by Alex | May 3, 2020 | COVID-19, group health insurance, PEO, Small Business Group Health

6 Advantages of a PEO during COVID-19

As COVID-19 unfolds, the importance of a PEO for a Small Business becomes evident. How can you protect your employees while also managing costs? Here are examples of how our PEO clients have benefited.

1. Rapid Law Changes

With recent CARES Act and FFCRA(Families First Coronavirus Response Act) to help struggling businesses, overwhelming info and regulations have mounted for the small business owner. Who is eligible for benefits? Tax credits? Furloughs and COBRA? Is their business Essential? Paid Sick Leave eligibility and additional tax credit entitlement?

PEOs provide a full team of experts who anxiously awaited the legislation, final rulings, and updates on all the Acts. They spend countless hours diving into legal jargon to answer business owners’ questions. Then, PEOs work alongside organizations to implement processes that assist in keeping the business compliant. They also help employees through the difficult time, with the livelihood of the business always in mind.

2. PEOs help with Paycheck Protection Program (PPP) loans through the CARES Act

Lenders are asking for historical payroll data and tax reports quickly produced by a PEO’s HRIS System. Many small businesses without HR help find these systems financially draining. Example: Needed 940/941 reporting is issued which can be sent to SBA Lender. Also, several leading PEO’s have supported clients with NYS Shared Loans Program.

Working with clients to understand options.

3. Payroll Burden

Payroll administration is now a nightmare. Tracking the FFCRA emergency sick leave and expanded FMLA separately from regular sick and FMLA leave has thrown a wrench in many payroll processors’ systems. Add on any furloughed or terminated employee reporting and tracking, and now the job has doubled.

Instead, our PEO Clientsy are spending their time on mission-critical work that could make or break the business. Additionally, their payroll is processed by professionals who have the time and expertise to know the nuances of payroll and payroll tax laws with back up teams of professionals in place.

4. Staffing Needs – On-Boarding and Terminations

A minimum 75% of PPP loans must be spent on staffing costs. Companies that had previously furloughed or terminated employees find they need to hire employees back. This comes with additional paperwork and many employee questions, such as whether benefits wait periods start over.

Conversely, when businesses do need to furlough or terminate employees, the PEO is a great guide for compliance. The layoff process, COBRA, paperwork including givernement reporting are supported.

5. HR Excellence

Partnering with a PEO is much like gaining access to a full-service HR division, with a team of HR experts who are up-to-date with new and changing employment laws and able to identify ways to streamline your HR.

According to a report conducted by the National Association of Professional Employer Organizations (NAPEO), PEOs provide access to more HR services at a cost that is close to $450 lower per employee, compared to companies that manage their HR services in-house.

Studies show that businesses in a PEO arrangement grow 7-9 percent faster, have 10-14 percent lower turnover, and are 50 percent less likely to go out of business.

6. Affordable and Better Benefits

By joining a large group risk-pool a a PEO can help employers gain access to high quality employee benefits, such as health insurance options with stable and affordable rates. Due to costs, small businesses often find high-quality employee benefits out of reach. The savings on health insurance alone can pay for the PEO itself.

If you’re interested in hearing more about the advantages of partnering with a PEO, we’d love to talk to you. Fill out the form below or email info@medicalsolutionscorp.com for a FREE Consultation Today!

The information provided on this website is intended for informational purposes only. Millennium Medical Solutions Corp. does not offer legal or medical guidance. Those with legal or medical questions should seek appropriate assistance from a licensed professional. Stay up to date by signing up for Newsletter and Coronavirus Dashboard below.

Learn how our PEO Partnership can help your group please contact us at info@360peo.com or (855)667-4621.

Put You & Your Employees in Good Hands

Get In Touch

For more information on PEOs or a customized quote please submit your contact. We will be in touch ASAP.

by Alex | Aug 23, 2019 | group health insurance, HR, PEO, Small Business Group Health

The number of small and medium-sized employers using professional employer organizations (PEO) continues to increase each year. Often, it is thought that the growth of the PEO industry is due mainly to the benefits business owners see from this partnership. However, owners aren’t the only ones who gain from working with a PEO.

