IRS Expands Preventive Care List for HSA

Last week, the IRS added care for a range of chronic conditions to the list of preventive care benefits that may be provided by an HSA compatible high deductible health plans (HDHP). Notice 2019-45, lists the new types of medical care that may be treated as preventive care for this purpose.

Individuals covered by an HSA compatible HDHP generally may establish and deduct contributions to a Health Savings Account (HSA) as long as they have no disqualifying health coverage or not enrolled in Medicare. To qualify as a high deductible health plan, an HDHP generally may not provide benefits for any year until the Federal (not health plan) minimum deductible for that year is satisfied.

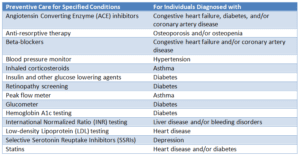

The IRS together with the Department of Health and Human Services, has determined that certain medical care services received and items purchased, including prescription drugs, for certain chronic conditions should be classified as preventive care. The following services and items for individuals with the specified chronic conditions listed are treated as preventive care.

Like this blog article? You might also like our full HSA 2019 Limits page.