by admin | Feb 15, 2013 | Health Care Reform

Provider Consolidation Infograph

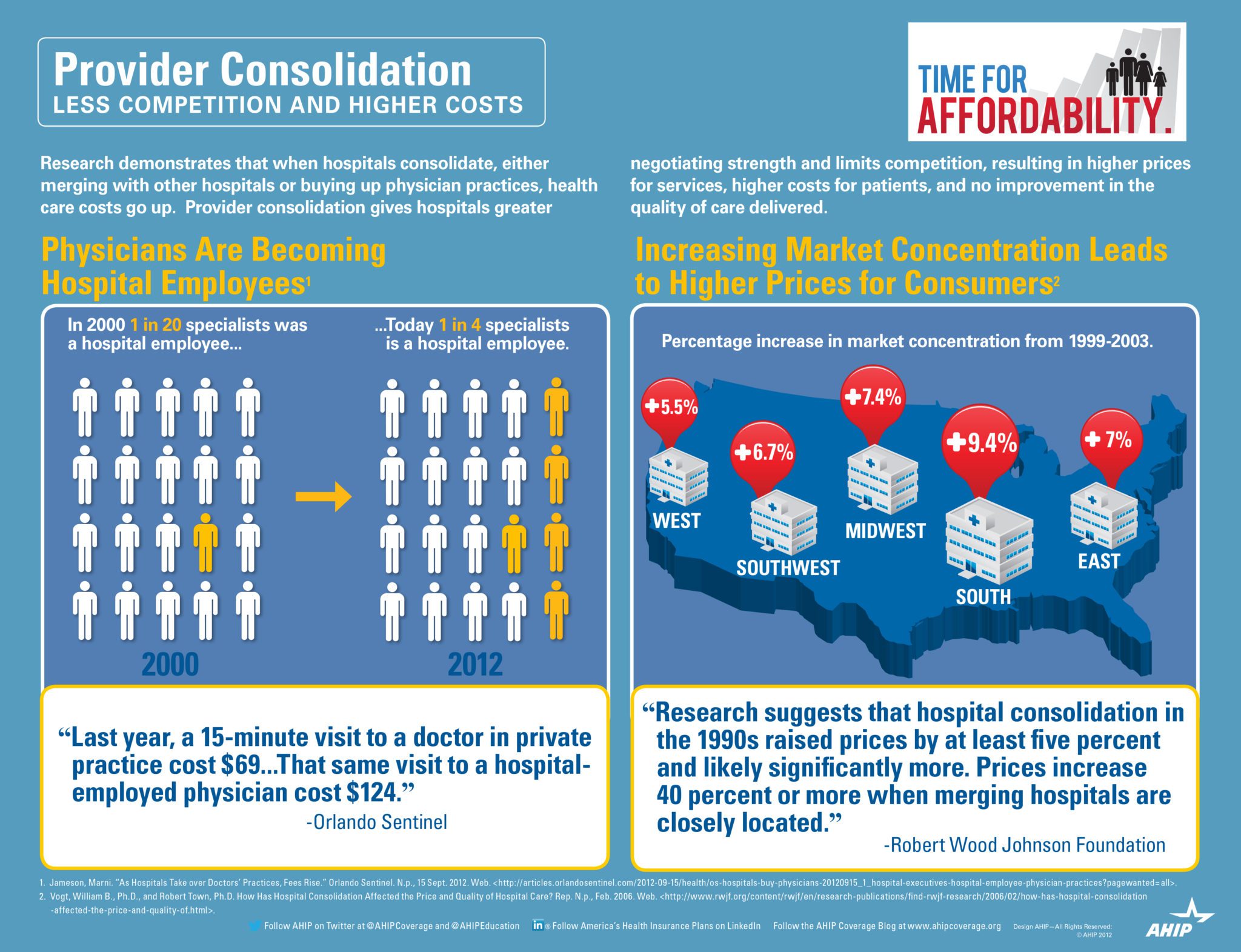

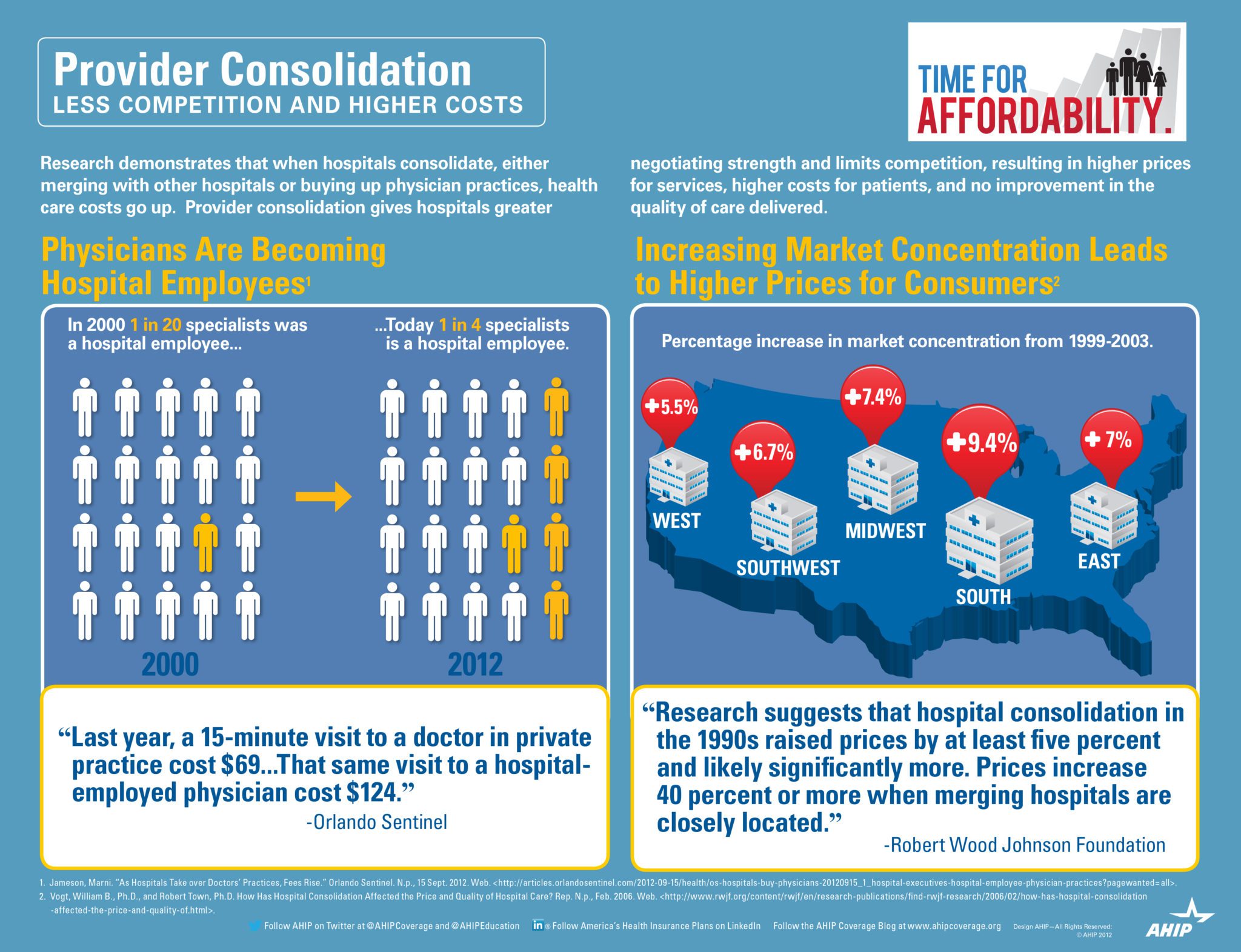

The AHIP infograph provides visually a great infograph describing how provider consolidation increases costs. According to Wall Street Journal Article this week –Four Key Questions for Health-Care Law “The proliferation of hospital mergers and hospitals’ appetite for buying doctors’ practices—in part to assure a steady stream of patients to fill hospital beds—could create local monopolies that raise prices without increasing efficiency. ‘Historically,’ says Deloitte’s Mr. Keckley, ‘hospital consolidation hasn’t reduced costs.’”

See prior blog posts on consolidations:

If we as a society ask our hospitals to behave as industries then size matters in achieving economies of scale. However, the important question we must then answer are we operating in a true free market economy when someone gets sick?

by admin | Aug 14, 2012 | healthcare

Bluecard PPO – Outside members home region, the PPO medical plan is known as BlueCard PPO. The BlueCard plan offers a network of quality doctors and hospitals known as the BlueCard Provider Network.

Bluecard PPO – Outside members home region, the PPO medical plan is known as BlueCard PPO. The BlueCard plan offers a network of quality doctors and hospitals known as the BlueCard Provider Network.

- freedom to seek care in-network or out-of-network;

- no need to select a primary care physician to coordinate your care;

- visit specialists directly — no referrals are required;

- no claim forms to submit when using an in-network provider;

- no balance bills when using an in-nework provider;

- wellness programs, including fitness reimbursement and discounts on alternative health care services, at no additional cost;

- enhanced programs to control and manage chronic conditions;

- preventive care for children and adults;

- enjoy in-network coverage anywhere in the United States when you use providers that participate in the Personal Choice or BlueCard PPO networks;

- worldwide coverage and recognition of the Blue Cross® symbol.

