When member drops out of plans when healthy again insurers have no “good years” to count on to save for the “bad years” when one is sick.

The NYS direct non-commercial market is 2 to 3 times as expensive for this very reason. A member can opt in and out any time. We are seeing the same results with the Massachusetts model of which the Reform Act mirrors. In an article by Washington DC’s media centrist , Dailey Caller, “Since the bill became law, the state’s total direct health-care spending has increased by a remarkable 52 percent. Medicaid spending has gone from less than $6 billion a year to more the $9 billion. Many consumers have seen double-digit percentage increases in their premiums.” The article goes on to quote a Boston Globe Report that found that in the first two years of the program, the state’s ER costs actually rose by 17 percent. “They said that ER visits would drop by 75 percent, and it hasn’t been even close to that,” said State Treasurer Tim Cahill, who is currently running for governor as an Independent. “It hasn’t changed people’s habits. It hasn’t been successful at getting people to use less expensive alternatives.”

In Massachusetts, people who get subsidized insurance from an exchange are in health plans that pay providers Medicaid rates plus 10 percent. That’s less than what Medicare pays, and a lot less than the rates paid by private plans. Since the state did nothing to expand the number of doctors as it cut its uninsured rate in half, people in plans with low reimbursement rates are being pushed to the rear of the waiting lines.

National factors:

- The Congressional Budget Office (CBO) estimates there will be 32 million newly insured under ObamaCare.

- Studies by think tanks like Rand and the Urban Institute show that insured people consume twice as much health care as the uninsured.

- So all other things being equal, 32 million people will suddenly be doubling their use of health care resources.

- In a state such as Texas, where one out of every four working age adults is currently uninsured, the rationing problem will be monumental.

We already see a small number of Physicians leaving private and public networks. Several more are contemplating reduced hours and early retirement. Not sure how this will affect Medical Students but the prospects of reduced reimbursement, higher workload, mounting malpractice insurance costs and a hefty tuition bill cannot be positive. Will further empowering Physician Assistants and Nurse Practitioners to fill in the gaps be the solution for this shortage?

Small businesses in that state have sought State relief form double digit rate increases. State programs that businesses previously didn’t qualify for have been tested and accepted. For example, the Commonwealth Care stipulated that only groups who’s members were uninsured for more than 6 months and employers contributions were less than 33% could qualify. But groups who voluntarily terminated their plans were also now being accepted.

Sounds great, public programs are cheaper and easy to qualify? The Catch 22 for the State is that the more the employer insurance system degrades, the higher the cost is going to be for the state in providing subsidies to low income workers. The affordability of health insurance coverage to small businesses is a critically important component of health reform. With lower profit margins, small businesses have a much more difficult time affording insurance coverage than their larger competitors. As a result, only 59% of businesses with between 2 and 199 employees offered coverage to their employees. Among the smallest employers, those with between 3 and 9 employees, only 45% offered coverage according to Kaiser Family Foundation.

Insurance is simply a tool to finance the underlying cost of health care, so unless spending is brought under control, all state and federal reforms will shift the financial burden from one group to another, but not solve the underlying problem. The challenge moving forward will be to overhaul the delivery system to promote prevention, quality, and results-based care, to encourage healthy lifestyles, and to eliminate waste and fraud in the system.

A healthy stable small business insurance market is a canary in the mines. From what we’re seeing in Massachusetts the canary is not doing too well.

Read more: http://dailycaller.com/2010/03/23/skyrocketing-massachusetts-health-costs-could-foreshadow-high-price-of-obamacare/#ixzz0yCe9vijY

by admin | Aug 5, 2010 | healthcare, latest health insurance news

The showdown is over and 45,000 Westchester Empire Blue Cross residents can now breathe a sigh of relief. The majority of the Westchester hospitals belong to this network – Lawrence Hospital Center,Northern Westchester Hospital, Phelps Memorial Hospital Center and White Plains Hospital Center.

While these hospitals were covered on emergencies and the physicians were unaffected it still posed an inconvenience. physicians were rerouting patients to participating hospitals such as Westchester Medical Center in Valhalla.

As I posted in prior blogs these tight negotiations will be the new norm as regional hospital systems have logically evolved to gain leverage in the market. Unlike in past negotiations this one has been a thriller as contracts have not been renewed since April 1. The PR campaign was heavy on both sides with political pressures coming down form the State, board of directors and passionate letter writing campaigns.

Ironically we are seeing the opposite trend from insurers who are building smaller networks focused on smaller regional hospitals and medical centers. The article in NYT, Insurers Push Plans That Limit Choice of Doctor, discusses how this model may possibly work in the new Obama Care. Many may be willing to make network concessions with savings of 15%. We are seeing this trend already with offshoots from insurers such as a 5 Boroughs plan – Aetna NYC HMO, Atlantis and Emblem CompreHealth HMO. We expect Empire and Oxford to come out with something similar. Our clients will be closely monitoring these networks.

