by admin | May 25, 2011

Health Insurance FAQ

What are the cheapest plans?

Most, if not all, of the insurance companies in the market include as one of their plans the combination of a health savings account and a high–deductible plan. EmblemHealth, for instance, offers a plan for $170 a month. These plans are very bare bones. The EmblemHealth plan has a deductible of $5,000. That’s not anyone’s idea of a rich benefit plan. When coupled with a health savings account, which gives the business and the employee the chance to make tax–free contributions toward expenses below that deductible, such plans do help employees with routine expenses and cover workers in case of a catastrophic illness.

Why do my rates keep going up?

Some plans raise rates sharply in the first few years of a plan because expenses were higher than actuaries predicted. But the big reason that costs for health care keep rising for small and large businesses is that people are using more health care services.

What will happen if I have a catastrophic claim?

Nothing. New York law prevents insurers from raising your rates based on your claims history.

How can I make sure the plan I choose has a good network?

You have to look at the fine print and decide what you want. There’s no guarantee that the doctor, or even the hospital you want, will be in–network. Memorial Sloan–Kettering Cancer Center, for instance, is not included in the networks of some low–cost plans.

How much will health care cost?

Most businesses we talk to that offer health insurance offer plans in the range of $350 to $450 a month and pay a part of the premium for employees.

Do I have to buy dental and vision insurance from the same company that I buy my major medical plan from?

No. In fact, it pays to shop around.

Are rates going to keep increasing?

There’s no real end in sight, unless health reform in Washington radically changes the market. Annual increases in the small business market have been in the mid– to high double–digits for several years.

What are my competitors in the labor market offering?

According to the National Federal of Independent Business, about 60% of small businesses offer health insurance to their employees and typically pay a greater share of expenses than big businesses.

What is an Explanation of Benefits (EOB)?

An Explanation of Benefits (EOB) is the form that is sent to the patient from the carrier to explain the charges that have been assigned to the carrier and the amount that the carrier has indicated that they will pay for the services rendered.

I have received an Explanation of Benefits (EOB) from the Carrier, what do I need to do?

The employee should contact the insurance carrier first to verify if the bill has been submitted to the carrier and processed.

I have received a bill from the provider but the services should be covered by my insurance plan, what should I do?

The employee should contact the insurance carrier first to verify if the bill has been submitted to the carrier and processed.

- If it has been received and processed, the employee will need to ask how the claim was processed to be sure that it was paid correctly.

- If the claim has been received but not yet processed, the employee should ask the carrier if any additional information is needed to process the claim.

- If the claim is not on file, the employee should contact the provider and request that they resubmit the claim to the carrier for processing.

What do I do if I have just enrolled in my insurance plan and have not yet received my ID card but need to see a doctor or get a prescription?

Contact a KYBA Benefits Account Manager who will contact the carrier and check the status of the application and see if ID cards have been mailed.

- If the employee is listed in the system, the employee should schedule an appointment with the provider and provide them with a Social Security number and Group number so the provider can call and verify benefits in order to treat the employee and/or fill a prescription.

- If the employee is not listed in the system, the employee can still see a provider by giving the provider the Social Security number and Group number, however, the employee should request that the provider not file the claim until the application is in the carrier system. If a prescription is needed prior to being in the system, the employee will need to pay for the medication and submit a claim form in order to get reimbursement up to the copay amount. In the mean time, the KYBA Benefits Account Manager will be working to get the application expedited in to the carrier’s system.

What should I do if my address has changed?

The employee should contact the HR Administrator at their employer to notify them of the change AND contact the customer service department of the insurance carrier to notify them of the address change.

How do I add or delete a dependent from my plan?

If there is a qualifying event or if the necessary change is during open enrollment, the employee will need to complete a change form for each carrier that is affected by the change and submit the form to the appropriate carriers.

What is Initial Enrollment for a New Employee?

Initial Enrollment is the first opportunity when you and your eligible dependents can enroll in your benefits. There are certain advantages of enrolling in benefits during your Initial Enrollment that are never offered again.

