by admin | Feb 15, 2013 | Health Care Reform

Provider Consolidation Infograph

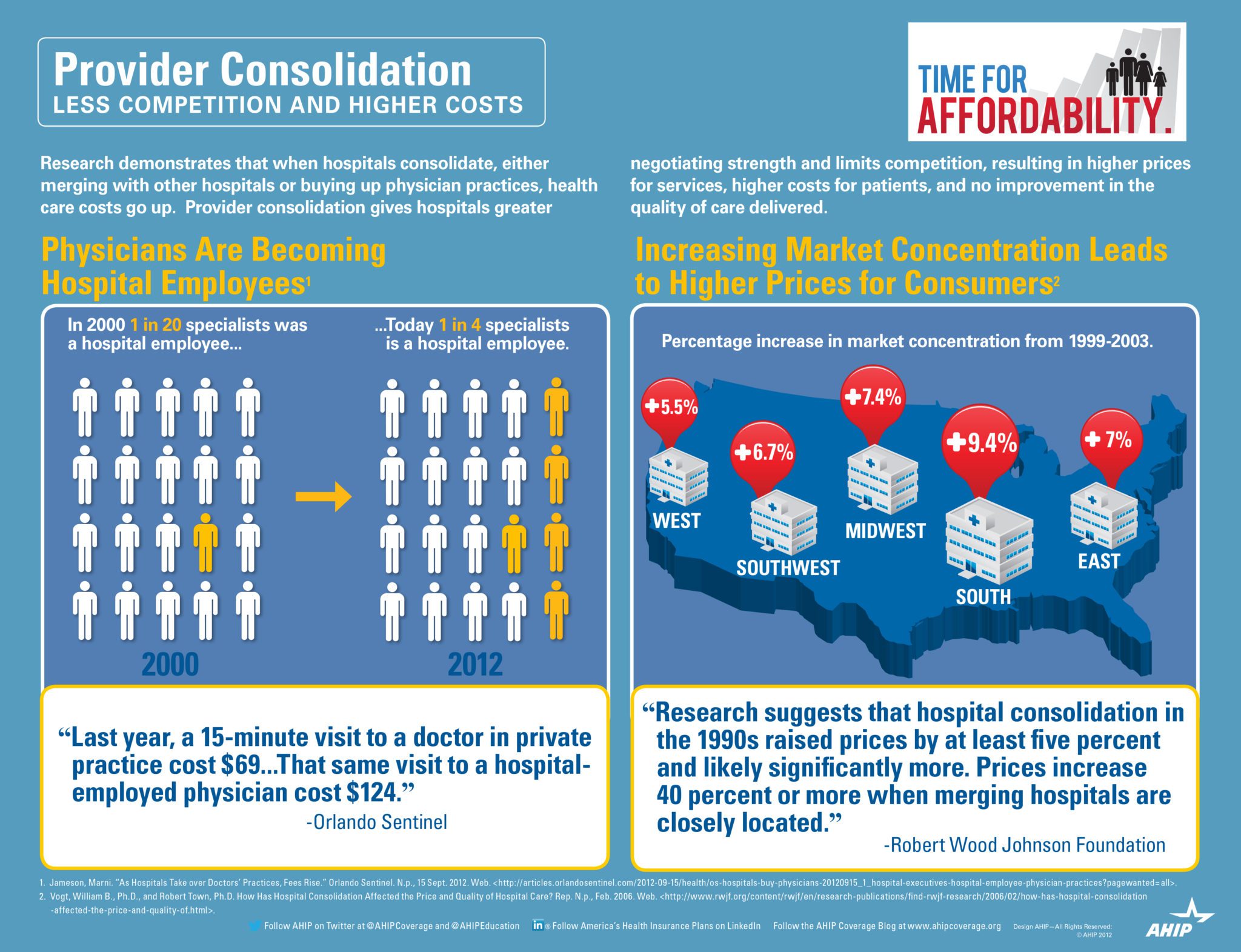

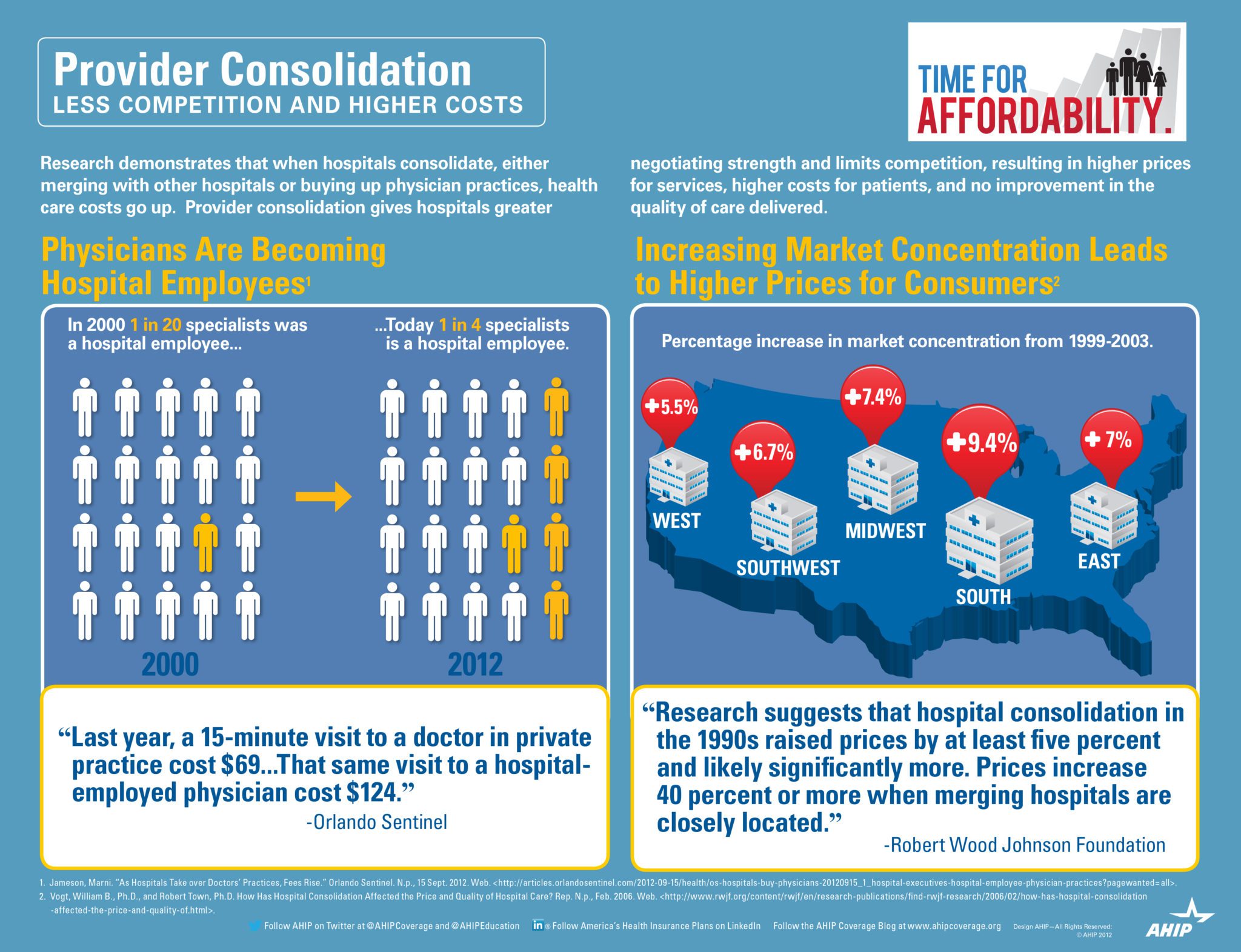

The AHIP infograph provides visually a great infograph describing how provider consolidation increases costs. According to Wall Street Journal Article this week –Four Key Questions for Health-Care Law “The proliferation of hospital mergers and hospitals’ appetite for buying doctors’ practices—in part to assure a steady stream of patients to fill hospital beds—could create local monopolies that raise prices without increasing efficiency. ‘Historically,’ says Deloitte’s Mr. Keckley, ‘hospital consolidation hasn’t reduced costs.’”

See prior blog posts on consolidations:

If we as a society ask our hospitals to behave as industries then size matters in achieving economies of scale. However, the important question we must then answer are we operating in a true free market economy when someone gets sick?

by admin | Mar 27, 2008 | NY News

HIP and GHI merger. GHI and HIP have been working since 2005 on merging under a common parent, EmblemHealth, serving more than four million members across the tri-state area. As sister companies, GHI and HIP has continued to operate separately until they get NY State Approval. Affiliation is the first step as GHI and HIP begin the process of combining and integrating as they move toward an eventual merger. Existing group coverage will not change as a result of the affiliation. Over time, their stated mission is to will develop and make available an expanded range of cost effective products and new services to you and your employee’s. There have been a recent executive fall out of the changes and expect more to come. NY will be losing the last few non-profits left in the state. The state is running public forums to review this, see state insurance site on recent meetings. Will this be NY State politics as usual and allow political leaders to dole out the stock market gains for personal gains or will citizens stand to gain? Unlike our state, California took a long term view for the medical care of its citizens. They set up a non-profit with a mission that the Blue Cross conversion set up a fund of not less than $100 million to be spent on charitable activities in 1994 and not less than 40 percent of WellPoint stock ($1.2 billion) to be contributed to a newly formed foundation. Pataki on the other hand used 90% of the $1.1Billion Empire Blue Cross 2002 conversion for Mr. Rivera’s powerful 1199 Union. I’m sure that this did not harm his 2002 reelection campaign but I wish New Yorkers did as well as California. See article in NY Times for your consideration.