Small business employees, too, stand to benefit from the services and solutions offered by PEOs today. Let’s take a look at a few examples of the positive outcomes that small business workers see when their employer works with a PEO.

1. Better Benefits

One of the most well-known advantages to using a PEO is gaining improved, modern benefits and perks. And while better benefits help employers retain and recruit talent, these enhanced perks often provide even greater for employees.

When working with a PEO, employees are given access to a wide-variety of personalized benefits, including:

- Health insurance

- Retirement benefits

- Voluntary benefits (pet insurance, identity theft protection, financial and legal programs, telehealth programs, etc.)

- Complimentary benefits (discount programs, employee assistance programs, etc.)

By having solid HR policies, a comprehensive benefit package, and employee perks, you are able to create a safe and happy workplace that helps you attract quality employees and retain them to reduce the cost of turnover.

2. Workers’ Compensation Savings

Over the last few years, the workers’ compensation market has gotten a lot tougher for business owners. PEOs help businesses secure competitive rates for workers’ compensation insurance. That can sometimes be challenging for start-up companies, companies with past losses or those with high-risk jobs. PEOs have flexible workers’ compensation programs with more affordable rates than stand-alone policies and staff who help manage the cost of claims, coordinate return-to-work programs and recommend safety training

In most cases, it will be a more cost effective option than the traditional market can offer. We can also include Employment Practices Liability insurance which covers lawsuits arising from wrongful termination, discrimination, and sexual harassment. Issues that are becoming more common in today’s workplace.

3. Solve HR Issues

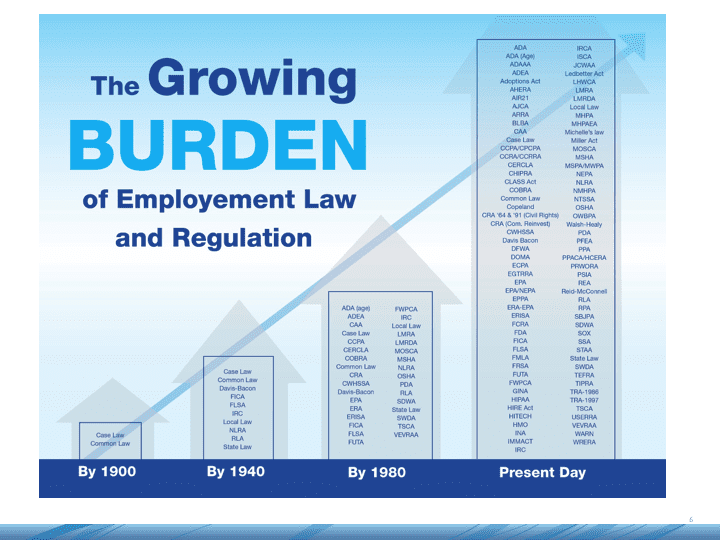

Federal, state and local regulations related to HR are more voluminous and complex than ever. Most businesses don’t have the staff for the in-depth subject matter expertise needed to adequately navigate wage and hour regulations and ensure compliance with the full range of employment and tax laws. When small and mid-sized businesses work with a PEO, they get a team of compliance experts who stay current with all the rules and regulations that apply to employers.

A PEO also helps manage HR risk by helping clients:

- Create an employee handbook to include anti-discrimination and harassment policies

- Familiarize themselves with wage and hour laws

- Pay employees in accordance with the law

- Pay employees in a timely manner

4. Compliance Relief

PEOs are responsible for staying up-to-date on the latest federal and state labor laws and regulations. This not only saves you time, but also the frustration that comes with trying to make sense of and implement many of these changes.

By staying up-to-date on these changes, you can avoid hefty fines and disgruntled employees.