Examples of this include but are not limited to:

- Dental Insurance plans have Late Entrant Penalties. If you add Dental Insurance to your coverage after your Initial Offering you will have to wait for certain benefits to take effect. Please review your Benefits Kit for the specific Late Entrant Penalties timetables.

- Supplemental Life Insurance plans offer guarantee issue limits offered during your Initial Offering. You are able to enroll up to these limits without evidence of insurability. If you do not take advantage of this initial offering, your next opportunity would require you and your dependents to provide evidence of insurability where you and your dependents may be declined coverage.

- Supplemental Disability Insurance plans offer guarantee issue limits offered only during your Initial Offering. You are able to enroll up to these limits without evidence of insurability. If you do not take advantage of this Initial Offering, your next opportunity would require you to provide evidence of insurability where you may be declined coverage.

How do I enroll as a New Employee?

Carefully review all the information in your Benefits Packet before making any decisions.

Make your benefit elections by completing the enrollment form(s) provided by your HR Administrator.

Return your completed enrollment form(s) to Human Resources right away but no later than the effective date of your benefits.

By waiting until your effective date to submit enrollment form(s) you may experience several problems, which include but are not limited to:

- Inability to access benefits on your effective date

- Delay in receiving your ID Card for up to 3 weeks from the date you submit your form(s) will create several problems.

- Not have ID cards on your effective date

When is the next opportunity to enroll or make changes in my benefits?

The next time you can make changes or enroll is the next Open Enrollment or Qualifying Event. Outside of Open Enrollment, the only time you or your eligible dependents can make a change in your benefits is during a Qualifying Event.

What is a Qualifying Event?

A Qualifying Event is a significant change in a person’s life that creates the need to add, drop, increase or change coverage. Outside of Open Enrollment, the only other time you can enroll, change or delete your benefit options is within 30 days of a Qualifying Event.

Examples of qualifying events include, but are not limited to, the following:

- Marriage or Divorce of the employee

- Death of the employee’s spouse or dependent

- Birth or Adoption of a Child

- Start or End of employment of the employee’s spouse

- Change in status or employment of the employee or spouse

- Significant change in health coverage of the employee or spouse due to the spouse’s employment

ONCE AGAIN…You MUST submit your request to change within 30 days of the Qualifying Event or it will be DECLINED!

What is Open Enrollment?

Open Enrollment is the annual event, for certain benefits, where you and your eligible dependents can request changes in your election and apply for coverage.

When can I drop benefits?

Benefits can be dropped ONLY during the Open Enrollment period OR if a Qualifying Event occurs.

