Mergersurance Mania

Insurance mergers aka Mergersurance Mania continues at a steady pace with April 2016 Florida’s approval of Anthem Blue Cross and CIGNA merger. This is one month after Florida approved the Aetna and Humana merger. Investors have given their blessings to be sure while 10 States have also given approval. The Anthem Cigna $54 billion merger leaves only three national major providers of health care. Worries remain about the potential effect on consumers and the rising cost of health care.

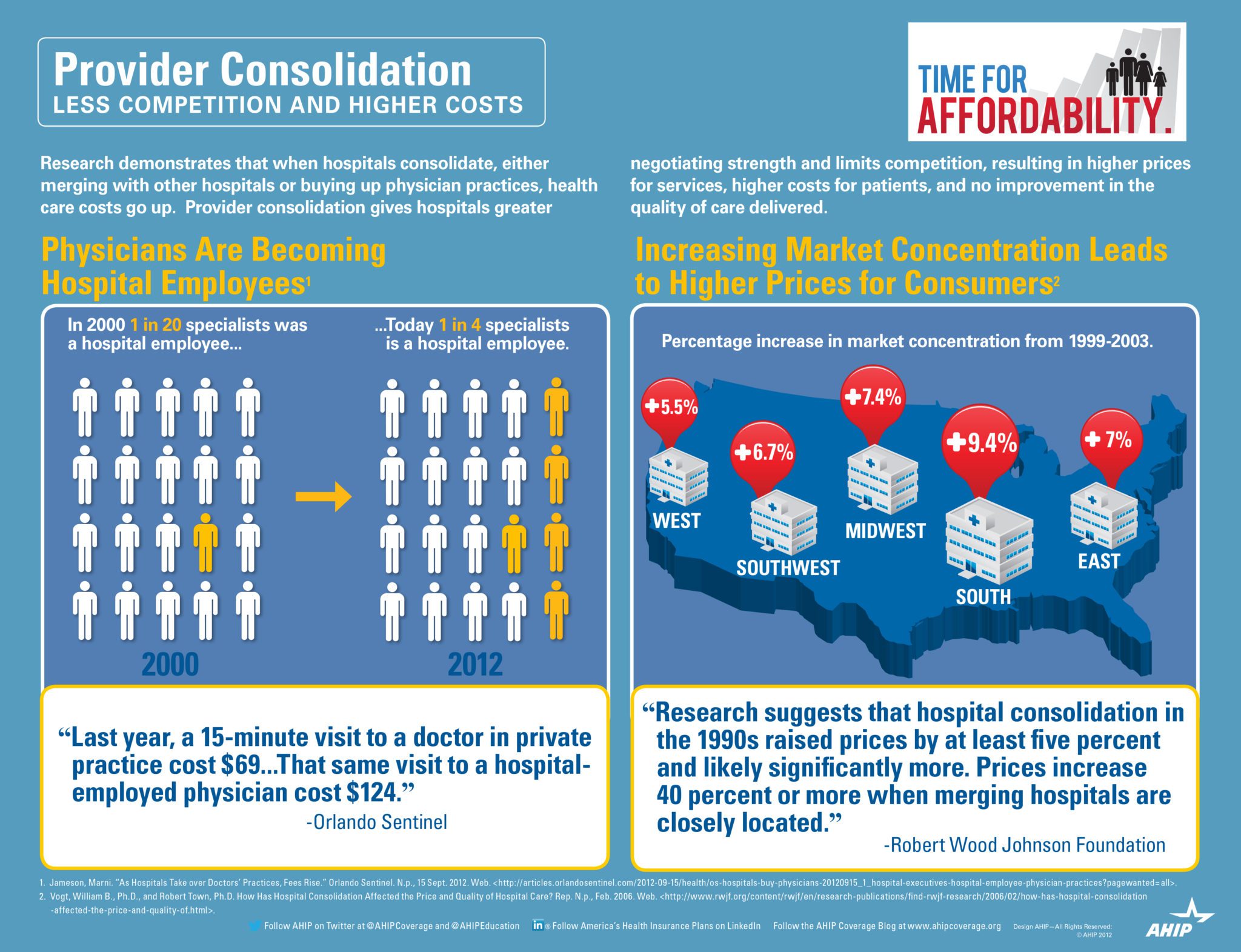

Health Insurers consolidation argument are that they need to be able to merge in order to absorb added costs and blunted profit margins under the Affordable Care Act. Additionally, medical groups and hospitals groups have merged themselves rapidly giving them negotiation cost controls. This has traditionally been trending in smaller regional markets but are now also felt in major US Cities.

Evidence indeed is pointing to expected large insurance increases due to overwhelming market domination by hospitals. While Doctors and AMA are rightfully concerned about Insurer mergers the vast majority are now working for a Hospital System or Medical IPA.

Without public outcry there seems to be lax Regulator oversight and the arms race should not come as a surprise. On the local level we have yet to see a recent example of hospital merger that was curtailed.

This goes well beyond political partisanship. In a tight Presidential race it is important to understand that whether or not one supports a Single Payer we all suffer. This is bad for consumers, providers and tax payer all around. In an Oligopoly health care system with lack of competition the U.S. tax payers are also stuck with inflated costs.

Past Articles:

Breaking: Maimonides North Shore LIJ Partnership Aug 2015

Montefiore Buying Sound Shore Hospital May 2013

NYU Beth Israel Hospital Merger and ACO June 2012

HIP/GHI Merger Mar 2008

.