5. Modern HR Tech

This desire for modern technology has also become an expectation for HR tasks that employees are asked to perform, such as requesting PTO, going through benefit enrollment, and submitted their hours.

The majority of PEOs offer their clients the kind of HR tech that employees want and need. Some even have mobile apps that make tasks as simple as possible for employees!

And most PEOs, through their HR technology, can offer small business employees learning and development programs and software that much larger organizations use.

A great HRIS System is fundamental today. By meeting employee expectations, employers help boost the happiness and ultimately retention of their workforce.

6. Employee Happiness

Enhanced benefits, robust learning and development programs, and easy-to-use, modern technology all help to boost the employee experience.

For employees, increased happiness makes their connection to their work and employer greater. And for employers, happy employees mean improved productivity and lesser chance of turnover – studies from the National Association of Professional Employer Organizations (NAPEO) have shown that PEOs help their clients reduce turnover by 10% to 14%.

A happier workplace and workforce are good outcomes for everyone and working with a PEO can help achieve these goals!

7. Competitive Business and Personal PEO Insurance Quotes

360PEO can also provide competitive quotes on all of your personal insurance needs. We work with several industry partners to help clients find coverage for many commercial lines of insurance, such as Group Long Term Care Insurance, Executive Benefits, General Liability, Property, and Commercial Auto.

We also offer personal lines insurance such as renter’s policies, home insurance, and life insurance.

Learn how our PEO Partnership can help your group please contact us at info@360peo.com or (855)667-4621.

Put You & Your Employees in Good Hands

Get In Touch

For more information on PEOs or a customized quote please submit your contact. We will be in touch ASAP.

by Alex | Aug 7, 2018 | CT, group health insurance, Health Care Reform, Health Exchanges, NJ, NY News, Small Business Group Health