by admin | May 12, 2011 | Health Care Reform, healthcare, PPACA

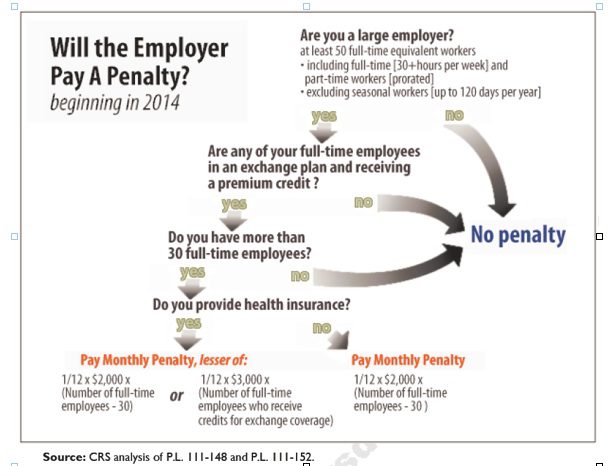

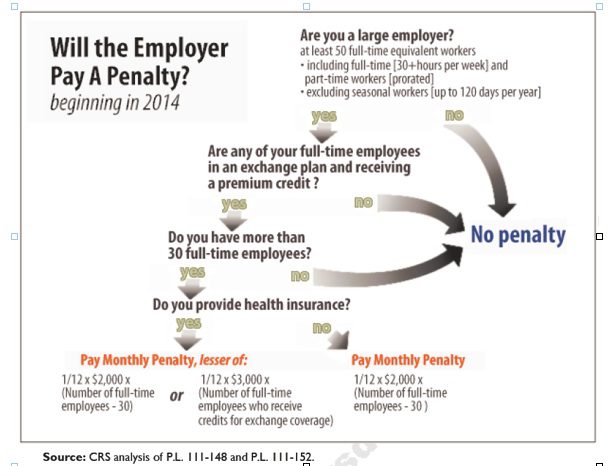

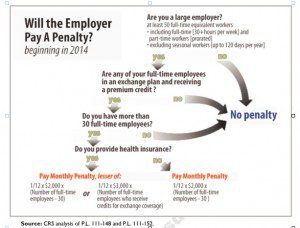

Larger employers that don’t offer minimum essential health coverage to full-time workers may face penalties under health care reform if any full-time employees receive a government premium credit or subsidy to buy their own insurance through an exchange.

The so-called employer mandate and the health insurance exchanges both go into effect in 2014 under the Patient Protection and Affordable Care Act.

The penalties generally apply to all employers with 50 or more full-time equivalent employees. An employer with at least 50 FTEs that provides access to coverage but fails to meet certain requirements, outlined below, may also be subject to a penalty.

To determine the FTE (Full Time Equivalent) you must count FT and PT employees. Full Time Employees are those working 30 hours+/week. See blog post “What does FTE mean?”

Affordability of the employer plan remains a consideration, however, since just one employee qualifying for federal premium assistance for exchange coverage will trigger a penalty for employers with 50 or more employees

Minimum essential coverage generally includes any coverage offered in the small or large group markets. Excepted benefits, such as limited-scope dental or vision offered under a separate policy, certificate or contract of insurance and Medicare supplemental plans, do not qualify.

Penalties explained

Starting in 2014, large employers that don’t offer coverage face a penalty of $2,000 per full-time employee (excluding the first 30) if at least one FTE receives a government subsidy to buy coverage on an exchange. This is sometimes referred to as the “play or pay” penalty.

Employers that offer coverage to employees may still face a “free rider” penalty if the coverage offered is deemed unaffordable or low in value.

If an employer offers coverage, but a full-time employee receives a premium credit subsidy through an exchange, the employer must pay an assessment equal to the lesser of:

- $3,000 for each employee that receives a subsidy

- $2,000 for each full-time employee after the first 30

The monetary penalties listed above are annual figures and may be pro-rated to the number of months for which the penalty applies.

Who’s eligible for a subsidy?

Employees who are offered coverage from their employer could be eligible for subsidies on the exchange if they don’t qualify for Medicaid or other programs, are not enrolled in their employer’s coverage and meet either of the following conditions:

- The employee’s share of the premium exceeds 9.5 percent of their household income

- The plan pays for less than 60 percent on average of covered health care expenses (e.g. coverage offered does not have at least a 60-percent actuarial value).

After 2014, penalty amounts are indexed by a premium adjustment percentage for the calendar year.

The Congressional Budget Office expects the penalties to generate $52 billion toward the overall cost of health reform by 2019. The Department of Health and Human Services estimates that fewer than 2 percent of large American employers will have to pay the assessments.

Disclaimer: This blog is not intended to represent legal advise and one should consult with a tax and/or legal expert.

![Massachusetts: 5 Years after Health Reform]()

by admin | Apr 28, 2011 | Health Care Reform

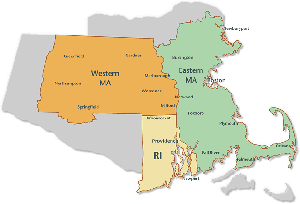

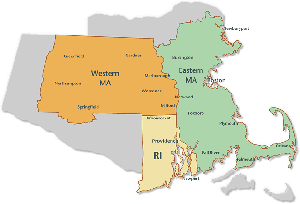

This month on April 12th, 2011 marked the five-year anniversary of Massachusetts 2006 State Health Care Reform. The reform was signed into law by then-governor Mitt Romney with the goal of providing affordable health insurance coverage to the estimated 6% of Massachusetts residents that were uninsured at the time.

