by admin | Dec 22, 2011 | healthcare, NY News

In a pleasant surprise, Empire will delay their April 2012 decision to “simplify” small group plans 1 more year from April 2012 to April 2013 instead. The Nov 4th Empire announcement to leave the NY Small Group Business was truly shocking after being in business for 75 years and insuring 35% of the market.

What this means for consumers is that insured members will now breath a sigh of relief and keep their contracted plan at least until their renewal. Evidentially, Empire was allowed to abruptly do a “hard shut down of their plans” for April and not allow a group to complete their 12 month contract. The negative consequence would have affected many unfairly as most members today have some kind of annual deductible and/or coinsurance on Rx plans, hospitalizations and surgeries. Example: a member signs up for a plan Oct 1 and has already met their deductible responsibilities would suddenly have to now change plans on April 2012. and start all over again.

A point needing further explanation is are they or they not exiting? Empire is stating that they are not in fact leaving but merely simplifying their offering to 6 plans but this is actually a red herring as the plans offered are not market friendly and allows Empire to stay within the market without having to really exit. Example: Their HMO monthly rate is $675/single when you can get the same plan from a leading competitor for $465/single.

So why be in the market without actually being in the market? The state’s regulation would not permit an insurer to re-enter for 3 years. With Health Care Reform changes in the subsequent years there are variables that may help NYS such as add’l federal funding. Additionally, it is an election year and with many unknown Health Care Reform variables still evolving such as Supreme Court hearing on individual mandate by June 2012 – WSJ Supreme Test for Health Law.

Either way this is welcome news to our existing clients and for the marketplace at large however short term it is.

Happy Holidays!!

[polldaddy poll=5783128]

Error: Contact form not found.

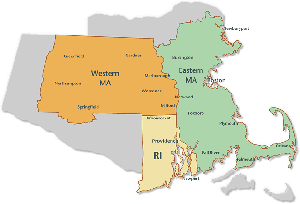

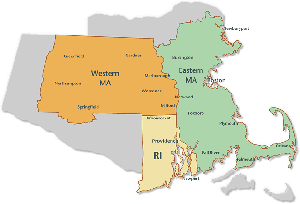

![Massachusetts: 5 Years after Health Reform]()

by admin | Apr 28, 2011 | Health Care Reform

This month on April 12th, 2011 marked the five-year anniversary of Massachusetts 2006 State Health Care Reform. The reform was signed into law by then-governor Mitt Romney with the goal of providing affordable health insurance coverage to the estimated 6% of Massachusetts residents that were uninsured at the time.

Massachusetts State Health Care Reform and the Affordable Care Act are virtually identical.Both reforms rely heavily on state-based health insurance exchanges, subsidies for qualifying individuals, and mandates for employers and individuals. As a result, Massachusetts presents the most appropriate example of what to expect from federal health care reform.

So, what have we learned from Massachusetts state reform? The 2006 Massachusetts State Health Care Reform:

- Created the MAHealthConnector (a state health insurance exchange) to provide guaranteed issue health insurance to MA residents;

- Mandated that every resident of the state obtain a minimum level of health insurance or face penalties;

- Mandated that employers provide a “fair and reasonable contribution” to their employees’ health insurance premiums or face penalties; and

- Provided free health insurance and partially-subsidized insurance to qualifying residents based on income.

Proponents of the law argue that Massachusetts Health Reform:

- Has resulted in Mass. being the state with the highest percentage of insured residents, at 98% in April 2011, including 99.8% of children.

- Has increased the percentage of private companies that offer health insurance from 70% in 2005 to greater than 77% today.

- Has lowered the cost of individual health insurance premiums in Mass. due to the fact that primarily healthy people have moved to the individual market.

Opponents of the law argue that Massachusetts Health Reform:

- Has increased costs for its residents, $13,788 for a family of four in 2010, in the state that already had the highest medical costs in the nation prior to implementation.

- Was setup for failure from the start due to its reliance on employer-sponsored health plans, plans that employers cannot afford due to rising costs.

- Has resulted in more than half of the newly-insured residents receiving health insurance that is partially or completely subsidized by Massachusetts’ taxpayers.

Has Massachusetts health care reform been properly utilized as a test bed for Federal Reform? Will the costs associated with Massachusetts health care reform be sustainable over the long term?