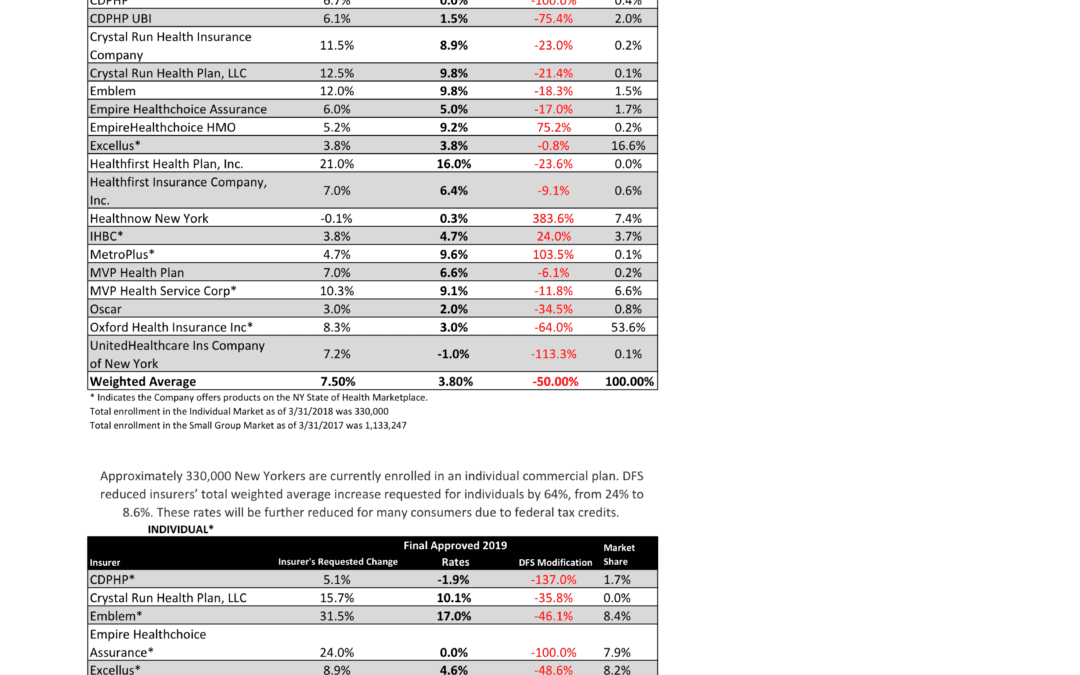

NYS 2019 Final Rates Approved

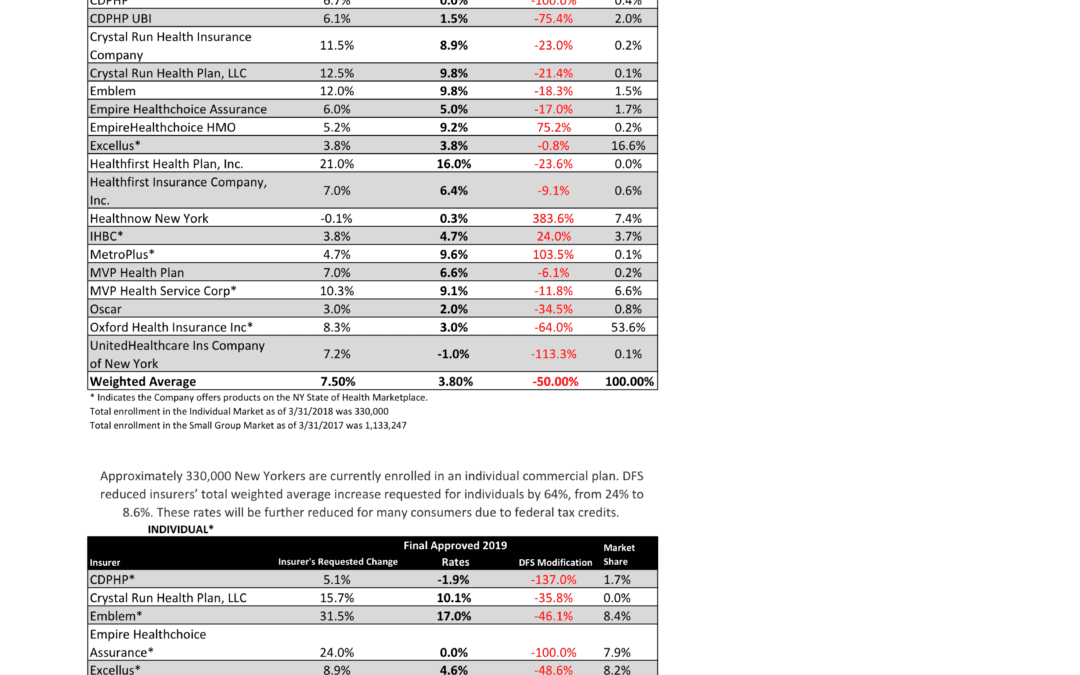

NYS has approved 2019 Final Rates last Friday. Small group rates will increase 3.8% and 8.6% for individuals.

As per NY State Law, Health Insurers are required to send out early notices of rate request filings to groups and subscribers see original –NYS 2019 Rate Requests. Despite only 3 months of mature claims data experience for 2018 health insurers’ original requests were noticeably below average 7.5% for small group and 24% for individuals. Ultimately NYS reduced this request substantially by approximately 50%.

Experts are concerned over the long term effects. Example, the Individual mandate was removed last December by Presidential order. Without the Mandate anyone can drop insurance without penalty. A comparable take away for similar auto insurance industry would be something like this -Drivers ought not be mandated to buy auto insurance as its a profit scheme by Insurers. While a popular decision this will hardly bend the curve long term and reduce competition. Furthermore, the new order of Selling Across State lines makes NYS most unwelcoming.

OTHER STATES

Insurers have been filing to sell Obamacare plans that will go into effect in 2019, and in some states they appear to be pricing in for the fact that the mandate is going away next year. Other states are seeing mild increases, but that is in part because they saw significant hikes for the previous year.