Massachusetts State Health Care Reform and the Affordable Care Act are virtually identical.Both reforms rely heavily on state-based health insurance exchanges, subsidies for qualifying individuals, and mandates for employers and individuals. As a result, Massachusetts presents the most appropriate example of what to expect from federal health care reform.

So, what have we learned from Massachusetts state reform? The 2006 Massachusetts State Health Care Reform:

- Created the MAHealthConnector (a state health insurance exchange) to provide guaranteed issue health insurance to MA residents;

- Mandated that every resident of the state obtain a minimum level of health insurance or face penalties;

- Mandated that employers provide a “fair and reasonable contribution” to their employees’ health insurance premiums or face penalties; and

- Provided free health insurance and partially-subsidized insurance to qualifying residents based on income.

Proponents of the law argue that Massachusetts Health Reform:

- Has resulted in Mass. being the state with the highest percentage of insured residents, at 98% in April 2011, including 99.8% of children.

- Has increased the percentage of private companies that offer health insurance from 70% in 2005 to greater than 77% today.

- Has lowered the cost of individual health insurance premiums in Mass. due to the fact that primarily healthy people have moved to the individual market.

Opponents of the law argue that Massachusetts Health Reform:

- Has increased costs for its residents, $13,788 for a family of four in 2010, in the state that already had the highest medical costs in the nation prior to implementation.

- Was setup for failure from the start due to its reliance on employer-sponsored health plans, plans that employers cannot afford due to rising costs.

- Has resulted in more than half of the newly-insured residents receiving health insurance that is partially or completely subsidized by Massachusetts’ taxpayers.

Has Massachusetts health care reform been properly utilized as a test bed for Federal Reform? Will the costs associated with Massachusetts health care reform be sustainable over the long term?

![Massachusetts: 5 Years after Health Reform]()

by admin | Jan 25, 2011 | Health Care Reform, healthcare

The IRS issued On December 22, 2010 a Notice http://www.irs.gov/pub/irs-drop/n-11-01.pdf which states compliance with the non-discrimination provisions of the Protection and Affordable Care Act (PPACA) are suspended for insured group health benefit plans….for now.

Under the original health care reform law, non-grandfathered, fully insured health plans would have required companies to meet the non-discrimination rules of IRC 105(h). This provision of the law is effective for plan years beginning on or after September 23, 2010. Therefore, if your company’s health plan renews on January 1, 2011 and it is non-grandfathered, your plan is subject to these rules on January 1, 2011.

The anti-discriminatory provisions were enacted primarily to prohibit highly-compensated employees (such as company owners and senior management) from receiving health benefits that are materially better than the “rank and file” employees. As contemplated in the health care reform measure, failure to comply with the anti-discriminatory rules could result in the payment of penalties to the IRS.

Affected plans must satisfy two tests; eligibility test, and benefits test. The tests determine whether or not the plan disproportionately benefits highly compensated individuals (HCI). Please contact us for further information on these tests.

According to the notice, the decision to delay the effective date was because:

Regulatory guidance is essential to the operation of the statutory provisions, the Treasury Department and the IRS, as well as the Departments of Labor and Health and Human Services (collectively, the Departments), have determined that compliance with § 2716 should not be required (and thus, any sanctions for failure to comply do not apply) until after regulations or other administrative guidance of general applicability has been issued under § 2716.

There has been no indication of the length of the delayed implementation, other than the provision would become effective after further rules were promulgated.

The employer is responsible for monitoring non-discrimination compliance. If the plan is deemed discriminatory, fines could be assessed at $100 per day per individual discriminated against. If reasonable cause exists (the employer can show good faith belief that the plan was not discriminatory), the penalty can be capped at the lesser of 10% of group health plan costs or $500,000.

Importantly, this doesn’t apply to “grandfathered plans“. Employers of non-grandfathered, fully insured plans should review their contribution structures and benefit designs to ensure that plans are not favoring highly compensated employees.

