7 Ways Small Businesses Benefit from a PEO

The number of small and medium-sized employers using professional employer organizations (PEO) continues to increase each year. Often, it is thought that the growth of the PEO industry is due mainly to the benefits business owners see from this partnership. However, owners aren’t the only ones who gain from working with a PEO.

Small business employees, too, stand to benefit from the services and solutions offered by PEOs today. Let’s take a look at a few examples of the positive outcomes that small business workers see when their employer works with a PEO.

1. Better Benefits

One of the most well-known advantages to using a PEO is gaining improved, modern benefits and perks. And while better benefits help employers retain and recruit talent, these enhanced perks often provide even greater for employees.

When working with a PEO, employees are given access to a wide-variety of personalized benefits, including:

- Health insurance

- Retirement benefits

- Voluntary benefits (pet insurance, identity theft protection, financial and legal programs, telehealth programs, etc.)

- Complimentary benefits (discount programs, employee assistance programs, etc.)

By having solid HR policies, a comprehensive benefit package, and employee perks, you are able to create a safe and happy workplace that helps you attract quality employees and retain them to reduce the cost of turnover.

2. Workers’ Compensation Savings

Over the last few years, the workers’ compensation market has gotten a lot tougher for business owners. PEOs help businesses secure competitive rates for workers’ compensation insurance. That can sometimes be challenging for start-up companies, companies with past losses or those with high-risk jobs. PEOs have flexible workers’ compensation programs with more affordable rates than stand-alone policies and staff who help manage the cost of claims, coordinate return-to-work programs and recommend safety training

In most cases, it will be a more cost effective option than the traditional market can offer. We can also include Employment Practices Liability insurance which covers lawsuits arising from wrongful termination, discrimination, and sexual harassment. Issues that are becoming more common in today’s workplace.

3. Solve HR Issues

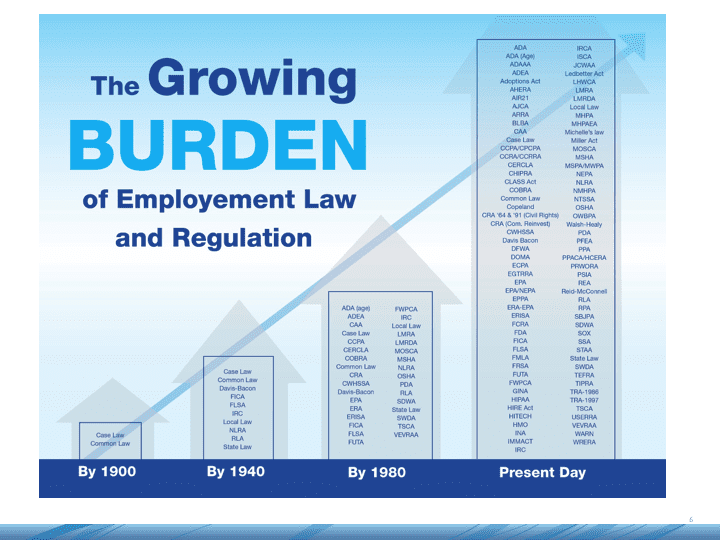

Federal, state and local regulations related to HR are more voluminous and complex than ever. Most businesses don’t have the staff for the in-depth subject matter expertise needed to adequately navigate wage and hour regulations and ensure compliance with the full range of employment and tax laws. When small and mid-sized businesses work with a PEO, they get a team of compliance experts who stay current with all the rules and regulations that apply to employers.

A PEO also helps manage HR risk by helping clients:

- Create an employee handbook to include anti-discrimination and harassment policies

- Familiarize themselves with wage and hour laws

- Pay employees in accordance with the law

- Pay employees in a timely manner

4. Compliance Relief

PEOs are responsible for staying up-to-date on the latest federal and state labor laws and regulations. This not only saves you time, but also the frustration that comes with trying to make sense of and implement many of these changes.

By staying up-to-date on these changes, you can avoid hefty fines and disgruntled employees.

5. Modern HR Tech

This desire for modern technology has also become an expectation for HR tasks that employees are asked to perform, such as requesting PTO, going through benefit enrollment, and submitted their hours.

The majority of PEOs offer their clients the kind of HR tech that employees want and need. Some even have mobile apps that make tasks as simple as possible for employees!

And most PEOs, through their HR technology, can offer small business employees learning and development programs and software that much larger organizations use.

A great HRIS System is fundamental today. By meeting employee expectations, employers help boost the happiness and ultimately retention of their workforce.

6. Employee Happiness

Enhanced benefits, robust learning and development programs, and easy-to-use, modern technology all help to boost the employee experience.

For employees, increased happiness makes their connection to their work and employer greater. And for employers, happy employees mean improved productivity and lesser chance of turnover – studies from the National Association of Professional Employer Organizations (NAPEO) have shown that PEOs help their clients reduce turnover by 10% to 14%.

A happier workplace and workforce are good outcomes for everyone and working with a PEO can help achieve these goals!

7. Competitive Business and Personal PEO Insurance Quotes

360PEO can also provide competitive quotes on all of your personal insurance needs. We work with several industry partners to help clients find coverage for many commercial lines of insurance, such as Group Long Term Care Insurance, Executive Benefits, General Liability, Property, and Commercial Auto.

We also offer personal lines insurance such as renter’s policies, home insurance, and life insurance.

Learn how our PEO Partnership can help your group please contact us at info@360peo.com or (855)667-4621.

Put You & Your Employees in Good Hands

Get In Touch

For more information on PEOs or a customized quote please submit your contact. We will be in touch ASAP.