How Does it Work?

Blank Suitcase Logo

A blank suitcase logo on a member’s ID card means that the patient has Blue Cross Blue Shield traditional, POS, or HMO benefits delivered through the BlueCard Program.

“PPO in a Suitcase” Logo

You’ll immediately recognize BlueCard PPO members by the special “PPO in a suitcase” logo on their membership card. BlueCard PPO members are Blue Cross and Blue Shield members whose PPO benefits are delivered through the BlueCard Program. It is important to remember that not all PPO members are BlueCard PPO members, only those whose membership cards carry this logo. BlueCard PPO members traveling or living outside of their Blue Plan’s area receive the PPO level of benefits when they obtain services from designated BlueCard PPO providers.

How to Verify Membership and Coverage

Once you’ve identified the alpha prefix, call BlueCard Eligibility to verify the patient’s eligibility and coverage.

| 1. Have the member’s ID card ready when calling. |

| 2. Dial 1.800.676.BLUE. |

Operators are available to assist you weekdays during regular business hours (7am – 10pm EST). They will ask for the alpha prefix shown on the patient’s ID card and will connect you directly to the appropriate membership and coverage unit at the member’s Blue Cross Blue Shield Plan. If you call after hours, you will get a recorded message stating the business hours.

Keep in mind BCBS Plans are located throughout the country and may operate on a different time schedule than Anthem Blue Cross and Blue Shield. It is possible you will be transferred to a voice response system linked to customer enrollment and benefits or you may need to call back at a later time.

International Claims

The claim submission process for international Blue Cross and Blue Shield Plan members is the same as for domestic Blue Cross and Blue Shield Plan members. You should submit the claim directly to Anthem Blue Cross and Blue Shield.

by admin | Sep 1, 2011 | group health insurance, Health Care Reform, healthcare, PPACA, Small Business Group Health

UnitedHealthcare Buying Medical Groups?

Optum Health owned by UnitedHealth Group

Today’s WSJ reports UnitedHealth Buys California Group of 2,300 Doctors may be a signal of future trends in healthcare where there is blurring of the lines between insurers and providers. The article goes on to to mention that United Healthcare has stated that providers acquired by Optum will not work exclusively with United’s health plan, and will continue to contract with an array of insurers.

The article goes on to state that “the potential complications that might ensue, Monarch is currently in an arrangement with United competitor WellPoint Inc. to create a cooperative “accountable-care organization” aimed at bringing down health-care costs and improving quality.”

In the aftermath of Health Care Reform, insurers profits will be curtailed. New price limitations imposed by MLR (Maximum Loss ratios) where 85% of large group premiums collected must be spent on healthcare services(claims) and health quality improvement . New state tax surcharges such as New York’s 82% of above MLR applies to small groups. In fact in NY the cost of doing business is a staggering 16%+ added to the usual corporate tax. See The NYS Surcharge.

Additionally, the industry as a whole will be paying an annual tax to help pay for PPACA(Patient Protection Affordability Care Act). This tax rises from $8 billion in 2014 to $14.3 billion in 2018 and in later years, even higher according to a complex index. See Kaiser Bill Summary .

While its unglamorous to defend insurers they are clearly paying their share and like it or not they are good at health care management. Unlike foreign HQ tax loop holes taken advantage by companies such as G.E. , an insurer cannot place patent rights in Zug, Switzerland and take advantage. Each of these taxes is increased regularly by the State and contributes significantly to annual increases in rates. The competition in the health insurance industry is already at a dangerous low levels. Negotiating with insurers has become an overwhelming challenge in the large group market. Hospital groups have merged to mirror this Oligopoly trend and contractual issues are the new normal. See Empire & Stelllaris Reach pact.

So what to do other than to find profits elsewhere? Many issues and questions will abound as to the antitrust nature of this action. A similar issue appeared in the 90s Merck-Medco merger between a pharmaceutical and mail order PBM. The conflict of interest claims will abound, how do you negotiate one provider group owned by United-Healthcare as opposed to one owned by HealthNet? Will insurer share competitive insights with other practices? Are small independent Dr. Groups completely left out of the loop and feel pressured to be bought out? Will the insurers medical group have unfair advantage in buying out the smaller physician practice? Perhaps in the same vein of the Merck-Medco analogy the health insurer shareholders will do well for a decade and then simply split up?

Its all too early to tell but this much is clear, there aint no money in running a health insurance management company today.