Further information can be found at http://www.irs.gov/irb/2010-41_IRB/ar07.html . Please contact our office for further guidance on your group’s plan.

by admin | Mar 23, 2010 | COBRA, Health Care Reform, healthcare, Healthy NY, Pharmaceutical Industry

The President earlier today has signed The Health Care and Education Affordability Reconciliation Act of  2010, a historic health care reform that’s been 14 months in the making. This is after Sunday’s Congressional passage by the slim margins of 219-212.

2010, a historic health care reform that’s been 14 months in the making. This is after Sunday’s Congressional passage by the slim margins of 219-212.

The Bill for the most part follows the President’s version of the Reform Health Bill which tweaked measures such as elimination of Nebraska’s politically wrangled special Medicaid deal, delays on Cadillac Tax enactment and the establishment of a new Health Insurance Rate Authority to give guidance and oversight to states and monitor insurance market behavior. “If a rate increase is unreasonable and unjustified, health insurers must lower premiums, provide rebates, or take other actions to make premiums affordable.” The 21% Medicare cuts to providers were rescinded.

The $940 billion over 10 year bill wont see most significant provisions until 2014.

Here’s a quick rundown of some of the expected changes.

Changes This Year:

- Children under 19 with certain pre-existing conditions could not be barred from coverage.

- Dependent children will be allowed to continue coverage on their parents’ plans until age 26 as long as they are not eligible for coverage from an employer. Previously, this applied only to full-time students usually up to the age of 23. Dependents previously dropped because they no longer met the old coverage requirements can be picked up by parents’ plans. At least some insurers will be charging adult children the full rate for an individual rather than including them in the family or employee and child rate. This may or may not be beneficial depending on the situation.

- Subsidies for Medicare Advantage will be cut but the so called donut hole under the Medicare Drug Plan would be closed. Seniors getting a prescription drug benefit under Medicare will get $250 later this year under the reconciliation bill. And starting this year, Medicare beneficiaries can get some free preventive services like routine cancer screenings.

- The bill creates a temporary pool for “high risk” uninsured. That is, individuals who currently have no coverage due to a pre-existing condition, and who have been uninsured for at least six months, would qualify for coverage under a government plan until the other provisions regulating coverage for pre-existing conditions kick in.

- There will be no lifetime limits on coverage paid out under insurance plans.

- Certain tax credits will also go into effect for small businesses.

Long Term Changes:

- Some medical devices will be newly taxed. Same with drug makers.

- Beginning in 2013, income over $200,000 for individuals and $250,000 a year for couples would be hit with a 2.35 percent Medicare payroll tax instead of the existing 1.45 percent rate. Those upper incomes would also see 3.8 percent more in taxes on unearned income such as stock dividends and interest income above the thresholds.

- By 2013, employers will have to redesign their flexible spending accounts to impose a $2,500 annual limit on contributions. There is no limit now, though employers typically impose limits between $4,000 and $5,000.

- In 2014, citizens will be required to have acceptable coverage or pay a penalty of $95, $325 in 2015, $695 (or up to 2.5 percent of income) in 2016. Families will pay half the amount for children, up to a cap of $2,250 per family. After 2016, penalties are indexed to Consumer Price Index.

- in 2014, a new affordability test will kick in that could result in employers facing assessments unless they redesign their plans. If the premium paid by an employee exceeds 9.5% of their income and the employee uses federal health insurance premium subsidies to purchase coverage through new state health insurance exchanges, the employer would have to pay an assessment of $3,000 for that employee.

- In 2014, employers with at least 50 employees that do not offer coverage will pay a tax of $2,000 for each employee without coverage. However, in determining the assessment, an employer’s first 30 employees would be excluded from the calculation. Taking the case of an employer with 100 employees that did not offer coverage, for example, its assessment would be 70 times $2,000.

- So-called Cadillac health plans would also get dinged. Employer-sponsored plans worth $10,200 for individuals and $27,500 for families would be hit with a 40% excise tax starting in 2018.

