IRS Extends 1094 and 1095 Deadlines

IRS Extends 1094 and 1095 Deadlines

The IRS Notice released today December 28, 2015 extends the due dates for the 2015 information reporting requirements (both furnishing to individuals and filing with the Internal Revenue Service) for insurers, self-insuring employers, and certain other providers of minimum essential coverage, that is, all Forms 1094 & 1095.

There is no extension for individual tax filings and individual taxpayers/employees may not receive their Forms 1095-B or 1095-C before they file their income tax returns for 2015.

Because of the delay, some employees will not receive their forms until after the April 15 tax filing deadline. The IRS indicates that these employees do not have to file an amended tax return. They should simply keep their forms in a file should they need them later.

Specifically, this notice IRS extends 1094 and 1095 deadlines to:

- Form 1095-C – from employer to employees – original deadline was 2/1/16, was extended to 3/31/16

- Form 1094-C and 1095-C IRS filing by the employer (paper) original deadline was 2/29/16, was extended to 5/31/16

- Form 1094-C and 1095-C IRS filing by employer (electronically) original deadline was 3/31/16, was extended to 6/30/16

Resource:

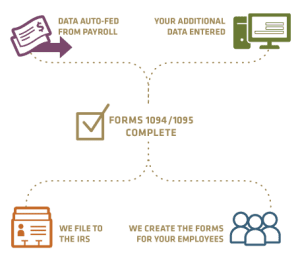

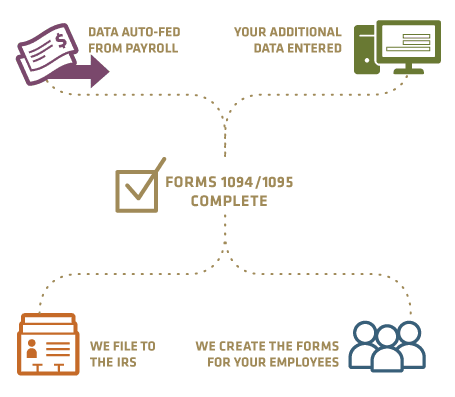

Our payroll partners offer the ability to fill out your Forms 1094 & 1095 as well as providing copies to your employees and filing them with the IRS. For additional general Payroll Support and ACA Tax filings 1094 & 1095 please contact us at 855-667-4621.