Insurers have concluded that fewer people will enroll without the mandate than otherwise, so in some places they are pricing their plans higher based on the assumption that sicker people will be left behind, which will increase medical costs for those left. It is well worth pointing out that in recent years the loss federal risk reinsurance corridor funds account for 5.5 percent of the rate increase.

How are neighboring States doing?

In NJ, not that bad. Last year the average increase were 5.5% for small groups and some popular plans such as Horizon Blue Cross Blue Shield’s OMINA increasing only 4.8% increase. This year the increase is only 5.2. Other insurers offering EPO and HMO plans in the individual market for 2019 include Oscar Health and Oxford Health Plans.

With individual mandate repeal fewer people will buy health insurance raising the prices for those who do. NJ Banking and Insurance Department officials said premium prices would have increased, on average, by 12.6 percent.

For CT market, on the other hand, things are much worse at least for the individual marketplace with average 25% rate increases last year. The 2019 proposed rate increases for both the individual and small group market are, on average lower, than last year: The proposed average small group rate increase request is a 10.22 percent and ranges from -5.0 percent to 21.1 percent. This compares to the average increase request of 18.06 percent requested last year.The proposed average individual rate increase request is 12.3 percent and ranges from -10.9 percent to 31.0 percent. This compares to the average increase request of 25.51 percent requested last year.

Final plan rates in New Jersey & CT will be finalized and released in the fall, state officials said. ACA open enrollment begins Nov. 1

- Trend: Trend is a factor that accounts for rising health care costs, including the cost of prescription drugs, and the increased demand for medical services.

- Uncertainty in Washington:

- Removal of penalty for individual mandate: The elimination of the penalty means that individuals who are typically younger and healthier would have no inducement to participate in the insurance pool, which could further destabilize the market. Lack of participation shrinks the pool and increases the cost of insurance to the remaining members.

- Short-duration health plans and Association Health Plans: Still pending are final federal regulations on non-ACA compliant short-duration plans, which may have implications for the ACA risk pool. Also, Connecticut along with other state insurance regulators, are awaiting clarification from the federal government on new federal regulations allowing association health plans, which could further shrink the ACA risk pool.

A bipartisan group of congressional representatives has discussed an agreement to extend and guarantee the payments, but it’s unclear whether they could do so by the new filing deadline of Sept. 5. A lawsuit filed by Congress against the Obama administration to challenge the payments is still pending. In addition, Trump has repeatedly threatened to withhold payments to insurers that reduce cost-sharing – deductibles, copays and coinsurance – paid by low-income customers. More than half of New Jersey’s marketplace customers receive that assistance, and without it, most would be unable to afford coverage.

Finally, a tax on health insurance premiums has been reinstated in 2018 after a one-year “tax holiday” approved by Congress for 2017. That contributed 2.3 percent to the rate hikes that insurers requested for 2019 and for 2019

SMALL GROUP MARKET VS. INDIVIDUAL MARKET

Importantly, small group market is still more advantageous than individual markets unless one gets a sizable low-income tax credit. Overall, about 350,000 individual plan consumers will be affected by the price hike, while more than a million users will be hit by higher small group fees. Last year, Blue Cross Blue Shield released a study showing Obamacare user costs were 22 percent higher than people with employer-sponsored health plans, while UnitedHealth plans to exit most Exchanges see – Breaking: Oxford Exits Metro Indiv & Oxford Liberty HMO 2017.

The correct approach for a small business in keeping with simplicity is a Private Exchange and with our large buying group PEO partnerships. This is a true defined contribution empowering employees with a choice of leading insurers offering paperless technologies integrating HRIS/Benefits/Payroll. Both employee and employers still gain tax advantage benefits under the business. Also, the benefits, rates and network size are superior under a group plan as the risk are lower for small group plans than individual markets.