Individual Mandate:

- All individuals will be required to have health insurance, with some exceptions, beginning in 2014. Those who do not have coverage will be required to pay a yearly financial penalty of the greater of $695 per person (up to a maximum of $2,085 per family), or 2.5% of household income, which will be phased-in from 2014-2016. Exceptions will be given for financial hardship and religious objections; and to American Indians; people who have been uninsured for less than three months; if the lowest cost health plan exceeds 8% of income; and if the individual has income below the poverty level ($10,830 for an individual and $22,050 for a family of four in 2009).

- Premium subsidies will be provided to families with incomes between 100-400% of the poverty level (or $22,050 to $88,200 for a family of four in 2009) to help them purchase insurance through the Exchanges. These subsidies will be offered on a sliding scale basis and will limit the cost of the premium to between 2% of income for those between 100-133% of the poverty level to 9.8% of income for those between 300- 400% of the poverty level.

Employer Requirements:

There is no employer mandate but employers with more than 50 employees will be assessed a fee of $2000 per full-time employee (excluding the first 30 employees from the assessment)

- Employers that offer coverage will be required to provide a free choice voucher to employees with incomes below 400% of the poverty level if their share of the premium cost is between 8-9.8% of income and who choose to enroll in a plan in an Exchange. Employers that offer a free choice voucher will not be subject to the above penalty.

- Large employers (more than 200 employees) that offer coverage will be required to automatically enroll employees into the employer’s lowest cost premium plan if the employee does not sign up for employer coverage or does not opt out of coverage.

- No employer may impose a waiting period that exceeds 90 days

Small Business Tax Credit

- Provides a two year tax credit to small businesses (less than 25 employees) with aver annual wages of less than $40,000 that purchase health insurance with the tax credit.

- For tax years 2010 to 2013, the tax credit would be up to 35% of the employer’s contribution toward the employee’s health insurance premium if the employer contributes at least 50% of the total premium cost.

- For tax years 2014 and later, for eligible businesses that purchase through the Exchanges, the tax credit would be up to 50% of the employer’s contribution toward the employee’s premium if the employer contributes at least 50% of the employee’s total premium cost.

- The full credit will be available to employers with 10 or few employees and average annual wages of $25,000 and less, the credit phases out as firm size and wages increase.

American Health Benefit Exchanges

- States will create the American Health Benefits Exchanges where individuals can purchase insurance and separate exchanges for small employers to purchase insurance. These new marketplaces will provide consumers with information to enable them to choose among plans. Premium and cost-sharing subsidies will be available to make coverage more affordable.

- subsidies will only be available to those without other coverage or whose share of the premium for coverage offered by an employer exceeds 9.8% of their income. Small businesses with up to 100 employees can purchase coverage through the Exchange.

- the Office of Personnel Management, which administers the Federal Employees Health Benefit Program, will contract with private insurers to offer at least two multi-state plans in each Exchange, including at least one offered by a non-profit entity. In addition, funds will be made available to establish non-profit, member-run health insurance CO-OPs in each state

- Plans in the Exchanges will be required to offer benefits that meet a minimum set of standards. Insurers will offer four levels of coverage that vary based on premiums, out-of-pocket costs, and benefits beyond the minimum required plus a catastrophic coverage plan.

- Premium subsidies will be provided to families with incomes between 100-400% of the poverty level (or $22,050 to $88,200 for a family of four in 2009) to help them purchase insurance through the Exchanges. These subsidies will be offered on a sliding scale basis and will limit the cost of the premium to between 2% of income for those between 100-133% of the poverty level to 9.8% of income for those between 300- 400% of the poverty level.

- Cost-sharing subsidies will also be available to people with incomes between 100-200% of the poverty level to limit out-of-pocket spending.

- Broker Role – HHS Secretary is required to “establish procedures under which a State may allow agents and brokers to enroll individuals” in Exchanges.

- Beginning in 2014, the legislation allows states the option of merging the individual and small group markets within the Exchanges.

A more comprehensive chart is available through NAHU (National Association of health Underwriters).

Several states have already challenged this law as an over extension of Federal powers. Additionally, the requirement of mandating an individual to buy insurance is not so clear.