So in an odd twist a Stellaria Hospital system may be the only hospital a Westchester resident can go to with a possible NYC hospital systems alliance such as Columbia Presbyterian Hospital/New York Cornell.

Either way Empire residents here will be sleeping soundly knowing that they are not limited, for now.

by admin | Jun 11, 2010 | healthcare

Yes its finally out there, the big issue came out this week! Sure some of you are thinking Time’s Person of the Year or Sports Illustrated Swim Suit issue(that’s in February) but those in the medical field know what I’m talking about. Ahhhh the long awaited annual 2010 NY Magazine’s Best Doctors issue is out. Is it HS all over again or is it for real?

Yes its finally out there, the big issue came out this week! Sure some of you are thinking Time’s Person of the Year or Sports Illustrated Swim Suit issue(that’s in February) but those in the medical field know what I’m talking about. Ahhhh the long awaited annual 2010 NY Magazine’s Best Doctors issue is out. Is it HS all over again or is it for real?

The annual list collects opinions of local doctors and asks whom they would refer a family member to. After this you get voila a ready to go Zagat-style guide of Best Doctors. Simple right?

Just like any profession there are politics and old boy cronyism with powerful medical departments overly represented while small offices are forgotten.

Nevertheless whats a New Yorker to do in a fast harried life style? This can be used as a general guide but much like a friendship the doctor-patient relationship happens organically. Well where there’s demand there’s supply. Insurers are indeed working on giving access to members with what else The Zagat Health Survey. Empire Blue Cross offers this to their members. Don’t simply sneer at this. Research has shown that patients who have a good relationship with their doctor are more likely to ask questions and follow the doctor’s advice – which can lead to better health.

So with both auspicious fine tools and a little leg work one is now empowered to get the best doctors. Now if we can only afford the copays and get an appointment.

by admin | May 28, 2010 | healthcare

According to a 2010 Athena Health Survey Humana is named as the Top Payor by Physicians.

According to a 2010 Athena Health Survey Humana is named as the Top Payor by Physicians.

For the second year in a row and third time in five years, Humana Inc. ranks #1 in overall performance — making it the easiest payer for health care providers to do business with — in a review of 2009 claims-payment data conducted by athenahealth Inc., a provider of Internet-based business services to doctors, and Physician’s Practice magazine.

Humana offers solutions such as real-time adjudication, which enables health-plan members to have a claim processed instantly before leaving the doctor’s office . A weighted measure is the metrics used are Days in Accounts Receivable.

Its too bad Humana is inactive in the northeast. With Health Care Reform changes, progressive states such as NY will less likely be hazardous and more welcoming to an outside insurer as most state laws are being mimicked by the Federal Government. Aetna was ranked second.

http://www.athenahealth.com/our-services/PayerView.php?intcmp=PAYERVIEW

![Pharmacists Role Expanding?]()

by admin | Apr 23, 2010 | healthcare, Hospitals, NY News

Just a heads up on a topic that will be all too familiar going forward. We see this as a trend and not the exception. As hospital systems have consolidated in reaction to negative market condition and increasing costs of doing business. But size is better when it comes to negotiating with insurers. We are seeing profitable hospitals asking for 15% rate increase form prior years. They can do this because insurer network marketability is on the quality and size of network.

Just a heads up on a topic that will be all too familiar going forward. We see this as a trend and not the exception. As hospital systems have consolidated in reaction to negative market condition and increasing costs of doing business. But size is better when it comes to negotiating with insurers. We are seeing profitable hospitals asking for 15% rate increase form prior years. They can do this because insurer network marketability is on the quality and size of network.

Current News:

Aetna: Effective 4/5/2010, Beth Israel Medical Center – Petrie Division, Beth Israel Medical Center – Kings Highway Division; Long Island College Hospital; New York Eye & Ear Infirmary; and St. Luke’s Roosevelt Hospital Center – Roosevelt Division, and St. Luke’s Roosevelt Hospital Center – St. Luke’s Division (the “Continuum Hospitals”) were terminated from the Metro NY Aetna network. The hospitals will remain participating and will be accepting In Network Rates until the end of the cooling off period on 6/5/2010.

Continuum had almost lost United/Oxford Health Net in march and Empire or Wellpoint last Spring.

Empire Effective 4/1/10 has lost Stellaris Health Network in Westchester. Those hospitals include Phelps Memorial, Lawrence Hosp, White Plains Hosp, and Northern Westchester Hosp. They were asking for double digit increases for each year of a mutli-year contract, which would have had to be passed on to our members in the form of higher premiums. Our Empire clients will be covered in those facilities for emergencies, as well as services that have already been pre-authorized and approved.

A released Empire Fact Sheet of the contract termination is available

While this happened somewhat in prior years things usually were worked out at 11th hour after a cooling of period. Whats troubling now is that there is little common ground to stand on. We believe in the short term they will get reworked as both Mammoth Corp need each other but this will be a serious concern worth watching.