Learn how a PEO Partnership can help your group please contact us at info@360PEO.com or (855)667-4621.

Newsletter Sign Up Now

by Alex | Jan 11, 2018 | PEO, Small Business Group Health

PEO vs. Employee Leasing. What’s the Difference?

Get PEO Quote

A common question asked “PEO and Employee Leasing. What’s the Difference?” Despite the growth within the PEO industry and the increased usage of them by small businesses, there are still some misconceptions around PEOs. One myth seems to come up more often than others – a PEO relationship and employee leasing are the same.

This confusion most likely stems from the relationship that actually exists between a PEO and its client, called co-employment. And while many think employee leasing and co-employment are one in the same, they are actually very different.

In order to clear up the misunderstanding, let’s take a closer look at both employee leasing and co-employment. How they differ from one another, and why PEOs aren’t the same as an employee leasing company.

What is Employee Leasing?

First, let’s define employee leasing. Also known as a temporary employment arrangement, it’s the practice of supplying new workers or contractors usually on a temporary basis. Often times employee leasing is for work on a specific project that has a start and end date.

Employee leasing is most often associated with staffing firms, although it also gets tied incorrectly to PEOs and HR outsourcing.

When a business works with a staffing company that uses employee leasing, the staffing firm provides workers to their client who do their work at the client’s place of business. Once the project, timeframe, or contract is complete, the workers return to the staffing company, who is their actual employer.

Employee leasing is a popular option for business owners who need new workers for a set time frame. A common strategy of 85% FT and 15% Temping is used. A popular option for Employers who don’t want to worry about the HR administrative and regulatory tasks associated with hiring contract or temporary workers.

What is Co-Employment?

The National Association of Professional Employer Organizations (NAPEO) defines co-employment as “the contractual allocation and sharing of certain employer responsibilities between the PEO and the client.” Essentially, in a co-employment relationship, employees are employed by two different entities – the client and the PEO.

However, the PEO does not supply workers to their client. All employees are either currently with the client, or future employees who are hired by the client.

In a co-employment relationship, a PEO assumes certain employer rights, responsibilities, risk, and other HR administrative tasks. These can include:

- Remitting wages and withholdings of the clients’ workers

- Issuing Form W-2 for compensation under its Employer Identification Number

- Reporting, collecting, and depositing employment taxes with local, state, and federal authorities

Meanwhile, the client retains control over the hiring and firing of its employees, and business leaders continue to make the day-to-day operating decisions for their company.

Co-employment Through a PEO and Employee Leasing Are Not the Same

We have already mentioned that one of the biggest myths about PEOs is that the relationship they have with clients is employee leasing. When you take a look at the differences between employee leasing and co-employment (which is how PEOs operate), it becomes clear that this myth is far from the truth.

- As a matter of fact, employee leasing and co-employment differ greatly. The biggest difference is that in co-employment relationship through a PEO, the PEO does not provide staff for their client. This responsibility falls on the client, as does any other staff-related decisions. This includes hiring new talent after the PEO partnership is established.

- Instead of being a leased or temporary worker, employees end up having two employers – the company who hired them AND the professional employer organization. The PEO becomes the company of record for HR, payroll, benefits, employment taxes, and other HR-related purposes.

- It’s very important to keep in mind that in a PEO partnership, small business owners do not lose control of various aspects of their business, including their employees and hiring/firing decisions. This is another common misconception about PEOs. Business owners retain full-control of their business, while the PEO handles the administrative side of human resources.

Don’t Let This Common PEO Myth Prevent Business Growth and Success

Working with a PEO, especially a Certified PEO, ensures small business owners that they remain compliant with all HR and employment related laws and regulations. Instead of having to worry about HR, business leaders can focus all their efforts on other activities that can grow the company.

Working with a PEO also provides small businesses with access to much improved health insurance and employee benefit offerings, greatly assisting with recruiting and employee retention. PEO partnerships allow small business owners to maintain control of their company, and hire new employees as they see fit.

