by admin | Feb 8, 2011 | Health Care Reform, healthcare, Small Business Group Health

More small businesses are providing health insurance to their employees in 2011 as a result of the tax credit of up to 35% and 25% for non-profits offered through PPACA starting in 2010. Several insurers have reported significant increases in small group enrollments. Coventry Health Care added 115,000 small group enrollments, representing an 8% increase; and Blue Cross Blue Shield of Kansas City saw a 58% jump, 38% of which had never offered health benefits to employees before. Click video [vimeo http://vimeo.com/19716548].

Further information can be found at http://www.irs.gov/newsroom/article/0,,id=223666,00.html. In addition, we have a simple work sheet that can determine exactly how much the credit is worth to you. Importantly, the Tax Credit will increase to 50% for small businesses by 2014!

Please contact our office for further guidance on your group’s plan.

by admin | Feb 1, 2011 | Health Care Reform, healthcare

Yesterdays ruling on Individual Mandate by Florida Federal Judge on buying a health plan is unconstitutional changes everything. More importantly, Judge Vinison also struck down the entire bill as unconstitutional.

According to Politico, the health reform law lacks a severability clause, a common legal phrase that prevents an entire law from being invalidated in court if one portion of the law is deemed illegal. He added that the law, “like a defectively designed watch, needs to be redesigned and reconstructed by the watchmaker” (New York Times, 1/31). Put in another way, he has compared the individual mandate to requiring an individual to buy broccoli because its good for you.

The Plaintiff, Florida DA, argued:

“The Individual Mandate is unprecedented. It compels citizens to engage in commerce even though they have not themselves chosen to enter the marketplace. Never before has Congress purported to use its power over interstate commerce to compel activity, rather than to regulate existing economic activity.”

If this ruling is upheld on appeal, many of the major provisions of PPACA will need to be redesigned or removed altogether. Further details regarding this ruling can be viewed at CNN.

![IRS Will Not Enforce Non-Discrimination Clause….For Now.]()

by admin | Jan 25, 2011 | Health Care Reform, healthcare

The IRS issued On December 22, 2010 a Notice http://www.irs.gov/pub/irs-drop/n-11-01.pdf which states compliance with the non-discrimination provisions of the Protection and Affordable Care Act (PPACA) are suspended for insured group health benefit plans….for now.

Under the original health care reform law, non-grandfathered, fully insured health plans would have required companies to meet the non-discrimination rules of IRC 105(h). This provision of the law is effective for plan years beginning on or after September 23, 2010. Therefore, if your company’s health plan renews on January 1, 2011 and it is non-grandfathered, your plan is subject to these rules on January 1, 2011.

The anti-discriminatory provisions were enacted primarily to prohibit highly-compensated employees (such as company owners and senior management) from receiving health benefits that are materially better than the “rank and file” employees. As contemplated in the health care reform measure, failure to comply with the anti-discriminatory rules could result in the payment of penalties to the IRS.

Affected plans must satisfy two tests; eligibility test, and benefits test. The tests determine whether or not the plan disproportionately benefits highly compensated individuals (HCI). Please contact us for further information on these tests.

According to the notice, the decision to delay the effective date was because:

Regulatory guidance is essential to the operation of the statutory provisions, the Treasury Department and the IRS, as well as the Departments of Labor and Health and Human Services (collectively, the Departments), have determined that compliance with § 2716 should not be required (and thus, any sanctions for failure to comply do not apply) until after regulations or other administrative guidance of general applicability has been issued under § 2716.

There has been no indication of the length of the delayed implementation, other than the provision would become effective after further rules were promulgated.

The employer is responsible for monitoring non-discrimination compliance. If the plan is deemed discriminatory, fines could be assessed at $100 per day per individual discriminated against. If reasonable cause exists (the employer can show good faith belief that the plan was not discriminatory), the penalty can be capped at the lesser of 10% of group health plan costs or $500,000.

Importantly, this doesn’t apply to “grandfathered plans“. Employers of non-grandfathered, fully insured plans should review their contribution structures and benefit designs to ensure that plans are not favoring highly compensated employees.

Further information can be found at http://www.irs.gov/irb/2010-41_IRB/ar07.html . Please contact our office for further guidance on your group’s plan.

