Section 125 Plans

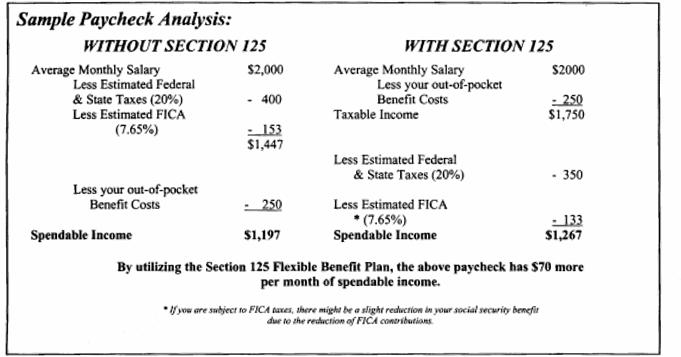

The term “Cafeteria Plan,” also referred to as a “Section 125 Plan,” is the most commonly used description for Flexible Benefit Plans (covered under Section 125 of the Internal Revenue Code).

A Cafeteria Plan is a flexible employee benefit plan that enables the employee to choose from a menu of certain fringe benefits and pay for all these benefits with pre-tax dollars.

Advantages to Employees:

Premiums can be paid with pre-tax dollars. Employees are tax dollars and increase their disposable income. More benefits can be afforded Employees to enjoy the flexibility of customizing their benefit plan.

Advantages to Employers:

Companies save tax dollars. Thorough planning and management, this positively effects the bottom line. Increases employee morale and retention rate with expanded employee benefits

Premium Only Plan (POP)

A POP is a simple method that allows premiums for employee group plans (such as an HIVIO, PPO, health insurance, cancer insurance, etc.) to be paid with an employee’s pre-tax dollars.

Health Savings Account (HSA)

Health Savings Accounts are a combination of a 401K type investment program and a high deductible health insurance plan.

Flexible Spending Accounts (FSA) FSAs allow employees to set aside pre-tax funds from their salaries into special accounts to pay for:

Health Reimbursement Account(HRA) allow an employer-funded account to repay the Non-reimbursed medical expenses of employees, along with an option to carry unused funds forward. An HRA account may reimburse any or all the same expenses as a Section 125 Flexible Spending Account (FSA). |