It’s a misconception that PEO and employee leasing are the same, which often times causes small business owners and brokers to dismiss a PEO solution, even though a perfect fit exists. Hopefully this article clears up the confusion surrounding co-employment and employee leasing.

Who knows, perhaps a PEO solution can be a competitive advantage for your business. Click here to get started on a PEO quote.

Want to learn more about PEOs? Check out PEO White Papers. This provides an overview of the PEO industry as well as helpful information employers!

by Alex | Jun 14, 2017 | NY News, Small Business Group Health

HealthPass Adds Oscar

HealthPass New York will start offering OSCAR Health Plans effective Sept 1, 2017 to small employers. Oscar will offer eight plans with varying benefits package with 1 to 100 employees. The plans are available to small businesses located in New York City, Long Island, Westchester and Rockland counties. NJ residents can also access Hospitals & physicians through the NJ Qualcare PPO Network

HealthPass New York, a private insurance exchange for small employers. The addition of Oscar gives small businesses access to 3 health networks – Oxford, CareConnect and Oscar. Also, Guardian is the insurer of record for the ancillary benefits comprising dental, vision, life insurance, disability and accident insurance

Oscar entered the NY market on Jan 1, 2014 and had around 16,000 members. In 2015, it expanded coverage to New Jersey and grew to about 40,000 members. In 2016, Oscar had 145,000 members in New York, New Jersey, California, and Texas. Oscar’s cutting edge technology and pioneering benefits have simplified the consumer health insurance experience propelled easier access and understanding of health plans. Examples of success have been ease of physician locator, online appointment setting and no cost telemedicine 24/7. Additionally, some plans have $0 Copay generics and annual 3 free office visits

Why a Private Exchange? The advantage of a Private Exchange is the ability to empower employees with choice. Much like a 401K your employees can use a defined contribution allocation for benefits. As affordable health plan networks are increasingly smaller with specific coverage areas the one size show for all approach to benefits no longer works.

Is a Private Exchange Right For My Group?

If you’re a small business owner who has concerns about payroll, filing paperwork, and complying with government regulations, co-employment may be the service you’ve been looking for. In some cases, a Private Exchange may NOT be right for you. With Health Care Reform your company may qualify for a small business tax credit or a be eligible for a large group discount under a PEO.

Try us on a custom demo, contact us at (855)667-4621.

by Alex | Jan 20, 2017 | PEO, Small Business Group Health

No Tax Restarts

No need to wait till next Jan 1st to make changes. No tax restarts are good news for PEO prospective groups. Federal Tax Restarts Are No Longer An Issue The significant added expense of having to pay tax restarts often postponed or ended the PEO conversation for many of our prospective clients. It was an important consideration since companies were not eligible for tax restart credits and the cost of the restarts often diminished the financial value proposition of partnering with a PEO.

Example: A group starting a plan in May would have to pay for annual FICA and FUTA all over again with new PEO. A PEO is considered a different employer group.

Moving forward, there are no federal tax restarts to worry about. FICA and FUTA wage bases will not restart when an employer joins a PEO. Ask us about our Quick Start Program to ensure a smooth start to our personalized PEO model, and offers perks for your staff.

Contact us to learn more about our Quick Start Program on-boarding processs but here are the high points:

- You’ll have access to the best healthcare providers, coupled with the pricing that is offered to much larger companies.

- Your Worker’s Compensation rate may favorably adjust since you will be “adopted” under the PEO and their typically much better rates.

- You’ll have a partner that will help build systems for recruiting, hiring, employee administration and more.

- You’ll also have experts who will work with you to establish and maintain policies and programs, including workplace safety, sexual harassment, diversity and others that are typically required by law.

While this certainly is not going to fix everything in the ever growing PEO industry, it’s a huge leap forward and offers clarity. If you would like to explore how a PEO can help your company, contact us and we will be happy to help you.

PEO White Paper

PEO Get Started