![IRS Will Not Enforce Non-Discrimination Clause….For Now.]()

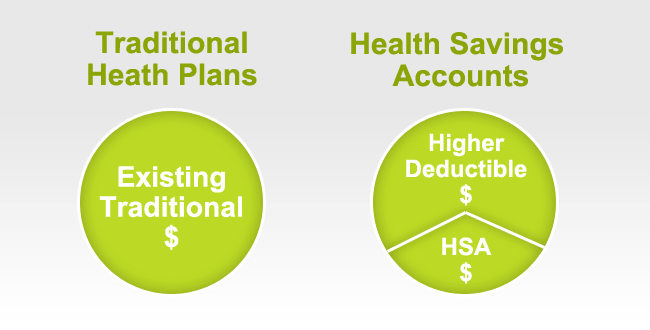

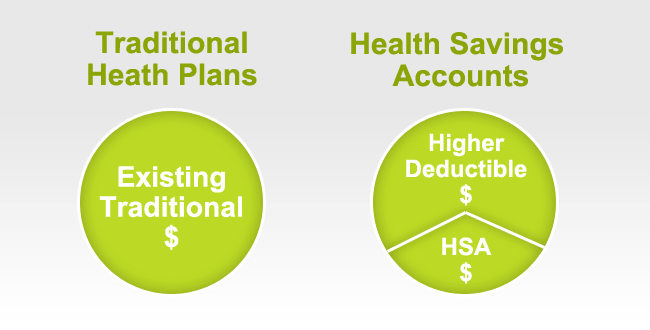

by admin | Nov 5, 2010 | group health insurance, healthcare, HSA, Small Business Group Health

The Internal Revenue Service has released the 2011 limits for health savings accounts (HSAs) and for high-deductible health plans (HDHPs), to which HSAs must be linked. The amounts for 2011 are unchanged from 2010.

In Revenue Procedure 2010-22, issued on May 24, 2010, the IRS provides the inflation-adjusted HSA contribution and HDHP minimum deductible and out-of-pocket limits for 2011. Under the cost-of-living adjustment and rounding rules of Internal Revenue Code section 223, the 2011 amounts are unchanged from the amounts for 2010. The 2011 amounts are shown below.

2011 Limits for Health Savings Accounts and High-Deductible Health Plans

HDHP minimum deductible amounts

Individual: $1,200

Family: $2,400

HDHP maximum out-of-pocket amounts

Individual: $5,950

Family: $11,900

HSA statutory contribution amount

Individual: $3,050

Family $6,150

HSA catch-up contributions (age 55 or older)

$1,000

HSA/HDHP Market Growth

HSA holders own the assets in the accounts and can build up substantial sums over time. Enrollment in HSA-compatible insurance plans has increased to 10 million earlier this year, from 1 million in March 2005, according to, America’s Health Insurance Plans (AHIP), a trade group.

HSAs were authorized starting in January 2004. Since then, AHIP has conducted a periodic census of health plans participating in the HSA/HDHP market.

• Between January 2009 and January 2010, the fastest growing market for HSA/HDHP products was large-group coverage, which rose by 33 percent, followed by small-group coverage, which grew by 22 percent.

• 30 percent of individuals covered by an HSA plan were in the small group market, 50 percent were in the large-group market, and the remaining 20 percent were in the individual market.

• States with the highest levels of HSA/HDHP enrollment were California, Ohio, Florida, Texas, Illinois and Minnesota

HSA Advantages:

Opportunity to build savings – Unused money stays in your account from year to year and earns tax-free interest. The HSA also gives you an investment opportunity.

Tax-free contributions and earnings – You don’t pay taxes on contributions or earnings.

Tax Free Money allowed for non traditional Medical coverage– As per IRS Publication 502, unused moneys can be used for dental,vision, lasik eye surgery, acupuncture, yoga, infertility etc. Popular Examples

Portability – The funds belong to you, so you keep the funds if you change jobs or retire.

Our overall experience with HSAs have been positive when employer funding is at minimum 50% using either the HSA or an HRA (Health Reimbursement Account-employer keeps unspent money). Traditional plans trend of higher copays and new in network deductibles has also led to the popularity of an HSA.

For more customized information and how to navigate this please contact us:

Millennium Medical Solutions Corp.

200 Business Park Drive

Armonk, NY 10504

914-207-6161

![IRS Will Not Enforce Non-Discrimination Clause….For Now.]()

by admin | Nov 3, 2010 | healthcare, Hospitals, Small Business Group Health

The teaching hospital of Valhalla and Empire no longer have a contractual agreement effective 11/1. This effects the commercial product and not the Medicare plan – MediBlue.

This comes up on the heels of the rancorous recent dispute between Empire and Stellaris Hospital Systems which was finally resolved after 5 months without a contract. Disputes like these are becoming industry wide- see Hospital Contract Non-Negotiation. Unusually, the dispute between Empire and Westchester Medical Center came as a rather surprise without the typical 11th hour press releases by both parties.

Size matters when it comes to these disputes. Empire is still #1 insurer with close to 5 million members. While the hospital serves the Westchester community and is a vital resource they do not have the scale as the 4 member hospital like Stellaris Hospital Systems which includes Phelps Memorial, Lawrence Hosp, White Plains Hosp, and Northern Westchester Hosp.

More info on Empire Blue Cross’s position can be reviewed here. We are awaiting further the hospitals position to share with clients and partners. For more customized information and how to navigate this please contact us:

Millennium Medical Solutions Corp.

200 Business Park Drive

Armonk, NY 10504

914-207-6161