Many additional questions will arise such as:

-How will plans with Federal minimum standards reconcile with progressive states like NY that have numerous state mandates already?

-Afterall, a Healthy NY plan can operate commercially without mandates that an ordinary group plan must comply with?

-What happens to community rated states like NY?

-Will they drop this rating methodology altogether?

-Since there will be no longer pre-existing conditions is it just cheaper for an individual to just withdraw pay the penalty and then hop in when in need of coverage?

Lastly and importantly, the bending of the cost curve is weak. There is language, however, on attacking fraud & billing abuses as well successful Pharmaceutical concession for Medicare Part D. But Rome was not built in a day and this lays the foundation for a path of extending coverage to as many people as possible. Heavy topics such as Tort Reform, exorbitant malpractice insurance, federal medical reimbursements cuts must wait for another day.

by admin | Jan 3, 2010 | COBRA, Dependent Coverage, Health Care Reform, latest health insurance news

Happy Holidays!

Happy Holidays!

As we enter 2010 we want to include some timely information on year end health reform and its possible impacts.

Right before Christmas, The Senate has passed 60-39 its version of a health care reform bill that, if enacted, will impact your business benefits plan more than any federal law in the past half century. The Senate’s bill must still be merged with legislation passed by the House before President Obama could sign a final bill in the new year.

Most measures are expected to take place in 2014. As for the impact on small businesses, The Senate would exempt companies with fewer than 50 workers from having to offer insurance. The House excuses companies with annual payrolls of less than $500,000; firms that are bigger would pay a fee equivalent to a portion of their payroll costs if they don’t offer insurance. That payment would rise to 8 percent of payroll for the largest firms.

Brief Comparison of Senate and House Health Reform Bills

The 10-year, $871 billion health reform bill is designed to extend insurance coverage to 31 million uninsured Americans.

Barring any major changes, the final health care reform bill is expected to:

- Require most employers to contribute to the cost of employee coverage or pay into a health fund, while small businesses would be exempt or receive tax credits.

- Require everyone to carry insurance, with discounts for people who cannot afford it and penalties for people who refuse to buy coverage.

- Create a new marketplace or “Exchange” for individuals and small businesses to comparison-shop for insurance.

- Levy a new excise tax on high-value health plans.

- Provide insurance discounts for those earning less than 400 percent of the federal poverty level (about $73,000 for a family of three).

- Impose new restrictions on insurance practices, such as prohibiting the denial of coverage because of pre-existing conditions, and increase the Medicare payroll tax on high-income people.

Most of these changes will likely be phased in beginning of 2013 and continue up until 2016, although changes to health care Flexible Spending Accounts could occur in 2011. The legislation would place an annual limit of $2,500 on the amount of funds employees can contribute to FSAs.

For more on specifics and timing of the pending legislation, please see Health Care Reform Frequently Asked Questions for employers by clicking here.

It’s important to remember that any dramatic changes would not be immediate. However, there are some things employers can do right now in preparation for the passage of a bill. The most important of these are to stay informed, follow developments and involve your benefits staff and partners.

Employers may also want to begin evaluating their employee demographics and assessing their current health plan design.

- Do you have a balanced health care plan?

- Will you be subjected to the 40% “Cadillac Tax”?

- Will you be subject to pay or play penalties?

- Can you take advantage of Exchange options if low-income employees would receive greater subsidies?

- What would be the overall impact to your budget?

Health care reform is estimated to cost between $890 billion and $1 trillion over 10 years. It would be paid for by a combination of savings to Medicare and Medicaid, along with new sources of revenue from tax changes.

Once a bill is signed into law, we will help our clients with the practical implications of the legislation and its potential impact to organizations.

Our agency has strived to be ahead of the curve and keep our clients within budget regardless. We realize your organization – now more than ever – needs up-to-date information, industry-leading expertise and the assurance a reliable benefits partner can bring to your business. We thank you all for reading our material, referring us business and most of all believing in us!

Once again thank you and we wish you and your family a wonderful Holiday Season!